Expert Says You Wont Get This Copper Stock at a Better Price

Technical Analyst Clive Maund explains why he thinks Interra Copper Corp. (IMCX:CSE; IMIMF:OTCQB; 3MX:FRA) is worth going overweight on.

Interra Copper Corp. (IMCX:CSE; IMIMF:OTCQB; 3MX:FRA) is a company that is considered to be extremely undervalued on both fundamental and technical grounds at this time and is accordingly rated an Immediate Strong Buy. Before we review the latest stock charts, we will see what the company has going for it fundamentally.

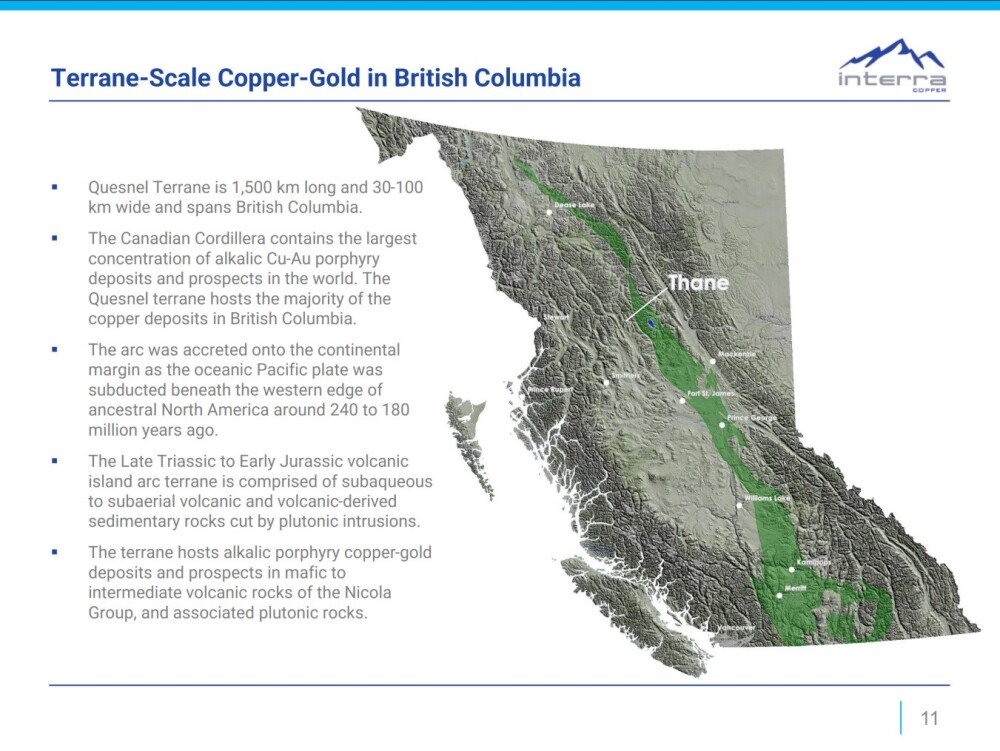

Although an early-stage exploration company, Interra has two very promising copper-gold prospects in British Columbia, with its flagship Thane Project being in the prolific Quesnel Terrane, and it is fully funded for upcoming drilling and exploration programs later this year and into 2025 following the recent completion of successful financings.

Here, summarized on one page from the investor deck, is what the company has going for it.

