Expect cascade of mining M&A - PwC's Braunsteiner

Despite unfavourable market conditions, the mining industry is staging a comeback thanks to highly publicized multi-billion mergers and acquisitions targeting mostly the gold sector.

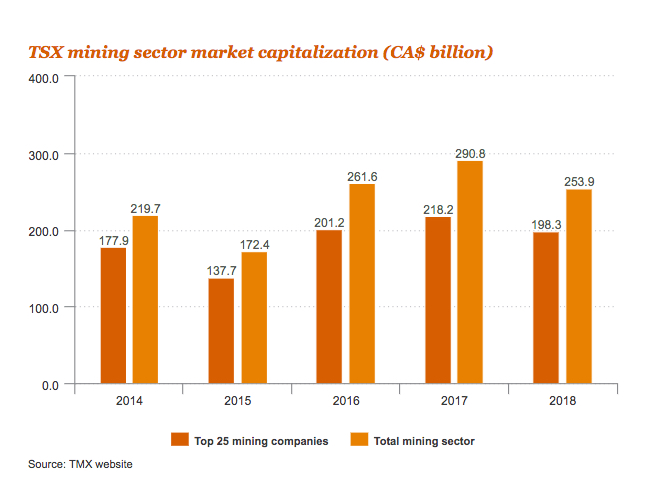

The aggregate valuation of all miners listed on the Toronto Stock Exchange (TSX) declined by 12.7% in 2018, to $253.9 billion, compared with a 10.8% decrease in the market capitalization of the entire TSX market, says PwC in its ?EUR<Canadian Mine?EUR< report published Thursday.

Liquidity also fell for the second year in a row, with the volume and value of TSX mining shares trading down by 21% and 20%, respectively.

Taken from: Canadian Mine 2019: Shifting Ground.

Performance was hampered by a downward shift in most commodity prices, following a strong showing in 2017, the report reads:

Spot prices for base and precious metals decreased across the board. Zinc tumbled 25%, copper 17% and nickel 6%. Even cobalt and lithium prices, which have registered strong gains over the past five years, suffered double-digit declines in 2018.

However, Dean Braunsteiner, PwC Canada National Mining Leader, believes 2018 marked a turning point for the mining industry.

"While recent mergers were a sign of a wave of consolidation that will help companies better compete for capital, we can expect even more M&A activity in the near future," Braunsteiner says. "That creates a cascading effect of further deals as companies sell off non-core assets, which brings new opportunities for management teams to build the next big Canadian mining company."

After years of speculation around how the sector could regain power, followed by a period of internal restructuring, companies are now focusing on opportunities, PwC ?EUR Growth was heavily powered by potash and gold. Nutrien overshadowed the top 25 during its first year of operation as the merged entity of Potash Corp. and Agrium. With a market capitalization of approximately $40 billion, it was almost twice as large as No. 2-ranked Barrick Gold. Yet, gold remained the most dominant commodity among the top 25, with 21 companies having exposure to the precious metal, up from 19 a year earlier, PwC notes. Taken from: Canadian Mine 2019: Shifting Ground. While joint ventures, mergers and acquisitions are one way the mining industry in Canada is responding to commodity and business pressures, some are also trying to improve the performance of their operations by refocusing their approach to digital transformation. PwC cites as an example a recent agreement signed by Goldcorp, Wheaton Precious Metals Corp. and Kutcho Copper Corp. to jointly build a new mining supply chain solution based on IBM Corp.'s blockchain platform.