Free-spending Biden and/or continued Fed stimulus will hike Gold prices / Commodities / Gold & Silver 2020

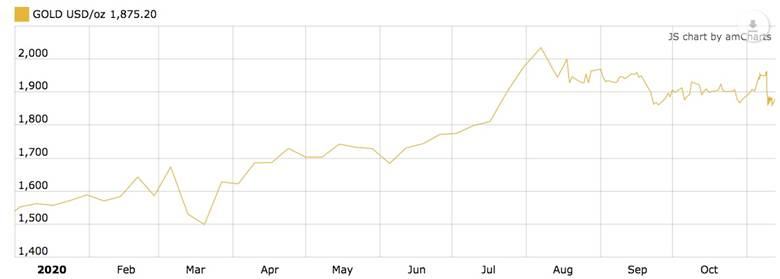

Gold may have comeoff the boil a bit after rising beyond $1,900 an ounce in the aftermath of theUS election, but the precious metal will do well under a Biden presidency, anAhead of the Herd analysis has found.

The main factors aredrastically increased government spending, leading to even more unsustainableUS debt levels than currently; dovish monetary policy as the Fed continues toadvocate “lower for longer” interest rates; and a sinking US dollar. Goldprices and the USD generally move in opposition to each other.

Goldand the debt to GDP ratio

Thedebt-to-GDP ratio is an important metric economists use for comparing acountry’s total debt to its gross domestic product (GDP).

Thepercentage arrived at by dividing the country’s total GDP by its total debtindicates the country’s ability to pay back its loans. The higher thepercentage, the higher the risk of a country being unable to pay the intereston its debt, and therefore defaulting on its debt.

Accordingto the World Bank, countries whose debt to GDP ratios are above 77% for longperiods experience significant slowdowns in economic growth. Every percentagepoint above 77% knocks 1.7% off GDP, according to the study, via Investopedia.

Duringthe rounds of quantitative easing (QE) conducted by the US Federal Reserveduring the financial crisis, the Fed increased the money supply by $4 trillion.But there was also a massive fiscal stimulus package launched to get the economymoving again. Bailing out the banks cost $250 billion and the American Recoveryand Reinvestment Act added $242 billion to budget deficits in 2009 and $400billion in 2010.

We sawthe debt to GDP ratio jump from 62% in 2007 to 83% in 2009, 90% in 2010, and ithas kept climbing ever since.

Gold,being a hedge against inflation, which typically rises when the money supplyincreases, has done well under periods of quantitative easing, when centralbanks literally “print money” to purchase sovereign debt instruments (like USTreasuries) and mortgage-backed securities (MBS).

Historically,we know that as the percentage of debt to GDP rises, so does gold. The chartbelow, by the Federal Reserve Bank of St. Louis, shows the debt to GDP ratiofrom 1970 to 2020. The second chart is the spot gold price since 1974.

The closecorrelation between gold and the debt to GDP ratio can also help to forecastgold prices, even during our current predicament. As the pandemic worsens inthe United States amid a “second wave” of infections there and in several othercountries, including Canada, GDP will fall, likely dramatically.

We arealready seeing signs of distress in the US economy, as the recovery thatstarted in summer begins to sputter amid a shocking rise in covid cases. (more than 125,000per day through early November, six times the levels in June. A thousand peoplea day are dying) Reservations for in-restaurant dining fell for a fourth week ina row, foot traffic to retail sites is dropping weekly, and the OxfordEconomics broad index of the recovery declined for its fourth straight week. Reuters quotes the firm’s chief economist saying the index of economic, socialand health data “is reeling”, noting it is back to midsummer levels largely dueto eroding health conditions, with local indicators falling in 47 states.

That’sthe first part of a rising debt to GDP ratio - a hit to GDP. The second part isan increase in debt. Back in March, when the Fed began to “spray billions intothe US economy” to deal with covid-19, a Bloomberg article stated that Combined with an unlimited quantitative easing program,the Fed’s souped-up lending facilities are set to push the central bank’sbalance sheet up sharply from an already record high $4.7 trillion, with someanalysts saying it could peak at $9-to-$10 trillion.

As ofNov. 4, the Fed’s balance sheet stood at $7.2 trillion.

Considerwhat a $10 trillion balance sheet will do to the debt to GDP ratio.

