Four Key Trends for Gold Market in 2018 / Commodities / Gold and Silver 2018

The World GoldCouncil published its gold market outlook for 2018. Will goldcontinue its January rally or should we expect declines?

The World GoldCouncil published its gold market outlook for 2018. Will goldcontinue its January rally or should we expect declines?

Solid Gold’sPerformance in 2017

The World Gold Council begins its report with a shortsummary of 2017. The organization points out that gold performed relativelywell, given the fact that the global economy picked up, risk assets rose invalue, while the Fed hiked interestrates three times. Against this backdrop,the price of gold in U.S. dollars rose 13.5 percent, the biggest annual gainsince 2010, actually outperforming many other asset classes.

But this is the past. In our reports we care about thefuture: first of all, your future and we’re working on adding as much profitsand sunshine to it as possible and, secondly, we care about gold’s future. Asfar as the latter is concerned, the WGC identifies for key themes that willdrive the global economy and the gold market: synchronized global economicgrowth; shrinking central bank balance sheets and rising rates; frothy assetprices; market transparency, efficiency, and access. Let’s analyze themcritically.

SynchronizedGlobal Economic Growth and Gold

Global growth increased in 2017 and the market expectsthat the growth will continue or it will even accelerate in 2018. According tothe WGC, continued economic growth will be positive for the gold demand, as risingincomes would translate into higher demand for gold jewelry, gold-containingtechnology (think “smartphones”), as well as for gold bars and coins.

Nonsense. Or maybe not, actually it might be true in away: rising incomes could imply higher demand for gold-containing technology,etc. But it doesn’t mean that strong economic growth implies higher goldprices. It would be in contradiction to the safe-havenrole of the yellow metal. Gold prices aren’t mostly driven by jewelryor technology demand, but by investment demand. And investors buy gold whenthey are afraid, or, actually, when they question the status of the U.S.dollar. Gold prices have been rising in the last months not because of strongeconomic growth and rising incomes, but because of the revival of the majoreconomies outside the U.S. As the global economy flourishes, investors arepulling funds from the greenback, which ceased to be the only safe currency intown. As an anti-dollar, gold benefits during this process.

Shrinking Central Banks’ BalanceSheets, Rising Rates, and Gold

The WGC notices that the continued global economicexpansion will likely result in tighter monetarypolicy. As higher interest rates increasethe opportunity costs of investing in gold, the normalization of the centralbanks’ stance should be negative for gold. However, the WGC believes that theimplications for gold are more nuanced. This is because the quantitativetightening may put financial markets under pressure. And with highindebtedness, governments (but households as well) should be more sensitive tochanges in interest rates than in the past.

Fair enough. We could even add that the expectedshrinking of the central banks’ balance sheets may be positive for gold, as itshould narrow the divergencein monetary policies among the major central banks in theworld.

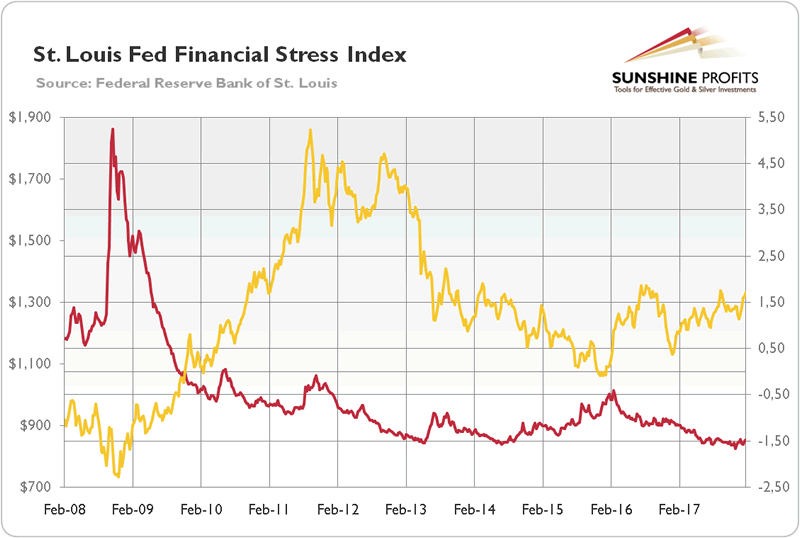

However, there is a catch. There is always a catch,isn’t? We mean that the Fed failed to tighten financial conditions. And themarkets are far from being under pressure. As the chart below shows, the St.Louis Fed Financial Stress Index remains at a very low level, despite all themonetary policy tightening. So gold may not be boosted by a tightening, asthere is no tightening at all. Actually, gold prices have been rising recentlydespite the decreasing financial stress.

Chart 1: St. Louis Fed Financial Stress Index (redline, right axis, index) and the price of gold (yellow line, left axis, LondonP.M. Fix, in $) over the last ten years.

Frothy Asset Prices and Gold

As the WGC notices, asset priceshit multi-year highs around the world in 2017. Should global financial marketscorrect, gold could gain. True. But financial stress remains muted, as we havealready noted. There are risks related to the asset market – this is for sure.But it doesn’t mean that financial crash will occur this very year. It seems tobe just WGC’s wishful thinking. A bust can always happen – but the WGC shouldpoint out the possible triggers, not the mere possibility. Moreover, pleasenotice a funny thing: “now” is always a great time for gold, according to theorganization. When everything is fine and incomes rise, it’s good for the shinymetal, as the demand for jewelry increases. But when everything is doomed, it’seven better for gold, as investors shift from risky assets toward safe havens.

Can you spot the bias? I bet you can.

Market Transparency, Efficiency, andAccess, and Gold

The gold market has become more transparent andefficient over the past few years. As the WGC reminds, in 2017, the LondonBullion Market Association launched a trade-data reporting initiative, whilethe London Metal Exchange launched LMEprecious, a suite of exchange-tradedcontracts. These developments were introduced to improve price transparency andefficiency of transactions, and they could bear fruit in 2018.

Splendid. But we dare to doubt whether thesedevelopments could significantly affect gold prices.

Conclusions

The World Gold Council has published its gold marketoutlook for 2018. It analyzes four key themes which should influence theprecious metals market this year. We examined the report critically and webelieve that it’s not accurate. This year could be supportive of gold demand,indeed, but it doesn’t follow from the WGC’s report, as it omits the impact ofan economic revival in the Eurozone. On the other hand, the WGC, as anorganization related to the gold market, has a bullish bias and sees the upsidepotential even when it’s not there (as in the case of rising incomes).Investors who want to remain unbiased – as we are – and make profits thanks tosound judgments, shouldn’t, thus, base their investment decision solely on theWGC’s reports.

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.