Genesis Metals Corp. - Value In The Abitibi Greenstone Belt

After one of the worst bear markets in history, gold and the gold mining stocks began a new bull market cycle in 2016. With the first 8 months of the year filled with incredible gains, a correction in the market ensued. Of the two, the gold mining stocks were hit the hardest, sending a large portion of the company share prices down or sideways over the last 16 months.

Today, in the 1st quarter of 2018, physical gold continues to show strength, while the gold stocks continue to waiver. Personally, I think the prospects of a change in sentiment toward the gold stocks will happen in 2018, and mark the next leg up in this bull market cycle.

Why do I think this is the case? There are a few reasons:

Lack of interest - In my opinion, the weed and blockchain sectors have captured the attention of the large majority of the speculative investors over the last year. Additionally, I have read numerous articles and headlines which allude to gold losing its luster, which I completely disagree with. I believe this is a sign of a great buying opportunity in the junior gold equities.1,033 point correction on the DOW - The broader market has been on a tear for roughly 8 years, and up until this 1,033 point correction on the DOW a couple weeks ago, it didn't appear to be slowing down. It's my contention that we are seeing an inflection point downwards in the broader markets bull cycle. My guess is that past will be prologue, gold and gold equities will be the major beneficiaries.Inflation - Although, I do think a correction in the broader market becomes more likely with each passing week, I see tremendous inflation in the future. In my opinion, we are entering a major bull cycle in the base metals, which will inflate the cost of living. Real assets will be sought out to curb the destructive and silent force which is inflation. The caveat to this belief is the adoption of artificial intelligence, which will have a huge deflationary impact on the world. However, I think that is still 10 years away from having a profound impact.Scarcity and Cost to produce an ounce of gold - As Brent Cook has often pointed out, we are losing approximately the equivalent of the Carlin Trend each year, in terms of gold ounces, and the majority of what we do discover isn't economic below $1250 USD/oz Au. When the cost of production is more than the price of the commodity, therefore, the price has to eventually go up. I must qualify this statement by saying that, according to regular accounting, gold isn't scarce, given the fact that more than 95% of all gold that has ever been mined still exists today, albeit in vaults. I don't, however, foresee gold becoming any less popular as a store of value and, therefore, believe that the scarcity reference is applicable.Mining is a sector in which the most valuable commodity, for a junior company, is the people. The right people make the right choices no matter what portion of the market cycle they are in. Therefore, picking the right people, in my opinion, gives you a higher probability of being successful with your investments. Bottom line, if you like the metal and its prospects for price appreciation in the future, buy the metal. If you're willing to do the due diligence, and can handle/manage the risk, there is huge potential in the junior mining stocks.

Which brings me to the company I would like to update you on today, Genesis Metals Corp.

Let's take a look!

Genesis Metals Corporation (GIS:TSXV) & (GGISF: OTC)

NOTE: DTC eligible

MCAP - $9.4 million (at the time of writing)

Shares - 74,801,204

Fully Diluted - 104,845,092

Management Ownership - 12%

The Genesis Metals Team

A junior resource company is only as good as its people, and in the case of Genesis Metals, they've assembled a great team.

Genesis Metals' CEO and Chairman, Brian Groves, is a 40-year veteran of the mining industry. Groves has explored in both Australia and Canada, working with AMAX Minerals, Noranda and Manager of Corporate Development at Placer Dome. Moving up the organizational ladder throughout his career, Groves has gained valuable experience in capital markets, project development, permitting and corporate strategy. Today, he leads a group of people who have not only worked together previously, but who have a history of success within the mining industry.

Working hand in hand with Groves is Jeff Sundar, President and Director of Genesis. Sundar has 18 years of experience in the mining industry, having held a VP and Director's position while working with other Genesis Board members in Underworld Resources. Underworld, in particular, was a great success, as the 1.6 Moz White Gold deposit was sold to Kinross for $140 million. Sundar and the team look to replicate this success with Genesis in the years ahead.

