GE Options Trader Braces for a Bigger Retreat

The weekly 9/13 9-strike put is GE's most active option today

The weekly 9/13 9-strike put is GE's most active option today

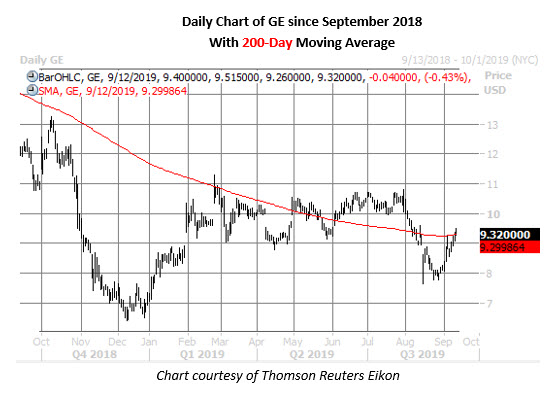

General Electric Company (NYSE:GE) stock jumped to a four-week peak of $9.51 earlier. However, the shares have since swung 0.5% lower on news the company plans to buy back $5 billion of existing debt, and one options trader appears to be bracing for an even stiffer pullback.

At last check around 93,000 calls and 74,000 puts have changed hands, a relatively light day of options trading for GE. The weekly 9/13 9-strike put is most active, due to a 25,000-contract block that was bought to open for $50,000 (number of contracts * $0.02 premium paid * 100 shares per contract).

This initial premium paid is the most the put buyer stands to lose, should General Electric remain above $9 through expiration at the close tomorrow, Sept. 13. Profit, meanwhile, will accumulate on a move below breakeven at $8.98 (strike less premium paid).

More broadly speaking, options traders have been buying to open puts relative to calls at a quicker-than-usual clip lately. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), GE's 10-day put/call volume ratio of 0.87 registers in the 84th annual percentile. The October 7 put has seen the biggest increase in open interest over this two-week time frame, and data confirms notable buy-to-open activity here.

Given GE's longer-term struggles -- the former Dow stock is down 23% year-over-year -- it's likely some of this recent put buying is at the hands of traditional options bears. However, considering General Electric is up almost 13% month-to-date, and holding above its 200-day moving average today, it's also possible shareholders are initiating protective puts to guard paper profits against any downside risk.