Fed Rate Cuts And Low Bond Yields Should Drive Up The Price Of Gold

Low bond yields and the languished equity markets will make gold an attractive investment.

Projected Fed rate cuts will weaken the dollar, subsequently increasing the value of gold.

JNUG's 3x leverage provides an adequate tool for investors to profit on the a short-term price movement in gold.

Intro:

After gold hit its year-to-date bottom of 1266.65 on May 2nd, gold has rallied 5.2% to $1323 in the span of just 32 days. I believe that with the mounting global uncertainties, predicted fed rate cuts, and lower bond yields will all attract investors to gold. Because of this, the Direxion Daily Junior Gold Miners Index Bull 3X Shares (JNUG) is becoming an attractive swing trade.

Low Yield:

The 30-year United States Treasury Bond (T-Bond) is currently at its lowest level since October of 2016 featuring a yield of 2.592% as of June 4th, 2019. This yield is down 33.9% from the October 2018 highs of 3.452% which represents a flooding of cash into the T-Bond market and is generally good for gold. This is because as bond yield starts to decrease, other asset classes that do not offer yield begin to become more appealing. The only apprehension I have is that individuals are starting to accept lower and lower yields to ensure the safekeeping of their assets. For instance, many European countries like Germany, Finland, and France are all offering negative interest rates. This means that one would have to pay these governments to hold their money as they would be used as some sort of quasi savings account. This is all the more reason investments have been flocking into the United States Treasury as investors are taking advantage of a positive yield where they are compensated for lending their cash.

Relating this back to gold, this precious metal is used in everything from jewelry to dentistry and has an intrinsic value that leaves investors with a sense of safety owning this commodity. The low yields may start to attract more investors as gold has been fairly range-bound over the past five years. After its huge run-up in price to almost $2,000 an ounce in 2011, it has been in a consolidation phase and I believe this will give investors a sense of confidence to put their money in a tried and true way of preserving wealth.

Low Yields Going Lower:

As the economy is faced with a potential global slowdown from the tariffs imposed on China, potential tariffs on Mexico and the threat of "Tariff Man" imposing sanctions on any global trade partner remains a looming threat as investors flock from the equities market. Since Trump's May 5th tweet about the trade war with China, the S&P 500 has fallen 6.2% with investors trying to hide out in safer assets such as bonds, driving down the yields.

On June 4th, Jerome Powell spoke about the U.S. economy and said, "We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective." Many people believe that this implies a rate cut and analysts even believe they could cut rates up to 75 basis points, starting this year.

For this to happen, this suggests that the global economy is headed for a global slowdown and equity prices would suffer leading to more investment in other asset classes. The Fed cutting rates would only be one part of a two-part action that would boost gold prices. The first is that lower rates would again lower the yields of bonds making investors increasingly interested in assets such as precious metals. The second is that for the Fed to lower rates, they introduce more dollars into the economy through quantitative easing, creating a weaker dollar.

Fed Will Weaken the Dollar:

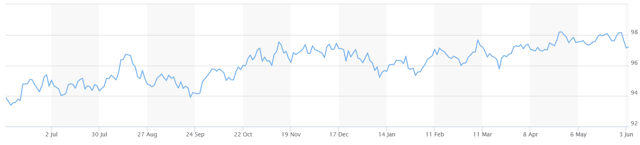

The dollar has been getting stronger over the years which can be seen with the Dollar Strength Index chart and coincides well with the quantitative tightening the fed has promoted over the past few years.

The market is pricing in two rate cuts by the end of the year and if this happens, the dollar will subsequently decrease in value. Since gold is determined in U.S dollars, the fall in the currencies price creates a subsequent rise in gold. This tactic has been used for years where gold is traded as a proxy to the rises and falls of a currency.

Trump Wants a Weaker Dollar:

Not only will the rate cuts create a weaker dollar, but Trump himself has been quoted as saying he believes the dollar is too strong. This is because when the dollar is strong, exports become more expensive and this reduces the purchases of U.S goods from other countries. As trade has become an increasingly large part of Trump's agenda, it can be inferred there will be measures taken to reduce the value of the dollar to increase exports.

In total, I believe that if the fed cuts rates and Trump is deadest on decreasing the value of the dollar, which seems to be the belief on Wall Street, gold will see a rise in price as more investors jump to this precious metal.

Why JNUG?

So why trade JNUG? Well, I believe that this is a good opportunity for a swing trade and the 3x leverage of the Direxion Daily Junior Gold Miners Index Bull 3X Shares JNUG will allow investors to be most aptly rewarded for their risk. With this, there is a higher risk associated with any 3x leveraged ETF and it should not be held as a long-term hold. The reason is because these ETF's suffer from time decay because managers of this fund need to constantly be purchasing derivatives to ensure the 3x leverage.

I believe that in the coming weeks, gold will start its run towards the April 2018 highs of $1366.59 because of all the reasons mentioned above. This represents an upside of 3.3% that can be magnified with the help of the 3x leverage.

Conclusion:

I believe that the price of gold will increase due to the projected quantitative easing, Trump establishing that he would like to see a weaker dollar, and the low bond yields. This should make gold an extra appealing investment and I believe that investors will start nibbling on this precious metal which will subsequently increase its price.

Disclosure: I am/we are long JNUG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Ryan Waldoch and get email alerts