GDXJ: Pullbacks Should Be Expected But The Gold Party Is Just Starting

The gold price has retreated back down to ~$1,501/oz, after briefly hitting a new high of ~$1,534/oz earlier in the day.

Gold and gold mining stocks have put in strong returns these past months, but may need a breather to digest some of the gains.

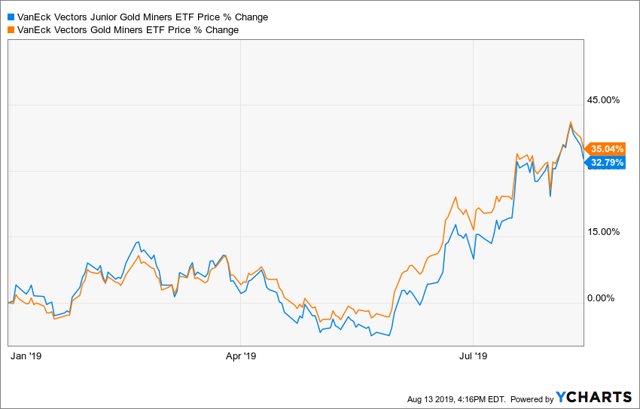

So far in 2019, GDXJ is up 32.79% but it is still trailing GDX, which is up 35.04%.

As we head into the fall season, there are a plethora of macro news events to stay tuned into, which could provide a further tailwind to gold's price rise, especially if certain situations worsen.

In the past, gold has performed well during the latter part of Q3.

During the early morning of August 13, it looked like gold was poised to make another big move up again, after hitting a high of ~$1,534/oz. However, it was not meant to be as the yellow metal promptly sold off shortly after market open and is now currently trading at ~$1,501/oz.

Source: Goldprice.org

Source: Goldprice.org

As the following headline shows, gold fell 2% when word broke out that the U.S. would delay new tariffs on certain Chinese-made goods until December 15.

Source: CNBC

Source: CNBC

Despite the headlines (and reasons), this most recent pullback in gold and gold mining stocks was arguably sorely needed, as the sector has been on an absolute tear in recent months.

Recent Froth, Pullback and Charts

As the following chart shows, the Gold Miners Bullish Percent Index has been displaying extreme froth, with the RSI (14) hitting 98.90.

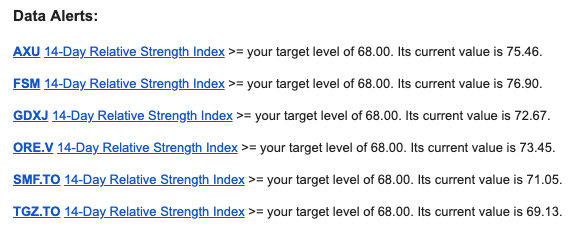

For many gold stocks that I have on my own personal watchlist, many names have been breaking through RSI (14) of 70 in recent months, which was not a data alert I remember being notified of much over the last year.

Source: YCharts; July 2019

A pullback has long been on the cards, and we may yet experience some more of it, after today's modest move back down.

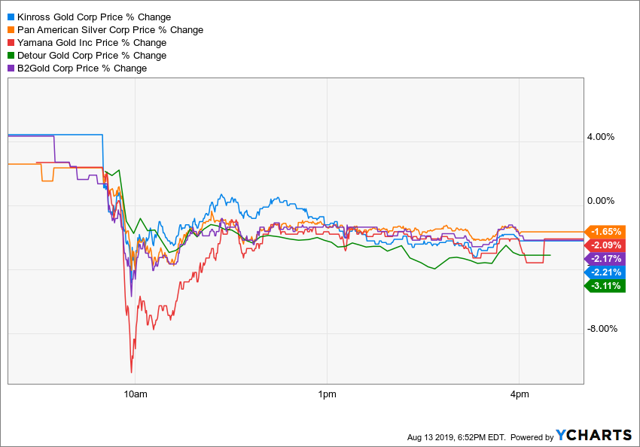

Here is a performance chart on the day for some holdings contained within the GDXJ ETF.

Kinross Gold (KGC) is down -2.21%. Pan American Silver (PAAS) is down -1.65%. Yamana Gold (AUY) is down -2.09%. Detour Gold (OTCPK:DRGDF/DGC.TO) is down -3.11%. B2Gold (BTG) is down 2.17%.Even in the context of a bull market, it's important to remember that volatility can still be immense to the downside; today's price action was only mild, but could be signaling the start of a more pronounced move to come for some "overbought" mining shares, which should it happen, wouldn't be alarming/unusual at all.

