Explorer Holds Nickel and Gold Assets in 'Low-Risk Jurisdictions with Fast Track Potential'

Maurice Jackson of Proven and Probable speaks with Huntsman Exploration CEO Peter Dickie about his company's nickel and gold divisions and the active exploration program it is carrying out in Australia.

Maurice Jackson of Proven and Probable speaks with Huntsman Exploration CEO Peter Dickie about his company's nickel and gold divisions and the active exploration program it is carrying out in Australia.

Maurice Jackson: Joining us for a conversation is Peter Dickie, the CEO of Huntsman Exploration Inc. (HMAN:TSX.V).

Pleasure to speak with you today and have you share the opportunity before us in Huntsman Exploration. Huntsman is a little different to many juniors in that you have a diversified approach to value creation, specifically, you have a nickel division and a gold division, both of which contain assets in low-risk jurisdictions with a fast track potential. Sir, please introduce us to Huntsman Exploration in the unique value proposition the company presents to Huntsman Exploration and the unique value proposition the company presents to the market.

Peter Dickie: We believe in investing both smartly and looking at the future as far as demand is concerned. We feel that the electrification of transportation and other sources of energy is going to be a very big factor going forward due to government and consumer support. But we also feel that the current economic situation worldwide, largely brought on by the pandemic but also with underlying factors and are gearing towards both the greening of the economy, and, unfortunately, Coronavirus related, is heavily increasing debt levels with governments.

As a result, we wanted to be involved in the battery metal space. And we believe that nickel will be one of the premier battery metals in demand, and it's proving up to be so. But we would be remiss to our shareholders if we didn't also participate in the gold market. Because all these massive levels of debt that the governments have brought on around the world will eventually have to be paid back. History has shown that big spending typically leads to inflation, and the safest, tried, and truly safe storage of wealth when it comes to inflation has always been gold.

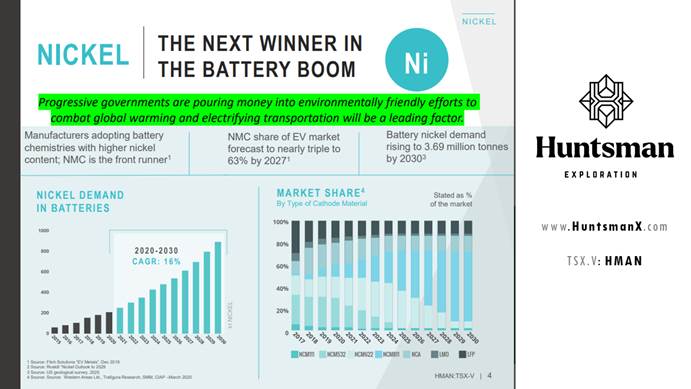

Maurice Jackson: To truly appreciate the opportunity before us in Huntsman Exploration, I want to focus on the nickel division at a 30,000-foot level. Let's cover some basics regarding nickel, which is a metal that is in high demand, but has been an absolute sleeper on many speculators' radar. Mr. Dickie, why should speculators have an interest in nickel?

Peter Dickie: Well, I'll give you three letters to start with, NMC. And that stands for nickel, manganese, cobalt. Now, everybody knows about Tesla and all their battery developments and the million-mile battery that has come out. People also know about solid-state batteries that are coming out which alleviate some of the issues with a liquid-based lithium-ion battery. But the core is involved with nickel, manganese, cobalt. And the reason why I point that out is that the predominant development is occurring in what they call an NMC, 811 battery. And that's eight parts nickel, one part manganese, one part cobalt. So obviously, when your predominant metal that you require in these batteries is nickel, we felt it very prudent to be involved in the nickel space. And Huntsman has a terrific asset in Australia with a nickel discovery on it.

Maurice Jackson: Now, here's where the story gets really interesting. For countries like the U.S. to go green, they need a particular type of nickel for the clean energy industry. It's a type that Huntsman Exploration has discovered on a seven-kilometer mineralized trend, which we will discuss here shortly. But before we do, sir, what is nickel sulfide? And how does it fit into the value proposition before its enhancement?

Peter Dickie: Well, there are two types of nickel deposits in the world. There are nickel sulfide deposits and then there are nickel laterite deposits. The laterite deposits are perhaps more common and more well known around the world. And they are an oxidized version essentially of a former sulfide deposit. Now, the problem with a laterite deposit is that it has contaminants that you can't introduce into a battery system because of the purity required for batteries. So the sulfide nickel is by a far stretch the required nickel source for battery metals.

