Expert Says Gold Co. In a Position To Take Off Higher

Technical Analyst Clive Maund shares his thoughts on Centenario Gold Corp.'s (CTG:TSX.V), a company he believes is an Immediate Buy.

While the details of what is going on at Centenario Gold Corp.'s (CTG:TSX.V) El Eden property quickly get quite complicated for anyone lacking technical geological knowledge, the story can be "boiled down" as follows:

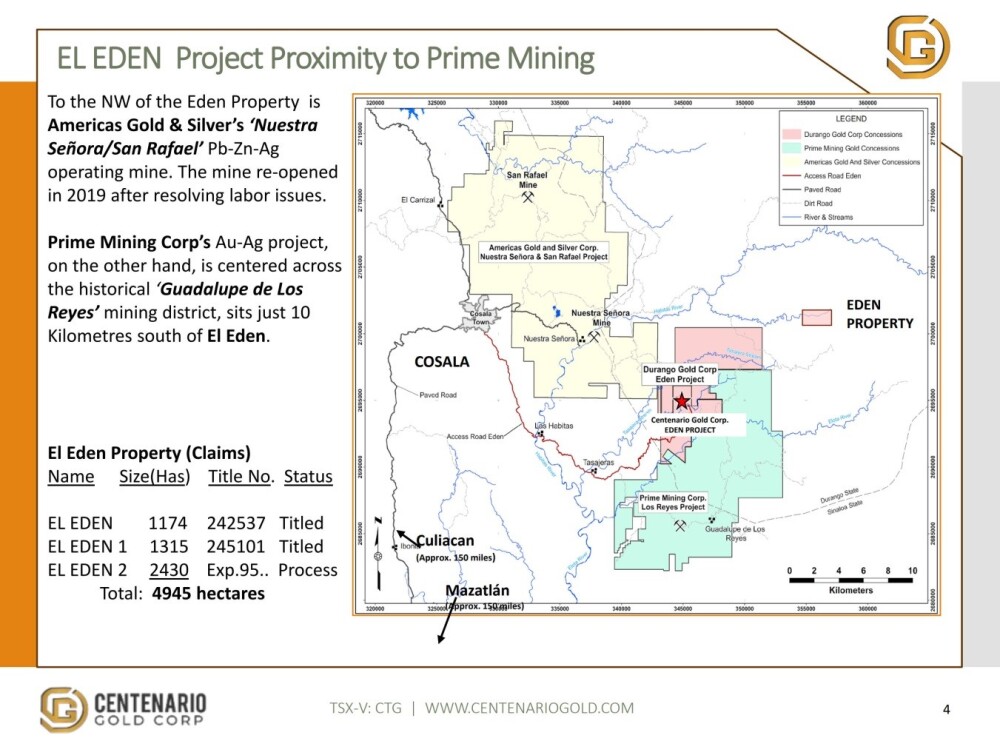

"Centenario Gold is a natural resource exploration company that was formed to focus on exploring and generating high-quality mineral prospects in Mexico. During 2020, the exploration team of Centenario visited and evaluated more than 12 mineral prospects before finding the Eden gold-silver property located in the Durango state of Mexico. On March 24, 2021, after completing the preliminary evaluation work and due diligence review, Durango Gold Corp SA de CV, the 100-per-cent-owned Mexican subsidiary of Centenario Gold, signed a four-year option agreement to acquire 100% of the mineral rights to the Eden Au-Ag property subject to a 1% net smelter return. The Eden project consists of three adjoining mineral concessions totaling 5,689 hectares in size, hosting a series of high-grade north-to-northeast-trending, epithermal Au-Ag vein structures. The Eden property's northern border is adjacent to Americas Gold & Silver's Nuestra Senora producing mine while the Eden property's southern border is adjacent to Prime Mining's Los Reyes property."

While this paragraph has been lifted from a news release, it is worth repeating verbatim because it is succinct and to the point. A key point to note is that Durango Gold is a 100% owned subsidiary of Centenario, so whenever you see Durango on a map, you are, in effect, seeing Centenario.

