Fura Gems to restart Colombia's iconic Coscuez emerald mine in April

Canada-listed Fura Gems (TSX-V:FUR), a new gemstone mining and marketing company headed by former COO of Gemfields (LON:GEM) Dev Shetty, is stepping up efforts to kick off operations at some of its key assets and so take advantage of a growing demand for coloured precious rocks.

The company, which began operations less than a year ago, in May 2017, has good reasons to be in a rush. Sales of emeralds, rubies and sapphires are picking up to the point they are outpacing the increase in demand for diamonds. That, in turn, is fuelling prices for coloured stones, with the market expected to grow from the current $2 billion to $10 billion, in the next ten years, according to the Natural Resource Governance Institute.

Fura's assets are all located in areas known for holding diamonds deposits, including operating mines currently undercapitalized and that need to be modernized.

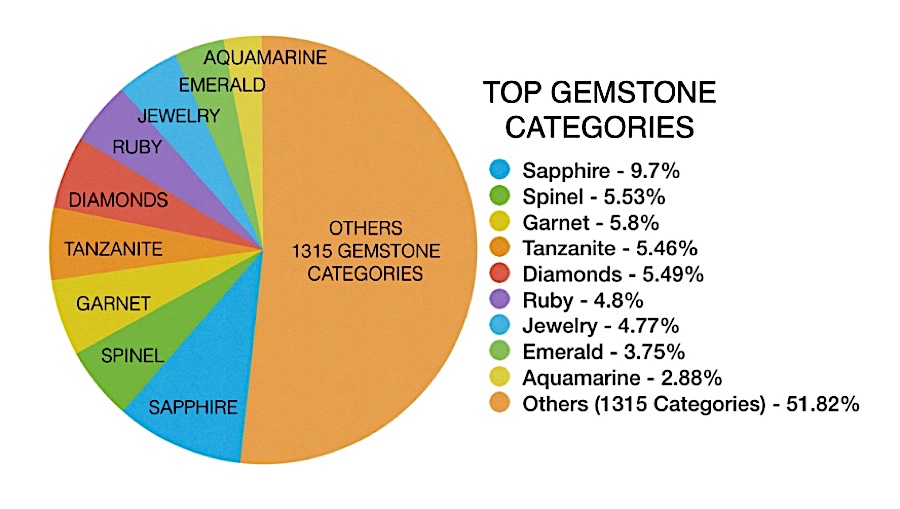

Graphic courtesy of Gem Rock Auctions.

A good example of those assets, Fura Gems chief executive officer Dev Shetty told MINING.com, is the company's Coscuez emerald mine in Colombia, which it grabbed from Gemfields in October.

Located in the mountainous department of Boyac??, Coscuez is probably one of the best-known emerald deposits in the world, said Shetty, adding it's known to have produced over 95% of Colombia's emerald supply in the 1970s.

Company believes its Coscuez emerald mine in Colombia has only been 'scratched on the surface' and that the best is yet to come."We firmly believe that mine has only been scratched on the surface, and the best is yet to come," Shetty said. "We estimate that if we capitalize it from the current state itself, [Coscuez] will have a minimum life of about 25 years or more, and there is a potential to expand the life by doing core drilling."

The executive noted Fura Gems already has a core management team on ground, with plans to restart mining there in April.

Similarly, in Mozambique, the company acquired four licences in the area known as "the ruby belt" and it believes is in position to start mining those assets "very soon."

Messy market

Unlike diamonds, which come mainly from known actors such as De Beers, Alrosa and Rio Tinto, and which are subject to clear regulations, 90% of the coloured gemstones supply comes from an unorganized sector.

90% of the global supply of coloured gemstones comes from a highly disorganized and fragmented industry, says CEO Dev Shetty."It is a highly disorganized and fragmented industry," Shetty said, "but there is considerable scope for growth."

Fura's plans in this regard are ambitious, as it aims to organize between 15% and 20% of the current trade, mostly done these days on a small-scale, artisanal basis. Shetty acknowledges that trying to whip the sector into shape won't be easy, but he thinks is possible and necessary.

"Fura's management team comprises of individuals who have sufficient experience in the coloured gemstone sector, and who have previously worked in Gemfields, playing an important role to make Zambia and Mozambique the world's largest supplier of emeralds and rubies respectively," Shetty said.

The company plans to centralize post-mining activities in Dubai, where its gemstones will undergo final grading before they are sold via an organized platform, mainly auctions and jewellery manufacturers.

Shetty highlighted he wants his company to stand out for its best practice mining methods, transparency and involvement of local communities.

"We believe that as we progress, the communities that we work within also need to advance. Even before we completed our Coscuez transaction in Colombia, we had recruited four CSR members to engage with the community and set a communication platform," the executive said.

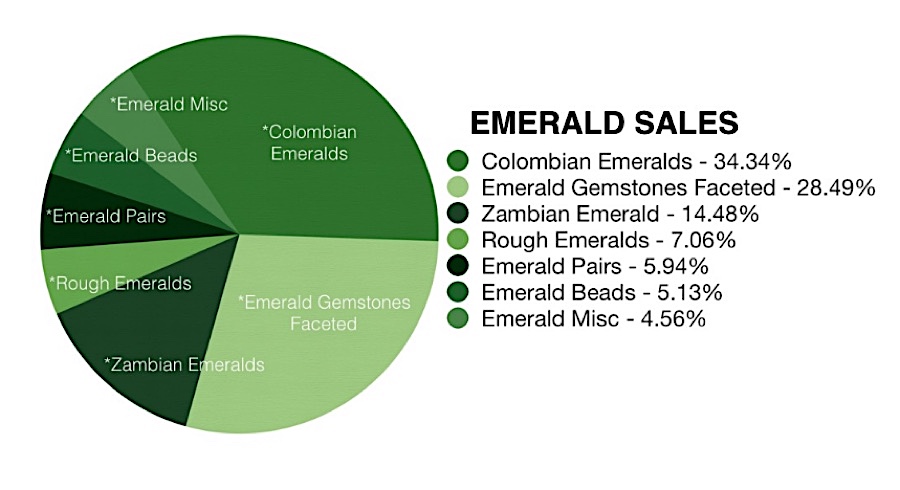

Graphic courtesy of Gem Rock Auctions.

He said locals know Fura's intention is to convert Coscuez into a modernized large-scale underground mine and that they've been "very forthcoming" with their suggestions.

"We are the 'only listed miner in the world' to own an operating emerald mine in Colombia. We believe that we will set an example of transparency and ethics and will help all the future organized players to come and operate an emerald mine in the country," Shetty said.

Colombia's emerald production dropped from its world-leading position in the early 2000's with 10 million carats a year to 2.6 million a decade later, losing ground to Zambia and Brazil, mainly as a result of social conflict, violence and instability triggered by drug lords. But since a final peace agreement signed in 2016, foreign companies are once again landing in the country, which is still the world's largest supplier of emeralds in terms of value.