Fortuna Silver Mines: Going for the Gold

By: Chris Marchese

Chief Mining Analyst at GoldSeek & SilverSeek

Shares Outstanding: 160.2m (Basic), 164.5m (Fully Diluted)

52 Week High-Low: $4.59-$2.39

(2/05/2020)

Fortuna Silver, one of the stalwarts amongst primary silver producers is now in the transition phase from deriving roughly and equal amount of revenue from both silver and gold. Like so many primary silver producers over the last decade, the dearth of primary silver deposits (that which derives more than 65% of total revenue from silver) basically forced Fortuna to look at gold and gold development projects as the best way to grow.

It is also beneficial for silver miners to derive a fair proportion of total revenue from gold especially for times like this, which we've been experiencing over the past 5+yrs (current gold-to-silver Ratio (GSR) in excess of 87:1, well above the historic average over the last 10,20...100+ years). Fortuna's search for growth via precious metals output came immediately following the optimization at its high-grade 3ktpd primary silver mine, San Jose, culminating in the acquisition of Goldrock Mines in mid-2016. This acquisition was to obtain the Lindero Gold project in Salta, Argentina and will serve as Fortuna's growth engine in 2020 and 2021. Lindero was an ideal target as it is a moderately sized gold deposit (large enough to materially increase silver or gold equivalent output but not so large that the capital requirements were untenable.

Fortuna is an increasingly diverse company producing both key precious metals from several assets in multiple countries (Mexico, Peru, and Argentina). Once Lindero is up running at design capacity, it will produce material quantities of both gold and silver, again ideally positioned as both gold and silver are in the early innings of a bull market. Fortuna has two flagship assets in a large silver mine at San Jose and a moderately sized gold mine at Lindero plus a nice, smaller complementary silver and base metals operation at Caylloma.

Fortuna has kept a strong balance sheet, even with capital cost over-runs at Lindero. As of the end of Q3, it has over $70m in cash and a $150m credit facility, of which $110m has been drawn upon. As Lindero ramps up to commercial production and once it is achieved, Fortuna will become a free cash flow machine, especially if the silver price manages to reach $20-$22/oz. Fortuna has also managed not to dilute shareholders needlessly in the lean

Most importantly, Fortuna has the people necessary to thrive, which has been illustrated over the last 14 or so years, starting small with the Caylloma mine then developing and optimizing the San Jose mine and more recently acquiring, developing and bringing the Lindero mine into production. Management has been very meticulous and has built the company slowly but surely keeping in mind shareholder value, that is, not diluting when the cost of equity was high and acquiring the Lindero gold project near the bottom of the market.

Assets:

San Jose (Producing, Oaxaca, Mexico): This high-grade, low sulphidation epithermal deposit has, over time, become a sizeable silver operation and has allowed Fortuna to increase its cash position every quarter, something that can't be said for most in the silver industry over from 2013-2016. San Jose, Fortuna's flagship silver asset, has been producing 7-8m oz. Ag and 45-50k+ oz. Au annually over recent years. This has become a more mature mining operation and there has been continued exploration success such that it has been able to maintain a five to six-year mine life, which will continue to be the goal on a forward basis. Part of the reason Fortuna has not been able to increase resources more aggressively is because it has rather limited surface access. For valuation purposes (Net Asset Value), we will use a mine life that is more realistic and in our view conservative, giving San Jose a 7yr mine life. Fortuna will continue spend roughly $5-$10m annually on exploration at San Jose.

San Jose is a very profitable production center despite suppressed silver prices due to a combination of its scale and all-in sustaining costs (AISC) per silver-equivalent oz. (roughly 11.70m AgEq oz. in 2019) remains low at $8.30-$10.20/oz. (Est) for 2019. San Jose will become an absolute cash cow at $22-$25/oz. Ag and current gold prices. There is an on-going dispute regarding a 3.0% royalty which covers approx. 25% of the current reserve base. This royalty was created before the change in mining laws in the 1980's, after which point any royalties could be purchased or transferred through a bidding process. But in the case of this royalty, it was via a direct sale. Fortuna, supported by legal opinions from three independent law firms, has previously advised the Mexican mining authorities that it is of the view that no royalty is payable. In 2018, Fortuna initiated administrative and legal proceedings against the Direccion General de Minas (DGM) to remove reference to the royalty on the title register.