Alreadyat 98%, a level not seen since World War II, the Congressional Budget Officesaid it expectedfederal debt held by the public to exceed the size of the US economy (ie. Debt>100% of GDP) on Oct. 1, 2020.

Withoverseas investors like China and Japan continuing to gobble up US Treasuries,and zero interest rates likely to remain in place for the foreseeable future,allowing the federal government to keep borrowing to pay for more stimulus, thedebt to GDP ratio will almost certainly go higher.

It’s notinconceivable for the ratio to spike to $150%, or 200%, meaning for everydollar the US economy produces, it has to borrow $1.50, or $2.00. That’sinsane.

The coming debt crisis

Indeedthe flip side of government spending, which everyone agrees is necessary duringthese unprecedented times, is a new calamity: the crisis of debt.

According to Foreign Policy,The nextU.S. administration will likely face a global debt crisis that could dwarf whatthe world experienced in 2008-2009. To prevent the worst, it will need toaddress the burdensome debt plaguing both the United States and the globaleconomy.

The current global debt level is a whopping 320% of world GDP.

The article notes that, in addition to the level of US public debtexceeding 100% of GDP for the first time since World War II, the amount ofcorporate debt in America has skyrocketed:

Almost 20 percent of U.S. corporations havebecome zombie companies that are unable to generate enough cash flow to serviceeven the interest on their debt, and only survive thanks to continued loans andbailouts.

Biden’s spending spree

The debtis only going to get worse under Biden, although this also means an exceptionally good market for certainmetals, including gold.

Duringthe presidential debates, Joe Biden indicated if he becomes president, therewill be a major shift away from fossil fuels to clean energy – wind and solar.

Biden hassignaled he will embrace central concepts of the “New Green Deal” - a programfirst espoused by New York Congresswoman, and Democratic wing-nut, imo, Alexandria Ocasio-Cortez - including spending $2 trillion over four years to counterclimate change.

(“AOC”will reportedly serve on a panel helping Biden to develop climate policy.)

Dubbed “Clean Energy Revolution”, the plan calls for installation of 500,000 electric vehiclecharging stations by 2030, and would provide $400 billion for R&D in cleantechnology.

Ifcoronavirus continues to grip the US economy during the winter, and we see noreason to believe it won’t, despite talk of a vaccine, slower growth willintensify calls for more stimulus. The $2 trillion aid package that Congressapproved back in March is largely exhausted. Biden’s election victory makes thechances of another stimulus bill more likely than if Trump had gotten back in.According to Capital Economics, via Associated Press,a packageof $1 trillion to $1.5 trillion would add as much as 4.5% to growth next year -enough to return the economy to its pre-pandemic level by the end of 2021.

The president-elect has promised nearly$5.4 trillion in new spending over the next decade, accordingto the University of Pennsylvania’s Penn WhartonBudget Model, including $1.9 trillion on education and $1.6 trillion on newinfrastructure — roads, bridges, highways and other public structures. Some ofit would be paid for by tax increases. Biden has said he would boost thecorporate income tax to 28% from 21%, reversing half of Trump’s cut from 35% in2017.

Two ways the dollar falls

Of course, mostobservers expect Biden will have difficulty passing his agenda through a GOPSenate, where Republican senators will fight his tax increases and probably tryto limit the size of any new stimulus package.

That brings up anotherfactor that bodes well for gold going forward: the US dollar.

A potentially dividedUS Congress – the Democrats’ smaller majority in the House combined with aRepublican-controlled Senate – could mean a smaller coronavirus aid packagefrom lawmakers. This would put pressure on the central bank to ramp upbond-buying and other loose monetary policies that have weighed on the USdollar this year.

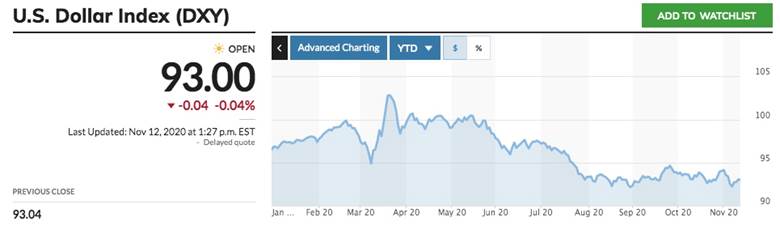

Since reaching a peakof 102 in March, the US Dollar Index (DXY) has lost nearly 10%, and iscurrently at a two-year low. The weaking of the dollar has been a significantfactor in gold prices rising 20.8% year to date.

