Fed cut sparks 1.7% rally for INK Canadian Insider Index

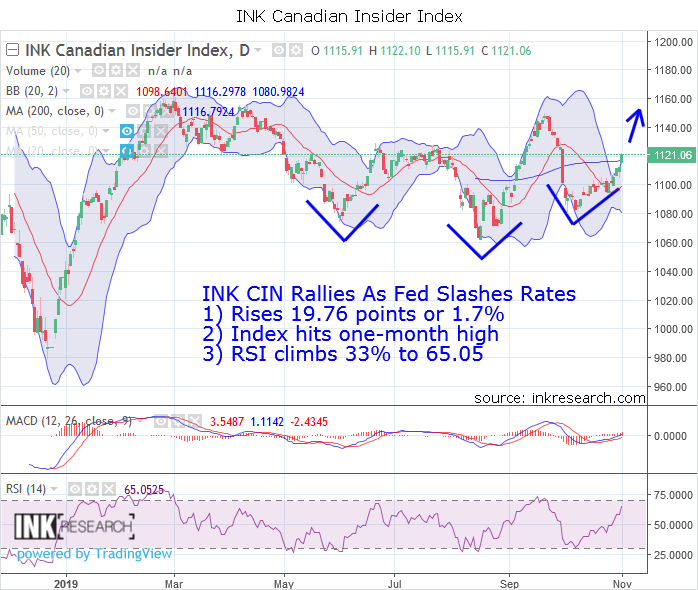

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. The INK CIN broke above its wall-like 1100 resistance once the US Federal Reserve slashed interest rates and all but ruled out the possibility of any hikes. The Index whipped 19.76 points higher to 1121.06 for a gain of 1.8% on the week and reached its highest point in the last month.

MACD lifted 1.8 points to 3.55. RSI erupted 16.15 points or 33% to reach 65.05, its highest level since late September.

Support moves up to 1108 (50-day moving average) and 1116 (mid-Bollinger band). Resistance rises to 1120 and 1125.

My prediction that commodities (historically cheap versus the US Markets) are seeing their bear markets end and are now beginning to reflate looks quite feasible, especially with the Fed continuing to cut interest rates.

The INK Canadian Insider Index put in an extremely impressive week, beating the SPDR S&P 500 ETF (SPY*US) which rallied 1.51%, gold (+0.41%), silver (+0.7%), crude oil (-0.81%), and copper (-0.84%). The INK CIN now has a good head of steam and looks like it could make a run at 1140 or 1150 in the next few weeks.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII).