For Americans Buying Gold and Silver: Still a Big U.S. Pricing Advantage / Commodities / Gold and Silver 2018

DavidSmith: Two years ago, in this space, I penned an essaydiscussing how Americans - and other countries that are "dollarized"- where the local currency is either the USD or pegged to it - had asignificant advantage when it came to getting the most for their money whenexchanging dollars for precious metals.

DavidSmith: Two years ago, in this space, I penned an essaydiscussing how Americans - and other countries that are "dollarized"- where the local currency is either the USD or pegged to it - had asignificant advantage when it came to getting the most for their money whenexchanging dollars for precious metals.

Lately I looked into this issue again and the good newsis - it's still a good deal. In relation to a lot of other folks, even betterthan before! But the bad news is that this might not be the case much longer...

The CandoDisadvantage

The Canadian Dollar is known in the trade as a"Cando". In 2008 it traded at US$1.10, which meant that at the time,Canadians could buy 10% more metal than Americans. In 2012, it had a high ofUS$1.01. In 2016, it bottomed at US$0.58 (ouch!), and today still trades atabout 80 cents on the dollar. As the chart shows, Canadians get about 20% lessgold and silver for their money than their southern neighbors (us).

Courtesy stockcharts.com

Zim and Ven, racingfor the bottom.

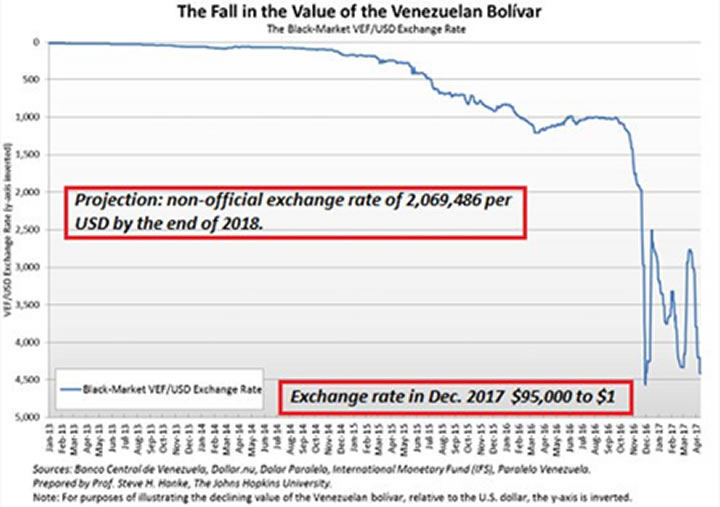

Then there's the perennial currency basket caseZimbabwe - now entering its second hyperinflationary blowout in just the lastcouple of decades. Zim is currently playing touch and go with Venezuela to seeif the latter's "bolivar fuerte" (strong bolivar), transacted by thepound on a produce scale rather than from a wallet, will incinerate itselffirst.

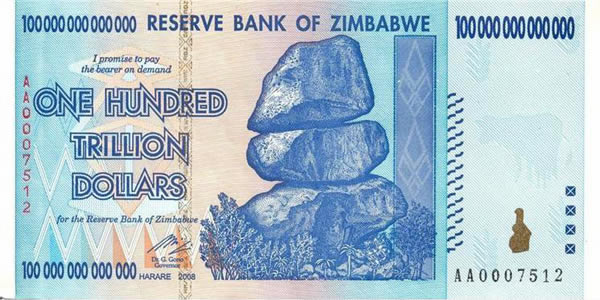

Zim's previous "PaperPromise"- Angling for a rematch?

Back in the day when theterm "strong bolivar" meant something...

But not now... (CourtesySources listed)

Emerging MarketsPurchasing Power Disadvantage

Buyers in Emerging Markets, in which gold prices aremaking new highs relative to their own fiat paper, are also paying more fortheir stash. Nevertheless, demand there is rising as well - which as previouslynoted - is an important "tell" regarding the health and durability ofthe ongoing bull market. This is because even when facing a less advantageousexchange rate, emerging market gold customers are stillsolidly on the buy.

