Eurosceptics Gained Seats in the EU. Will Gold Shine Now? / Commodities / Gold & Silver 2019

More than 200 million people in 28 nations voted inthe second-largest democratic elections in the world. What interestinginformation can we glean from their vote – which way the wind blows now? Crucially,how does it reflect on gold?

Populistsand Greens Gain Seats in the EU Parliament

People across the European Union have voted for in theEuropean Parliament elections. Turnout was 50.5 percent, the highest level in20 years. Last time, it stood just 42.6 percent. However, despite high turnout– which usually supports mainstream, big parties – the two biggest voting blocs have lost their majority in the EuropeanParliament. The centre-right European People’s Party and the centre-leftSocialists and Democrats will remain the two largest blocs, but they lost 74seats. They had 403 of the 751 seats in the EU parliament, now they will havejust 329 seats.

Does it meanthat the populists have taken over the EU? Not really.Of course, the nationalist and populist groups have gained several seats.According to provisional estimates, the major Eurosceptic groups will make uparound 25 percent of the chamber, growing from around a fifth. In particular,the populists did the best in Italy and France, where Marine Le Pen’s NationalRally recorded a strong 23.5 percent of the French vote, a narrow symbolicvictory over Emmanuel Macron’s party. However, the eurosceptics performed belowthan expectations and in some countries worse than in previous, national elections. The pro-EU parties hold aroundtwo-thirds of seats.

Actually, Greens and Liberals achieved the greatestsuccess, as they jumped from 52 and 68 MEPs in 2014 to around 70 and 107 now.These parties surged to second or third place in several countries. Togetherwith eurosceptics’ gains, it implies that less orthodox views will have greaterimportance in the EU.

What does itall mean for the gold market? Well, first of all, the far-rightearthquake didn’t quite shake the parliament’s foundations, as some peopleworried before the elections. It’s badnews for gold, as we will not see a surge in a safe-haven demand for the shiny metal (however,we will see some political turmoil in the EU: the new president of the EuropeanCommission will be elected now, there will be snap elections in Greece, etc.).

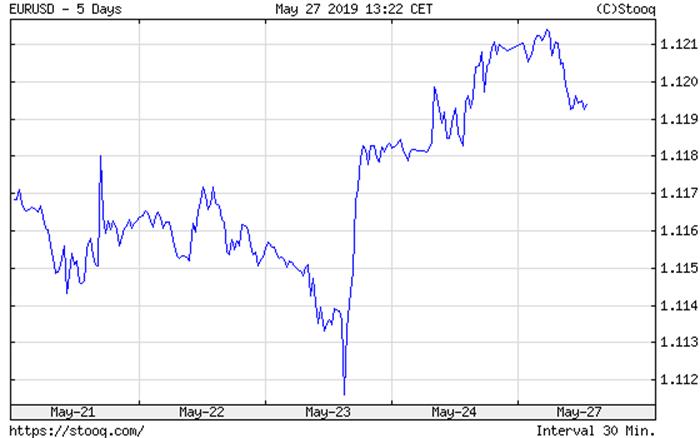

Moreover, the Green wave among the Europeans couldforce the EU executive to adopt a tougher line on environmental protections andthe global warming agenda. The problem is that pro-environmental agenda veryoften stifles the industry and economic growth. Hence, the EU is likely tostill grow slower that the US, which is more business-friendly. That divergence will support the greenback, being a headwind for gold. Who knows – maybe this is why the euro declinedagainst the US dollar on Monday morning?

Chart 1: EUR/USD exchange rate from May 21 to May 27,2019.

Brexit DramaContinues

In the UK, which took part in the elections despitethe desire to leave the bloc, the Brexit Party was the clear winner. NigelFarage’s party, which was launched just six weeks ago – received 32 percent ofthe vote, the highest share. The rulingConservative Party got just 9 percent, the worst performance since 1832.The Labor Party got just 14 percent, also recording a plunge in support. Itseems that the endless debate about Brexit hurt thebiggest parties. The voters clearly showed their dissatisfaction with thefailure of Prime Minister Theresa May to take the United Kingdom out of theEuropean Union.

Oh, did I say “prime minister”? Oops, my mistake – May resigned on Friday, as anotherpolitical twist in the protracted Brexit drama. It should not be surprising, asMay strived to please both fractions within the Conservative Party, trying toprevent division, but she ended annoying everyone. As David Cameron did notsense the mood of society, May did not sense the mood of the Parliament.Anyway, a few months after the Brexit deadline, we still do not know how, whenor even whether the country will leave the EU. May’s resignation only adds further uncertainty as the ruling partyhas to choose the new prime minister among several candidates who holddifferent views on the Brexit.

However, just like British voters, gold investors seemto be fed up with the Brexit saga, and they do not react strongly to the newsabout the UK’s exit. If any at all, the impact of further uncertainty may be negative on the yellow metal –after all, the US dollar strengthened initially against the British pound afterthe May’s resignation. It seems that therising tensions between the US and Iran have more potential to support the goldprices. We will write about them in the future editions of the Gold News Monitor – staytuned!

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.