Expert Sees Major Bull Market Starting For This Gold Co.

Technical Analyst Clive Maund explains why he believes Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) is a Strong Buy.

Although Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) is still at about the same price as where we looked at it last April, its technical condition is vastly improved as we will proceed to see after again reviewing the fundamentals of the company.

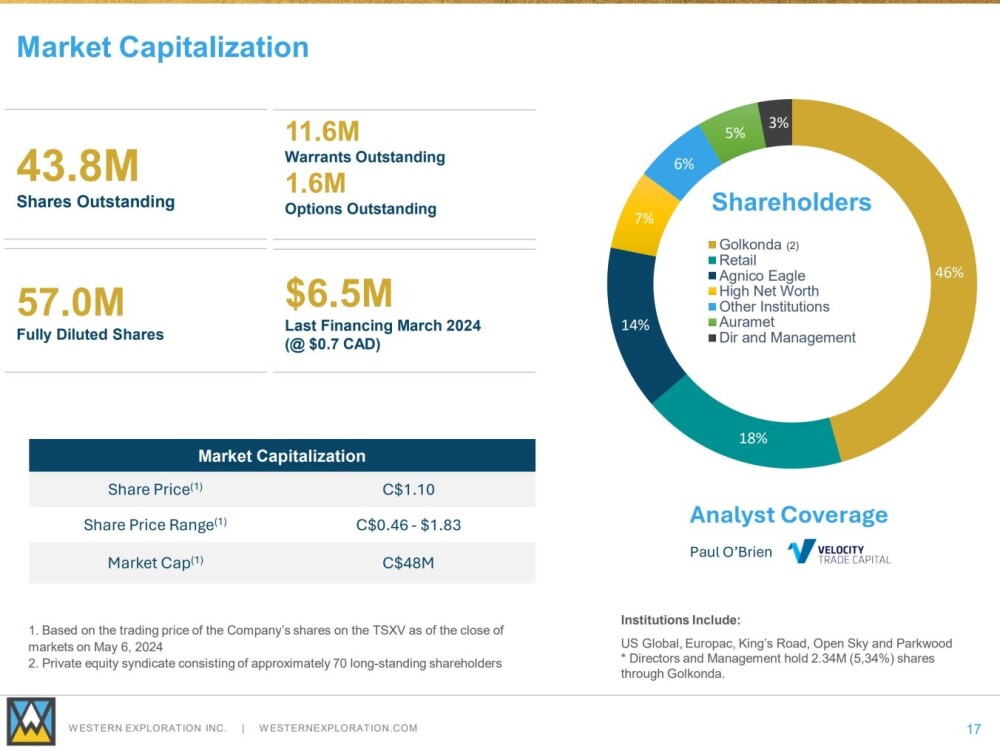

Western Exploration is chiefly a gold explorer, and gold is set to perform very well over the next several years due to accelerating currency debasement and war, with silver set to do very well too, especially later in the cycle, and these trends will clearly be beneficial for the company. Another big positive is that the company has already discovered significant reserves at its projects in northern Nevada, which is a mining-friendly jurisdiction and still another positive is that the number of shares available to retail investors is tiny at about 6% of the number of shares in issue which itself is a reasonable 43.8 million. This means that any significant increase in demand for the stock could lead to a spectacular spike, and the stock is already powering up to make significant gains.

The following slide, taken from the company's latest investor deck, shows the key investment highlights of the company.

The company's flagship property in northern Nevada has two main ore bearing areas, Doby George and Gravel Creek.

The next slide displays the MRE (mineral resource estimate) for the Aura Project.

The last slide shows the capital structure of the company, and it shows that due to Golkonda owning a sizable 46% stake in the company, Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) owning a further 14%, other institutions owning 18%, high net worth investors owning 7% and directors and management owning 3%, that only leaves a meager 6% of shares in the float for retail investors to buy.

So it is clear that once interest in this sector ramps up, which it appears to be now, the scope for speculative gains in a stock such as this is great.

Turning now to the charts, we quickly realize that Western Exploration is powering up for a major bull market. We had earlier observed the breakout from a Head-and-Shoulders bottom in March that is shown on the 20-month chart below, and whilst we had expected a normal post-breakout reaction, it was not expected to react back as far as it did, for as we can see, it reacted back into the H&S bottom and although this was a somewhat disquieting development, the buoyancy of the Accumulation line when this happened suggested that it would reverse back to the upside and that it has done.

A Double Bottom base pattern formed above CA$0.70, and the good news is that it broke out of this Double Bottom on really strong upside volume, which is clearly bullish, and we will now proceed to look at this in more detail on the 6-month chart.

On the 6-month chart we see how the price broke out of the second low of the Double Bottom on really strong volume late last month a move that was followed by consolidation in a small Flag leading to renewed advance with very positive price / volume action with the Accumulation line strong and momentum (MACD) improving.

The price / volume has been positive for most of this year, and the price is now starting to advance away from the base that started to form as far back as August of last year, and at a time when the entire sector is commencing a major bull market.

Holders of Western Exploration should, therefore, stay long, and it is rated a Strong Buy here as the bull market is still in its earliest stages.

Western Exploration's website.

Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) closed at CA$1.11, US$0.803 on August 20, 2024.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc. and Agnico Eagle Mines Ltd. Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.