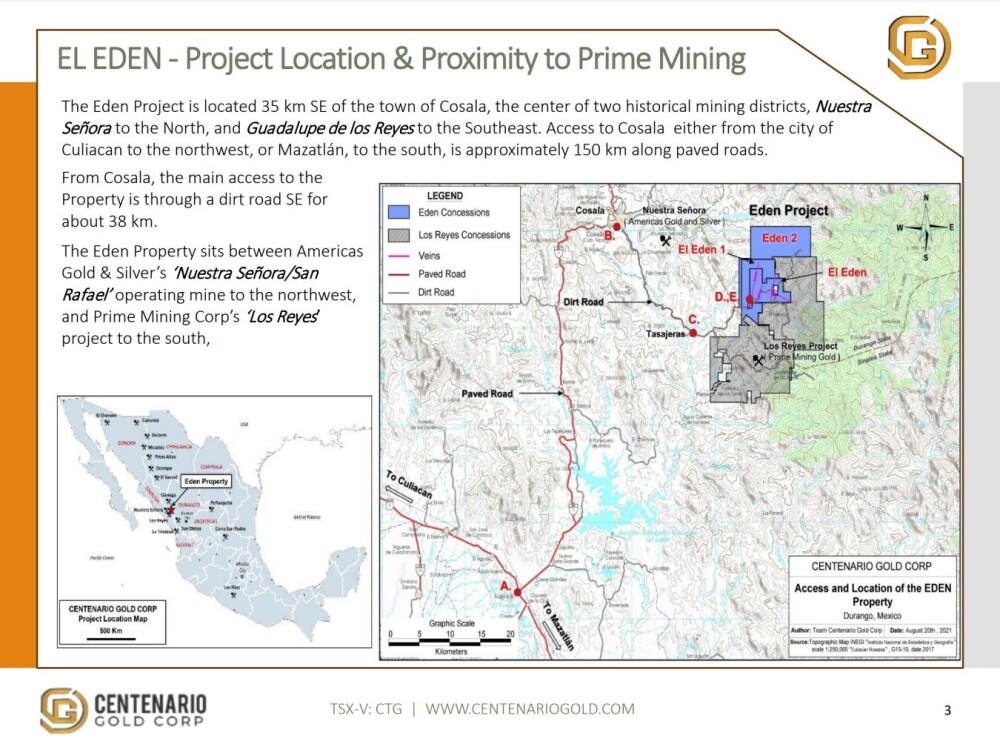

El Eden Project location and proximity to Prime Mining can be shown below.

The potential of the El Eden project is made obvious by the fact that it is sandwiched between Americas Gold & Silver's Nuestra Se?ora and San Rafael Project, with Nuestra Se?ora being a producing mine and Prime Mining's Los Reyes Project and Prime Mining's stock (code PRYM) made massive gains in 2020 and 2021 which gives an indication of what will happen to Centenario's stock if they hit.

Whilst having immediate neighbors in possession of discoveries or producing mines is not a guarantee of success, it certainly tilts the odds in Centenario's favor.

What makes the company interesting to investors at this juncture, in addition to its stock charts, which show that it is in a position to take off higher if anything significant is discovered, as we will soon see, is where the company is in its path of development.

Late last year and into this year, it undertook an exploratory drilling program at El Eden, and although what was discovered was somewhat inconclusive relative to what was found at surface, it was still encouraging.

As Alain Charest, the chief executive officer, commented, "Although we were unable to repeat the results obtained on surface, the information we got from this first drilling program confirmed that the Buenavista mineralized system is continuous at depth and along strike. The drill information will further help us to better vector in on the mineralized zones within the system. Only a very small portion of the Buenavista corridor has been drill tested so far, so there remain plenty of targets to drill along this structure and along the others."

The company believes that the Eden property, as a whole, hosts a significant gold-silver system, as proven by the exploration work that has been completed so far. With this in mind, it is firmly determined to continue exploring and initiate the second-phase drill program.

