Get In Harmony With Gold

Gold miners are outperforming the S&P 500 this year.

Lots of upside for gold miners from here.

WMA fundamental ranking of the gold miners.

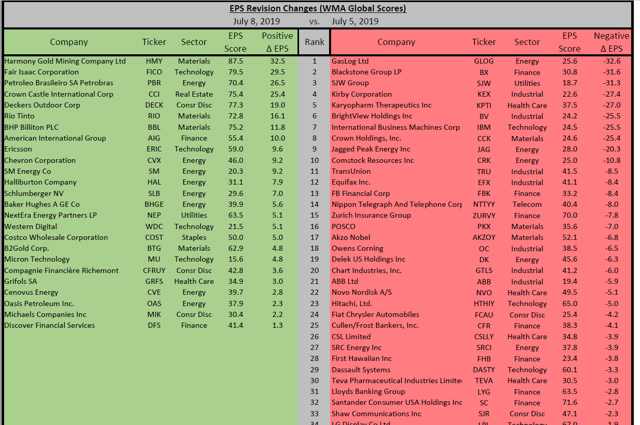

Gold miners have been popping up on our radar screen thanks to positive EPS revisions of late. For example, in our EPS Revisions Changes Monitor for Monday, July 8, we had a few more miners see their consensus profit outlooks revised higher for the current year and for next year.

Harmony Gold Mining Company (HMY), which had enjoyed the highest consensus EPS revision among miners in recent days, has also risen to the top of our rankings among miners. Harmony is a South African miner. For dollar-based investors looking at the share in the U.S. (ticker HMY), the rand/dollar exchange rate will also be a consideration for this investment.

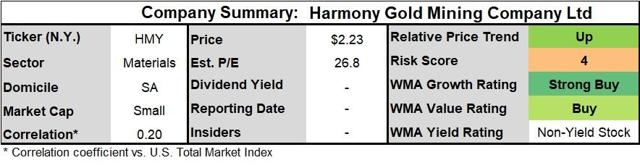

Here is the WMA company summary for Harmony Gold Mining Company.

We have a Strong Buy on Harmony from the point of view of growth investors and a Buy on the stock for value investors. We walk through the components which generated these recommendations below. While Harmony does not pay a yield, we do note that company insiders are buying and the chart of Harmony's stock price is compelling today, as shown in the last section below.

Gold In A Crazy Equity Rally

Let's be clear. Gold is not rising this year because of inflation expectations. The Fed has tried for years to stimulate inflation with ultra-accommodative monetary policy. And the only inflation that has occurred can be found in the S&P 500. Gold is rising because the market is worried about both the resolution to the trade war and monetary policy excesses. In addition, with U.S. rates set to come down and negative interest rates already prevailing in Europe, the opportunity cost of holding a non-yielding asset like gold is not as great.

We are not reading too much into the parallel rallies in gold and the S&P 500. The 15-year historical correlation coefficient between the two assets is 0.04. We also saw gold collapse from 2011 to 2016 as the S&P 500 only levitated. We can logically expect gold to continue rallying the day the music fades for S&P 500 stocks. Recall that gold still has to rally another +38% before reaching record highs from 2011.

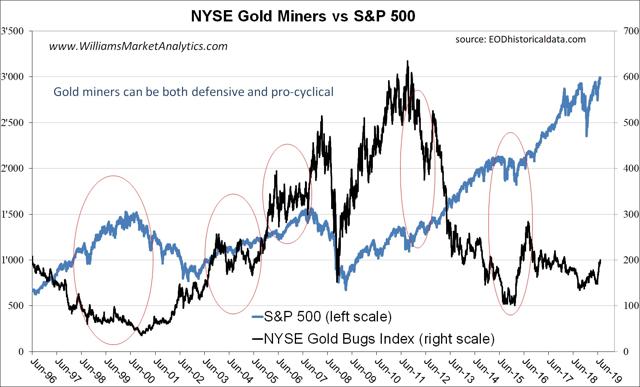

Gold Miners In A Non-Defensive Role

Historically, gold mining stocks have done well in periods of equity market turbulence and, obviously, when the price of gold is trending up. The comparison chart below shows the NYSE Gold Miner Index (in black) versus the S&P 500 (in blue). With the exception of the 2008 Financial Crisis when everything fell, we see that gold miners tend to do well when the S&P 500 hits a rough patch (red circles on chart).