That's not to say that laterite deposits can't be used, but for them to be used, they have to go through an expensive and extensive chemical upgrading process, which adds to the cost of producing that nickel. Therefore, the sulfide deposits are at an obvious advantage right from the start.

Maurice Jackson: What I like about nickel, but in particular with nickel sulfide, is that it is a "when," not an "if" proposition. And if you have a "when" proposition, you will have a "win" proposition. But the opportunity before us becomes a little bit more compelling. Please fill us in on the pending supply deficit for the battery-grade nickel.

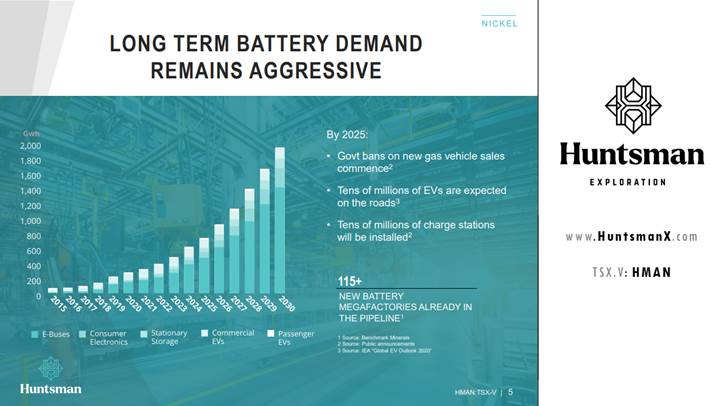

Peter Dickie: Well, as I mentioned earlier, the growth in the greening of the economy is driving enormous growth in the electrification of in particular vehicle production. And you're seeing vehicle producers, major vehicle producers around the world that have announced start dates as to when they will be 100% electrifying their fleet as far as production is concerned. And in recent cases, we're seeing that date moved up. In response to the pandemic, the governments around the world are pumping enormous amounts of money and taking advantage of the situation as they can direct their economies into the greening of the economy. So we see this momentum and this trend speeding up.

As a result, the demand for nickel is ramping up, perhaps even quicker than was forecast 24 months ago. There is a large number of what they call mega factories, either in the planning or construction stage to produce batteries. And these, of course, will be required for all of the electrified vehicles that will be put out there.

Maurice Jackson: What are some of the distinct competitive advantages that Huntsman Exploration has among your peers?

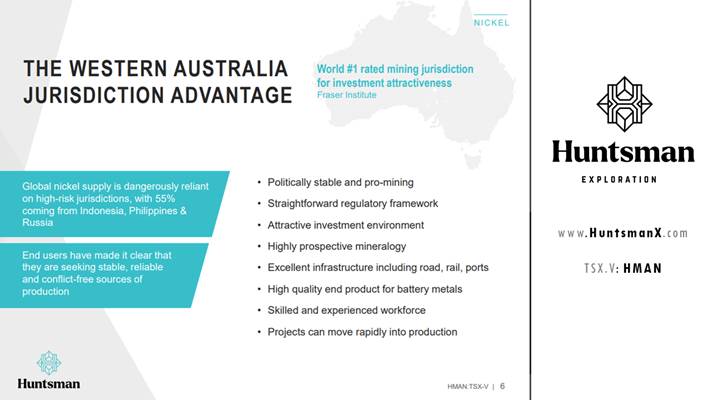

Peter Dickie: Well, right off the top, we talked about a two-fold approach to investment to create shareholder wealth. I believe that's a very strong key, and that we can take advantage of both the growing nickel market and as we feel there's a strong gold market as well. We're also located in jurisdictions that are both safe politically and renowned for their mining-friendly atmosphere and their mining-friendly attitude. I know that in Western Australia, for readers that may not be familiar, there are various instances where projects there have gone from discovery to production, in as short as two, three, four years versus in North America, certainly in Canada, which is used to more of a decade outlook.

On the U.S. front as far as our gold properties are concerned, Nevada is one of the most mining-friendly jurisdictions in the US. And they are certainly amenable to future growth as far as additional deposits are concerned. But as I say the key in obtaining the assets that we did obtain and are working on is the safeness of the jurisdiction, the security of title, and the ease and ability to be able to bring these assets into production.

