Expert Says Diverse Minerals Co. Has Unusually Favorable Risk/Reward Ratio

Technical Analyst Clive Maund explains why Avrupa Minerals Ltd. (AVU:TSX.V; AVPMF:OTC; 8AM:FSE) is a Strong Buy.

Avrupa Minerals Ltd. (AVU:TSX.V; AVPMF:OTC; 8AM:FSE) is a polymetallic exploration company with a range of projects spanning Europe. It is looking for both base and precious metals in a diversity of locations across Europe. Its focus is on copper, zinc, and gold, which are all expected to be in strong demand for years to come.

It is common knowledge that a severe shortfall is bearing down on the copper market, and both copper and zinc are crucial metals for the energy transition. Meanwhile, gold also has a wide and growing range of industrial uses and will be in increasing demand as a store of value in the face of debt and currency crises. It is likely to regain its central role as a solid backing for money as the current fiat system "comes off the rails." So, demand for all of the metals that the company is exploring looks set to soar.

Now, we will proceed to overview the company using a range of slides from the company's investor deck before moving on to examine its stock charts, on which it will quickly become apparent why the company's stock is so attractive here.

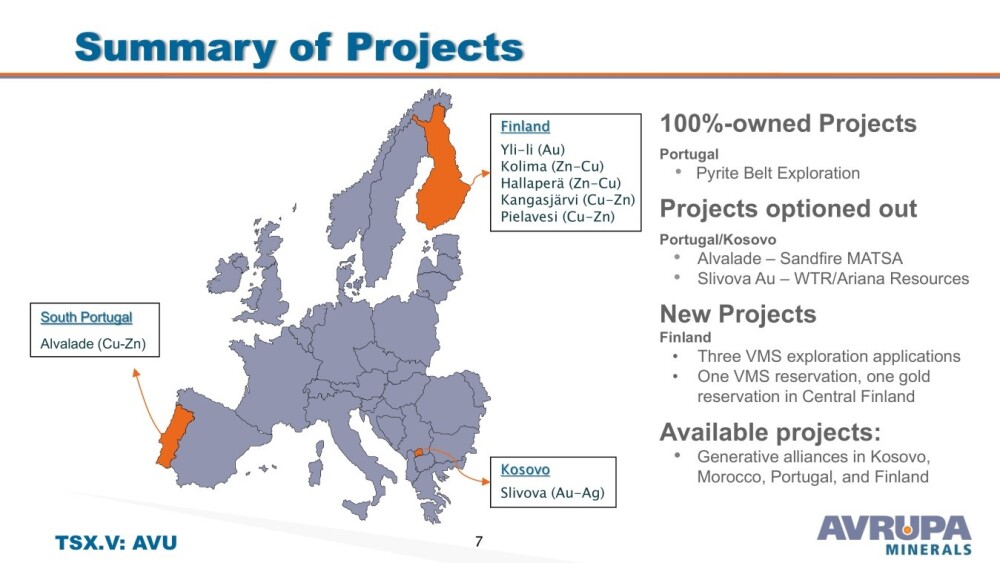

The first slide shows the locations of the company's projects across Europe. As we can see, they range from Finland to Kosovo to Portugal.