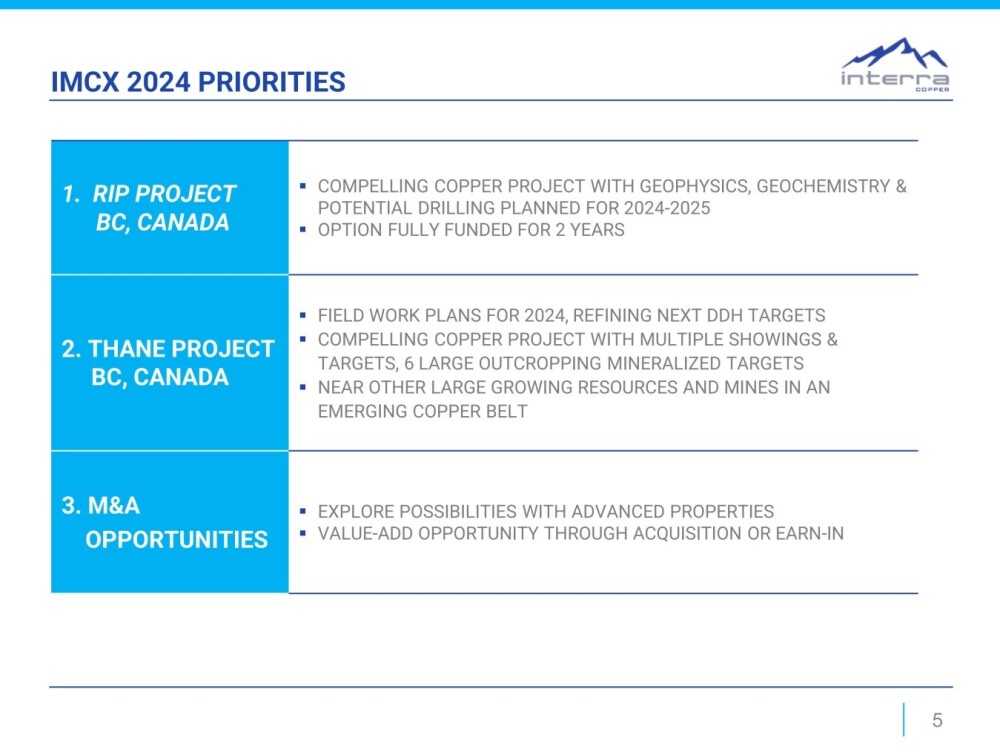

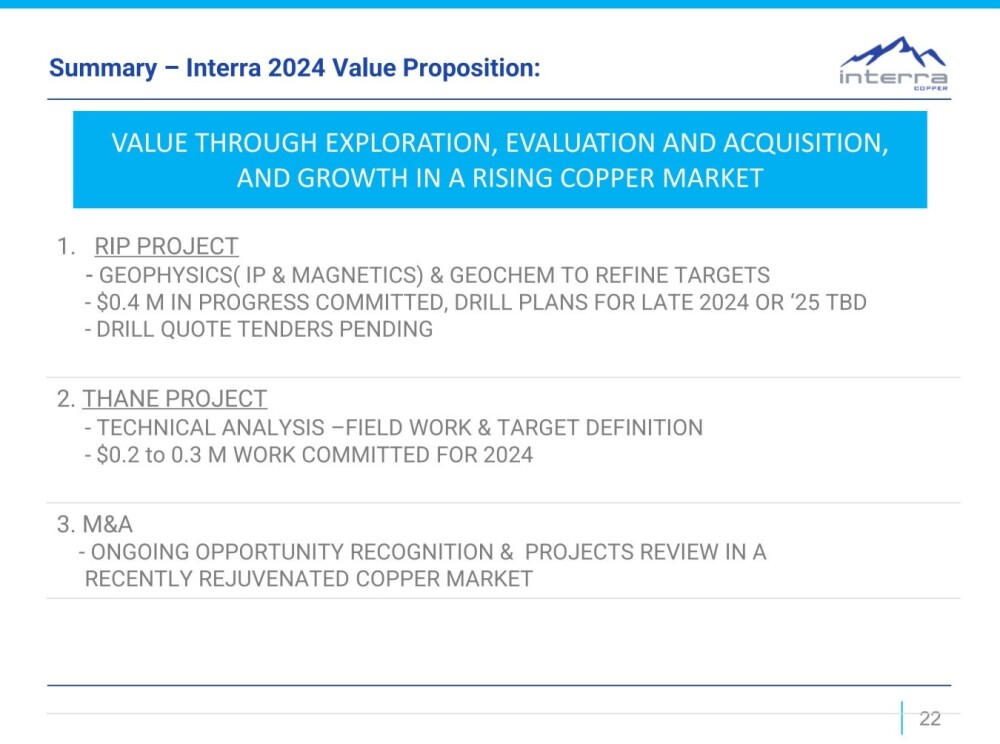

The company's 2024 priorities are as follows:

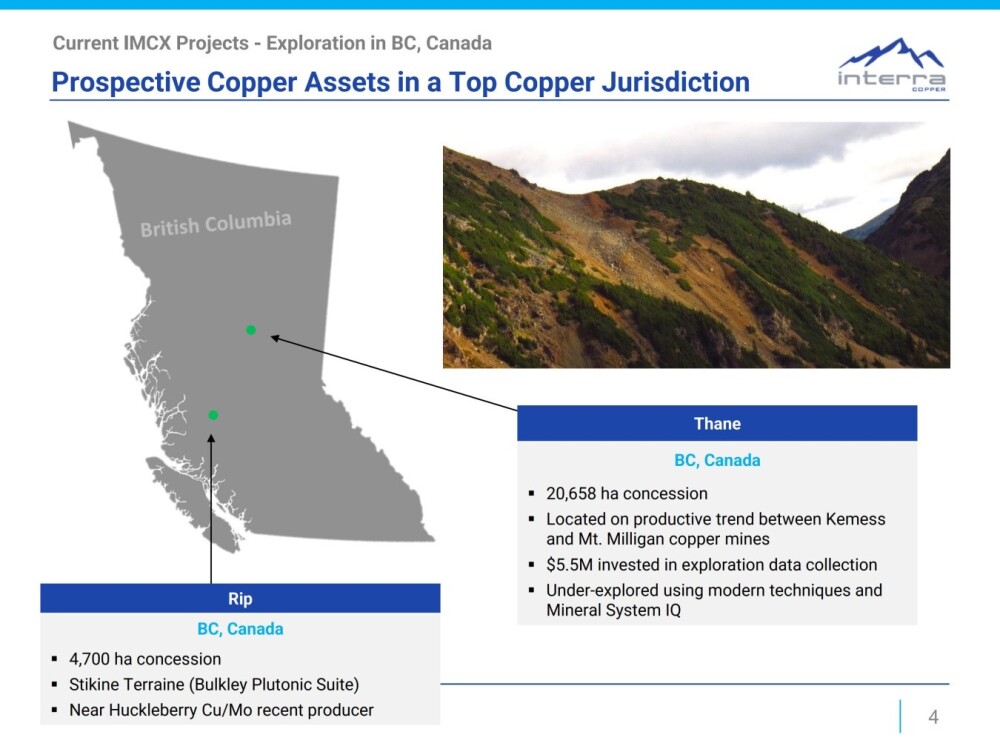

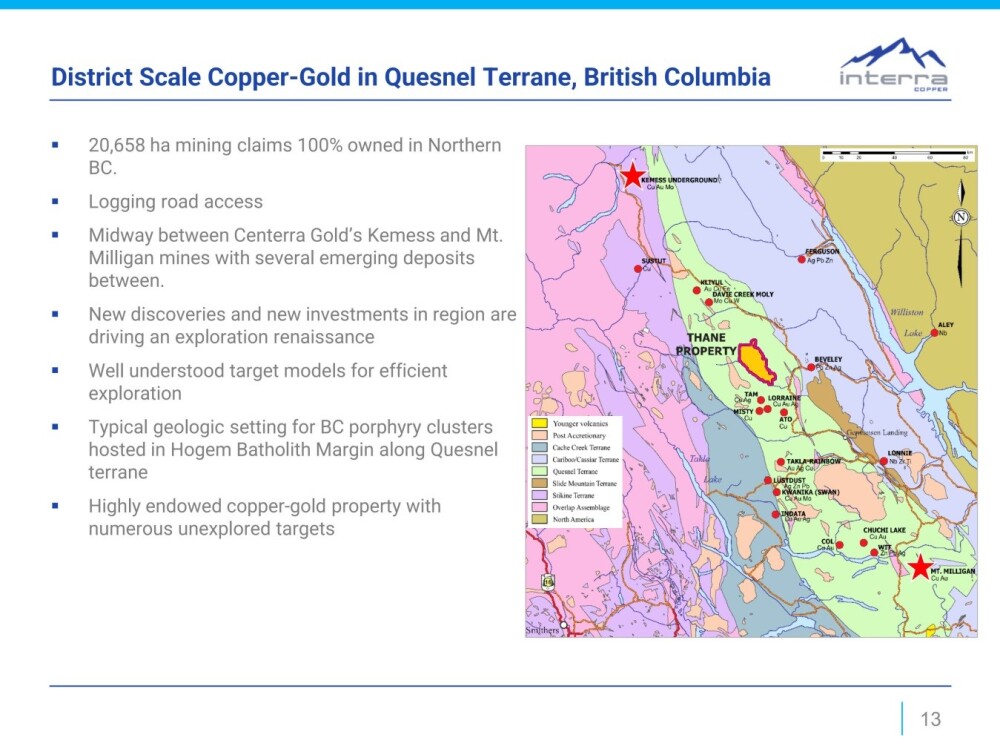

This slide shows the location of the company's two properties in British Columbia and provides a brief overview of their attributes.

