Fed Rate Hold is a Game-changer for the Price of Gold! / Commodities / Gold & Silver 2023

Yesterday’s FOMC and the following press conference were groundbreaking. Rates stayed, but Fedsaid about raising them twice this year = no U-turn!

This is a game-changer because so manyinvestors were still believing in a quick, dovish U-turn. And those dreams werejust dispelled. The fact that rates were not hiked yesterday doesn’t matter asmuch as the fact that their expected future path is still to the upside.

While the core CPI didn’t move recently, inflation is moving down. With inflation moving down andinterest rates going higher, what does that imply?

Much higher real interest rates!

And this is one of the two keyfundamental drivers for gold prices. The otheris the USD Index, and yesterday’s FOMC was a game-changer for its short-termtrend as well.

The USD Index Soars onFOMC

All intraday breakdowns below the flagpattern were quickly invalidated. And given the Jun. 14 reversal, the odds arethat the correction is over.

The invalidation of the move below the50% Fibonacci retracement suggests the same thing.

This means that gold price now has notone but two headwinds.

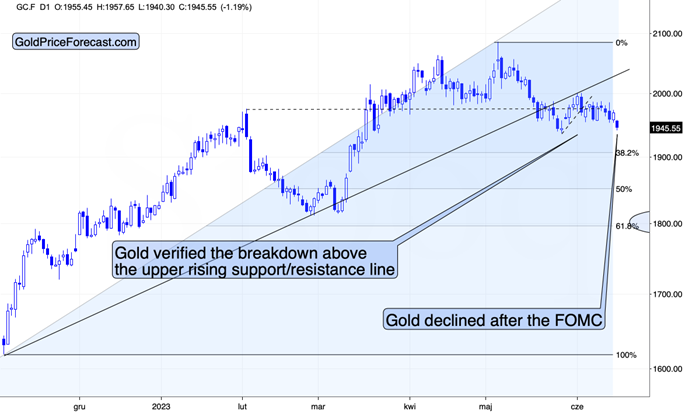

And boy, did the gold price react!

Gold was initially hesitating to decline,which is normal, given that the investment public didn’t necessarily fullygrasp the implications of what just happened yesterday, and it might bestarting to realize it fully only in the following days.

Gold overnight trading, however, showed wherethe next move is going to take the yellow metal – lower.

It’s currently trading at new June lows,but it seems that we’ll see a move below May lows any day (or hour) now.

Silver price is down significantly, but most importantly, it just moved below itsrising support lines. The next big decline is likely underway.

And junior miners?

JuniorMining Stocks Already Broke Lower

Even though it might not be clear on theabove chart, the fact is that junior miners closed the day below their risingred support line. This is a breakdown that didn’t happen in May, so thesituation is now more bearish than it was back then.

Let’s keep in mind that it was before gold’s overnight decline! Thismeans that junior miners are likely to catch up with gold by sliding more. Thiswill likely cause the breakdown to be verified and lead to a bigger decline inthe following days.

The next short-term stop is at about the$33 level, as that’s where we have the 61.8% Fibonacci retracement and 2023 low(so far).

In fact, please take a look at what theGDXJ is doing in today’s London trading.

The GDXJ just briefly moved below its Maylows, indicating what comes next. It might need the U.S. trading hours to breakbelow this level, though.

And given that the investment public isjust starting to realize what the implications of yesterday’s FOMC were (afterthey read reports prepared by professionals), the odds are that the decline inthe GDXJ will continue – and accelerate.

Please note that you knew about theupcoming decline in advance – well before the FOMC, based on technicalanalysis, relative valuations, and other things that I’ve beendescribing recently.

I saved the best for the last part.

In my analysis yesterday, I focused onthe stocks and why they are not as bullish or invincible as many claim.

The rally stopped, and the S&P 500futures are down in the pre-market trading. This – plus the fact that theinvestment public is likely to still digest what just happened – implies thatthe momentum is gone. And with the momentum gone, rising rates, and RSI atextremely overbought levels, there is one very likely action that stocks aregoing to take.

Slide.

Please remember that junior miners brokebelow their rising support line even without the stocks’ help. But as soon asthey get it, they are likely to truly tumble.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

https://www.goldpriceforecast.com

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.