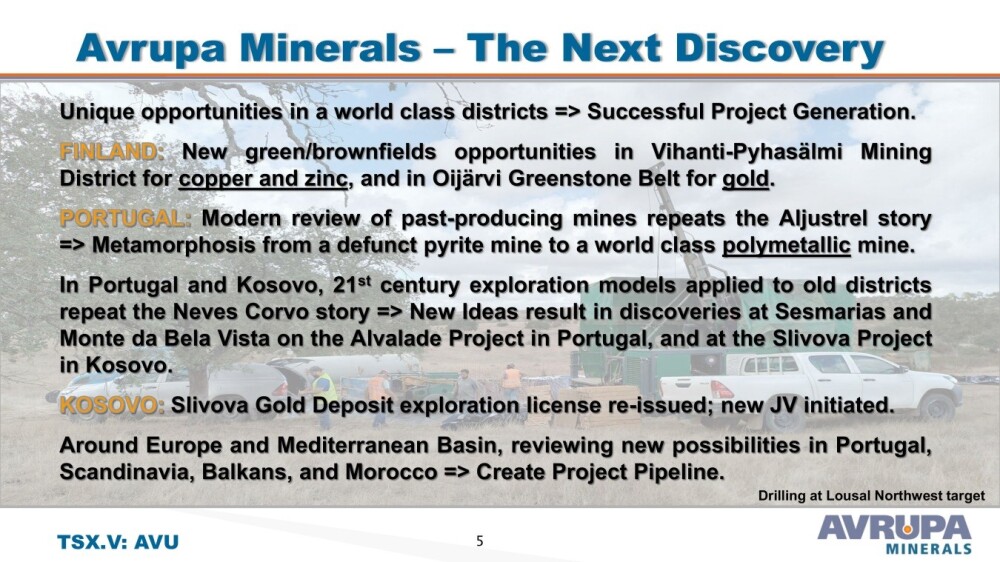

Early-stage exploration is, of course, a risky business, and while critics may argue that they can see that, given that the company's stock has fallen from a high of almost CA$2.40 in 2011 to the current meager 3 cents, we are not here to dwell on the past but rather to look to the future, and when we look at the stock charts for the company, we will see the clear evidence of accumulation that portends a new bull market so the risk mitigation strategies that the company has in place shown on the following slide are appropriate and should lead to success, especially given the brightening outlook for the metals that has already been alluded to.

This next slide summarizes the company's projects.

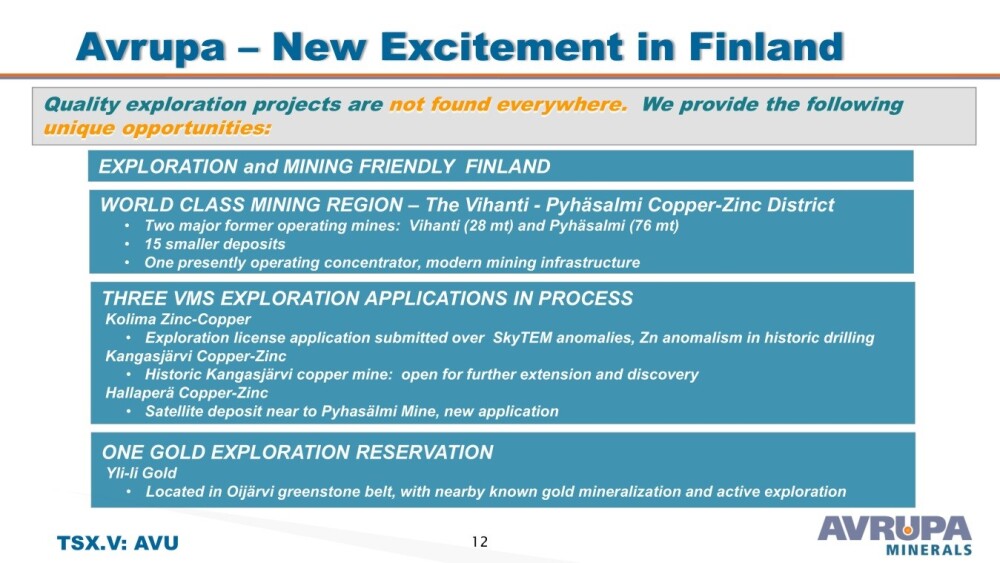

This slide gives details of the ongoing copper-gold and zinc exploration in Finland.