Adrian Fleming, the former President and CEO of Underworld Resources and former VP Exploration of Placer Dome, joins the Genesis team as an Executive Director. Fleming is a Professional Geologist with over 30 years of experience in the mining industry. Some of Fleming's most notable work experience includes the following:

Former VP Exploration for Placer Dome based in Sydney Australia. Fleming spearheaded Placer Dome into Western Australia, where he directed the group and found the Big Bell Mine.Fleming co-led the team that found the high grade zone at the monster, 28 Moz gold equivalent, Porgera copper gold deposit, located in Papua New Guinea.Former VP Exploration for Golden Star in the early 90's. Fleming directed the team that uncovered the Gross Rosebel Deposit, which has now grown to 17 Moz of gold.Fleming will be counted on to provide valuable input as Genesis moves forward with a plan to expand its Chevrier Gold Deposit resource, and explore the gold anomalies at their October gold project.John Florek, the former Senior Geologist at Barrick Gold's Famous Hemlo Mines, is on Genesis' Board of Directors. Hemlo was a world-class gold deposit and is credited as being the catalyst for the 1980's exploration boom. Florek co-led the exploration team that found an additional 2 Moz of gold, which extended the Hemlo mine life. He was also Senior District Exploration Geologist for Placer Dome in Red Lake, and in 2008, his team was awarded the Northwestern Ontario Prospectors award. Florek's more than 20 years of experience in the mining business as a professional geologist should add great value for Genesis in the future.

Last, but certainly not least, Andre Liboiron is the Exploration Manager for Genesis' projects, Chevrier and October. Liboiron is a Quebec native with more than 26 years of experience as a geologist in Quebec, as well as internationally.

Strategic Advisor

Robert McLeod, Genesis Co-Founder and former Chairman of Genesis' Board, relinquished his position because of the heavy time commitment required by his primary focus as CEO of IDM Mining, a near term producer in BC's Golden Triangle. Given the work history of the members of this management team, however, McLeod has agreed to remain with the company as a strategic advisor.

McLeod is on Casey Research's Nexten list, which features the top young professionals in the mining industry. A quote taken from Casey Research's profile of McLeod,

"Luck has nothing to do with it. Rob has the pedigree, the smarts, and the perseverance to have forged a stellar career in mining exploration and company development." ~ Casey Research

Also, Genesis has added former Laurentian Bank Securities Mining Analyst and Peartree Securities Technical Advisor, Eric Lemieux. Lemieux is a geologist by trade and has 25 years in the mining industry with experience in a variety of areas, such as mineral exploration and project valuation. Lemieux's addition to the Genesis team should prove advantageous as Genesis looks to develop their properties.

Strategic Shareholders

While the people who run junior resource companies are the core component for investment, looking at the people who choose to invest in the companies is a great gauge for potential value. In Genesis' case, there are a few heavy hitters who have taken major positions in this junior gold exploration company.

The list of strategic shareholders is headlined by Osisko Mining, which acquired a 6.4% position in Genesis through a private placement announced in 2017. For those unfamiliar with Osisko Mining, they're a major player in the gold sector, owning strategic positions in a lot of great companies, such as: Falco Resources, IDM Mining and Beaufield Resources. Outside of owning strategic positions in companies, Osisko is exploring their 70,000 Ha Windfall property, which is located in the Urban-Barry Greenstone Belt in Quebec. Osisko is known for their geological expertise and well timed investment in smaller junior gold companies. Their investment in Genesis speaks volumes about Genesis' potential.

The strategic shareholders list is further headlined by Eric Sprott, who has acquired a 7.2% position in Genesis through a private placement announced in 2017. Sprott is a major player in the resource sector, with a history of successful investments throughout his career. Also, Sprott has multiple Sprott named companies offering various market related products across the sector. Over the last few years, he has taken strategic positions in a few junior gold companies such as Kirkland Lake Gold. Sprott's investment, like Osisko's, is a great gauge for potential value in Genesis.

