Fed Sends Bullish Signal For Gold Investors

Fed confirms that gold has nothing to fear from rising rates.

Stronger pound and weaker dollar also continue to support bullion.

Gold's relative strength versus S&P 500 bodes well for interim outlook.

The outlook for gold continues to brighten now that it no longer has to compete with higher interest rates. In today's report, we'll discuss the Federal Reserve's latest interest rate statement and its impact on the bullion price. We'll also examine gold's next upside objective based on technical factors, as well as its continually improving currency component.

The price of gold was higher on Wednesday in the wake of the latest policy announcement from the Federal Reserve. Gold rallied along with stocks after the latest FOMC meeting. The U.S. central bank held its benchmark interest rate steady and signaled that there likely won't be any additional rate increases anytime soon. The Fed's latest decision, although widely expected, was nonetheless cheered by equity investors and also proved to be encouraging for gold investors due to the lack of competition from higher rates.

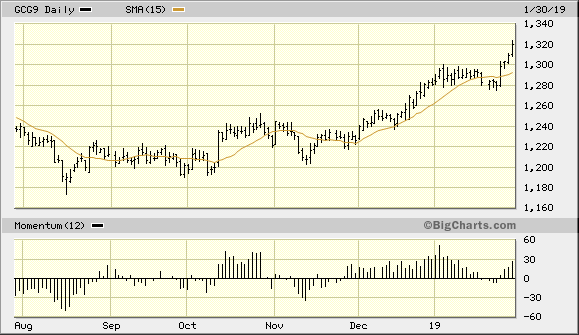

February gold futures rose 0.80 percent in the Jan. 30 session to a new 7-month high at just under the $1,320 level. Having decisively overcome the psychological $1,300 benchmark level, gold's next obstacle is the $1,335 area where gold's major breakdown occurred last June. If gold soon recovers above $1,335, it will not only have regained most its losses from 2018 but will also have crossed above a major technical and psychological threshold.

Source: BigCharts

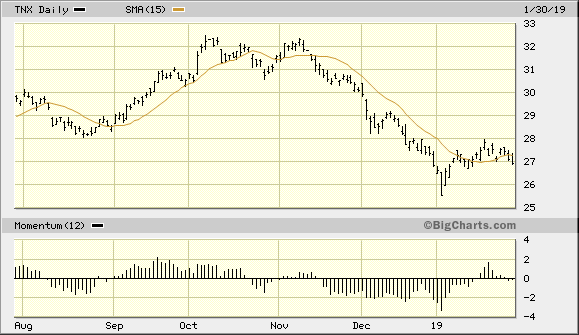

The market's diminishing fears over higher rates is also reflected in the following graph which shows the recent performance of the 10-Year Treasury Note Yield Index (TNX). After hitting its highest level in seven years in late 2018, the 10-year yield has fallen back sharply in the last two months. This in part is a result of the market's shift in interest rate expectations for 2019. Now that investors are no longer worried about the negative impacts of higher rates, gold has one less headwind to contend with.

Source: BigCharts

Meanwhile on the foreign currency front, the British pound has rallied in recent weeks even as the U.S. dollar has weakened. The pound recently made a 3-month high against the dollar based largely on expectations that Britain will dodge a "no-deal" Brexit. Although the British Parliament recently voted to block a no-deal Brexit, Britain is still scheduled to leave the European Union on March 29. The uncertainty which continues to swirl around the Brexit saga is another supporting factor for the gold price as investors are using the metal as a safety hedge until the implications of Britain's departure from the EU are made clear by the government.

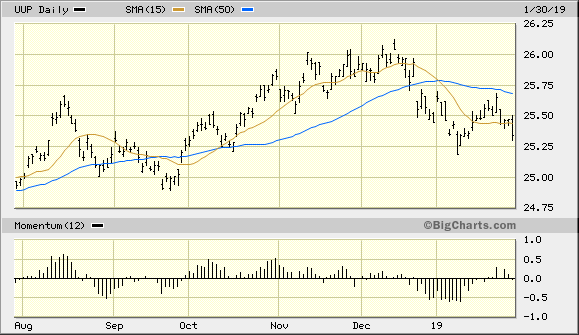

The strengthening pound has contributed to the latest downside pressure in the U.S. dollar index. The dollar's recent weakness has been one of the biggest contributors to gold's strength since gold is priced in dollars. Below is the Invesco DB U.S. Dollar Index Bullish Fund (UUP), my favorite dollar proxy. UUP was down in the latest session on the dollar's weakness and it remains below its 15-day moving average which confirms the dollar's immediate-term (1-4 week) trend is down. More importantly though is the fact that UUP remains under the widely-watched 50-day moving average. The 50-day MA is my favorite tool for evaluating the market's intermediate-term (3-9 month) trend. As long as the dollar ETF remains under the 50-day MA on a weekly closing basis, investors should assume that the dollar remains weak. This in turn will strengthen gold's currency component and bodes well for the metal's ongoing intermediate-term recovery

Source: BigCharts

Gold's recent strength relative to the dollar's weakness is impressive, but it's relative strength versus the U.S. stock market is equally impressive. Consider for instance that gold gained nearly 8 percent in the fourth quarter of 2018, while the benchmark S&P 500 Index (SPX) was down almost 14%. This relative outperformance is made clear in the graph below, which shows the gold price compared with the SPX. As you see, the gold:SPX ratio is trending above the rising 50-day moving average after establishing a 4-month pattern of higher highs and higher lows. Gold's relative strength versus equities is a bullish factor for the metal's interim outlook, for fund managers typically look at this variable when considering whether or not to invest in gold.

Source: StockCharts

Source: StockCharts

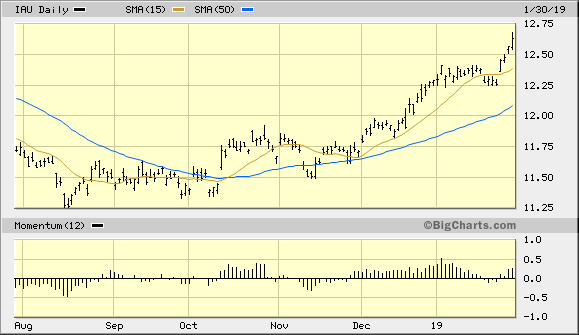

On the ETF front, the iShares Gold Trust (IAU) also continues to outperform the broad equity market in reflection of gold's rising fortunes. The ETF is also benefiting from the dollar's recent weakness, as well as the market's Brexit worries mentioned above. IAU continues to drift higher above its rising 15-day moving average, which technically confirms that the immediate-term trend is still up. I continue to maintain that as long as the IAU remains above its rising 15-day MA on a weekly closing basis, the immediate-term upward trend for the gold ETF is intact.

Source: BigCharts

With rising interest rates no longer an imminent threat for gold, investors are still justified in maintaining a bullish posture and in assuming that gold's recovery will continue in the coming months. What's more, a strengthening British pound and weaker U.S. dollar are providing bullion an additional boost. Gold also still has an abundance of support in the form of geopolitical uncertainty, which increases its safe-haven appeal.

On a strategic note, we are still long the iShares Gold Trust after recently taking some profit. I also recently recommended raising the stop loss for the remainder of this trading position to slightly under the $12.35 level on an intraday basis. A violation of $12.35 in the IAU would signal a decisive shift in the gold ETF's immediate-term trend by putting the price under the 15-day moving average.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts