Expert Says Silver Co. Has Lots of Upside

Technical Analyst Clive Maund explains why he thinks Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) is an Immediate Strong Buy.

Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) is advancing steadily towards its goals, with the combination of improving cost efficiencies, increasing production, and a rising price for its principal product silver holding out the prospect of a bright future for the company.

This being so, its stock continues to be viewed as very attractive here.

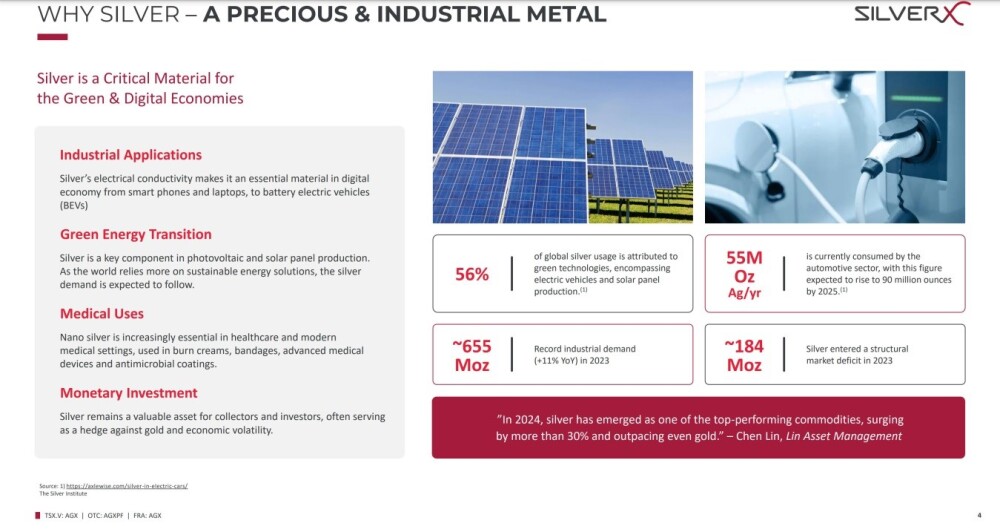

Before looking at the specifics of the company it's worth reminding ourselves why silver is such an attractive investment here.

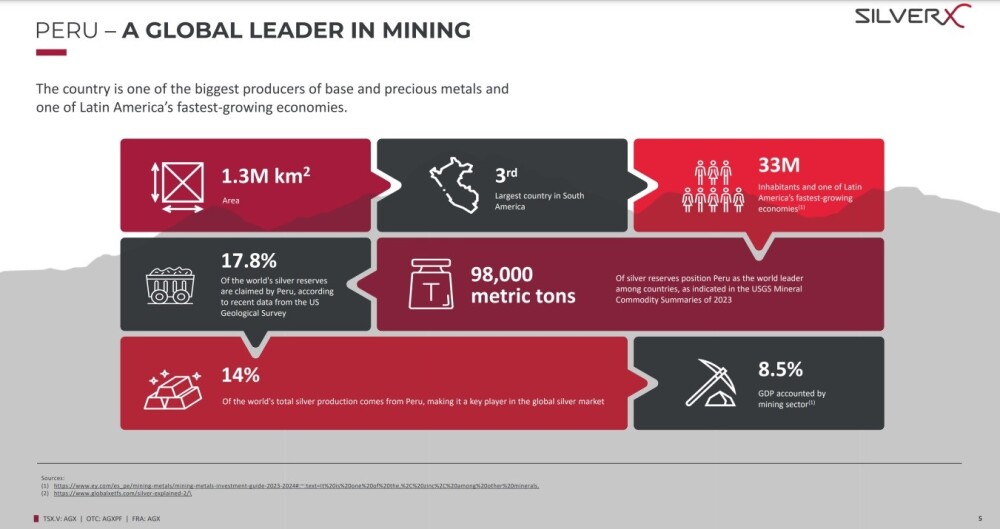

It's also worth considering the attributes of Peru, where the company's operations are located.

As we can see on the following slide, it is a most important silver-producing country.

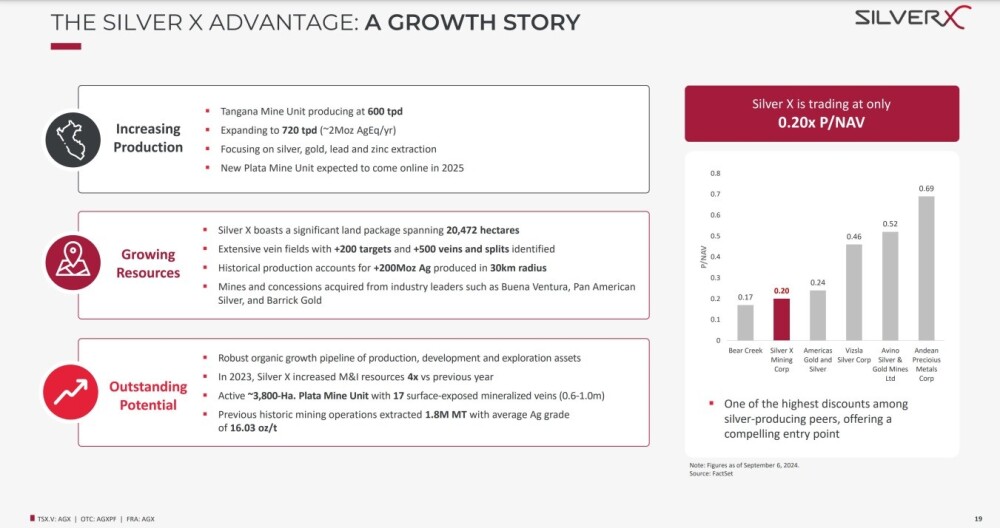

Believe it or not, the case for Silver X as an investment can be summarized on just one page, and of particular note on this slide is that the company increased measured and inferred resources by four times in just one year, 2023.

Before examining the latest stock charts for Silver X, we will review the fundamentals of the company with the assistance of the latest investor deck, which is new out this month.

The first point to make is that Silver X is already a producer that, in addition to its principal product, silver, also mines gold, lead, and zinc at its district-scale mining operation in Peru, which has plenty of scope for both ramping up production and brownfield expansion. So there is the prospect of strong growth especially given the outlook for rapidly rising metal prices.

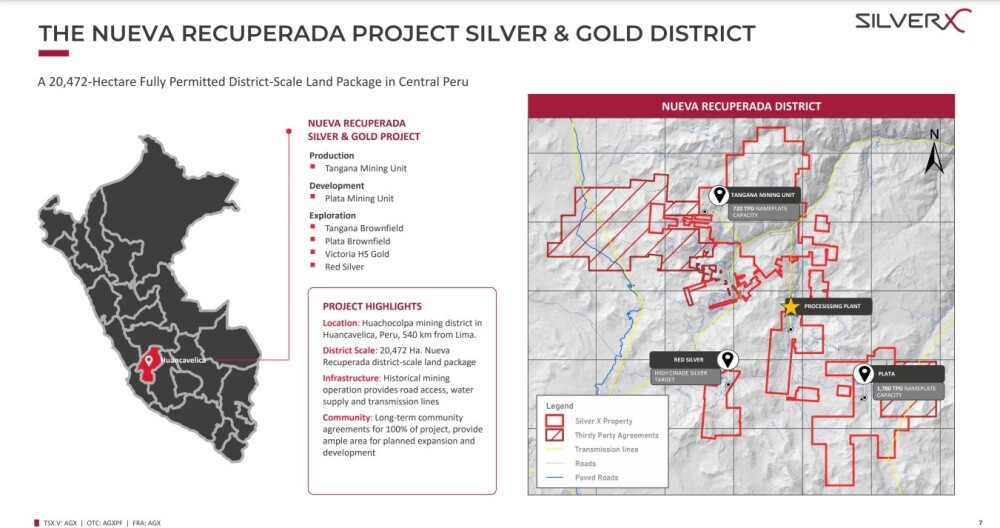

The company has two properties which are in Peru. By far the largest is the Nueva Recuperada silver project which is already in production with production set to continue to increase. The following slide shows the location of Nueva Recuperada in Peru and also a map showing the principal targets within the property.

Nueva Recuperada is a huge 20,000-hectare district-scale property with massive potential this next slide presents an overview of it.