For those who aren't familiar, the Societ?(C) de development de la Baie-James (SDBJ) is a government run organization focused on the development of natural resource projects within Qu?(C)bec. Their mission statement is as follows;

"To promote the economic development, development and exploitation of natural resources, other than hydroelectric resources within the mandate of Hydro-Qu?(C)bec, of the James Bay territory, from a sustainable development perspective. In particular, it may encourage, support and participate in projects aimed at these ends." ~SDBJ

Additionally, the SIDEX fund, which was created by the government of Qu?(C)bec to support mineral exploration activities within its borders, participated in the latest financing. Having both SDBJ and SIDEX as stakeholders in Genesis is a great sign of political support for Genesis' Chevrier Gold Project. The strategic shareholders list is rounded out by Delbrook Capital, Gold 2000, US Global Investors and Medalist Capital. These organizations and people represent smart money in the sector and I'm happy to speculate along with them.

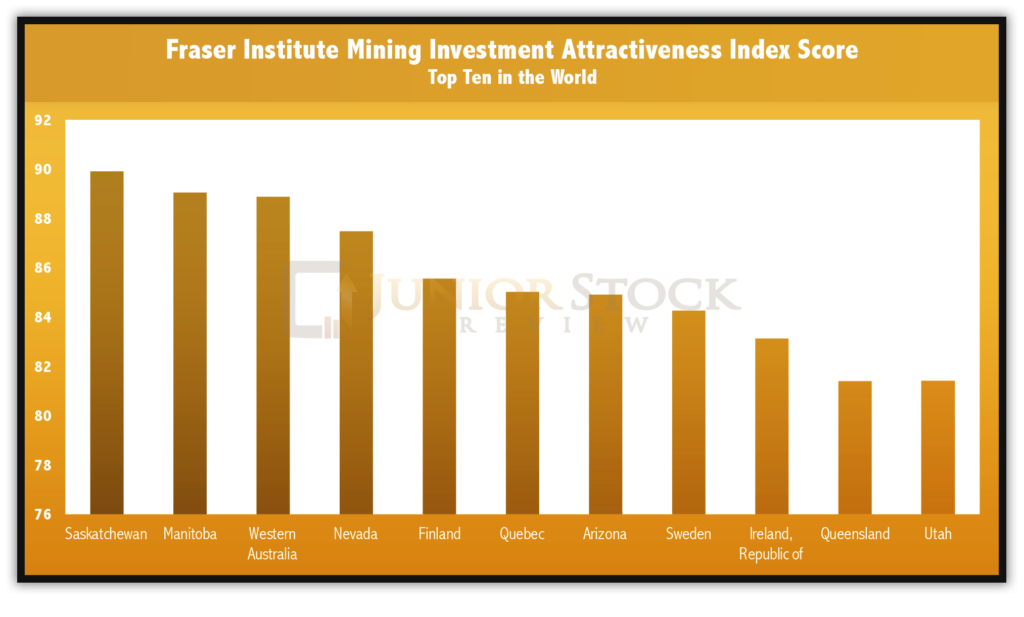

6th Best Jurisdiction for Mining Investment in the World

From a jurisdictional standpoint, it doesn't get much better than Quebec when it comes to mining investment attractiveness. The Fraser Institute (FI) gives Quebec an index score of 85.02, ranking it 3rd in Canada and 6th in the world. FI's mining investment attractiveness index score is reflective of both the mineral potential and the government policy perception of the region.

Source: Fraser Institute

Quebec's Mineral Potential

Quebec is home to 25 producing mines and over 350 surface mineral mining operations, putting the value of Quebec's mineral shipments at $8.7 billion in 2014 (Investissement Quebec). Quebec is Canada's 2nd largest producer of gold, largest producer of iron and zinc, and the only North American producer of niobium. The mineral wealth is evident and is a big reason why FI ranks Quebec among the world's top ten in mining investment attractiveness.