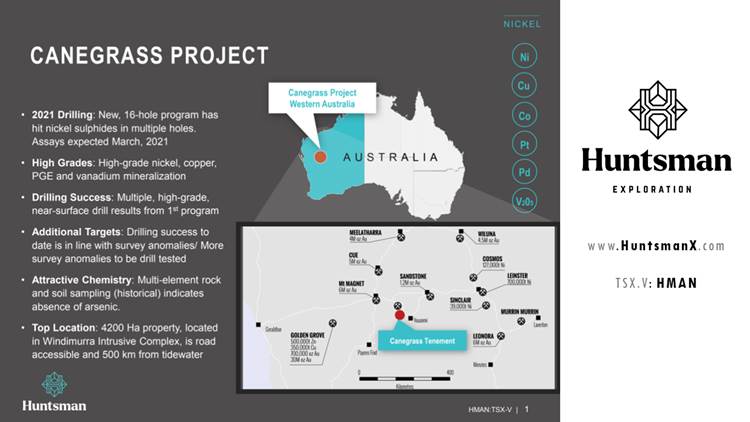

Maurice Jackson: Speaking of Western Australia, take us there and introduce us to the flagship Canegrass project.

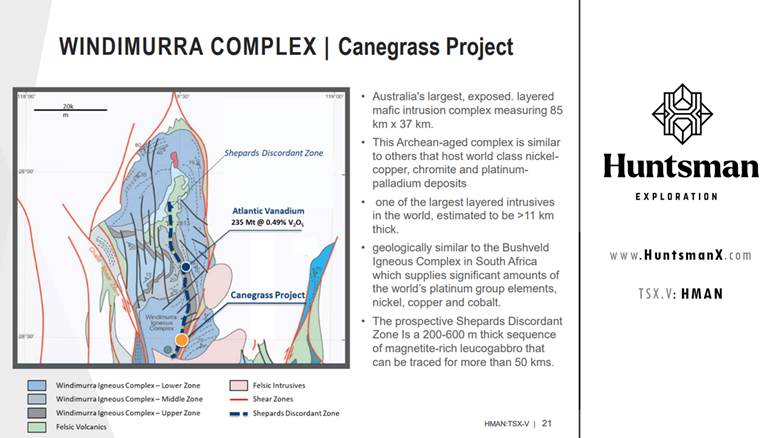

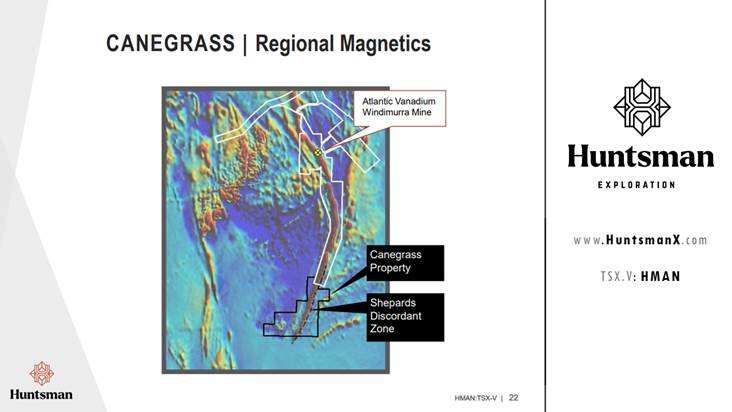

Peter Dickie: Canegrass was an asset that was acquired by the company several years ago. There was a maiden drill program done on it in 2018. And as you mentioned at the start, there's a seven-kilometer-long geophysical structure that runs from the northeast to southwest of the property. It's called the Shepard Discordant, all part of the Windermere Complex. Along that particular zone, further north adjoining property is a large privately run vanadium mine. So this is a type of geophysical structure that does host deposits. Initially, when the project was looked at, we soon realized that it may be another source of a variety of minerals. When I say variety, there are a host of minerals on this property.

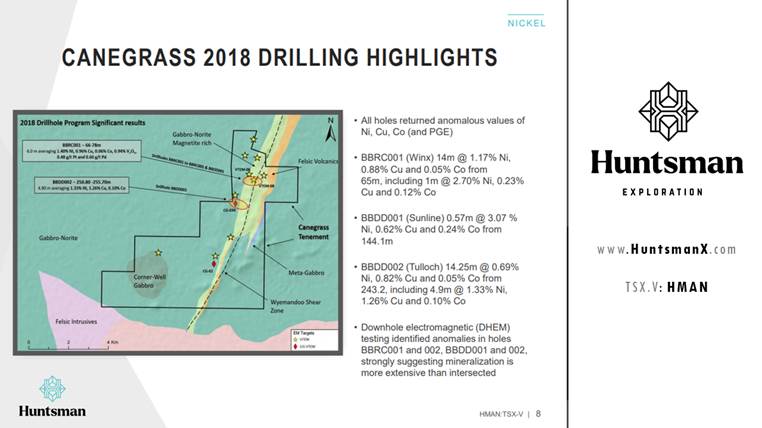

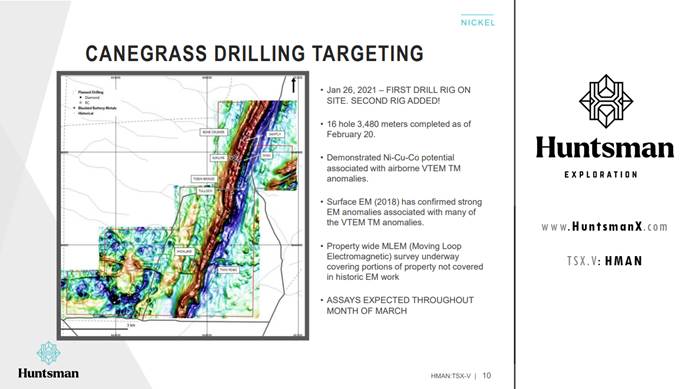

The maiden drilling program was done in 2018; there were some significant nickel, copper, cobalt, and in some cases, platinum group metals discovered. Unfortunately, at the time, the nickel market had not quite yet recovered from previous lows, and the whole concept of electrifying automobiles and the demand for batteries had not ramped up yet. So the project sat quietly while these recoveries took place. And then in late 2020, we were able to secure a substantial amount of funding and we were able to resume drilling again. We've just incidentally completed our 2021 drill program, which is a follow-up to 2018. And we're expecting results on that shortly.

Maurice Jackson: Please walk us through the geological model and then the exploration approach.

Peter Dickie: Well, in Australia, which is an area that's renowned for high-grade sulfide nickel deposits, there's been a number of them discovered. And in particular, I want to mention the consulting company that we work with based in Perth, it's a company called NEWEXCO. And they have been involved in no less than about 10 substantial mine discoveries in the last 15, 20 years, including several large nickel sulfide deposits that were discoveries and are now producing mines.

But the discoveries there, well quite often the way it's explained to somebody who's not a geologist is that they often are found in a deposit similar to what you would see if you hold your hand up. And what we believe we're hitting at the moment in our drill program is the fingers extending from the hand. And of course, what you look for is the source of those fingers, the palm of the deposit, that is the ultimate goal, which in other instances in Australia tends to be the highest grade, large tonnage repository of the nickel sulfide material.

We believe our drilling to date has been touching on the fingers right now. And we will continue our hunt until we find the palm.

Maurice Jackson: Speaking of those fingertips last week, Huntsman Exploration released (Press Release) the initial results of your 2021 drilling regarding multiple holes containing nickel sulfide. Sir, walk us through the highlights from last week's press release.

Peter Dickie: Well, I wish I could have complete assay results for you. But those of you that are familiar will know that when a drill program occurs, technology through the use of a handheld, what they call an XRF machine, allows the geological team to spot check material that comes out of the drill, both in samples from the RC program and core from a diamond drill program. That will confirm what they will visually see in the core. That allows them to narrow down exactly what goes in for assay. There's no point spending dollars on assay material that you don't believe contains any form of mineralization that you're after.

As a result of the spot checks in the field, as we mentioned in our previous release, a substantial number of samples have been delivered to the lab. We're in the process of finalizing splitting of our core to send a substantial amount of drill core, diamond drill core to the assay lab as well. And that will give the true picture of exactly what's in the material and also give an accurate picture of the extent of the mineralization, the grade of the mineralization, and the overall width that we encountered in our drilling.