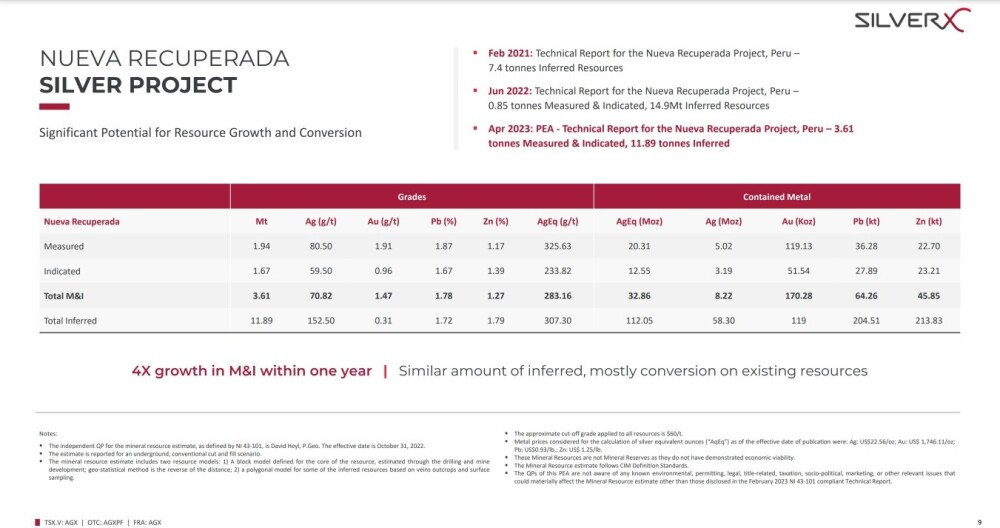

The following resource chart for Nueva Recuperada shows that there has been a four times increase in measured and indicated resources within one year, as mentioned above.

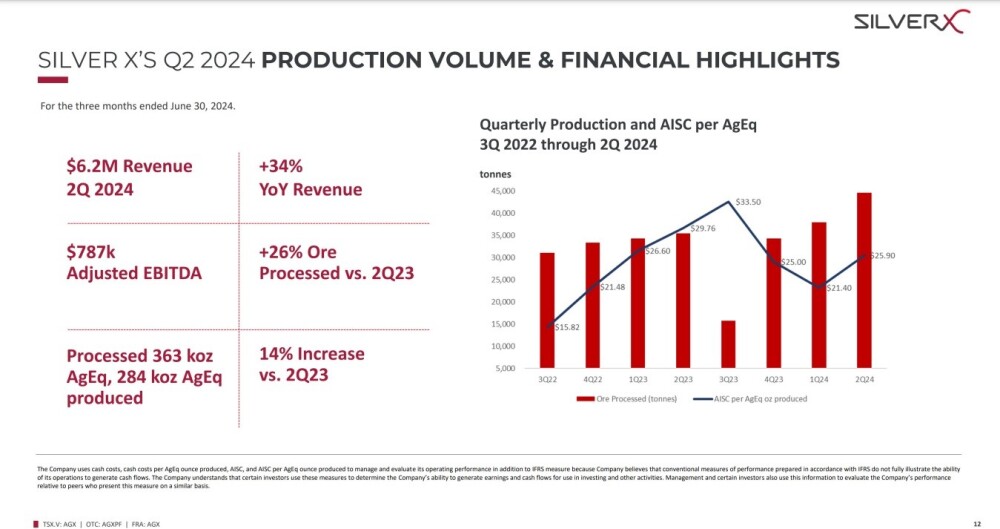

This slide shows the production volume and financial highlights.

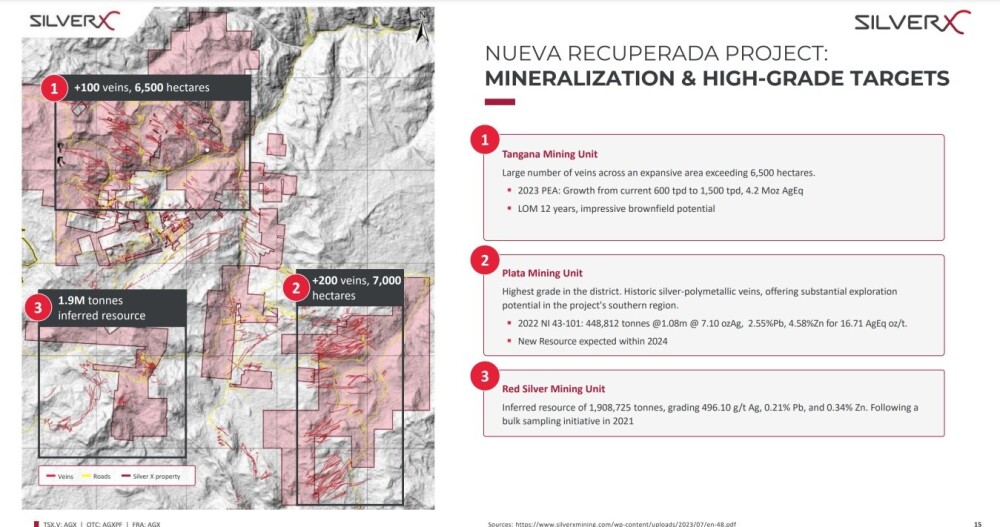

The following interesting slide includes a map showing the Mineralization and high-grade targets at Nueva Recuperada.

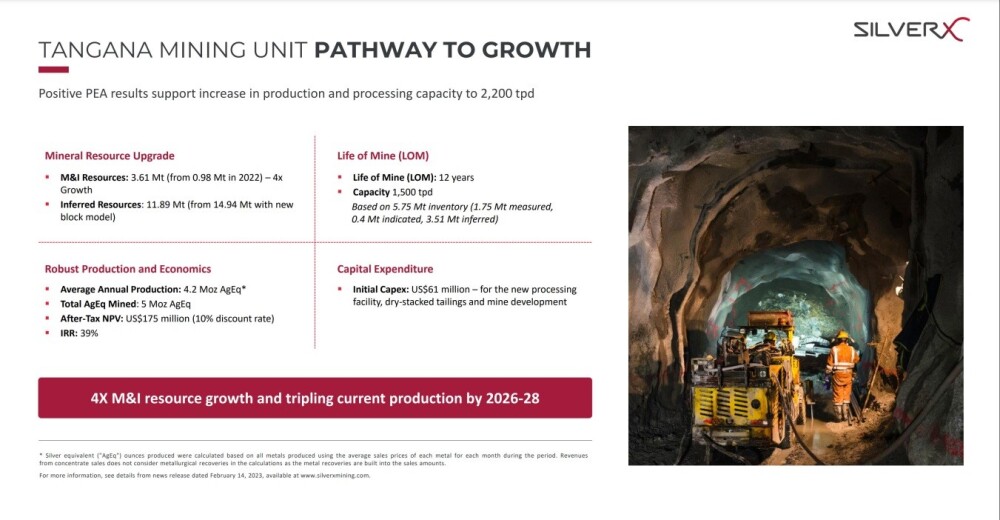

The Tangana Mining Unit is expected to triple current production through 2026 - 2028.

For additional details regarding the geology of the project, please refer to the company's September investor deck.

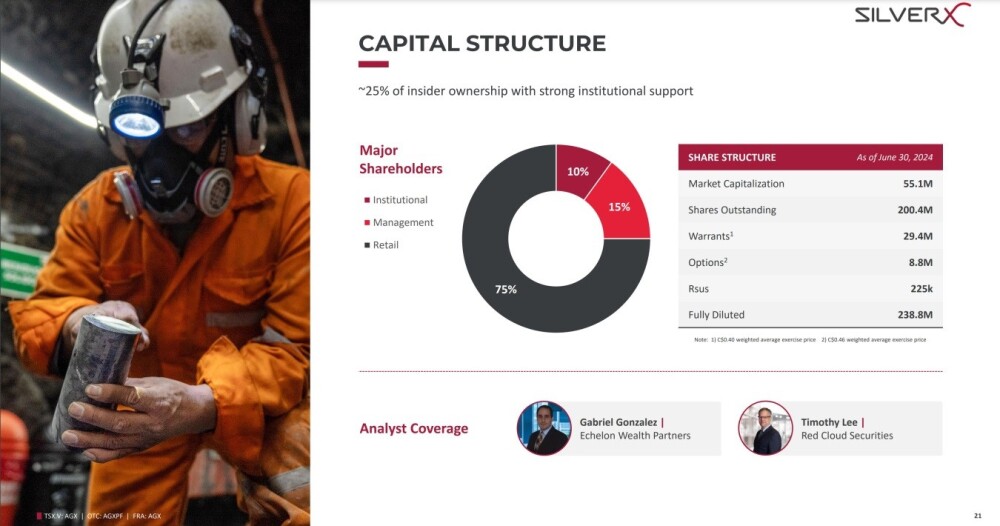

The last slide shows the capital structure of the company.

Turning now to the stock charts for Silver X, we see on the longer-term 5-year chart that the stock appears to be in the latest stages of a giant basing pattern, with the price still not far above a multi-year band of support at and above CA$0.15.

The fact that it has underperformed other silver stocks in the recent past can be put down to the lingering effect of earlier operating losses, but these are being addressed by the combination of a substantial ramping up of production at a time when metals prices are set to appreciate significantly, especially silver, and so the current relatively low price is not expected to last much longer.

The pattern is a giant Double Bottom with a drawn-out second bottom, and the persistent higher volume this year indicates a continuous rotation of stock from weaker to stronger hands, which is clearly bullish. Completion of the base pattern will see the price advance to the top of it in the CA$0.45 - CA$0.50 zone as a first objective.

The 15-month chart opens out the second low of the Double Bottom and reveals it to be a big trading range within which the price has fluctuated within the definite trends shown.

Having recently broken out of the latest downtrend, the least we can expect to see over the near term is for the price to run up to the band of resistance in the CA$0.31 area, which would mark a worthwhile percentage increase from the current price.

The conclusion is that, with little downside from the current price and a lot of upside, Silver X Mining is rated an Immediate Buy for all time horizons.

Silver X Mining's website.

Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) closed for trading at CA$0.22, US$0.16395 on September 23, 2024

| Want to be the first to know about interestingSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Silver X Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp.Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.