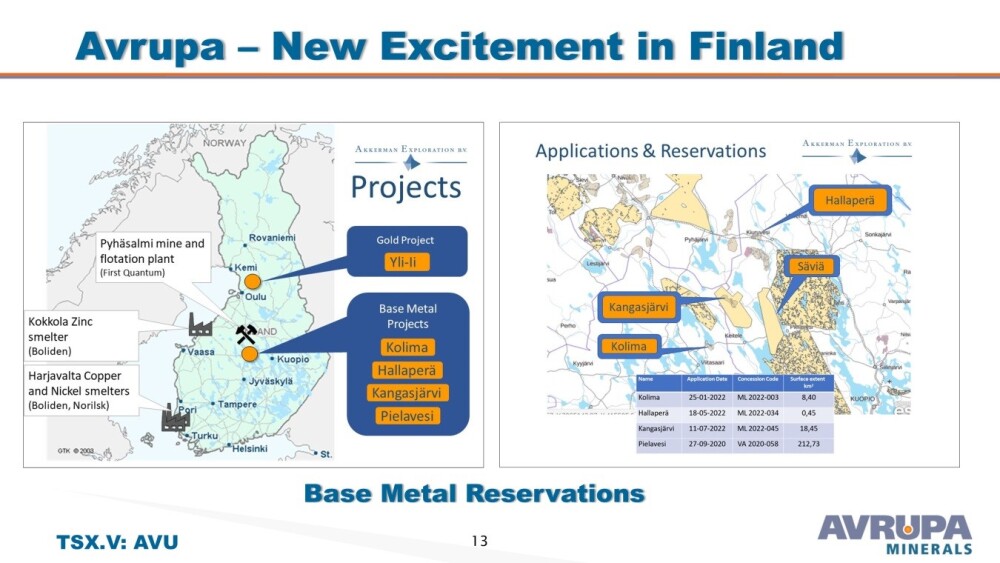

This slide shows the location of the Finnish projects.

This one provides a summary of the operations in Finland.

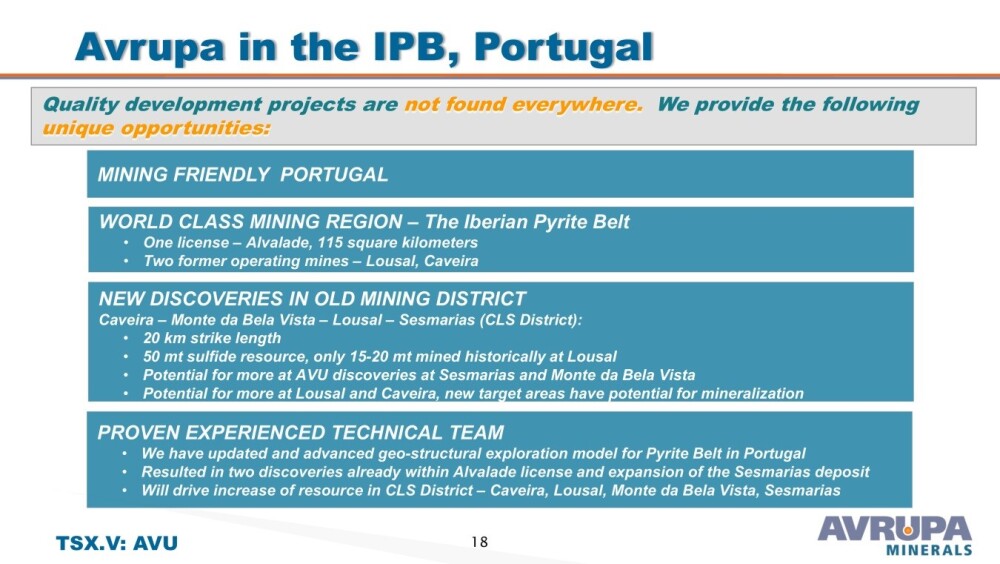

This slide gives details of the exploration in the Iberian Pyrite Belt in Portugal.