Currently, the VanEck Vectors Junior Gold Miners ETF (GDXJ) is trading at $40.13/share.

On a relative basis, GDXJ is up quite a bit so far this year, but it's still underperforming its large-cap brother, the VanEck Vectors Gold Miners ETF (GDX).

GDXJ is up 32.79%. GDX is up 35.04%.Although it's never quite so simple trying to figure out just where we are in a cycle, if we were to compare the run we've had in 2019 so far with the last major bull market for gold, observed in early 2016, one would expect to see the junior names (e.g., GDXJ) start to outpace their "less nimble" large-cap siblings (e.g., GDX).

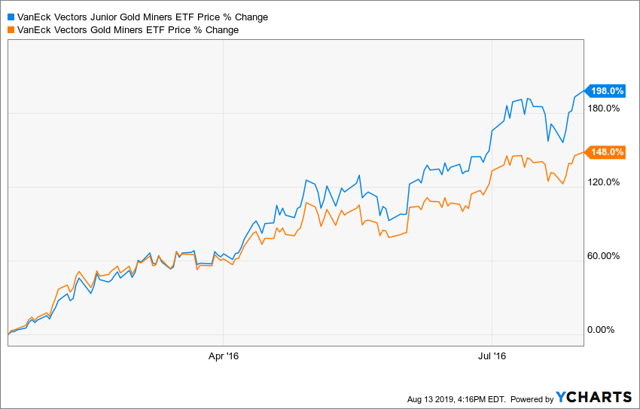

Looking back, the start of the bull market up until a late-stage peak (from January 19 to August 1, 2016), we can see from the following chart an example of when/how GDXJ starts to separate and outpace GDX, the deeper we get into a precious metals bull market run.

GDXJ was up 198%. GDX was up 148%.Granted, there're never any guarantees that history will repeat/rhyme in the same fashion again in the future, but nevertheless, the above chart can still be a useful data point to keep in mind.

The Macro Picture

As the markets gear up to enter the fall season (which historically have shown they can be most volatile/choppy), there's already been a plethora of news thrown out there that could provide further tailwinds to gold's price ascent.

Source: Business Insider

Source: Business Insider

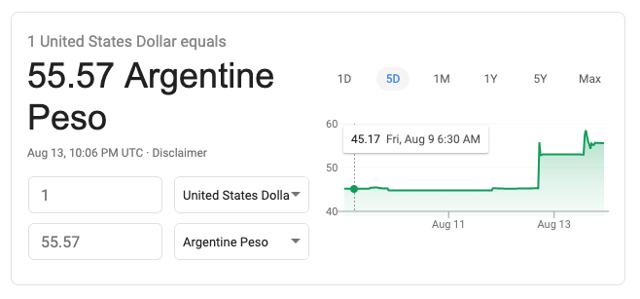

This past Monday, the Argentine Peso (ARS) crashed, relative to the US Dollar, and is now trading at USD:ARS of 55.57 (from ~45 this past Friday).

From Kitco:

Investors were also still assessing the wider damage caused by Monday's crash in Argentina after its President Mauricio Macri became the latest pro-free market, pro-reform leader to be given a beating at the polls by a populist rival.

The response was brutal. The peso collapsed 15%, equities crumbled 48% in dollar terms -the second biggest one-day slump anywhere since 1950- and the bond market crashed, with a 100-year bond that investors had recently gobbled up tumbling 20% as fears of yet another government default spiked.

"Yes, Argentina is a small economy. However, the last thing global markets want to see is another market-friendly government fall to populism and/or geopolitics," said Rabobank strategist Michael Every.

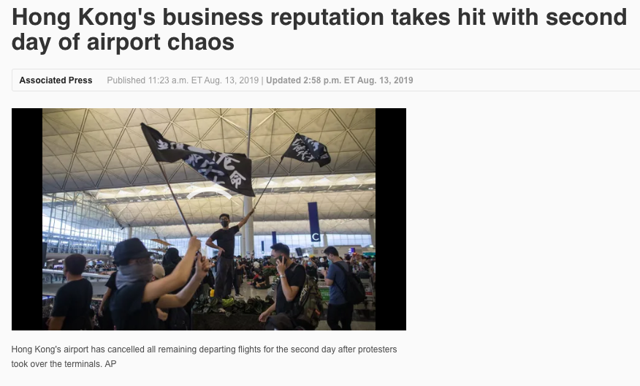

Moving over to Asia, the tensions in Hong Kong continue to escalate, as the airport was closed on Monday, and Tuesday marked a second day of "airport chaos" as protests continue.

Source: USA Today

Source: USA Today

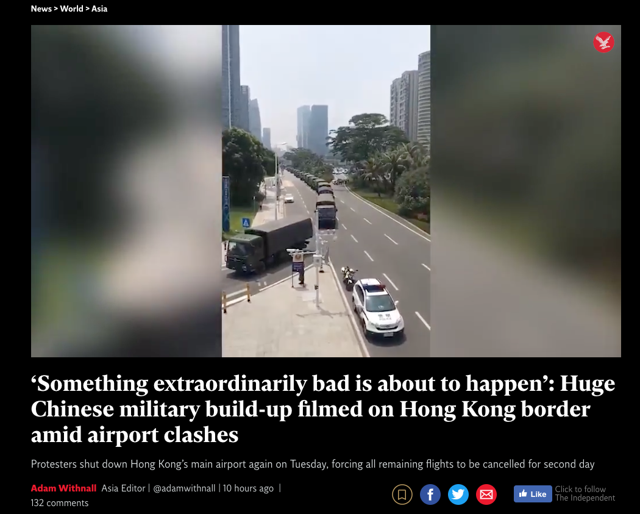

Now, there's also been video clips circulating around the web of Chinese military build-up, assembling nearby in Shenzhen, which is only adding to the uneasiness/fears/tensions around the region.

Source: Independent

Source: Independent

Needless to say, there's a lot going on around the globe right now, as highlighted by Rabobank strategist Michael Every:

He added the "wall of worry" also now includes: the trade war, Brexit, China, Hong Kong, Iran, Italy, Kashmir, North Korea, South China Sea, Turkey, and Venezuela. "Did I miss anything with tired eyes?"

Then there's also the matter of global debt with negative yields now sitting at $15 trillion.

Source: CNBC

Source: CNBC

Although it's true that gold is a non-yielding asset, zero > negative, and with demand for safe-haven assets arguably growing by the day around the globe, there are now analysts calling for gold to hit $2,000/oz (not right away, but down the line).

From CNBC:

"We have a long position trade on. We are targeting $1,585," said Daniel Ghali, commodities strategist at TD Securities. "We do think gold is on its way higher for the time being...Over the coming years as the likelihood of the unconventional policy becomes more of a reality, I could see a case for gold at $2,000."

"Negative yields are symptomatic for the search for safe assets. The reason they're trading at negative yields is because the demand for safe assets is bigger than the supply for them,?EUR? said Ghali. "Gold stands to benefit quite a bit from that.. the trade we've been recommending we have it as a three month time horizon. I would argue we are likely on the cusp of a multi-year bull market for gold."

Heading Into the Fall

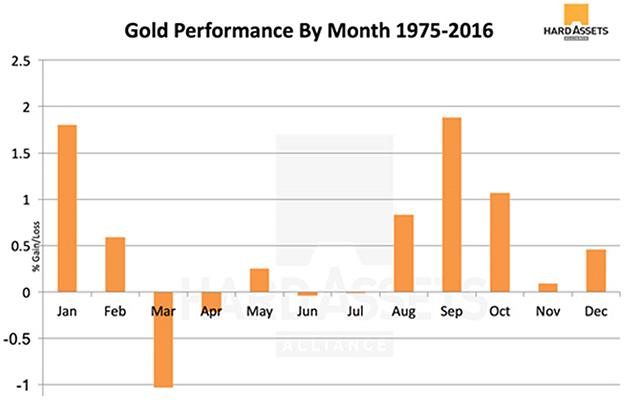

In terms of seasonality, although it's not always a reliable indicator, in the past, gold has shown that it typically does better after the summer months, in the latter part of Q3 time frame, as shown below.

Source: Hard Assets Alliance

Source: Hard Assets Alliance

This year, gold and gold mining stocks decided to get things going a little earlier than usual, back in June, but in the bigger picture, this party might just only be getting started.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow FI Fighter and get email alerts