Fortuna is now trying to get clarity from the mining minister and has 60-days to resolve this or it will have to pay the holder (Mexican Geological Service "SGM) $30m. We think this claim is weak, but anything can happen when dealing with governments. Further, the holder of the royalty has no way to accurately calculate the amount of pay due to them, making the $30m claim quite arbitrary. Worst case scenario, Fortuna must pay the $30m.

As Lindero ramps up production, especially in this higher gold price environment, the combination of San Jose and Lindero will make Fortuna a free cash flow machine (beginning Q2-Q3 of this year), at which point the company can focus on deleveraging and well as engaging is more aggressive exploration programs at all three of its mines, nearby areas, and greenfield exploration. San Jose, as of the most recent resource estimate has proven and probable reserves (2P) of 39m oz. Ag and 257k oz. Au. As well as 15.2m oz. Ag and 112k oz. Au in the Inferred category.

Once commercial production was achieved at San Jose at initial design capacity in 2011 (1ktpd), it was clear, San Jose would be the growth drive for the next several years and that turned out to be the case. Multiple expansions were soon completed, initially in 2013 when it was expanded to from 1.15ktpd to 1.8ktpd and again in April 2014 to 2ktpd followed by a further expansion completed in July 2016 , this time to 3ktpd (capable of 3.2ktpd throughput), making it a sizeable silver operation (>6m oz. p.a.).

Lindero (Producing[1], Salta, Argentina): Although Lindero was a construction ready project when acquired, Fortuna undertook its own technical studies to identify and capitalize on any optimization opportunities. Construction began in September 2017 and reached pre-production before year-end 2020, with commercial production expected mid-2020. Lindero suffered from some setbacks, namely a longer construction timeline and capital cost over-runs (+25%), nonetheless Fortuna has kept a strong financial position, so the company didn't need to dilute it shareholders to complete the buildout.

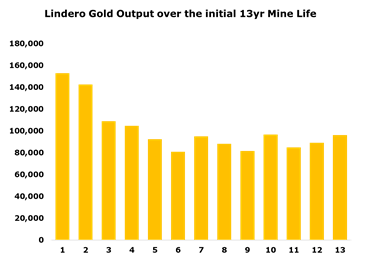

Based on current 2P reserves, Lindero has an initial mine life of 13yrs[2] but the company has already identified several high-priority targets (Arizaro: brownfields). In its first full year of production, Lindero is expected to produce 145-160k oz. Au and slightly above 101k oz. Au over the life of mine (initial 13yrs). Of course, this is only based on the feasibility study but if Fortuna's exploration is successful and it can identify higher-grade mineralization, output beyond year three could remain higher, in turn increasing both average annual output and mine life. Despite this being a rather low-grade open pit mine, it has a low AISC profile over the life of mine (due in part to the low strip ratio of 1.2:1) of $802/oz., lower in the earlier years and higher in the later years. Fortuna's goal is to identify higher grade material (>=0.60 g/t Au) to feed the mill beginning in year-5 onward in order to maintain production of 100k oz. Au annually.

Caylloma (Producing, Arequipa, Peru): While a rather small operation, it nicely complements San Jose on the silver side. Currently Fortuna is focused on mining the more base-metal rich veins as opposed to the more silver-rich veins. This has been the case over recent years after silver prices fell and have remained at depressed levels while base metals, namely zinc, have fared much better. 2019 production is estimated at 0.9-1m oz. Ag, 26.1m-28.8m lbs. Pb, and 39.8m-44m lbs. Zn at AISC of $11.8-$14.50/AgEq oz (which is much closer to AISC/oz. Ag of approx. $6/oz +/-). When silver prices rise past $22-$24/oz., Fortuna will likely switch back toward mining higher grade silver veins, with the potential to more than double production to 2m+ oz. Ag.

As of the most recent resource estimate, Caylloma has 2P reserves of 6.5m oz. Ag and 15.2k oz. Au, with additional resources of 5.3m oz. Ag and 20.7k oz. Au of measured and indicated (M&I) and 17.6m oz. Ag and 55.8k oz. Au. In other words, assuming moderate additional exploration success and conversion of resources to reserves in-line with historical rates, Caylloma has a reasonable long mine life (8-9yrs).

