Explorer Expands Land Position at Nevada Gold Project by 400%

Riley Gold Corp. reported it has greatly expanded the land position at its Tokop Gold Project to more than 21 square kilometers.

Riley Gold Corp. (RLYG:TSX.V) announced in a news release that "it has significantly increased the land position of its Tokop Gold Project located within the Walker Lane Trend in Nevada by 400% to over 21 square kilometers."

The company advised that its strategy to significantly increase the Tokop Project land package was implemented to cover additional geological interpretation. The firm explained that it completed the expansion of the Tokop property by staking 160 additional unpatented mining claims covering around 3,280 acres (13.3 km?) and by signing an option agreement to acquire additional unpatented mining claims on the Rattlesnake East property covering about 922 acres (3.7 km?). The firm indicated that the Tokop Project area now consists of approximately 21 km? after the addition of the newly acquired land package.

Riley Gold's CEO Todd Hilditch remarked, "Since closing our Nevada property transactions (Tokop and Pipeline West/Clipper) in October 2020, we have completed a mapping and rock/chip sampling program at the Tokop Project in an effort to further identify the project geology and structural setting. We have sent over 110 samples to the assay lab, pending results, and have quadrupled the land package to cover an interpreted, larger than expected, mineralized system. We are extremely pleased with our findings at the Tokop Project to date and look forward to initiating our maiden drill program, which is expected to begin in late March/early April 2021."

The firm noted that in the second half of 2020 it consolidated the core of the Tokop Project by executing several non-dilutive purchase and option agreements with land holders. The company stated that it made the decision to demonstrably expand the Tokop Project's land package after "extensive review of available data from previous work that included a successful drill program and more recently generated data by field personnel; Riley Gold's initial surface rock samples confirm the high-grade nature of the system; and Riley Gold's re-interpretation of geophysical/drilling results outlining potential for a much larger mineralizing system than previously interpreted."

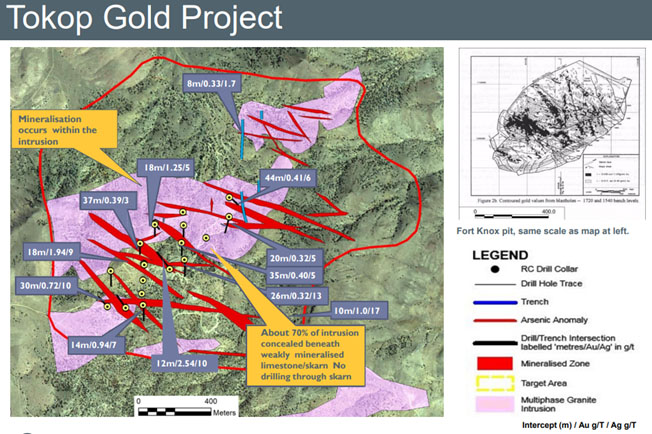

The firm stated that "Tokop could host an intrusion-related gold system similar to those of Fort Knox type in the Tintina Gold Belt of central Alaska and contiguous parts of the Yukon." Shear-hosted veins at Tokop have been found to extend for almost two kilometers along strike and historical test samples from within the vein systems ran as high as 34.4 g/t gold and 36.0 g/t silver. The company noted that it has received a limited amount of data from newer sampling efforts that returned values greater than 16.0 g/t gold and 70.8 g/t silver. The firm pointed out that these assay results were for only 9 of 120 samples gathered and that it will release the complete results after they have been received.

The company reiterated that it has already staked and filed 160 unpatented royalty-free mining claims and has entered into an Exploration and Option Agreement with Mountain Gold Claims LLC (MGC) for the Rattlesnake East Property. The agreement provides Riley Gold with the option to purchase a 100% interest in certain unpatented MGC Property mining claims in Esmeralda County, Nevada.

The firm reported that the option agreement is valid for a period of 20 years. As set out in the agreement, Riley Gold has made a one-time payment to MGC in the amount of US$7,788 to reimburse MGC for the 2021 maintenance fees paid to the Bureau of Land Management. The agreement further stipulates that Riley Gold must issue a cash payment of US$5,000 to MGC that it has already paid and must also commit to a first year work commitment of US$5,000, though no further work commitments are required after the first year.

The agreement gives Riley Gold the right to purchase the property any time during the first 10 years for US$500,000. In the event that the company elects to maintain the lease for the full 20-year term, cumulative payments totaling US$1,537,788 will have been paid to fulfill the purchase price. Should Riley elect to exercise the option, it will be required to pay MGC a 3.0% NSR royalty on the Property.

[NLINSERT]Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Riley Gold. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Riley Gold, a company mentioned in this article.