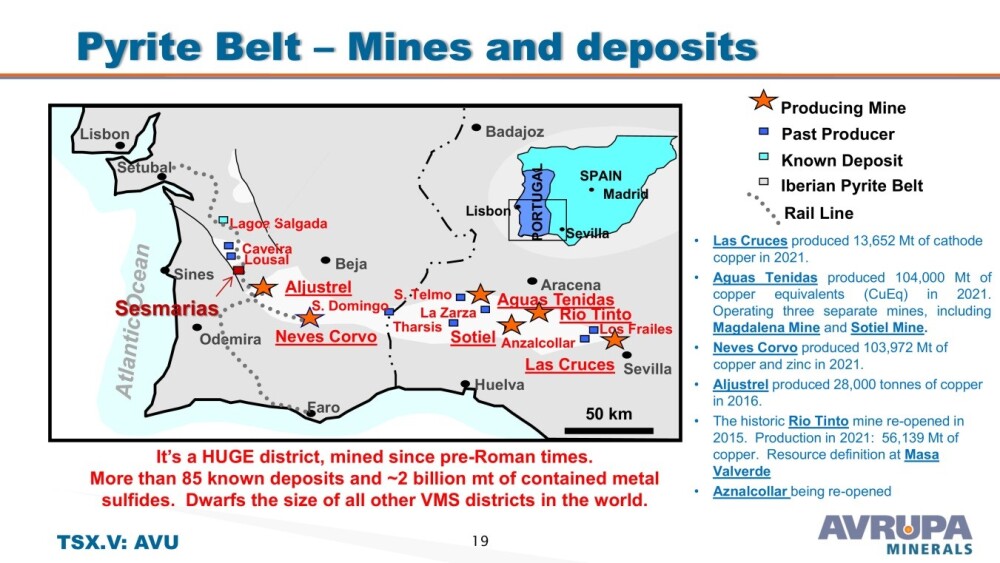

The prolific Iberian Pyrite Belt stretches from Seville in southern Spain westwards across the south of Portugal.

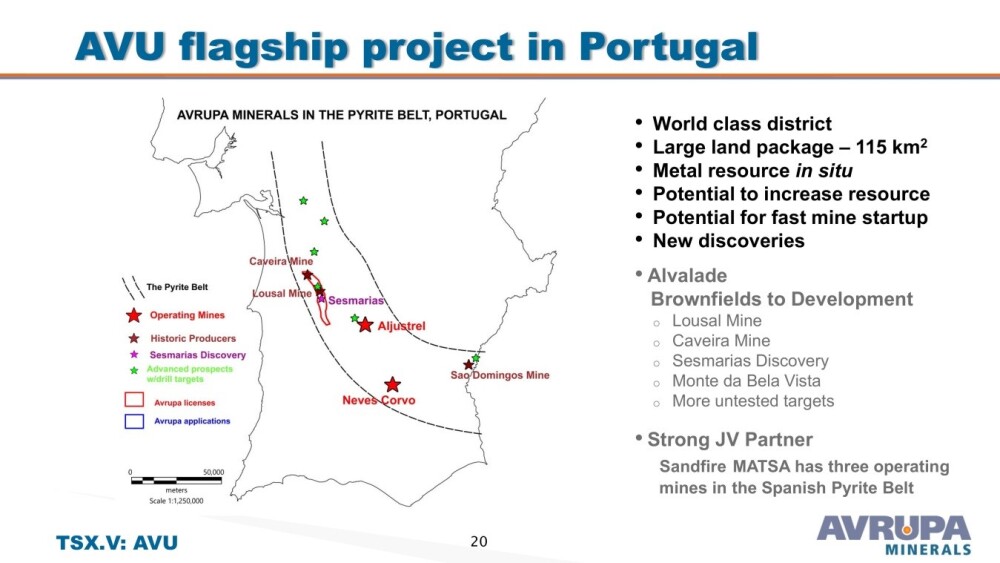

The location of and a description of the company's properties in the Iberian Pyrite Belt are provided in the following slide.

This slide gives details of exploration in Kosovo.

Avrupa's plans for the Kosovo properties are set out here.

Now, we will review the stock charts for Avrupa Minerals, on which it is clear that the case for buying it here is simple and strong.

