Extreme Levels of Work-for-Gold Ratio / Commodities / Gold & Silver 2024

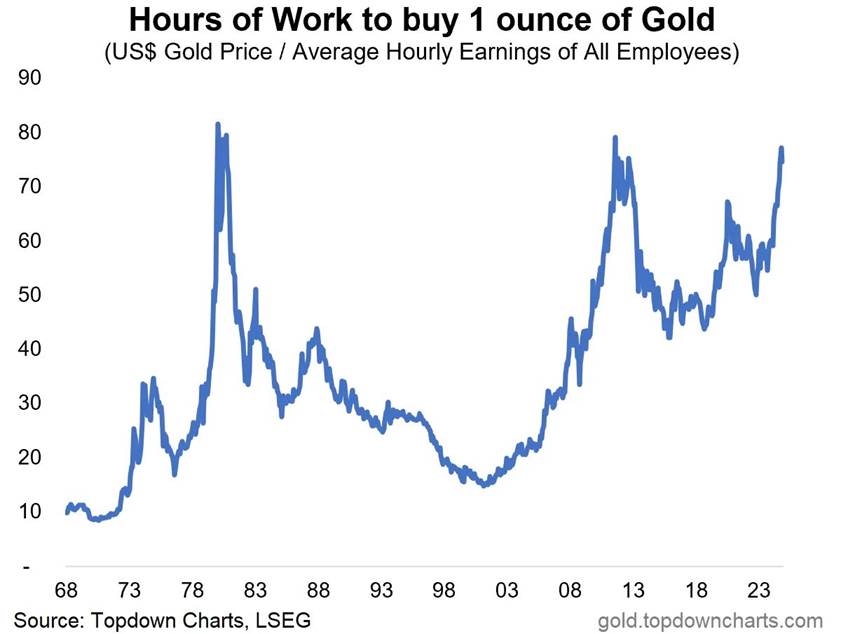

How many hours of work would it take topurchase one ounce of gold? Now you’ll know.

Interesting, right?

The 1980 Peak StillReigns

Gold price truly peaked in the 1980,and while it moved to new nominal highs in 2011, this wasn’t the case in termsof how much one would have to work for it. In 2011, gold peaked slightly belowthe previous high. This year, we saw another move to those extreme valuations,but once again turned south slightly.

Has gold reached its medium-term peak?The above chart makes it likely. Gold – more or less – reached the price levelsat which, when compared to the average hourly earnings, it used to reverse.

If this was just one thing pointing tothat outlook, one might ignore it… But it isn’t.

The more angles one uses to look at agiven market, be better quality of forecasts they can make. So,let’s take a look at gold from the European perspective.

Gold price in terms of the euro hadrallied substantially in the previous months, but based on the RSI indicator itrallied too far too fast, and it now needs to correct or decline in a moreprofound manner. That’s simply how the markets work. No market moves up or downwithout periodic corrections. Gold is no exception.

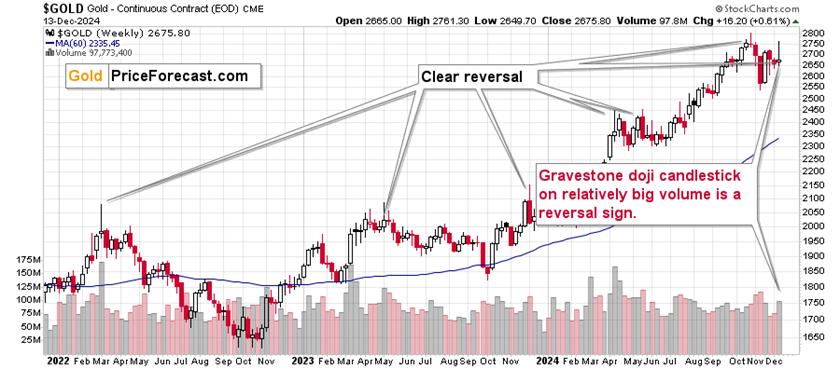

Zooming in, we see that last week goldreversed in a profound manner last week.

A Turning Point?

Gold ended the week $16.20 higher thanit had opened it, but it matters little compared to the fact that on anintraweek basis, gold erased almost $100 (declining from $2,761.30 to$2,675.80). In other words, we saw a profound weekly reversal; and it wasn’tprofound just because of the size of the price swings – the high volumeconfirmed it.

Gold moved quite close to its yearlyhigh, but it didn’t reach it. By the way, I’m not sure if you know, but one ofthe new experts on Golden Meadow – RickAckerman – forecasted $2,803.40 as the likely top for gold onSeptember 12, when gold moved past $2,576. Gold topped at $2801.80 – almostexactly at Rick’s target.

Getting back to the current situation, doyou know what else confirmed the reversal? Pretty much every other part of theprecious metals market. At least the ones that are meaningful with regard tooutlook.

The GLD ETF reversed, but it’s normalsince the price of the ETF is directly linked to gold’s performance. However,it was not obvious that both: silver and gold stocks would create analogousreversals – and they did.

Oh, and platinum and palladium formedweekly reversals, too.

With all this, should one really expectgold to rally in the following months? I don’t think so. Perhaps gold itselfdoesn’t “think” so either, as last month was the first month in a long timewhen gold declined. And it’s down in December as well.

Now, do gold, silver, or mining stocksneed to fall right away? Absolutely not. (And even if they do, there are waysto earnmoney on gold while you simply hold it.)

This is the FOMC week, and the interestrate decision is due on Wednesday, and the same goes for the press conference.Before that, the markets may move erratically. The Fed is widely expected tocut rates, so when that happens, we may see an immediate move up that’sfollowed by the “buy-the-rumor-sell-the-fact” decline. Or we might see somepost-decision volatility. But the important thing remains intact – themedium-term indications favor lower prices in the following weeks.

The mining stocks are likely to declineas well, but the detailed (and just-updated) downside targets / profit-takelevels for GDX and GDXJ are things that I’ll reserve for my subscribers.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.