The larger Thane property is situated in the prolific Quesnel Terrane, which runs almost the entire length of British Columbia.

The 100% owned district-scale Thane property is over 20,000 Ha in extent.

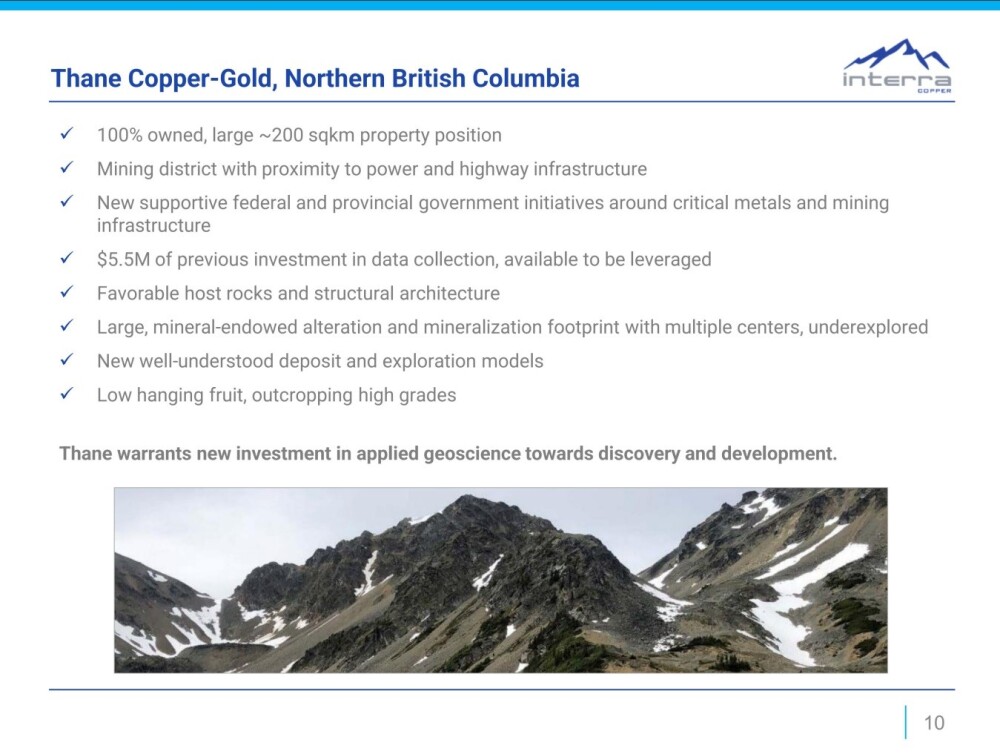

This slide shows the principal attributes of the Thane property.