To illustrate Caylloma's potential to increase silver output once higher prices are seen, the following is a brief breakdown of the silver grades of the silver-rich veins relative to those of the base-metal rich veins. Today and in recent years, less than 10% of mill feed comes from more silver rich veins. When Fortuna does decide to begin sourcing a larger proportion of material from the silver-veins, the company will have to increase resources and would take roughly a year for a more to blend the mill feed.

Category | Ag g/t | Au g/t | Zn% | Pb% | |

Silver Veins | 2P reserves | 491 | 0.79 | 0.30 | 0.21 |

Polymetallic Veins | 2P reserves | 62 | 0.16 | 3.81 | 2.18 |

Fortuna will soon become a multi-mine, multi-country primary silver and gold producer, deriving significant revenue from both silver as well as gold. In turn, due to its increased diversity, scale and profitability, it should earn a NAV multiple more in line with its peers. For example, Fortuna is currently trading below NAV relative to a company Like First Majestic, which is trading more than 2x NAV.

For valuation purposes regarding Net Asset Value (NAV) and applying a NAV multiple, the assumptions being used are todays lead and zinc prices, long-term precious metal price decks of $19/oz. Ag and $1,500/oz. Au using various discount rates: 5.0% for Caylloma, 6.0% for San Jose and 7.50% for Lindero. Higher discount rates for San Jose and Lindero are warranted given some uncertainty surrounding geo-political risk. Instead of using the current life of mine solely based on 2P reserves for each asset, we want to be realistic yet remain on the conservative side. For this reason, we will use a 7yr mine life at San Jose, a 10yr mine life at Caylloma and the initial 13yr mine at Lindero plus an additional 2yrs of leach rinsing. We will also apply a NAV multiple of 1.50x and sensitize the NAV using higher and lower metal prices:

Fortuna Net Asset Value: $19/oz. Ag & $1,500/oz. LT Price Deck | ||

Asset | NAV ($000's) | 1.50x NAV ($000's) |

Lindero | $506,186 | $759,279 |

San Jose | $410,669 | $616,003 |

Caylloma | $73,634 | $110,452 |

Cash | $72,200 | $72,200 |

Debt | ($135,000) | ($135,000) |

Other Expenses | ($36,786) | ($36,786) |

Total | $791,317 | $1,286,562 |

Shares Out (Basic) | 160,200 | |

Per Share | $4.94 | $8.03 |

NAV Sensitivity Analysis: Changes in Ag prices and Au Prices | |||||

$4.94 | $1,200 | $1,400 | $1,600 | $1,800 | $2,000 |

$15 | $2.63 | $3.40 | $4.17 | $4.94 | $5.71 |

$18 | $3.50 | $4.27 | $5.04 | $5.81 | $6.58 |

$21 | $4.36 | $5.13 | $5.90 | $6.67 | $7.44 |

$24 | $5.72 | $6.49 | $7.26 | $8.03 | $8.80 |

$27 | $6.67 | $7.44 | $8.21 | $8.98 | $9.75 |

$30 | $7.61 | $8.38 | $9.15 | $9.92 | $10.69 |

Sensitivity Analysis: 1.50x NAV | |||||

$8.03 | $1,200 | $1,400 | $1,600 | $1,800 | $2,000 |

$15 | $4.57 | $5.73 | $6.88 | $8.04 | $9.19 |

$18 | $5.87 | $7.02 | $8.18 | $9.33 | $10.49 |

$21 | $7.16 | $8.32 | $9.47 | $10.63 | $11.78 |

$24 | $9.21 | $10.36 | $11.52 | $12.67 | $13.83 |

$27 | $10.62 | $11.78 | $12.93 | $14.09 | $15.24 |

$30 | $12.03 | $13.19 | $14.34 | $15.50 | $16.66 |

Fortuna has always carried a rather pristine balance sheet. Due to moderate capital cost over-runs ($60-$70m), the company currently has a higher debt[1]-to-EBITDA ratio than it would like. This will quickly decrease as Lindero ramps up to commercial production, currently standing at approx. 1.50-1.55:1 but we fully expect this to fall to roughly 0.7:1 by year end 2020 and 0.5:1 or lower by the end of Q1 2021.