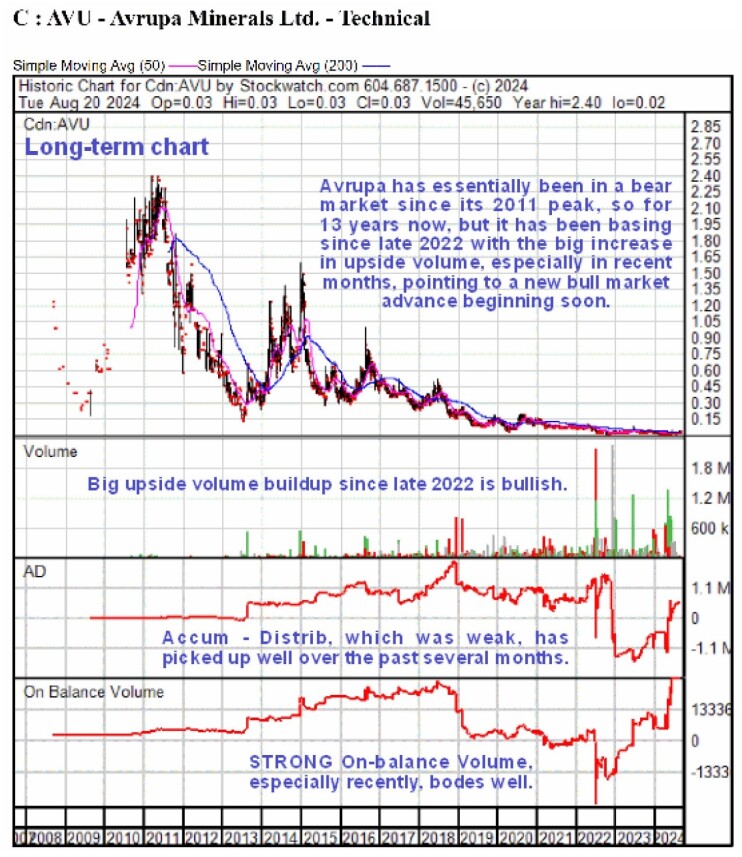

Starting with the very long-term chart going back about 16 years so that it shows the entire history of the stock, we see that it has been in a long bear market since it peaked at about CA$2.80 back in 2008, which ended late in 2022, although it is difficult to see that the bear market is over on this chart. Before leaving this chart, note the big volume buildup since the late 2022 low, which has driven volume indicators strongly higher, which is a bullish sign.

Zooming out via a 5-year chart "opens out" the recent base pattern, enabling us to see much more clearly what has been going on. Here, we see that a fine Double Bottom has formed from mid-late 2022 with a floor at a very low price of about 2 cents.

The duration of this base pattern has allowed time for a considerable quantity of stock to rotate from weaker to stronger hands and for the falling 200-day moving average to catch up to the price and flatten out.

On the 3-year chart, we can examine the base pattern in more detail. There are several positive points to observe. The first is the robust upside volume in recent months, which is a sign of position-taking by those who believe better times lie ahead for the company, and the positive implications of this are reinforced by the strength of both volume indicators shown, not just over the past few months but for a year or two.

Lastly, the price and its moving averages are bunching in a potent manner, with the averages swinging into a more bullish alignment. The second low of the Double Bottom looks complete, and these technical indications strongly suggest that the price will advance out of the base pattern before much longer.

The conclusion is that Avrupa Minerals has very little downside here and big upside potential. Thus, it is viewed as having an unusually favorable risk/reward ratio and is thus rated an immediate Strong Buy.

On September 5, the company closed a fully subscribed private placement in which 10 million units, each comprised of one share at CA$0.035 and one warrant at CA$0.10, were sold, raising $350,000.

Avrupa Minerals' website.

Avrupa Minerals Ltd. (AVU:TSX.V; AVPMF:OTC; 8AM:FSE) closed for trading at CA$0.03, US$0.014 on September 11, 2024.

| Want to be the first to know about interestingGold,Critical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Avrupa Minerals Ltd.Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.