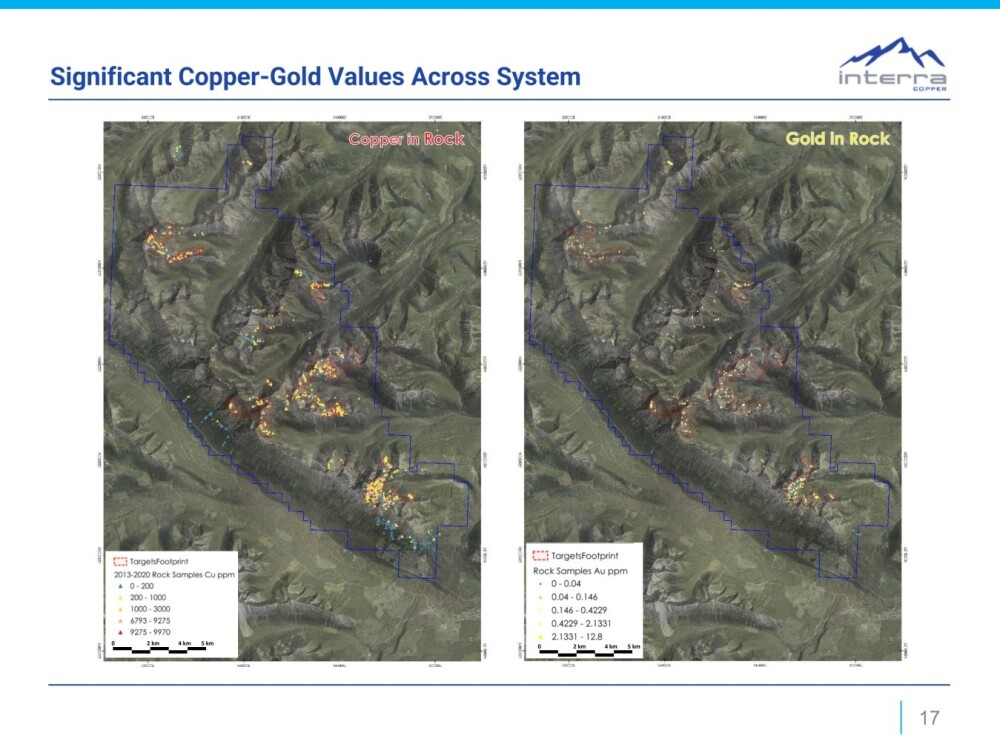

Thane boasts significant copper-gold values across the system.

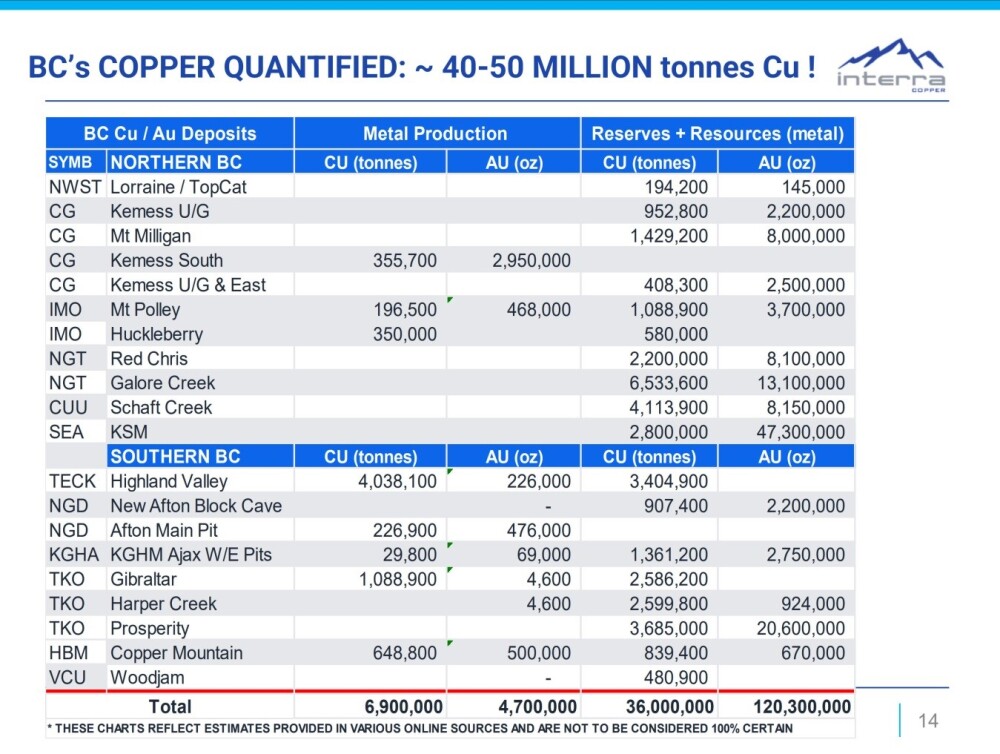

There is a lot of copper in BC which bodes well for exploration on the company's properties, especially given Thane's location in the Quesnel Terrane.

