Geopolitical Fears Rock Stocks, Bond Yields

Stocks were lower from start to finish

Stocks were lower from start to finish

Stocks spent the entire day in the red, and losses accelerated into the close, as fear about the state of the global economy weighed. Traders monitored the protests in Hong Kong and falling Treasury yields, sending the Dow to a nearly 400-point loss at the close. Bank and tech stocks were some of the biggest losers on the day, with U.S.-China trade tensions also adding to the risk-off approach.

Continue reading for more on today's market, including:

Why headwinds could be coming for this pair of retailers. 2 names to watch after an election shocker in Argentina. Call buyers stay after First Solar stock. Plus, 3 stocks hit by bear notes; why JD.com could pop; and puts pick up on one chemical stock.

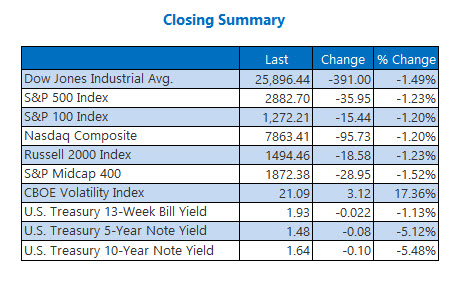

The Dow Jones Industrial Average (DJI - 25,896.44) fell 391 points, or 1.5%, with 29 of 30 Dow stocks closing in the red. The only blue chip to manage gains was Johnson & Johnson (JNJ), up 0.1% at the close. Goldman Sachs (GS) paced the losers, giving up 2.8%.

The S&P 500 Index (SPX - 2,882.70) fell 36 points, or 1.2%, and the Nasdaq Composite (IXIC - 7,863.41) gave back 95.7 points, or 1.2%.

The Cboe Volatility Index (VIX - 21.09) added 3.1 points, or 17.4%.

5 Items on our Radar Today

The U.S. budget deficit rose 27% from a year ago in July, a year and a half after the Trump administration passed its signature tax cut law. The Treasury Department is projecting a deficit of over a $1 trillion by year's end. (CNBC)Morgan Stanley analysts are now expecting the Fed to cut rates in September and October. The firm cited trade, the global economy, and falling inflation expectations in the note. Goldman Sachs made a similar prediction earlier this month. (Reuters)3 stocks that sank on bear notes. Why China's JD.com could be due to pop. Put traders are betting on more losses for this chemical stock.

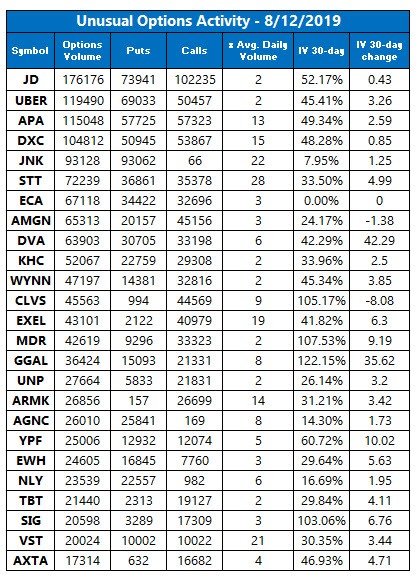

Data courtesy of Trade-Alert

Oil Grabs a Win

Oil prices managed to rise today, despite the fears around the global economy. September crude was up 43 cents, or 0.8%, to close at $54.93 per barrel.

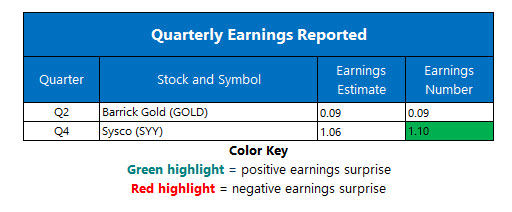

Gold prices got another bump today due to the market weakness. December-dated gold added $8.70, or 0.6% to finish at $1,517.20 an ounce.