ERY Energy Bear Continues Basing Setup - Breakout Expected Near January 24th / Commodities / Energy Resources

After watching Crude Oil fall from the $65ppb level to the $58 ppb level (-10.7%) over the past few weeks, we stillbelieve the energy sector is setting up for another great trade for skilledinvestors/traders.

We are all keenly aware that Winter is stillhere and that heating oil demands may continue to push certain energy priceshigher. Yet Winter is also a time whenpeople don’t travel as much and, overall, energy prices tend to weakenthroughout Winter.

Over the past 37 years, the historical monthly breakdown for Crude Oil is as follows: December: Generally lower by -$0.33 to -$0.86. Averages to the downside: -3.65 to +3.08 January: Generally lower by -$4.57 to -$6.72. Averages to the downside: -2.68 to +2.27 February: Generally higher by +$8.41 to +13.73. Averages to the upside +3.07 to -2.54 March: Generally higher by +7.33 to +$15.62. Averages to the upside by +2.84 to -2.14

Over the past 25 years, the historical monthly breakdown for Natural Gas is as follows: December: Generally lower by -$2.34 to -$5.26. Averages to the downside: -0.81 to +0.69 January: Generally lower by -$5.14 to -$7.97. Averages to the downside: -0.69 to +0.45 February: Generally lower by -$1.48 to -$3.62. Averages to the downside -0.50 to +0.49 March: Generally higher by +0.63 to +$1.88. Averages to the upside by +0.41 to -0.70

Over the past 35 years, the historical monthly breakdown for Heating Oil is as follows: December: Generally lower by -$0.16 to -$0.37. Averages to the downside: -0.14 to +0.09 January: Generally lower by -$0.52 to -$0.96. Averages to the downside: -0.09 to +0.10 February: Generally higher by +$0.48 to +$1.06. Averages to the upside +0.11 to -0.08 March: Generally higher by +0.03 to +$0.11. Averages to the upside by +0.09 to -0.10

This data suggests an extended Winter in theUS may prompt further contraction in certain segments of the energy sector thatmay prompt an exaggerated downside price move in Crude Oil and NaturalGas. Heating Oil may rise a bit if thecold weather continues well past March/April 2019.

Conversely, if an early spring sets up inthe US, then Crude Oil may begin to base a bit as people begin to travelingmore, but Heating Oil and Natural Gas may decline as cold weather demandsabate.

Heating Oil has almost mirrored Crude Oil inprice action recently. Our modelingsystems are suggesting that Crude Oil may attempt to move below $40 ppb. This move would be a result of a number offactors – mostly slowing global demand and a shift to electric vehicles. We authored this research post early inJanuary 2020 – please review it.

January 8, 2020: IS THE ENERGY SECTOR SETTING UP ANOTHER GREAT ENTRY?

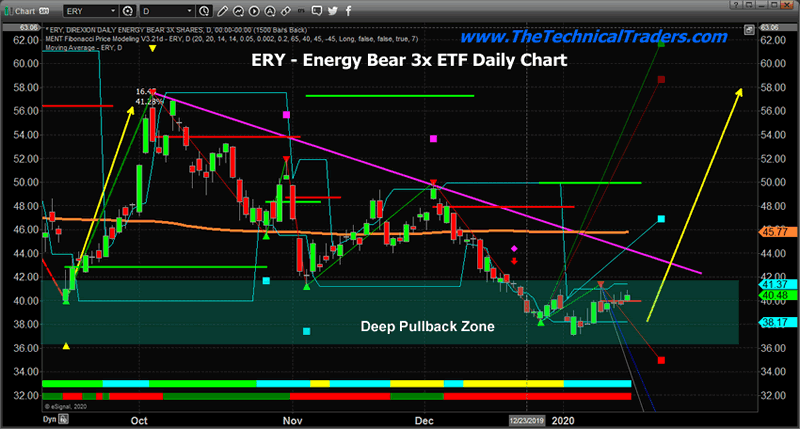

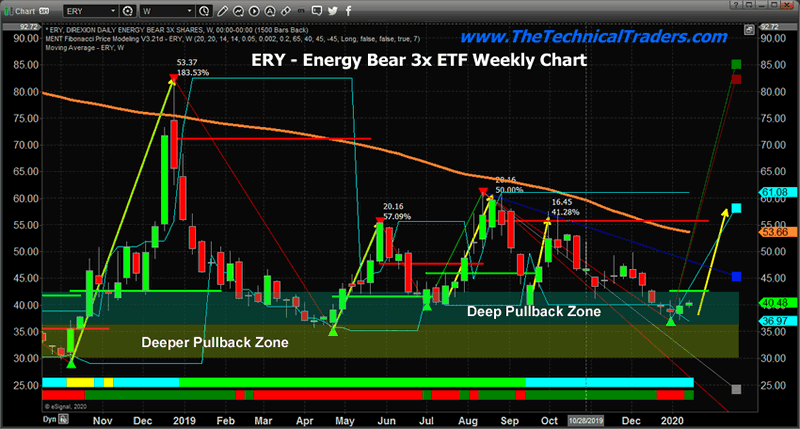

We believe any price level below $40 in ERYis setting up for a very strong basing level going forward. We have identified two “pullback zones”. The first is what we call the “Deep PullbackZone”. The second is what we call the“Deeper Pullback Zone”. Any upside pricemove from below $40 to recent upside target levels (above $50) would representa 25%+ price rotation.

Historically, February is a very strongmonth for ERY. The data going back overthe past 12 years suggests February produces substantially higher upside pricegains (+1899.30 to -394.28) – translating into a 4.8:1 upside price ratio over12 years. Both January and March reflectoverall price weakness in ERY over the past 12 years. Thus, the real opportunity is the setup ofthe “February price advance”.

We believe any opportunity to take advantageof this historical technical price pattern is advantageous for skilledtraders/investors.

This is a pure technical pattern based onprice bar data mining. This is somethingyou may not have ever considered unless you had the tools to search forhistorical price anomalies and rotation patterns. We have created a suite of tools and pricemodeling systems we use to help our members find incredible opportunities –this being one of them.

Get ready, February will likely prompt a very nice rally in ERY if historical price triggers confirm future price activity. The price pattern in February suggests a large upside price move is likely in ERY and we believe these low price basing patterns are an excellent opportunity for skilled traders.

Join my Wealth Building Newsletter if you like what you read here and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involvedin the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader,and is the author of the book: 7 Steps to Win With Logic

Through years ofresearch, trading and helping individual traders around the world. He learnedthat many traders have great trading ideas, but they lack one thing, theystruggle to execute trades in a systematic way for consistent results. Chrishelps educate traders with a three-hourvideo course that can change your trading results for the better.

His mission is to help hisclients boost their trading performance while reducing market exposure andportfolio volatility.

He is a regularspeaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chriswas also featured on the cover of AmalgaTrader Magazine, and contributesarticles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.