Falling Gold Volatility Index Explains Divergence Between Gold And Miners

Many gold investors have been confused this year by the divergence between the solid performance of gold itself and the shaky performance of gold miner stocks.

The answer can be found in the much lower volatility of the gold price in 2017 compared to 2016.

Gold miner stocks offer excellent leverage to a rapidly rising gold price, but not so much for a slowly rising gold price.

The disappointing performance of gold miner stocks this year is about falling expectations of a shock rise in the gold price to $1,500 or $,1700 or $2,000 very quickly.

Many gold investors have been confused this year by the divergence between the solid performance of gold itself (SPDR Gold Shares (NYSEARCA:GLD), Sprott Physical Gold Trust (NYSEARCA:PHYS)) and the shaky performance of gold miner stocks (VanEck Vectors Gold Miners ETF (NYSEARCA:GDX), VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ)).

I think the answer to why the gold miners have struggled while the gold price has risen in 2017 can be found in the much lower volatility of the gold price this year compared to 2016.

Here is a chart of the Gold Volatility Index over the past two years:

This index measures the market's expectation of 30-day volatility of the price of the SPDR Gold Shares (NYSEARCA:GLD), by means of the prices of GLD option premiums.

It is clear from the chart that the market has expected much less volatility in the gold price in 2017 than it did in 2016.

Investors and traders buy gold mining stocks to get leverage on a rising gold price. But most gold miners won't become massively profitable if the gold price only rises slowly: $1,300 this year, $1,400 next year, $1,500 the year after that. The gold miners make their windfall profits when the gold price spikes higher rapidly: $1,500 this year, $2,000 next year.

The disappointing performance of gold miner stocks this year is not about the gold price itself, it is about falling expectations of a shock rise in the gold price to $1,500 or $1,700 or $2,000 very quickly. The falling Gold Volatility Index reflects these falling expectations.

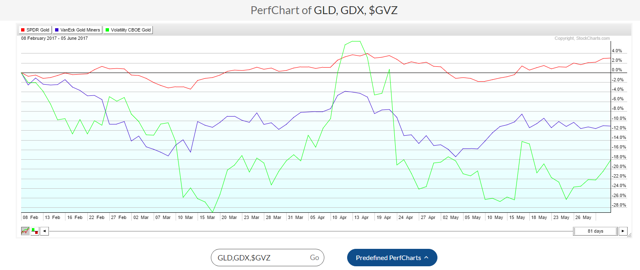

Let's look at the recent correlation in more detail. Here's a chart comparing the performance of GLD, GDX, and the Gold Volatility Index since gold miners peaked in February:

The red line is gold, the blue line is the GDX gold miners, and the green line is the Gold Volatility Index.

As you can see, the gold miners have followed the path of gold volatility downward, rather than holding up with the price of gold itself.

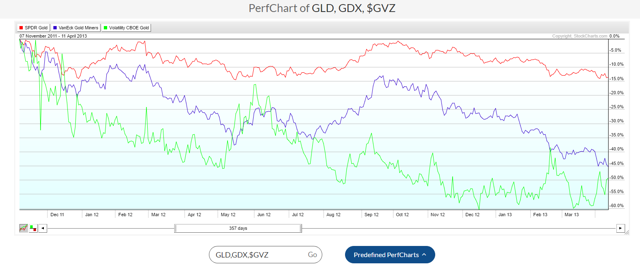

In fact a very similar dynamic occurred back in late 2011 and throughout 2012. The bull market in gold and gold miners had peaked in August-September 2011, but the market did not simply crash after the peak. It hung in there for a while, and the gold price in particular stayed at rather elevated levels until it truly crashed in the spring of 2013. But during that period, the gold miners market was falling much more rapidly. And the following chart shows us that once again, the gold miners followed the direction of the Gold Volatility Index, rather than the gold price itself:

You can see very clearly here that the pattern in 2012 was similar to what it has been in 2017: gold miners falling with gold volatility, while only the gold price holds up relatively well.

I will be looking at the Gold Volatility Index more than the gold price itself for signs about the direction of gold miner stocks. Right now, those signs are clearly negative.

Please note, I am NOT saying that the gold miners market now is the same as it was in 2012, and I am NOT saying that gold miners are heading into another brutal bear market like that of 2011-2015. I am just saying that the trend right now is negative, and the gold price alone may not be enough to rally gold miners, if we don't get some high volatility rising gold price action to boost them.

As always, I will continue to monitor the situation, and if and when the gold miners' trend changes convincingly to positive, I will be very happy to get back into more of my favorite junior gold miner stocks.

But so long as the trend and the signs are negative, I don't want to bleed away all of my gains of early 2016 and early 2017 waiting and hoping for the trend to change. In the meantime, I can be making plenty of profits in plenty of bullish rising sectors of the U.S. and global stock markets instead.

Note to readers: This is a "sneak peak" at the kind of analysis I offer in my new subscription service, the Stock & Gold Market Report. Early Bird subscribers can join now and get (1) my top investment idea for June (catalyst this month), (2) a bonus pick "My Favorite Junior Natural Resource Stock In The World Right Now", (3) a weekly market update, and (4) the first installment of "The Basics" series, on the 4 basic asset group allocations of a well-balanced portfolio.

Disclosure: I am/we are long PHYS.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.