Maurice Jackson: Allow me to be the first to congratulate you, the probability of hitting on all of your targets is such low probability. And your team did it. This is a great demonstration of the geological acumen and the proof of concept. Can you share when we might receive the official assay results?

Peter Dickie: As far as assays are concerned, we're expecting the results from the first batch of RC drilling results to come in early March, likely the second week, and we expect a fairly steady production of results right through March. So it should be a very exciting time.

Maurice Jackson: And what about the survey? I understand that you are carrying out another survey - similar to the one that you did before - that will cover several new areas. Considering the incredible success of the first one, almost like an X marks the spot for your drill targeting, I imagine you are very keen on the expanded survey data.

Peter Dickie: We took a combination of an aero mag survey and then paired it up with a ground survey. And when the two overlapping survey results produced electromagnetic highs, then we found that those were the ideal targets to aim for. And as you mentioned, in 2018, we hit on 100% of the holes. And in our 2021 program, I will await the assays to come in. But I can tell you it's shaping up to be another very successful turn.

In 2018, for reasons given at the time, the ground survey follow-up program simply followed a swath down the length of the property that followed the primary geological trend that runs through the property, the Shephards Discordance Zone, it's called. So there was a substantial amount of the property that did not see the ground follow-up electromagnetic survey. And that's what we're conducting at the moment. It started about a week following the commencement of drilling operations in early February. And the amount of ground they're covering, they will be at it for several more weeks. And the results will come out shortly after they're completed. It's a little quicker process than obtaining assays. They will also be involved in some of the downhill electromagnetic surveys that will be done with the drilling that we just completed.

Maurice Jackson: Now, if the new results are as strong as you hope, what do you think will be the next steps? Western Australia is a place for moving projects along quickly. So what milestones are on the table for you this year?

Peter Dickie: We anticipate doing another substantial round of drilling at Canegrass this year.

There were seven or eight different prospects that we targeted. Some had seen drill holes in the past, others haven't. From the interpretation that we have to date, we know that there are two or three of those targets that will receive the bulk of priority in the upcoming drill program. And we hope to chase those sources of mineralzation and hopefully, start looking at being able to accumulate drill results together on some of those specific targets, to the point where we can start talking about tonnages.

Maurice Jackson: In my opinion, the market cap should be higher, and you're probably agreeing here with me. Which bodes well for those joining us today. Why has the company been under speculators' radars?

Peter Dickie: Well, it's largely because the company has been relatively quiet since the 2018 drill program up until the late summer, early fall of 2020 when we obtained the gold properties in the U.S. and we raised the capital. The company was fairly quiet, the nickel market hadn't picked up substantially. We did have a change of management approximately a year ago when I was coaxed out of retirement to come and lead this project. I can tell you the first thing I did before I agreed to this project, and this was marginally pre COVID, is I flew to Perth, I met the property vendors. I met the geological team down there. I talked to several people I was introduced to in the mining industry there.

And the amount of encouragement that I received concerning our property and the virtues of operating Western Australia was unprecedented from my point of view and encouraged me to accept and take on the role of president and CEO. So there was certainly a low after the 2018 drill program. And it has taken us a little bit of time to get things organized. But now that we are funded, now that we've secured the projects that we feel are key to advance the company. We're all guns a-blazing and moving forward as quickly as we can now.

Maurice Jackson: Let's discuss some other topics important to this discussion here, are your projects 100% owned, or do they have any earn-in options with reversionary interest?

Peter Dickie: Our gold project in Nevada is an earn-in process, to earn up to 70%. The holding company is a company called Liberty Gold. Liberty is a 19.5% shareholder of us. They've been great shareholders.

As far as Australia and the Canegrass project is concerned, it was an option agreement for 100% of the property. It required some payments and expenditures on the property. And I'm happy to say that with this drill program that we have just completed, we have completed our obligations under the agreement and we will be obtaining a transfer of title into our name in the coming weeks.

Maurice Jackson: We're going to get into some numbers later in this discussion. But from a capital expenditure standpoint, how is infrastructure on your projects?

Peter Dickie: The Canegrass Project is typical of an Australian project. Looks somewhat remote, if one were to look at it with Google Earth, but I can tell you that almost every mine operating in Western Australia looked remote at one point or another. Their infrastructure system there is geared heavily towards producing and delivering material to markets. There are operating nickel facilities that are in the not too distant area around our property. There are also mines within close proximity of our property. So there are processing facilities. There is the ability to get staffing there, there are road networks there. It's a great jurisdiction to operate in.