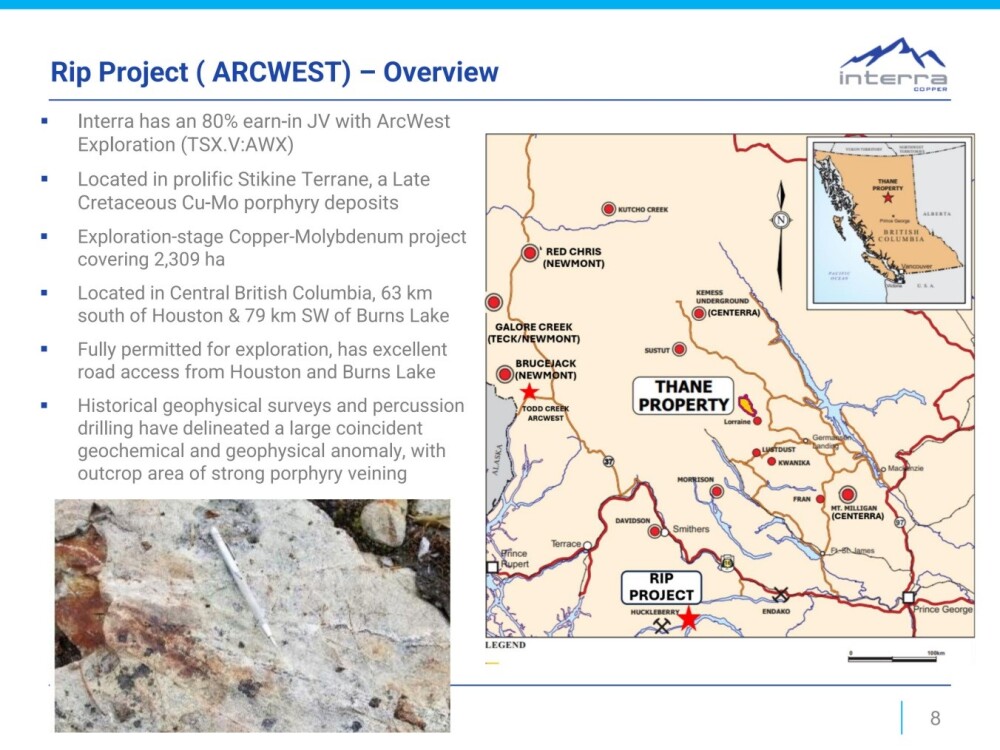

This slide provides an overview of the smaller Rip property to the southwest.

Here is what is planned for this year going into 2025.

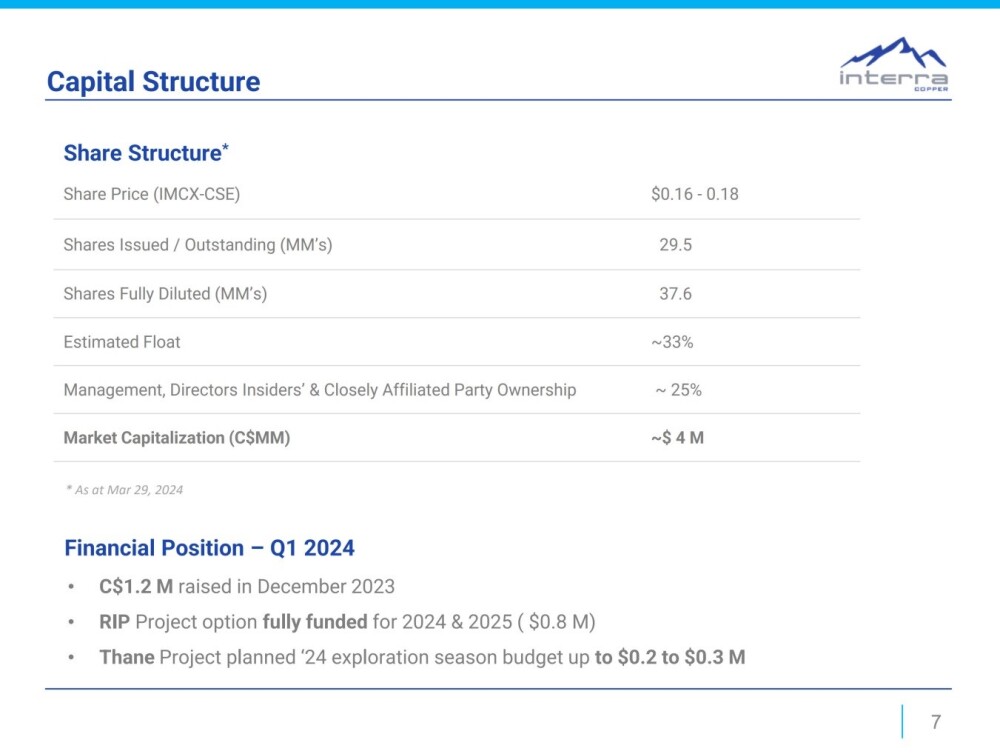

Lastly, this slide shows the capital structure. It is noteworthy that of the modest 29.5 million shares in issue, only a third, or under 10 million, are in the float.