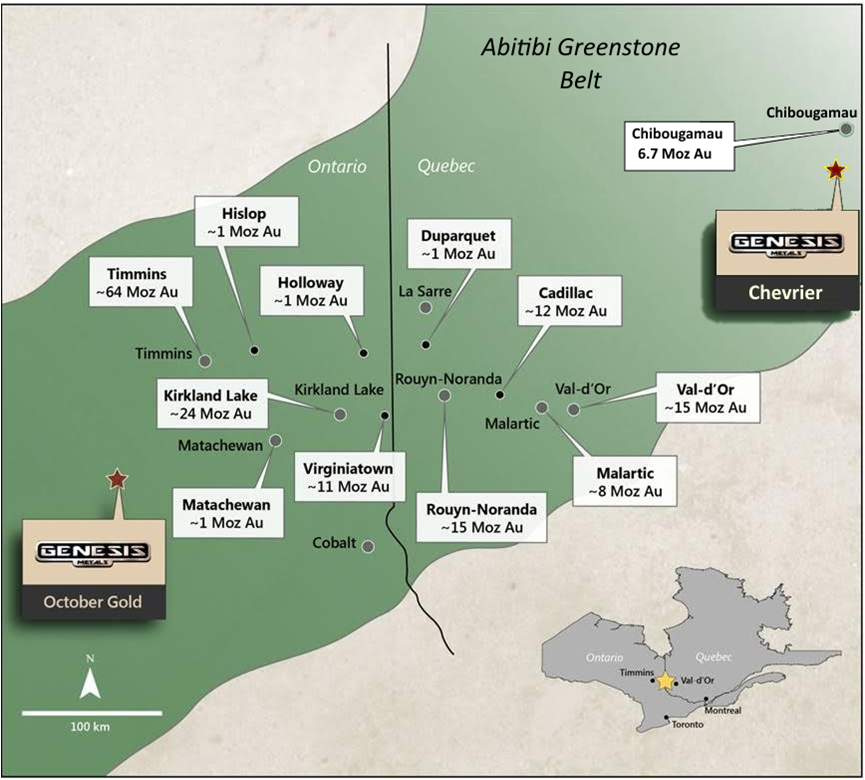

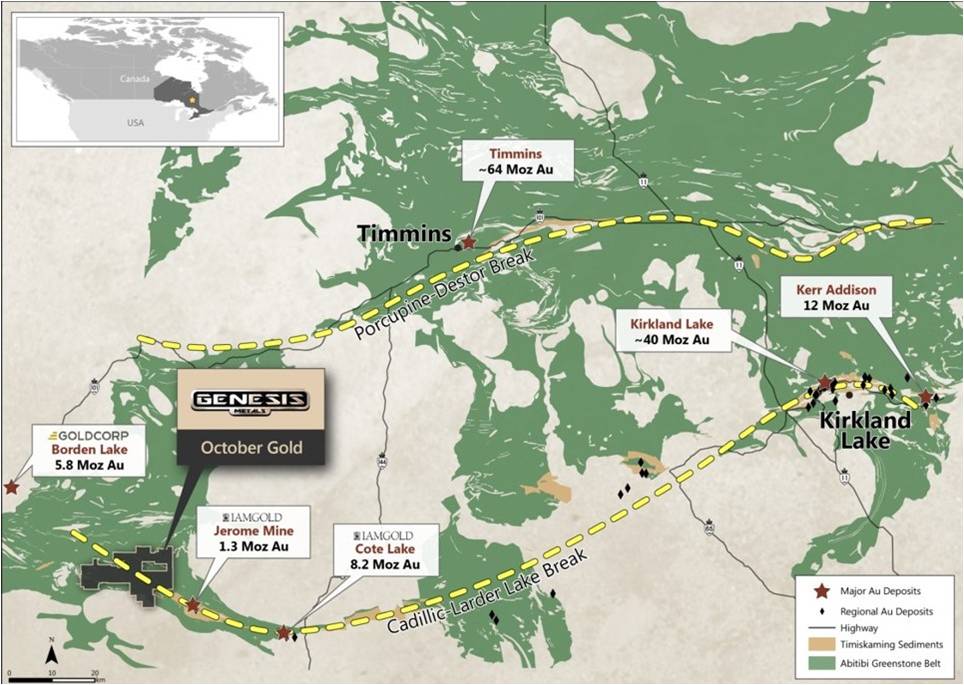

Highlighting Quebec's world class mineralization is the Abitibi Greenstone Belt (AGB), which is 150 km wide and stretches 650 km from roughly Wawa, Ontario to Val d'Or, Quebec. The belt has produced millions of ounces of gold over its history, with the Cadillac Gold Camp, Virginiatown, Rouyn-Noranda Gold Camp, and Val d'Or Gold Camp being just a few of its largest contributors.

Source: Genesis Metals

Quebec Politics and Infrastructure

The government of Quebec supports mineral exploration within its borders with a tax credit system that refunds 25% of eligible exploration expenses for non-operating corporations, and 10% of eligible exploration expenses for operating corporations (Financial Incentives). So, roughly, for every $1 spent by a Quebec based mineral explorer, 25 cents will come back to the company, which can effectively be rolled right back into further exploration work. This is not only a huge plus for the company and its shareholders, but an ingenious way for the province to promote mineral exploration.

The long history of mining in the AGB means that most regions of the belt are accessible or near infrastructure such as highways, rail, power, and deep water ports along the St. Lawrence Seaway. Also, Quebec boasts some of the most competitive electricity rates in Canada, as its hydroelectric dams constitute a major portion of its electricity production.

Finally, Quebec takes great pride in a transparent mining system, which is built around three key pillars:

"Open access to resources is ensured on the largest possible portion of territory, Mineral rights are granted on a first-come, first-served basis and if a discovery is made, the title holder can be reasonably sure of obtaining the right to develop the resource." ~ Investissement Quebec

Favourable politics and world class geology - for me, it doesn't get much better than Quebec, as far as your investment buck goes!

Gensis Metals Corp. - Chevrier Gold Project Phase 1 and 2 Drill Update

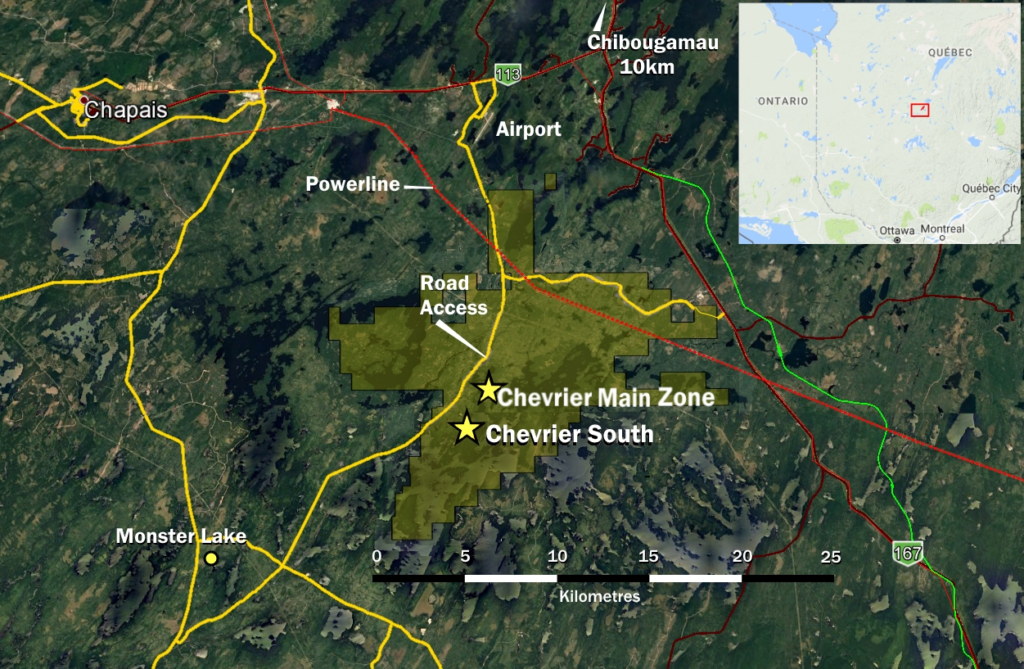

