Friday night blues for short sellers battling Bonterra, Home Capital and Corus Ent. insiders

During the past week, in the INK morning report we focused on two situations where insiders were taking the opposite position against short sellers of their stock. On Thursday we highlighted CEO and CFO buying at Bonterra Energy (Mostly Sunny; BNE) while on Friday we revisited the Home Capital Group ( Sunny; HCG) story. Meanwhile, shorts suffered another set back at Corus Entertainment (Sunny; CJR) which we highlighted at the end of last year.

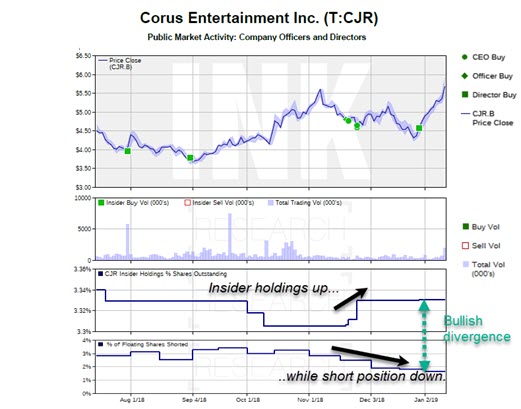

Bullish divergence at Corus Ent.: Insider holdings up, shorts down (click for larger)

As we said Thursday, short-interest in Bonterra Energy ticked up slightly in the December 31st report from IIROC. As of that report, it stands at 10.88% of its float (estimated shares outstanding available for trading) which puts it in the top five most shorted stocks on the TSX as a percentage of float.

Short-sellers have had a nice run of it with Bonterra off more than 60% over the past 3 months, and, indeed, the stock is down a further 10% since our last report. However, we saw the makings of a short squeeze situation as the short-sellers are betting against a stock with relatively high insider commitment. Chairman and CEO George Fink and CFO Robb Thompson have spent a combined $359,814 picking up stocks in the public market since we last reported on Bonterra. Clearly, insiders are betting that Bonterra's cash flow situation will improve on the back of firmer commodity prices and the company's operating activities which include 2 wells drilled in December expected to add production early in 2019, the tie-in of three wells previously drilled in the Q3, as well as the previously announced reduction in dividend.

Bonterra stock is up 9.5% over the past two days, so maybe the tide is turning in favour of the insiders.

Meanwhile, as we suggested Friday morning, betting against Home Capital Group is proving to be a challenge, despite the mid-December news that Berkshire Hathaway (BRK*US) had sold a substantial position in the stock. Short-sellers were emboldened by the Berkshire news and bet it would signal a lack of confidence in HCG's prospects. The HCG short position rose by 0.7% as of December 31st. That put the short position in HCG at 6.78% of the float, making it one of the 25 most shorted TSX stocks. However, there is another perspective to the Berkshire move. As Warren Buffett notes in a December 19th press release, after HCG paid back Berkshire's line of credit and HCG shareholders turned down an additional Berkshire equity investment in September 2017, Berkshire's investment in HCG was too small for the insurance giant to justify continued involvement. Large institutional investors that make direct investments often prefer to take big stakes in companies to justify ongoing monitoring costs.

Home Capital Group insiders keep buying despite the gloomy talk

Continued insider buying represents a challenge to short-sellers as it signals confidence in the firm's future prospects. Another obstacle for the shorts is the Bank of Canada putting interest rate hikes on hold. Monetary policy, once a tailwind for the shorts, has now stopped blowing in their favour. Canadian housing markets are vulnerable to rising rates, but with Canada bond yields falling, interest rates may yet turn into a headwind for short-sellers. That said, mortgage finance companies must still contend with tighter lending rules and slowing housing demand. As of Q3, at any rate, HCG has been undeterred by these factors. The firm managed diluted EPS of $0.41, up from $0.37 in Q3 2017 with a net interest margin of 2.03%, up from 1.85% in the comparable period. We will be keeping an eye on the short-insider tug-of-war at HCG. Since our last report on August 27th, insiders are winning, with the stock up 15.1% (as of Thursday).

While short-selling reports often get a lot of attention due to their allegations and conclusions. Sometimes they are right, but other times they flop. While not infallible by any stretch, insider behaviour can often help investors put short-selling situations in context. Generally, it is a bullish sign for a stock to see shorts reducing their positions while insiders are buying.

For example, in our December 28th report Will Corus Entertainment shorts be singing New Year blues? we looked at the short report for the Canadian market published on December 21st. We pointed out that short interest at Corus Entertainment had continue to fall, standing at 1.8% down from about 3% in late October. Meanwhile, insiders at the firm had been buying, most notably CEO Doug Murphy. Corus Ent. released quarterly results Friday morning and investors cheered, sending the stock up 5.8%.

We know which corner of the market is playing the Friday night blues as we head into the weekend.

INK outlook categories are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For more background, please read INK's FAQ#5.

Join the Canadian Insider Club to get the Morning INK Report emailed to you every trading day. You will also receive our monthly Top 40 Stock Report and enjoy an ad-free experience on this website plus much more. Click here to read about out the benefits of joining the club which helps to support this website.