Maurice Jackson: What is your relationship with the indigenous people?

Peter Dickie: In Australia, it's a great relationship. Before drilling this operation, Huntsman completed what is referred to as a heritage survey there. It was completed successfully, we didn't encounter any areas where there are major concerns. We don't want to disturb any areas that are of significant heritage value.

Maurice Jackson: Very responsible. Are you fully permitted, sir?

Peter Dickie: We are. That was part of the process we went through in the fall, updating our heritage permits, updating our drilling permits, and it's all moving forward now.

Maurice Jackson: All right, is the ultimate goal to build a mine or arbitrage?

Peter Dickie: That's a great question. I get more excited about the finding and discovering. And the last project I was with I felt the same way. So, when it got to a certain point post-discovery in the deposit, when we knew the deposit size was certainly of economic significance, then we started bringing onboard Fortune 500 level staffing that could take it to the next step.

I would like to be alongside certainly but I also realize that to build a project properly and efficiently, it's best to bring in the most appropriate and most talented people at every level. And if that means in the future that we take on a significant partner, or a significant partner wants to acquire us, then we would certainly look at it from a shareholder return point of view.

Maurice Jackson: We've discussed the good, let's address the bad. What can go wrong? And what are your action plans to mitigate that wrong?

Peter Dickie: Well, when you're looking for a mine, the first thing that can go wrong is you don't find it. We feel that our drilling results to date and the indications that we have from our current drilling program, are certainly leading us down the right path. I believe myself that our assay results will help guide us moving forward. The next steps, obviously, are for us to drill enough material to justify the production of a resource report, and potentially a feasibility report that would justify whether that resource is sufficient enough to go into production or not. That's the largest impediment to a junior mining company looking to discover a mine.

We feel all the indicators are there. But we still have to prove that out. And of course, there will be ongoing funding requirements which we will have to raise. We have received a tremendous amount of positive feedback from the markets to date, and I believe if we continue to produce results, the way we have seen them in the past, and the way we feel we're sitting on now, then that will continue.

Maurice Jackson: Let's discuss the people responsible for increasing shareholder value. Mr. Dickie, please introduce us to your board of directors.

Peter Dickie: We have a combination of both geological and market-based people. To start with, I'll talk about Nathan Tribble. He's one of our professional geologists, who is in charge of our Australian operations. He's based in Ontario, and he's held senior positions with Sprott Mining, VALE Resources, Jerritt Canyon, Kerr Mines, Northern Gold. We also have Mr. Neil McCallum who's also a professional geologist. I've worked with Neil for over 15 years now.

Neil is the fellow who's in charge of our North American operations. And he will be instrumental in working with our Nevada team as far as development. I worked alongside Neil right from the early stages on a superalloy project in Nebraska that was the last substantial project that I worked on.

We also have Jeremy Ross, who's a director with over 20 years of experience in capital markets, venture capital financing. And he's worked with companies in the top 50 TSXV for performance. So, a very experienced capital markets individual. And our CFO is Joseph Meager, who is a CPA and a CA, and he's been involved with several companies that I've been a shareholder of, and certainly very familiar with how to keep mining companies operating both fiscally and prudently and ensuring that we have capital to develop assets as we move forward.

Maurice Jackson: Well-rounded team. Who is Peter Dickie, and what makes him qualified for the task at hand?

Peter Dickie: Well, that's a great question. I've been around the markets since the mid-80s. I first started in the markets as a stockbroker. And I converted from there into a company site individual. I've worked with over a dozen junior companies at the management level.

My last significant project, as I mentioned, was a strategic metal deposit in Nebraska. That is in feasibility, pre-construction phase right now, and was certainly a big success, but took up a lot of my time in the last decade, but following which, it allowed me actually to kind of step away and spend some time with my family for the last few years, until I was presented with this opportunity, which I simply couldn't pass by.

Maurice Jackson: How about boots on the ground? Who do you have on your technical team?

Peter Dickie: Boots on the ground, as I mentioned, we have an outfit called NEWEXCO based in Perth. And they in turn oversee our exploration on the Canegrass Project.

Maurice Jackson: Let's get into some numbers. Sir, please provide the capital structure for Huntsmen Exploration.

