Fresh wave of Chinese firms to go after Congo's riches - report

First was Latin America, now Africa. No matter where the projects are located, if they are promising copper or gold assets, Chinese investors are coming for it.

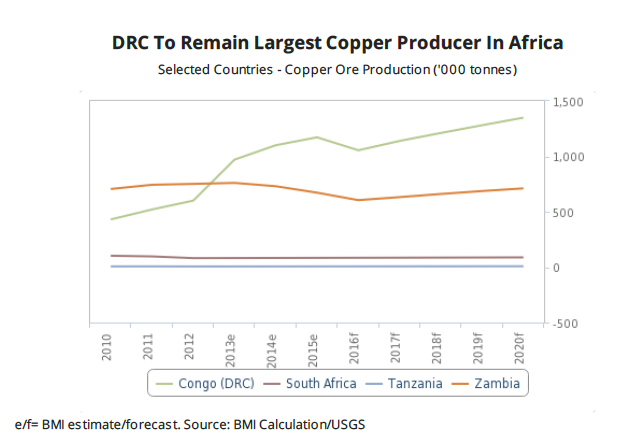

The imminent acquisition of Freeport-McMoRan's Tenke Fungurume mine in the Democratic Republic of Congo is just the latest sign of a growing trend, as analysts expect the Asian nation to continue its quest for a steady supply of metals, mainly copper, cobalt and gold.

According to a report released Friday by BMI Research, the DRC will remain the destination of choice for Chinese mining investors in the coming years, thanks to the country's low production costs and the largest undeveloped high-grade (2-3% compared to global average of 0.8%) copper deposits in the world.

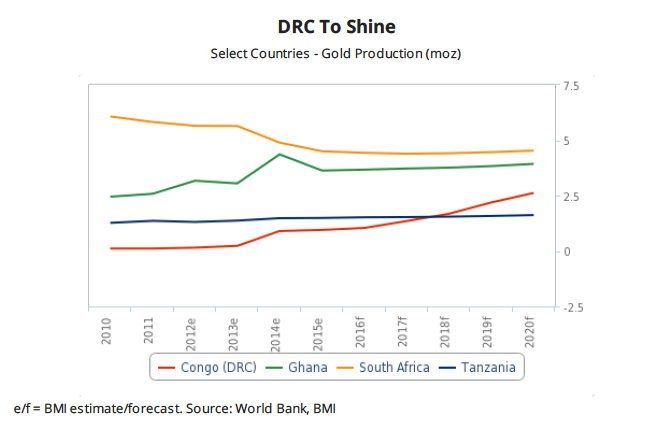

The analysts argue that China's slowing gold production growth as a result of depleting domestic reserves and rising production costs will also boost the presence of Asian investors in the DRC's largely untapped gold sector:

DRC's growing economy - with an average annual real GDP growth rate of 7.9% during 2011-2015, and the mining industry accounting for 10.9% of GDP in 20 15 - will increasingly absorb most foreign investment in the African region with South Africa's production costs on the rise.

Infrastructure boost

In many ways, China is repeating a known strategy for those in the mining industry. At the turn of the millennium, the country moved to secure supplies of traditional commodities, such as oil and industrial metals, sometimes through acquisitions, other times through investments and loans-for-oil deals with nations including Angola and Venezuela, which held big deposits of the raw materials.

In Africa, they are now also investing in infrastructure, but the experts at BMI say it will take years for those ventures to benefit the region's mining sector.

As an example, they mention a $6 billion loan in place since 2009 between Exim Bank of China and the DRC, which is expected to improve Congolese infrastructure and boost the development of mines in return for control over some copper deposits.

Progress on the matter continues. Last month, the Congolese government awarded a $660 million contract to a consortium of Chinese investors to build a 240 mega watt hydroelectric project at Busanga, near the location of the Sicomines copper project, which is a joint venture between DRC-owned Gecamines S.A., China Sinohydro and the China Railway Group Ltd.

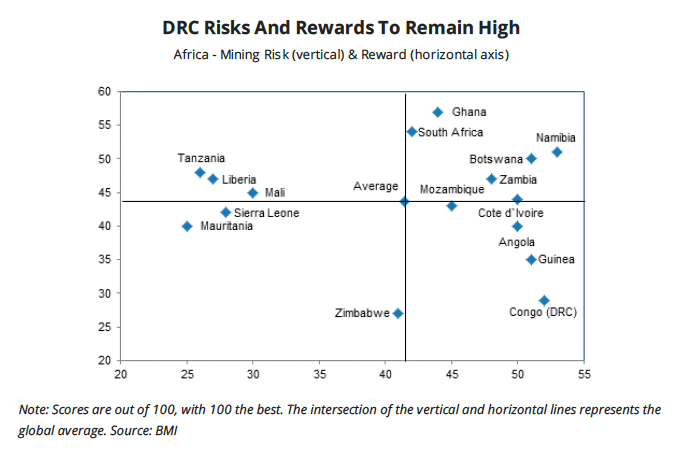

However, BMI's report acknowledges that regulatory uncertainty in the country, mostly linked to a potential revision of its mining code and upcoming presidential elections, will remain a key barrier to the resource sector's long-term growth. They place the country in the 59th position for mining risks out of the 61 countries they list in their Mining Risk/Reward Index.

BMI also warns that the lack of substantial infrastructure and power are two other factors that will weigh on investors decisions in years to come.