Additional evidence indicates that we are just nowentering the second year of what could become a lengthier - and considerablymore powerful than-expected upside run.

Courtesy allstarcharts.com

We say this in part because of some serious work doneby Bob Hoye's InstitutionalAdvisors along with the Technical observations of Ross Clark They note that for thelast 50 years, important lows for gold have taken place on a regular basis,stating, "The most recent (low) was in December 2016, one year after apremature low at 7.2 years in December 2015."

In a January 2018 public domain post, they stated,

After an initial surge off the cycle lows, the pricetends to move methodically higher for the first two years. During that period,we have found that a lower 20-week moving average envelope provides support.This was most recently tested in December 2017... Except for 2002, a trailingone-week stop after the 55th week, kept participants in the market until thefirst week after the top.

You might want to commit that last part to memory. Ifthe 8-year cycle pattern continues to play itself out, not only could thisnascent gold bull have a long ways to run in terms of time and price, but anattentive investor could use the kind of trailing stop-loss discussed, in orderto stay with the trend as long as possible, holding onto significant gainsbefore offsetting all or most of their holdings for a good profit.

Now for the Bad News...

The U.S. dollar has been "king of the hill"since its establishment as a backstop for the so-called petrodollar, in anagreement with Saudi Arabia and other oil producing countries as a result ofthe 1970's oil spike. That idea was to create a stable and reliable revenuestream for oil exporters. The price of oil was thus set in dollars, in theprocess establishing the unit of account as the world's reserve currency. Evenso, the petrodollar's purchasing power is, to some extent, predicated upon therate of inflation and the value of the dollar on the FOREX.

Things worked well for quite a while, but in recentyears, for a number of reasons, the status quo has been increasingly calledinto question. A detailed rationale is beyond the scope of this report, buthere are a few of the elements:

Profligatecreation of dollars by the Federal Reserve, many of which have"migrated" offshore, driving down the recipients' purchasing power.Massivedebt growth at all levels of the U.S. body politic - leading inevitably to moredollar creation in an attempt to pay the bill.Unnaturallylow interest rates since the 2008 melt-down, obscuring the "signals"given by rates that indicate if a given investment makes "dollars andsense", leading to soaring mal-investment and speculation.Achanging geopolitical landscape, wherein the BRIC countries - Brazil, Russia,India and China (plus others) - have tired of the constraints placed upon themby restrictive U.S. policies.Thelaunch and coming build-out of The New Silk Road from Asia to Europe and theMiddle East, encompassing 40 per cent of the world's population in aneconomic-financial-political paradigm less-incumbent on the West's wishes.Lesseningdependence on the US dollar as the world's reserve currency in favor of loansand payments denominated in Chinese yuan, Russian rubles, commodities...andgold.All these factors and more, mean that right now andcontinuing during the coming years, the U.S. dollar is going to be buying lessof just about everything, and that includes precious metals. The key elementsof this sea-change as they relate to you?

LowerU.S. dollar-denominated gold and silver purchasing power.Increasedglobal demand for these metals, especially in the many countries seeing theirlocal currencies strengthen vis a vis the dollar.Depletinggold reserves due to a lack of big discoveries.Lowerhead-grades across the board.Increasedcost of production due to environmental and "country risk".And this...

Note established 50-day MA(blue line) "Golden Cross"

While just about everything in life is based uponprobabilities, the odds right now strongly favor that the next leg of thesecular bull run in the metals is underway. Four years of a cyclical bearmarket 45-50% retracement (2011-15); an 8-month initial bull counter-trendrally (most of 2016); and finally, 18 months of retracement and consolidation(mid-2016 to December 2017) have already taken place.

Taken together, this alignment of factors makes acompelling argument for completing your metals' acquisition plan in a timelymanner. And if you still have yet to get started... what's your excuse?

David Smith isSenior Analyst for TheMorganReport.com anda regular contributor to MoneyMetals.com.For the past 15 years, he has investigated precious metals’ mines andexploration sites in Argentina, Chile, Mexico, Bolivia, China, Canada, and theU.S. He shares his resource sector findings with readers, the media, and NorthAmerican investment conference attendees.

© 2018 David Smith - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.