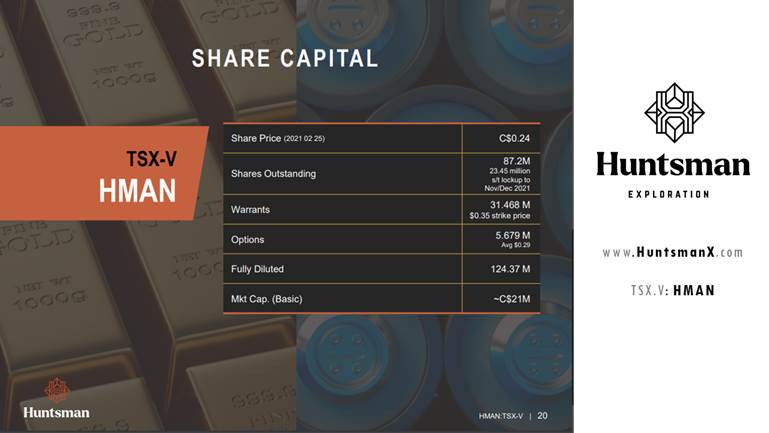

Peter Dickie: Currently, we have about 87 million shares outstanding. Approximately 23.5 million of that is tied in with our acquisitions in the U.S. and is subject to a lock-up until the end of 2021. With that financing, we have about 31.5 million warrants outstanding with a strike price of 35 cents. And then there are about 5.9 million options outstanding, again, with a strike price near 30 cents. So fully diluted were approximately 124 million shares outstanding. So given our current share price, we're in the sub $30-million market cap on a basic level. But we believe once we start proving up some of our talk and providing some assay results to not only justify our current drilling program but enhance our future drill programs that will see a lot of growth there.

Maurice Jackson: How much cash and cash equivalents do you have?

Peter Dickie: We have just over $2 million in cash. Our existing drill program is almost entirely paid for already. And so we do have flexibility there as far as starting up a new drill program. Our monthly burn rate is fairly low. As I mentioned, we run as low a management infrastructure as possible. But it will be inevitable that we will have to raise further funds. But we also believe that we will see a lot of people encouraged to exercise warrants, provided our results are as good as we believe they will be.

Maurice Jackson: How much debt do you have?

Peter Dickie: Zero.

Maurice Jackson: Are there any redundant assets on the books that we should know about?

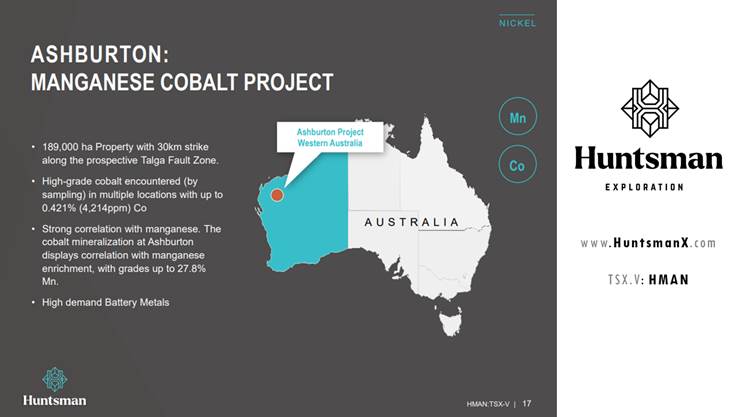

Peter Dickie: Well, we do have an additional asset in Australia, which is 100% owned. It's called the Ashburton project. And we did retain it, despite sheddingsome assets a year and a half ago. The Ashburton project is interestingly enough, a manganese cobalt prospect, which is the other two letters in the NMC batteries.