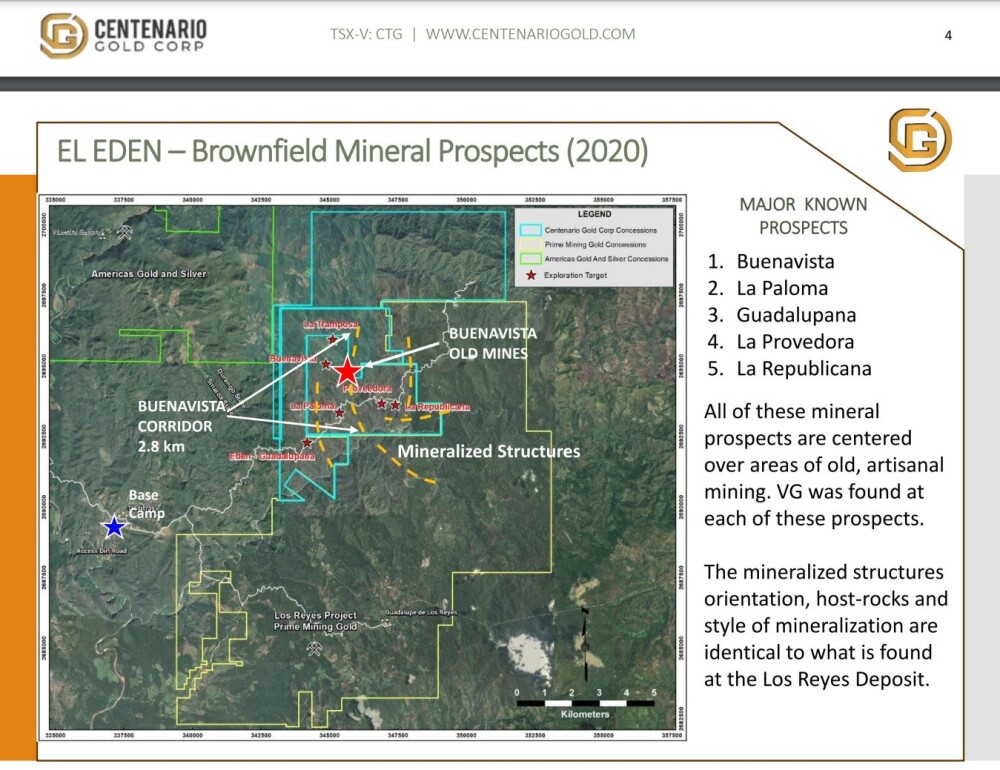

The following map shows the major prospects on the El Eden Project, which are, therefore, exploration targets.

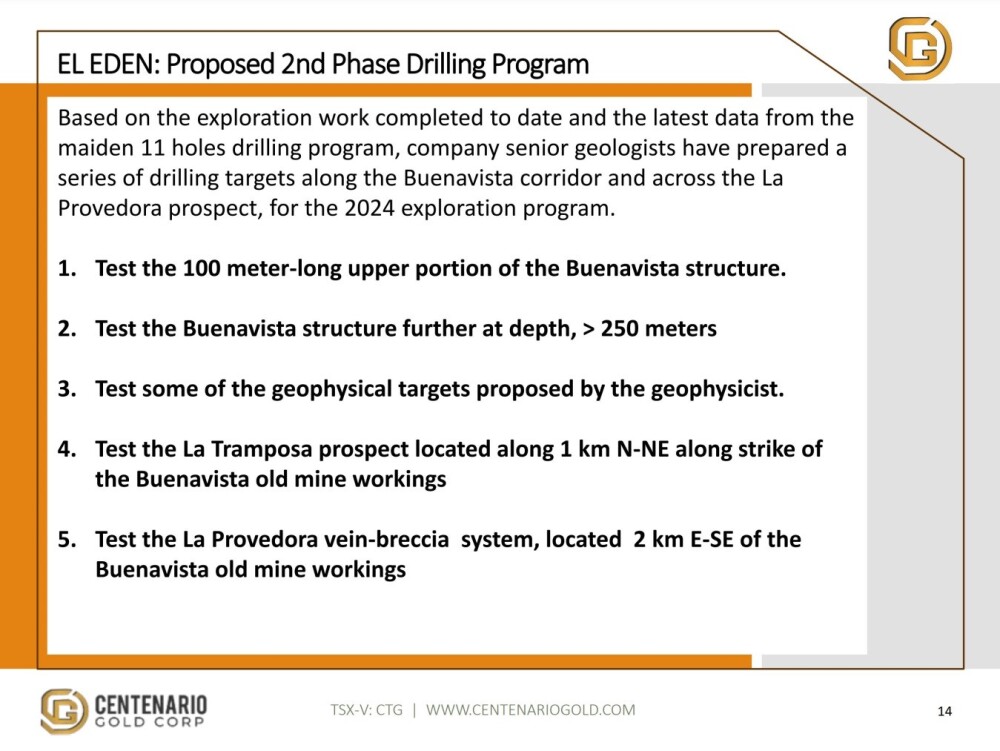

Now, here is where it gets interesting for investors. On the basis of what was learned from the Maiden drill program, the company has mapped out an extensive second-phase drill program that will explore many promising targets across the El Eden property, which is expected to get underway soon, and the next slide sets out a list of these drilling targets for the 2024 drilling season.

This second phase drilling program will clearly provide a lot of potential catalysts during the balance of this year, especially as the $1 million private placement announced on May 25 to raise funds to help pay for the drilling program is thought likely to be announced closed soon, which announcement will remove a constraint on the share price and is therefore considered to be another catalyst.

Details regarding the upcoming drilling targets are set out in the latest company presentation, as well as details of the 2023 / 2024 Maiden Drilling Program findings, and there is much information on the geology of El Eden.

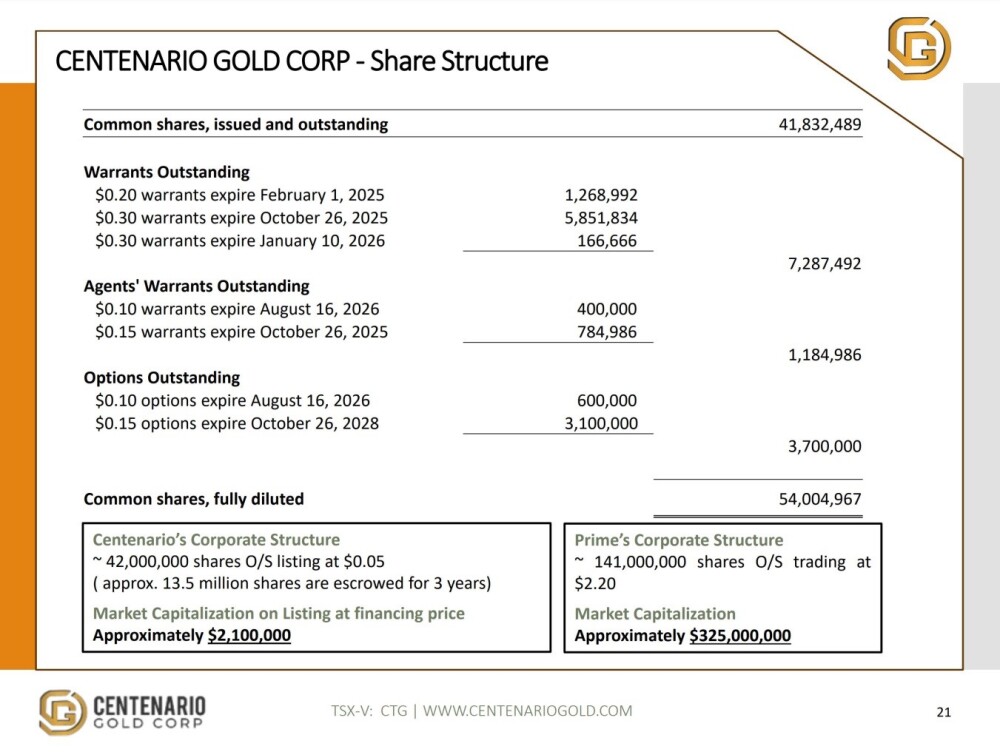

The last slide details the share structure of the company, and as we see, the number of shares in issue is very reasonable at about 43 million.

After Centenario Gold came to market late in October, it went straight into a severe bear market that took it all the way down from a peak at CA$0.18 on the day it started trading to bottom at a mere CA$0.01 in April.

However, although it hit bottom in April, a V-shaped Cup base had started to form early in March, as we can see on its latest 11-month chart below, and we will now proceed to look at the action within this Cup base in more detail on the 6-month chart.

On the 6-month chart, we can see that completion of this Cup took it back up to touch CA$0.06 early in May, after which it ran off sideways, forming a "Handle" to complement the Cup, so it looks like it will soon end up completing a Cup and Handle base. The volume pattern as this base pattern has formed has been consistently bullish, with quite a strong upside volume as the price rose to complete the right side of the Cup that has dropped right back as the price has since drifted sideways, marking out the Handle.

Upside volume has started picking up again over the past month as the price has been gently shepherded higher by the now rising 50-day moving average with volume indicators ascending. This is a bullish price / volume action that promises an upside breakout from the pattern before long.

The conclusion is that, while there are no guarantees that the drill program will be successful, the probability that it will be is high due to a combination of what the company has already found, what its immediate neighbors have found, the extensiveness of the upcoming drill program and lastly the very promising pattern that has developed on the chart of its stock and Centenario Gold is therefore rated an Immediate Strong Speculative Buy, especially as it is currently at such a favorable entry point.

Centenario Gold Corp.'s website.

Centenario Gold Corp.'s (CTG:TSX.V) closed for trading at CA$0.05 on July 23. 2024.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Centenario Gold Corp. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$1,500 and US$2,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Centenario Gold Corp. Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.