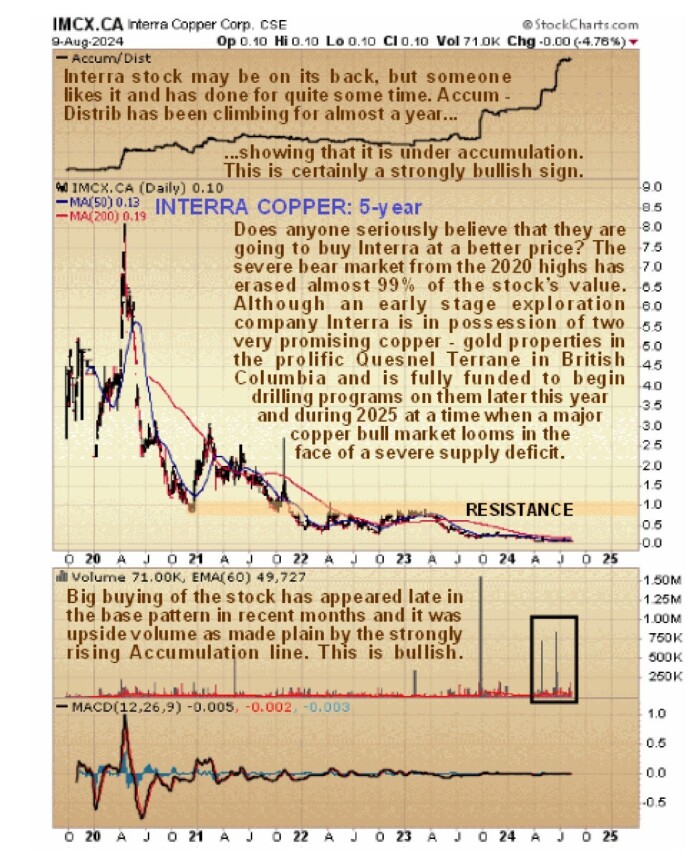

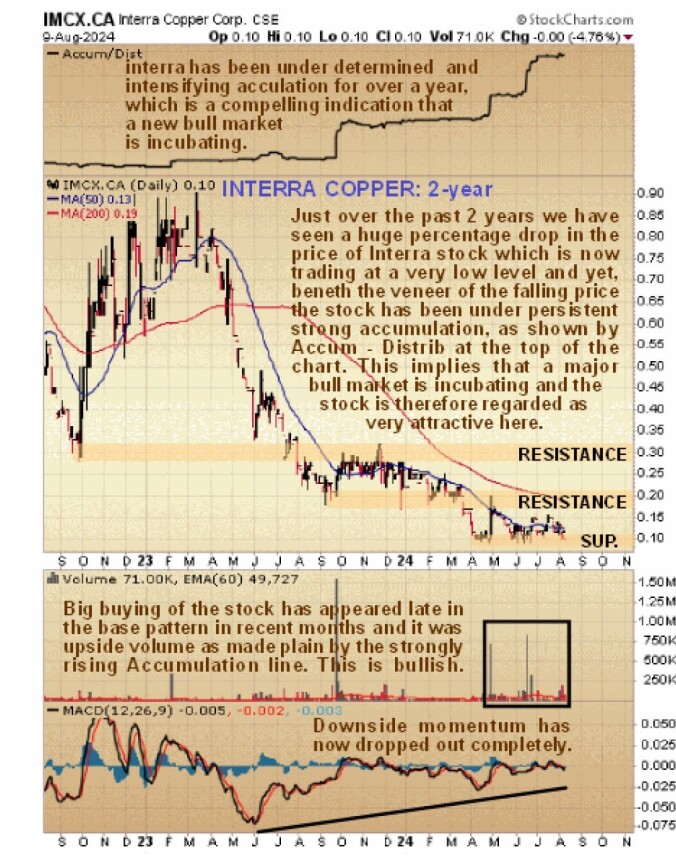

Now we will proceed to examine the charts for Interra Copper on which it will quickly become clear in the light of the positive fundamentals for the company described above that we have a rare and unusual situation where there is huge upside potential, especially in percentage terms, and downside is almost non-existent in other words the risk / reward ratio is massively skewed in favor of buyers of the stock here.

