Fitch junks Anglo overhaul on South Africa fears

On Wednesday another ratings agency downgraded Anglo American's credit to junk status. Fitch Ratings follows Moody's rating and also believe the outlook for the company is negative.

Yesterday the London-listed miner said it's exiting the coal sector by selling its remaining operations in Australia, South Africa and Colombia. Anglo also said it would extract itself, over time, from its iron ore business, including its Kumba unit in South Africa and its Minas-Rio project in Brazil.

Nickel operations and a minority stake in a South African manganese business, would also go. In total some 25 assets are on the block. The more than a century-old company will now focus on its copper, De Beers diamonds and platinum businesses.

The business will be less diversified overall with a dependence on a smaller number of commodities and high exposure to Africa - around 54% of earningsFitch has serious misgivings about the restructuring plans outlined by the world's number five diversified miner.

The bearish outlook "primarily reflects the high level of uncertainty regarding the ultimate success of the group's restructuring plan," says Fitch:

"In part this comes from the large number of mining assets currently available for purchase, creating a buyers' market."

Even if management is successful in executing on its plans and deliver the necessary cost cutting the agency is worried about the risk associated with the much-diminished company that will emerge.

While Anglo will retain a "meaningful market position" and have "cost-competitive assets" in the diamond, platinum and copper sectors:

Anglo shares jumped 17% in New York, bringing its year to date gains to a mouthwatering 54%However, the business will be less diversified overall with a dependence on a smaller number of commodities and high exposure to Africa (around 54% of EBITDA), particularly South Africa," Fitch said:

"We believe South Africa is a less favourable country for mining companies to operate, given the recent history of an active, unionised workforce and comparatively higher wage and electricity cost inflation."

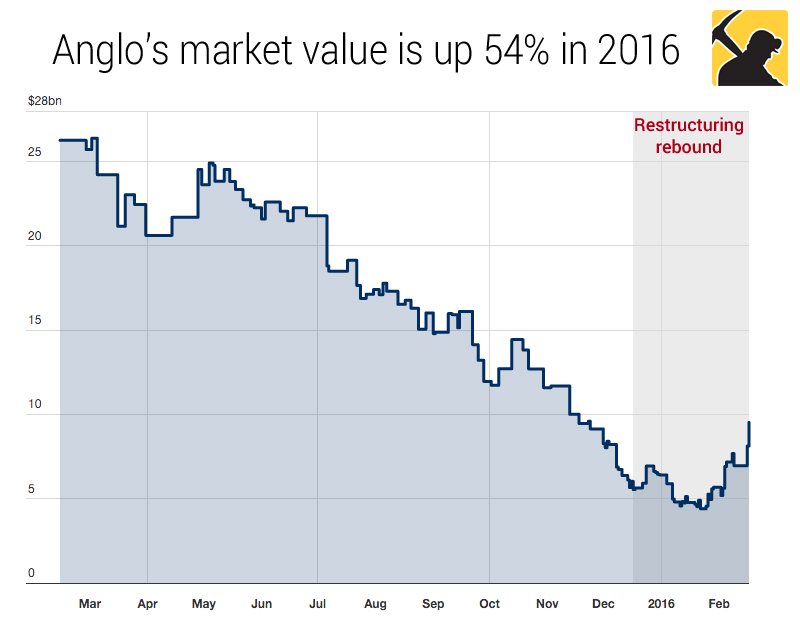

Investors were taking a more sanguine view of the future for Anglo. On the LSE on Wednesday, the share (LON:AAL) jumped 11.3% bringing its year to date gains to a mouthwatering 54%.

The company's ADRs trading in New York (OTCMKTS:AAUKF) surged nearly 17% on the day affording the company a $9.5 billion market value.

Anglo bulls are still nursing a 62% decline over the past year however and those who got in at the top early in 2011 have seen more than $60 billion in market cap evaporate.