Even top juniors are running out of money

The drying up of equity and debt markets coupled with new lows in cash reserves have pushed Canada's junior mining industry to the brink says PwC's annual report on the TSX Venture's top 100 junior mining companies.

According to report, now in its ninth year, juniors raised $514 million in equity financing in 2015, down 25% from last year, while debt financing fell 27% to $278 million over the same period.

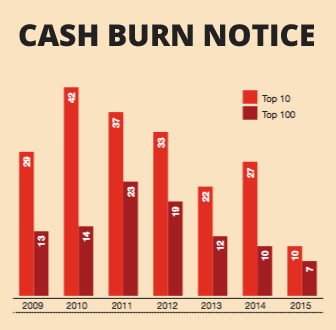

Despite attempts to reduce spending, cash reserves are dwindling to new lows as the top 100's on-hand cash dropped on average from $10 million to $7 million. That's down nearly one third in a year and 70% below the peak in 2011.For explorers the fall has been dramatic and the top 100 juniors have seen cash balances declined by over 43%, but for those already operating cash flows are just as severely strained with money in the bank dropping by more than half.

The management consultants have a stark warning for the industry emphasizing that despite the prudent steps taken by companies the trends are clear and waiting it out is no longer a viable strategy:

"Many of Canada's junior miners will soon find themselves running out of cash, and those that wait too long to act may find themselves without options.

"Many companies are assessing their cash burn out rate as a matter of months-yet another reason companies should start looking at new ideas for keeping afloat."

Source: PwC Junior 2015

According to the report overall revenue is down 28% from 2014, a drop of nearly $195 million, balanced slightly by an 18% reduction in overall net losses. Market capitalization dropped significantly from $7.9 billion to $4.8 billion as of June, 2015."The challenges in the junior mining sector persist and the industry is really at a crossroads," said Liam Fitzgerald, PwC's Canadian Mining Leader.

"Despite the downward trend we have seen some stories of true innovation this year - those junior miners who have moved from simply keeping the lights on to transforming their business have given us a glimpse into what could be a more optimistic future."

Click here to download the full report and read how Oban Mining, First Mining Finance, Premier Gold Mines, NovaCopper, Klondex, Jaguar Mining and Alloycorp defied the odds in today's market.

Creative commons image by Hitchester