[1] Remaining conservative, we have assumed Fortuna has drawn down an additional $20-$25m since the last reporting period

Liquidity & Solvency |

|

Current Ratio | 1.57 |

Operating CF to CL | 1 |

Operating CF to TL | 0.27 |

Debt-to-Equity | 0.21 |

Interest Coverage (Normalized) | >45 |

Debt-to-EBITDA (TTM) | 1.55 |

FWD Debt-to-EBITDA | 0.7 |

Aside from trading at a rather steep discount to 1.50x Net Asset Value, Fortuna is cheap by nearly every metric. It is worth noting that on a forward basis, it is trading at less than 5x operating cash flow (EV/OCF). Gold and silver companies in constructive tend to trade between 6-9x OCF. It is worth noting, this is only including 7-months of production from Lindero for 2019 and this is using $19/oz. Ag and $1,500/oz. Au price deck.

Profitability |

|

Shares Out (Basic) | 161,000 |

Share Price (Closing Price 2/05/20) | $3.85 |

Market Cap | $619,850 |

Cash | $72,200 |

Debt | ($135,000) |

Enterprise Value (EV) | $682,650 |

2019 OCF | $60,500 |

2020 OCF (EST) | $150,000 |

EV/Operating CF (2019) | 11.28 |

EV/FWD Operating CF (2020) | 4.55 |

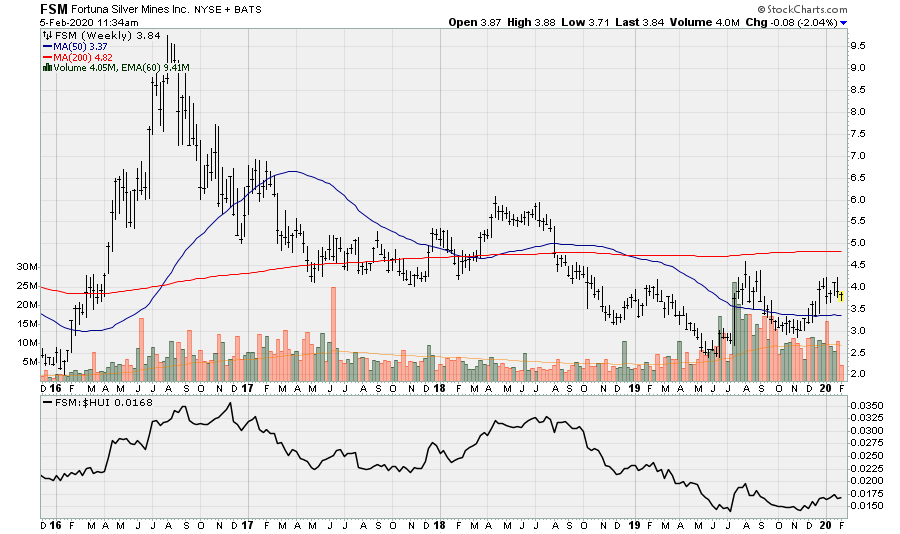

Fortuna is cheap on a fundamental basis and looking at a chart going to the resumption of the bull market in early 2016, the stock price has lagged. Lindero, which when in full production will account for roughly 50% of Fortuna's attributable production at an 85:1 GSR (dropping to roughly 40% at a more normal 60:1 GSR) beginning in 2020. This is important because the gold price is significantly higher relative to early 2016 (silver as well albeit to a much lesser degree). As with any investment there are always risks, the two most important to keep track of regarding Fortuna Silver being geopolitical risk namely Argentina and Mexico to a lesser degree.

Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice. Any action taken as a result of reading this independent market research is solely the responsibility of the reader.

Chris Marchese, Chief Mining Analyst at GoldSeek & SilverSeek

Chief Mining Analyst with GoldSeek and SilverSeek. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

Shares Outstanding: 160.2m (Basic), 164.5m (Fully Diluted)

52 Week High-Low: $4.59-$2.39

(2/05/2020)

[1] First Dore production expected in Q1 and commercial production expected to be achieved in late Q2-Q3 2020.

[2] 15yrs total, Last two years residual heap rinsing.

[3] Remaining conservative, we have assumed Fortuna has drawn down an additional $20-$25m since the last reporting period

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto. Fortuna Silver Mines is not a sponsor of this, or any other related, websites. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.