Expecting Range Bound Trading In Gold

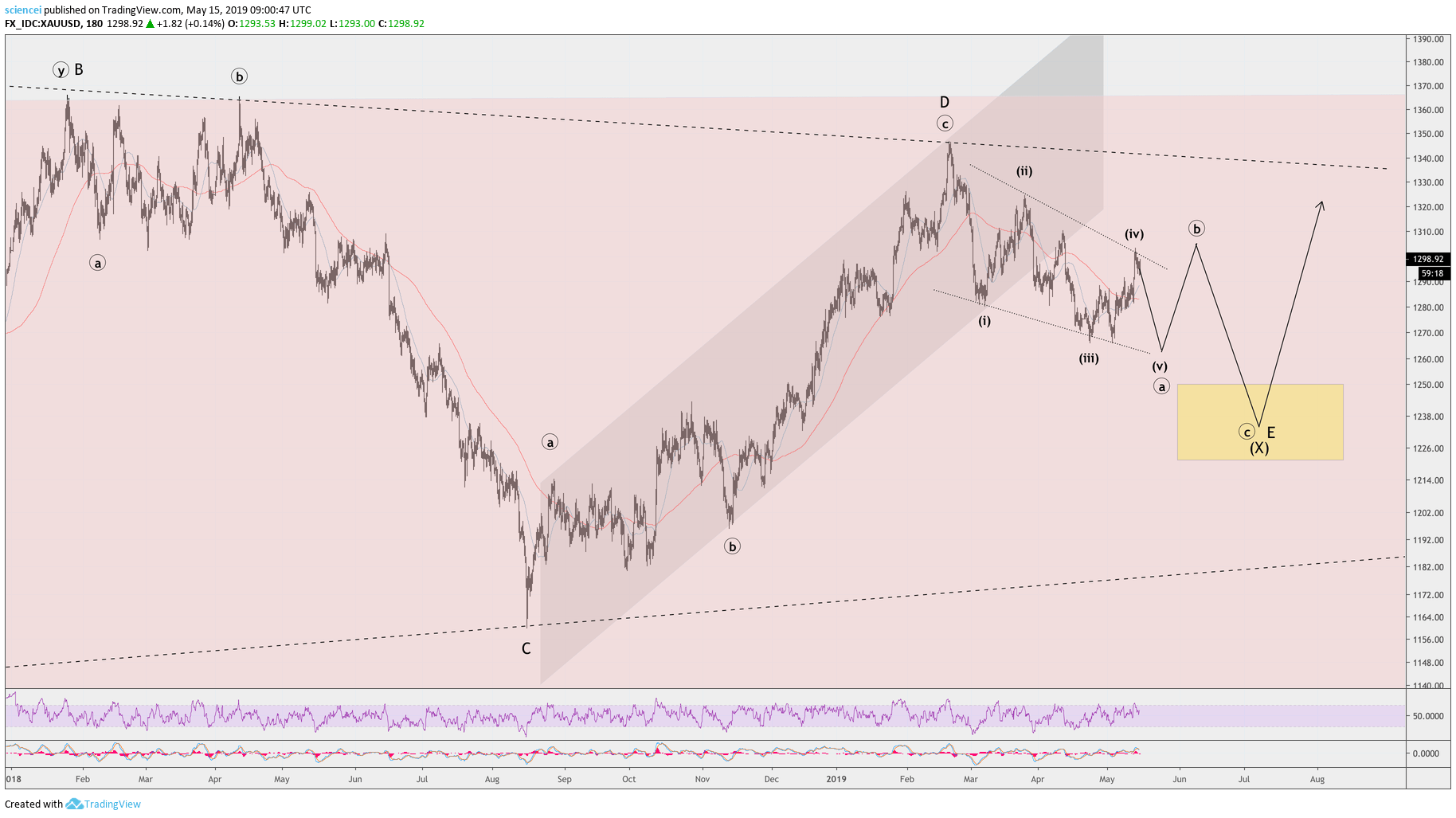

Our neutral stance on gold proved correct so far. We’ve forecasted a correction in the neighborhood of 5%-7% from the swing high, which ended in February 2018. Price action took us right into that area already. The overall result is that gold has not made any progress since Christmas 2018.

We remain with our forecast that the current correction will bring an attractive entry opportunity. Gold is likely to push through the 1,350-1,370 area eventually. The final target is around 1,500. The initial kick-off is expected to happen within the next few weeks. The mid-term pattern remains challenging, but its next leg is most likely up. Sentiment cooled of remarkably during the past few weeks. Therefore, a triangle pattern appears most likely. It unfolds within the pale red sideways trend, which is about to end. We’ve labeled it as intermediate wave (X).

The final pullback within the pale red sideways trend probably takes some more time. The fractal within wave E is most likely incomplete at the time of this write-up. Another leg to the downside seems likely. The next big confluence area is within the 1,220-1,245 cluster. Price action oscillated more or less around this area for the past six years. We expect a triangle resolution from roughly that area. It is highlighted by the yellow box in the short-term chart below.

Interested in more of our ideas? Check out Scienceinvesting for more details!

The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. Reproduction without ESI Analytics’ prior consent is strictly forbidden.