Further Clues Reveal Gold's Weakness / Commodities / Gold & Silver 2020

It might have been tempting to thinkthat the recent move lower in the U.S. Dollar Index would serve to push goldhigher, as it usually does according to the traditional pattern. But these areextraordinary times and there are too many external factors weighing negativelyon the price of the yellow metal.

As if the previous vaccine announcementsweren’t enough, the latest vaccine trials from AstraZeneca further propelledpositive news. And as Trump reluctantly gave Joe Biden the green light towardsa transition to the White House, what more can the precious metals do butcapitulate? The risky assets train is leaving the station and investors areclimbing on board. There simply is no clear catalyst for gold to rally and itcan only go further down from here before bottoming.

With this glut of headlines, what newscan I possibly give you today? Well, I can tell you about some of the cluesthat yesterday’s decline provided and about one from today’s pre-market USD and gold trading .

Let’s start with the latter.

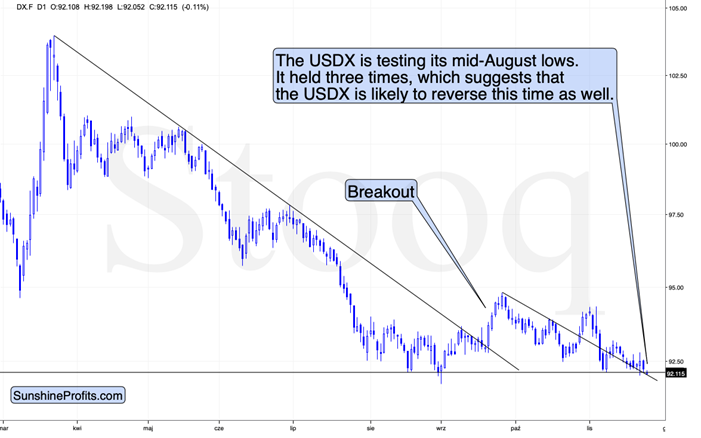

In today’s pre-market trading, the USDIndex moved slightly lower, and at the moment of writing these words, it findsitself a bit below the mid-August bottom.

The invalidation of the intradaybreakdown below this level was what triggered the biggest part of gold’sdecline on Monday (Nov 23). This might happen again very soon, but this is notthe clue that I was writing about earlier. Today’s clue is that since the USDIndex might be breaking lower here, gold should have reacted with a visiblerally – if it was past a bottom.

Gold didn’t react with a visible rally.Conversely, gold reacted with a small decline. This subtle clue tells us thatgold hasn’t formed a bottom yet. And since golddoesn’t want to rally from here, and it seems that it’s about to geta bearish push from the USD Index (I expect the tiny breakdown to beinvalidated just like the previous 3 attempts), we have a quite bearishcombination of factors for the yellow metal.

Please note that moves in both the USDIndex and gold were relatively small (so they could be invalidated before youread this) but this lowers the bearish implications only a little – after all,for some time in today’s pre-market trading gold was definitely moving a bitlower while the USDX was a bit lower as well.

What about the clues from yesterday’ssession? They are visible on the miningstock chart .

Miners moved lower and while they triedto bounce back, they failed to do so, creating a bearish reversal during theday. This kind of shape during the day’s session is bearish in nature. It’sespecially the case when we see it after a rally (it’s a shooting starcandlestick or a gravestone doji candlestick in this case), but even during adecline it indicates more weakness. Please note that we already saw that a fewtimes recently: on November 12 and 13, and on October 26.

The shape of yesterday’s session is oneclue, and the steady buildup in volume as prices decline is another. TheAugust, September, and October bottoms were characterized by a relativelyaverage volume during the declines preceding them, and then a huge spike in volume at thebottom. This time, the volume is also significant in absolute terms, but not inrelative terms. The volume is simply increasing as the price moves lower asmore and more people become convinced that gold is no longer in a bullish mode.

The RSIindicator is approaching the 30 level, which some might view asbullish, but let’s keep in mind that back in March, the bottom was not yet inuntil the RSI moved into its low 20s.

So, while it’s clear that there arecounter-trend rallies within any move, it seems that the precious metals marketis not yet ready to launch a counter-trend rally right now. And even if it doesstart this kind of move, it’s unlikely that it would be significant. The outlook for the precious metals market remains bearish for the next few weeks.

Thank you for reading our free analysistoday. Please note that the following is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the downsidetarget for gold that could be reached in the next few weeks.

Thankyou for reading the above free analysis. It’s part of today’s extensive Gold& Silver Trading Alert. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Signup for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.