Last week, Fed ChairJerome Powell said that the central bank was committed to keeping its bondpurchases steady at $120 billion a month.

But whatever happenswith the new Congress in January, the dollar takes the brunt. If, however unlikely,the Dems manage to take the two Senate seats still up for grabs in Georgia,that could mean a larger stimulus, and a loosening of the spigot on a torrentof green infrastructure spending by Biden.

A cheaper dollar wouldbe welcomed by many US companies because it makes their goods more competitiveabroad, but the problem is in that case, the dollar’s competing currencies arestrengthened. So far this year the euro has gained around 6% against thegreenback and the Japanese yen has risen about 5%.

These gains go againstforeign central banks’ efforts to boost economic growth, by keeping theircurrencies low in relation to the dollar. Reuters quotes Momtchil Pojarliev, head of currencies at BNP Asset Management, who believesthe dollar will sink to fresh lows over the next three months.

“The Fed is very dovishand is going to stay dovish,” he said. “The bigger the stimulus, the worse forthe dollar.”

CNBC adds that the dollar is also likely to fall due to the market viewing geopoliticalrisks to be lower with a Biden win, and the fact that US trade policy willprobably become more predictable, without escalating tariff threats. (investorstend to move their funds into US dollars, or USD-denominated assets likeTreasuries, in the event of destabilizing events like trade wars, civil unrestor military confrontations)

Conclusion

Biden,despite claiming otherwise, believes strongly in the power of the state to taxand spend, and will face overwhelming pressure from the left wing of theDemocratic Party – supporters of hard-left progressives like Elizabeth Warrenand Bernie Sanders – to toe the party line. A long wish list waits to befilled, with little to no concern regarding the already out of control $27billion national debt, courtesy of Modern Monetary Theory, or MMT.

MMT is anew way of approaching the US federal budget that is both unconventional andabsurd. It posits that rather than obsessing about how large the debt has grownand the ongoing annual deficits that fuel debt, we should focus on spending,specifically, how the government can target certain spending programs that willcause minimal inflation. Fiscal policy on steroids is, according to itsproponents, to be the new engine of US growth and prosperity.

Governmentis therefore given a free pass on spending, because the only thing that we haveto worry about with the national debt is inflation. Curb inflation and the debtcan keep growing, with no consequences. This is because the US government cannever run out of money. It just keeps printing it, because dollars are alwaysin demand (with the dollar being the reserve currency, and commodities aretraded in dollars).

MMT andthe ideas of the Democratic Party’s far left fit like hand and glove. Pleas foruniversal medical coverage, free college tuition and a minimum $15 per hourwage can all be paid for by setting the money presses free.

Itdoesn’t take a great deal of economics knowledge to see that MMT would decimatethe value of the US dollar, which has lost a significant amount of value sincehitting multi-year highs in March.

Thedollar and commodities move in opposite directions, because when the dollarfalls, those using other currencies get a better exchange when they swap theirmoney for US dollars, thereby boosting demand for said commodities.

Forexample, when the dollar slumped between 1998 and 2008, gold prices nearlytripled, reaching $1,000 an ounce in early 2008. A falling dollar due to MMTwill be good for gold, and all metal prices.

Goldprices will also be strengthened by a slew of other factors, includingcovid-19, inflation expectations on the back of (seemingly) unlimited monetarystimulus, low interest rates worldwide, and geopolitical concerns especially US-China tensions over trade, and the South China Sea. China will be the topforeign policy priority for Biden and his team.

Even ifBiden doesn’t fully embrace MMT, we expect stimulus spending on steroidsespecially if he gets a Democratic mandate from both the Senate and the House.The flood gates of coronavirus relief will be opened, with billions spent onmandatory masks, stricter social distancing protocols, increased and sustainedrelief for individuals, businesses, food banks, day cares, etc. As long asinterest rates remain low, and they are expected to until at least 2023, expectmany trillions of dollars to fly out of the Treasury, with little to noconsideration of the consequences.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.