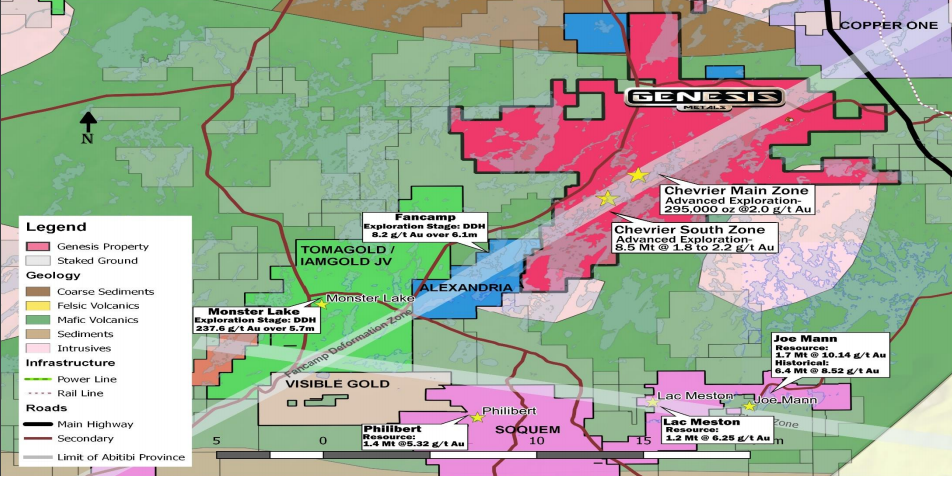

Genesis' 100% owned Chevrier Gold Project encompasses 120 square km and is located 35 km south of Chibougamau, Quebec, in the heart of the Abitibi Greenstone Belt. Chevrier straddles 15 km of the Fancamp deformation zone, and is 15 km northeast of IAMGOLD's high-grade Monster Lake gold discovery.

Chevrier has an existing NI 43-101 inferred resource for its Main Zone, which is 300,000 oz of gold at 1.99 g/t (1 g/t cut-off), and is open for further expansion at depth and to the north.

Phase 1 Drilling

Roughly 5,000 metres of drilling was completed in Phase 1 at Chevrier. The focus of the drilling was four fold; confirm historical Geonova drill holes by twinning, complete infill and step out drilling on the existing Main Zone Deposit, and finally, explore other IP and geological targets.

The results of the twinned and infill holes did not disappoint, as they confirm continuity of the shallow gold mineralization within Chevrier's Main Zone. A full list of drill results can be found on SEDAR, a few of the highlights from the results are:

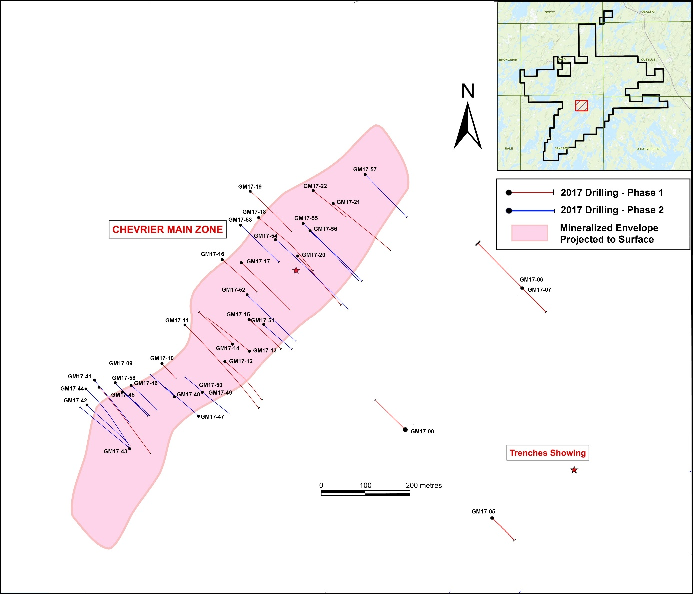

Twinned hole GM17-09 returned 2.94 g/t gold (Au) over a width of 58.70 m (starting at 74.60 m down hole), which included an interval of 14.01 g/t over a width of 6.35 m.Hole GM17-20 returned 2.00 g/t Au over 35.20 m within a zone that graded 0.93 g/t Au over 94.90m starting at 91.5 m down hole.Hole GM17-21 returned 1.13 g/t Au over 38.05 m.Hole GM17-22 returned 1.06 g/t Au over 24.45 m.Hole GM17-16 returned 1.06 g/t Au over 14.22 m including: 3.50 g/t Au over 3.22 m.Using the image below to reference the highlighted holes:

Chevrier Gold Project - 2017 Drilling

Trenching

The IP survey of the property identified a geophysical anomaly roughly 5 km northeast of the Chevrier Main Zone. During the Phase 1 drill program, Genesis completed exploration of this anomaly via trenching. In a news release on October 3rd, 2017, Genesis reported that they had identified a new area of gold mineralization in Trench 29, returning a channel sample of 2.55 g/t Au over 2.3 m. This area will be explored further in the future.

Phase 2 Drilling

On January 22, 2018 Genesis announced the results of its 5,000 metre Phase 2 drill program on the Chevrier Gold Project. The Main Zone was the focus of Phase 2, completing 18 holes of infill and step-out drilling. The results, in my opinion, look good. Check out highlights from the drill program:

8.73 g/t Au over 21.35 m including 37.97 g/t Au over 3.00 m in hole GM-17-423.59 g/t Au over 22.60 m in a separate zone in hole GM-17-424.26 g/t Au over 19.40 m including 8.99 g/t Au over 7.80 m in hole GM-17-484.47 g/t Au over 12.45 m within an interval of 1.08 g/t Au over 84.85 m in hole GM-17-465.06 g/t Au over 8.45 m and 1.23 g/t Au over 43.00 m in two intervals in hole GM-17-414.53 g/t Au over 13.80 m in hole GM-17-441.04 g/t Au over 50.05 m including 1.94 g/t Au over 17.10 m in hole GM-17-44Putting the results into perspective, remember that the Main Zone's existing inferred resource has an average grade of 1.99 g/t. The impact of these shallow, higher grade results should be realized in Genesis' resource update for the project coming later this year.

Additionally, and of particular importance, was the step-out results which came from holes GM-17-45 and GM-17-46. These holes were drilled with the intent of testing for an extension of the mineralization from hole GM-17-09, which was drilled in Phase 1 (refer to the image above for the location).

The results from these two holes reveal a new north-east trending shallow extension of the mineralization discovered in GM-17-09. Specifically, from the drill results table in the news release , GM-17-45 returned a shallow interval (35.4 m down hole) of 63 metres at 0.5 g/t gold, while GM-17-46 returned a shallow interval (19.35 m down hole) of 84.85 metres of 1.08 g/t gold.

PUSH: Announcement of follow up drill program on the Main Zone, focusing on the high grade holes which were discovered in 2017.

PUSH: Chevrier Gold Project resource estimate update in 2018.

Chevrier South Zone

While Chevrier's Main Zone, with its existing Inferred Resource, has garnered the bulk of drilling over the history of the Project, I believe there's the possibility of some great results from Chevrier's South Zone. Why? Although the South Zone doesn't have an existing 43-101 resource, Met-Chem's comments within the technical report state,

"the Chevrier South deposit contains a potential between 8.5 and 9.0 million tons of mineralized material grading 1.8 to 2.2 g/t Au." ~ Met-Chem - 43-101 Technical Report on the Mineral Resource of the Chevrier Gold Project - pg.93

If you express the 8.5 million tons of mineralized material at 1.8 g/ton, you get 459,000 ounces of gold. Met-Chem's reference to the possible resource size of the South Zone deposit is based off a small historical drill data set and its similarities in alteration and deformation like the Main Zone. The fact is, the South Zone needs further drilling before a 43-101 complaint resource can be officially estimated.

As Genesis intends to update the Chevrier Gold Project resource estimate in 2018, I believe there's a good chance that we could see them refocus their attention on the Project's South Zone. Given Met-Chem's comments, I believe there's good reason to believe drilling within the South Zone could have a tremendous impact on the updated resource estimate for the entire Project.

In my opinion, the updated resource on the Chevrier Gold Project, which will include both the Main and South Zones, will exceed 1 million ounces and should set Genesis up for a market re-rating, as its current sub $10 million MCAP doesn't reflect the potential of what it possess.

