Explorer Approved 'To Go Where No Drill Has Gone Before' in Idaho

The amendment to Liberty Gold's plan of operations for Black Pine and recent drill results from the project are discussed in a Haywood Securities report.

Liberty Gold Black Pine

Liberty Gold Black PineIn a Feb. 18 research note, Haywood Securities analyst Geordie Mark reported that Liberty Gold Corp. (LGD:TSX; LGDTF:OTCQB) received approval of the amendment to its flagship Black Pine project's plan of operations, allowing the company "to go where no drill has gone before."

Mark specified exactly how the amendment does just that.

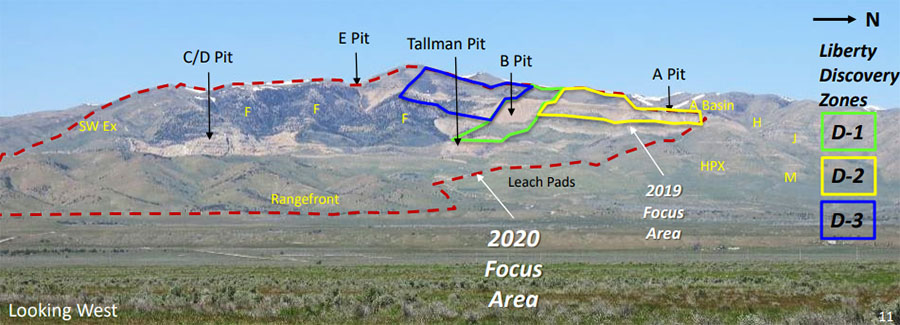

It adds another 4.6 square kilometers (4.6 sq km) to the explorable Black Pine project area, taking the total to 11.9 sq km, he wrote. It expands road access by another 15.3 miles, increasing the number to 56.7 miles. It allows access to the areas between the Rangefront and M zones to the east of the primary area of focus and between the F and J zones to the west, thereby connecting the Black Pine system on a broader scale. The amendment also adds 154 permitted new drill pad sites to the existing 442. Finally, it allows Liberty to access well water that was used historically.

"Given the success realized at Black Pine and the unconstrained limits of the defined gold mineralization," Mark wrote, "we view this update positively as additional access to potent exploration ground and infrastructure de-risking could lead to an augmented lower-risk project over time."

Mark also presented the highlights of recent drilling at Black Pine, done to support metallurgical testing.

Infill drilling encountered noteworthy intersections of higher grade oxide gold mineralization, he noted, "supporting the potential for grade continuity and (and grade thickness) and interval stacking at Black Pine, with oxidized intervals also showing potential amenability to simple heap-leach processing."

Highlight hole LBP-214C demonstrated the latter, returning 3.32 grams per ton gold (3.32 g/t) over 47.4 meters (47.4m), including 12.5 g/t gold over 5.8m. Those two intervals showed weighted average cyanide-soluble gold of 91% and 90%, respectively.

"We anticipate upcoming results will provide further confirmation of the targeted thesis of gold mineralization within the core Black Pine area, with gold mineralization continuing to demonstrate grade continuity and favorable heap leach-compatible metallurgy," commented Mark.

He listed the potential stock moving events expected to happen this year at Black Pine.

Near term is the release of pending 2020 drill results, he indicated. In Q2/21, Liberty should complete a maiden resource estimate. In April, the explorer plans to start a two-pronged drill program, 48,000 meters of reverse circulation drilling and 8,000 meters of diamond drilling, followed in Q3/21 by starting work on a preliminary economic assessment. Finally, also in the third quarter, results of the phase 3 metallurgical testing should be available.

Mark concluded that "Liberty is well positioned for resource growth in the near term and given its attractive valuation, remains a highly prospective acquisition target through downstream mergers and acquisitions activity."

Haywood rates Liberty Gold a Buy. Liberty stock is trading at about CA$1.58 per share, and Haywood's target price on the company is CA$3.15 per share.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Liberty Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Liberty Gold, a company mentioned in this article.

Disclosures from Haywood Securities, Liberty Gold Corp., Research Report, February 18, 2021

Analyst Certification: I, Geordie Mark, hereby certify that the views expressed in this report (which includes the rating assigned to the issuer's shares as well as the analytical substance and tone of the report) accurately reflect my/our personal views about the subject securities and the issuer. No part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendations.

Important Disclosures

?-? Haywood Securities, Inc. has reviewed lead projects of Liberty Gold Corp. and a portion of the expenses for this travel have been reimbursed by the issuer.

Other material conflict of interest of the research analyst of which the research analyst or Haywood Securities Inc. knows or has reason to know at the time of publication or at the time of public appearance: n/a.

Research policy is available here.