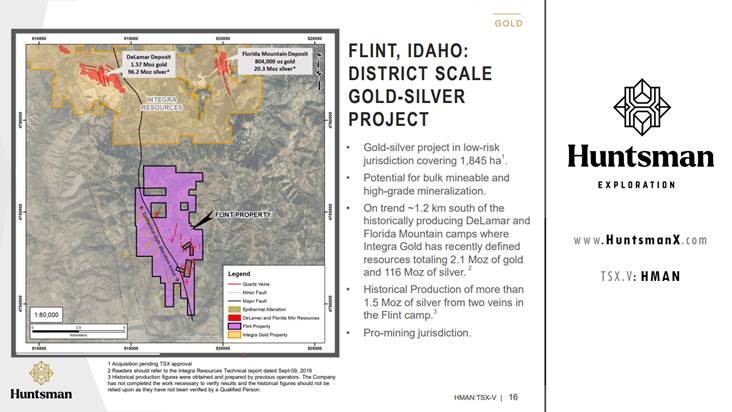

The preliminary work that was done on it, makes it look quite interesting. But by comparison, it pales somewhat to the Canegrass Project. So if the future is bright enough, and the ability is there, we may perform some exploration work on the Ashburton project later this year, but the priority is going to be on the Canegrass. In the U.S., we also have a fairly substantial greenfield gold project in Idaho, which is just south of Integra's Idaho projects, which is a past-producing Kinross mine.

But it is an earlier stage project in a gold, silver jurisdiction. There was a silver mine in the vicinity of our project, which our claims surround, but it is something more of a greenfields prospect, and we will likely see some activity on that project this year. But it may not be to the same extent as either Nevada from a gold perspective or certainly Canegrass from a nickel perspective.

Maurice Jackson: Understandable. Are there any change of control fees? If yes, what is the compensation?

Peter Dickie: No, there are not.

Maurice Jackson: Is management charging any consultant fees?

Peter Dickie: Directors are compensated on a basis of technical work put into the company and receive stock options. And our management in the office here does charge consulting fees. And certainly in line with what industry norms are, and that all falls within our monthly burn rate.

Maurice Jackson: In closing, multilayered question, what is the next unanswered question for Huntsman Exploration? When can we expect a response, and what determines success?

Peter Dickie: Well, I guess the biggest thing we're sitting on right now is awaiting assay results. As I've mentioned a few times, we're very encouraged based on the field analysis of the recent drilling. So much so that we've started planning will execute a second drill program. But the assay, the results themselves are sort of the proof in the pudding. And once we obtain those, throughout March, I think the picture will become substantially clearer, though won't be crystal clear yet. There's certainly more drilling to occur, but I think we'll be in a much better position to start getting a better picture of the global prospects for our Canegrass project. Also, as the month unfolds, and into April, we will likely start our exploration on our gold project in Nevada.

And that's another historically explored project, which certainly has an interesting historical numbers, some very high-grade gold intercepts. And we intend to follow up on that. And I believe the combination of the two assets is prudent for our shareholders in creating wealth. And I believe that we have two ideal projects in both of those fields, gold, and nickel, that will have plenty of blue sky ability for discovery in the future.

Maurice Jackson: Sir, what keeps you up at night that we don't know about?

Peter Dickie: Part of it is phone calls from Perth.

Maurice Jackson: That's right.

Peter Dickie: As you may know, it's a substantial time difference between Vancouver and Perth. So I do a lot of my communicating in the middle of the night with the folks in Perth, I can tell you it's a great way to stay up at night. What else keeps me up at night? I constantly worry about the management of shareholder's money. And that is what my position is to manage shareholder's money. And to manage shareholders' money as wisely as possible. And I can tell you, a substantial portion of that is my own money.

Maurice Jackson: Last question. What did I forget to ask?

Peter Dickie: That's a great question. You've been very thorough.

Maurice Jackson: We do our best.

Peter Dickie: I think that if any of the listeners have any further questions, I would encourage them to get in touch with me. The easiest method in this day and age is through email. And I can provide my email address for you. It's a tremendous pair of projects, a set of projects that we're developing. And I think the projects themselves will do all the talking.

Maurice Jackson: Mr. Dickie, for someone listening today who wants to get more information on Huntsman Exploration, please share that website address.

Peter Dickie: www.HuntsmanX.com or email [email protected].

Maurice Jackson: Mr. Dickie, it's been a pleasure speaking with you today, wishing you and Huntsman Exploration the absolute best, sir.

Before you make your next precious metals purchase (Platinum) make sure you contact me. I'm a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments where we have several options to expand your precious metals portfolio from physical delivery of gold, silver, platinum, palladium, and rhodium directly to your home or office, to offshore depositories and precious metal IRAs. Call me directly at 855.505.1900 or email: [email protected]. Finally, please subscribe to Proven and Probable, where we provide Mining Insights and Bullion Sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Huntsman Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Huntsman Exploration is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Liberty Gold. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Liberty Gold, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.