PUSH: Watch for the announcement of a drill program on Chevrier's South Zone. The results from a South Zone drill program could have a major impact on Chevrier's updated overall resource estimate.

October Gold Project

Genesis also owns 100% of the 203 square km October Gold Project, located in the southern Swayze greenstone belt in Benton Township, Ontario. This project is located 35 km northwest of IAMGOLD's Cote Lake deposit, and 50 km southeast of Goldcorp's Borden Gold Deposit. The Cote Lake Deposit was purchased by IAMGOLD from Trelawney Mining for $585 million, while the Borden Gold Deposit was purchased by Goldcorp from Probe Mines for $526 million. This demonstrates how coveted this Ridout Deformation Zone is, and Genesis' October Gold Project is right in the middle, and on trend.

IAMGOLD announced in a press release on June 5, 2017 that Sumitomo Metal Mining has acquired a 30% undivided participating joint venture interest in IAMGOLD's ownership interest in the Cote Gold Project for an aggregate $195 million. Sumitomo's interest in this area of Northern Ontario should bring more attention to the surrounding land claim owners, one of which is Genesis' October Gold Project.

The October Gold Project straddles what is considered the western extension of the Larder Lake-Cadillac Deformation and a portion of the Ridout Deformation zone. Historic gold deposits on these deformations, Kirkland Lake and Kerr Addison-Chesterville, have historic gold production north of 49 Moz.

The October Gold property saw surface exploration work in 2011. The program comprised of Soil Gas Hydrocarbon (SGH) sampling and reconnaissance level gravity geophysical surveys.

"A SGH survey is a deep penetrating geochemical method that involves the analysis of various hydrocarbons associated with ore bodies at depth using a forensic and comparative approach for Identification. " ~ Genesis

The program has identified two gold anomalies, which Actlabs, the interpreting laboratory, says have a high degree of confidence. This confidence is based on comparisons with other surveys that Actlabs has completed on other gold deposits. These anomalies will see future surface work which should better define where the diamond drilling should take place.

The October Gold project property is early stage, but holds very promising gold exploration potential.

Concluding Remarks

The Genesis Metals story is not without risk, as any gold exploration company runs the risk of not finding anything or not finding mineralization which is economic. In Genesis' case, I believe further modelling of the gold grade distribution within the Main Zone, should feed nicely into Chevrier's updated resource estimate later this year. While on the exploration side, drilling on Chevrier's South Zone appears to be very promising.

Outside of the risk of exploration, Genesis has some compelling facts that make their story undervalued in comparison to the paltry sub $10 million MCAP that they currently possess, including:

A proven management team: Groves, Sundar, Fleming, Florek, Liboiron and McleodStrategic Shareholders List Headlined by: Osisko Mining, Eric Sprott, Delbrook Capital, Gold 2000, US Global Investors, SIDEX/SDBJ and Medalist CapitalLocated in the 6th best jurisdiction in the world, QuebecPUSH: Announcement of a follow up drill program, focused on Chevrier's Main Zone high grade drill holes, which were discovered in 2017.PUSH: Announcement of a drill program focused on Chevrier's South Zone in 2018.PUSH: 2018 Chevrier Gold Project Resource Estimate Update - In my opinion this estimate could exceed 1 million ounces of gold.Great bang for their drilling buck, as their all-in drill costs thus far have roughly averaged $220 per metreLarge land package with exploration potential, Chevrier Gold Project and October Gold ProjectThe next leg of the gold bull market is upon us, fortunes will be made in the coming years by buying right and sitting tight, investing in companies that look to add value for their shareholders. Genesis Metals (GIS:TSXV) is a great example of this and is a company in which I'm investing.

Don't want to miss a new investment idea, interview or financial product review? Become a Junior Stock Review VIP now - it's FREE!

Until next time,

Brian Leni P.Eng

Founder - Junior Stock Review

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I do own Genesis Metals Corporation stock. All Genesis Metals Corporation analytics were taken from their website and press release. Genesis Metals Corporation is a Sponsor of Junior Stock Review.