Starting with the long-term 5-year chart, we see that from its (admittedly short-lived) peak above CA$8.00 towards the middle of 2020, Interra has lost almost 99% of its value at its current price following a long and especially severe bear market. Yet, when we consider the now favorable outlook both for the company following successful financings and the prices of the metals it is looking to produce, primarily copper and gold, it quickly becomes clear that there is a whole lot of upside for the stock and no downside.

Even on this long-term chart, it can be seen that there are some smart money investors who hold this view too, as their accumulation of the stock over the past year, revealed by the high volume buying, especially in recent months, has driven the Accumulation line strongly higher, which is very bullish.

Moving on, the 2-year chart captures the latter part of the bear market and opens it out so that we can see more clearly what has been going on. Here we see that, following the last severe downleg in the Spring, the stock has been trading in another range that superficially looks like it may lead to another downleg, but a downleg to where exactly?

It's already at only 10 cents, so there's hardly any downside left.

It is, therefore, very interesting to observe that while this trading range has been building out, there has been a marked increase in upside volume with buyers becoming more aggressive, which has driven the Accumulation line more steeply higher. This is a powerful indication of buying by those who see better times ahead and consider the stock to be way undervalued, and it implies that this trading range is, in fact, a base pattern.

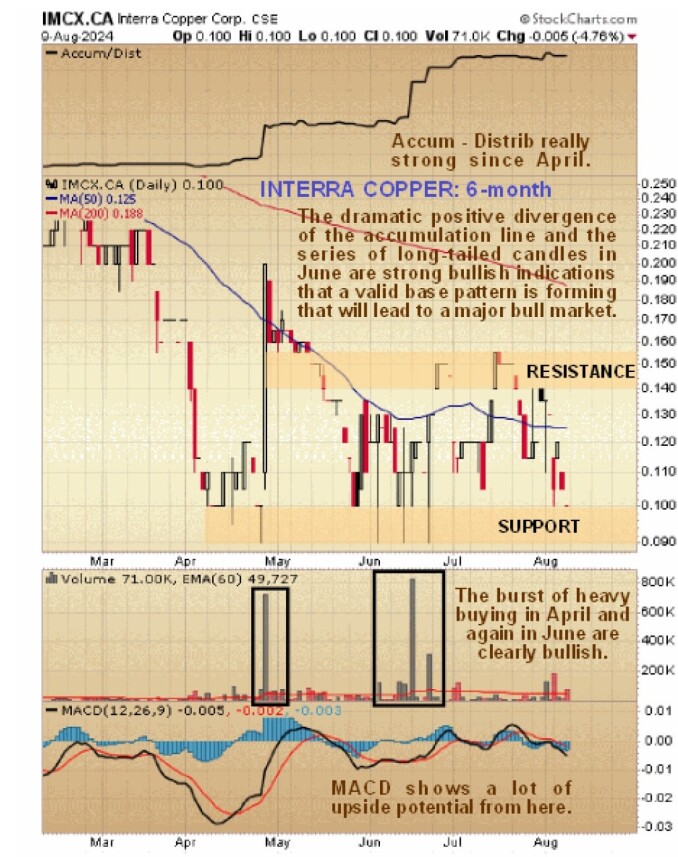

The 6-month chart enables us to examine the presumed base pattern that has formed from the April lows in detail. Here, we can clearly see the strong buying that has put a floor under the price of 9 cents. Most of this upside volume is plainly evident from the volume pattern, the strongly rising accumulation line, and the long-tailed candles in June when there was strong buying.

This is all very bullish, and the "cherry on the cake" for buyers of the stock here is that it is now at a great price (at the time of writing) following the reaction back of the past two weeks or so that has brought it back to a mere 10 cents.

Lastly, it's worth us taking a quick look at the copper price chart as it is an important background factor.

On its latest 3-year chart, we see that it has corrected quite hard since mid-May, but having arrived in a zone of quite strong support where it is now oversold, this is a good point for it to reverse back to the upside again soon, which would be a positive for copper stocks generally.

The conclusion is that, whilst Interra Copper must be classed as speculative as it is a junior exploration stock at a very low price the risk / reward ratio is about as good as it gets and with this proviso it is rated an Immediate Strong Buy and one that is worth going overweight on.

Interra Copper's website.

Interra Copper Corp. (IMCX:CSE; IMIMF:OTCQB; 3MX:FRA) closed for trading at CA$0.10, US$0.099 on August 12, 2024

| Want to be the first to know about interestingCritical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Interra Copper Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Interra Copper Corp. Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.