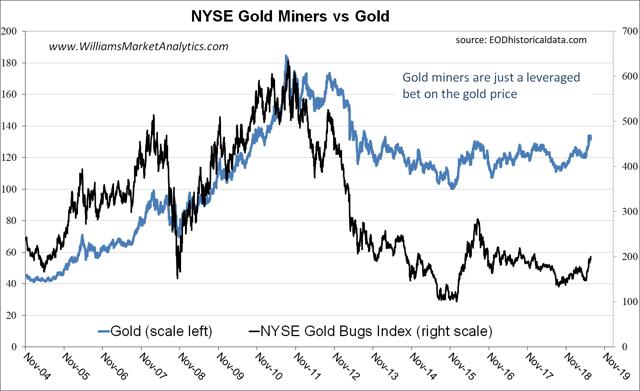

But regardless of what the S&P 500 does, gold miners track the price of physical gold.

Besides getting exposure to gold, the gold mining companies do pay meager dividends, which allows investors to play gold without holding a non-yielding asset. Gold miner dividends range from 0% to 1.54% for Wheaton Precious Metals (WPM), with the average dividend for the GDX at 0.45%.

Let's now explain our Strong Buy rating on Harmony for growth investors. Harmony is expected to provide above average EPS and revenue growth for its shareholders in the coming year. Compared to the largest gold miners, the company is blowing away its competition. The 82.37 growth score puts Harmony in the top 97.1 percentile within the Materials sector.

Ticker (U.S.) | Gold Miner | Growth |

Sibanye Gold Ltd. | 90.89 | |

HMY | Harmony Gold Mining Company Ltd. | 82.37 |

IAMGOLD Corp. | 78.99 | |

Gold Resource Corp. | 75.33 | |

Asanko Gold Inc. | 73.39 | |

Wesdome Gold Mines | 64.35 | |

Newmont Mining Corp. | 63.43 | |

Agnico Eagle Mines Ltd. | 62.65 | |

Coeur Mining Inc. | 60.97 | |

Franco Nevada Corp. | 60.42 | |

New Gold Inc. | 60.11 | |

Newcrest Mining Limited | 59.67 | |

Centerra Gold Inc. | 58.83 | |

Gold Fields Limited | 58.48 | |

Kirkland Lake Gold Ltd. | 56.82 | |

B2Gold Corp. | 56.58 | |

AngloGold Ashanti Limited | 56.38 | |

WPM | Wheaton Precious Metals Corp. | 55.41 |

OceanaGold Corporation | 53.27 | |

Barrick Gold Corp. | 53.26 | |

Detour Gold Corporation | 52.36 | |

Kinross Gold Corporation | 51.67 | |

Alamos Gold Inc. | 49.60 | |

Alio Gold Inc. | 27.35 | |

Yamana Gold Inc. | 24.05 | |

Vista Gold Corp. | 17.34 | |

NovaGold Resources Inc. | 0.00 | |

Goldcorp Inc. | NA | |

Pershing Gold Corp. | NA | |

US Gold Corp. | NA |

Looking back over the past month at consensus EPS revisions, Harmony has also seen an acceleration of forecasted EPS for the coming year. Note that revisions are positive for most of the gold miners. A score of above 50 implies EPS forecasts have been revised higher for a combined measure of current and next year EPS.

Ticker (U.S.) | Gold Miner | 1m Total EPS Revisions |

GOLD | Barrick Gold Corp. | 100.00 |

AU | AngloGold Ashanti Limited | 91.67 |

NEM | Newmont Mining Corp. | 85.00 |

SBGL | Sibanye Gold Ltd. | 78.57 |

NCMGY | Newcrest Mining Limited | 77.56 |

IAG | IAMGOLD Corp. | 75.00 |

DRGDF | Detour Gold Corporation | 75.00 |

KGC | Kinross Gold Corporation | 75.00 |

CAGDF | Centerra Gold Inc. | 73.80 |

AUY | Yamana Gold Inc. | 63.46 |

KL | Kirkland Lake Gold Ltd. | 63.24 |

OCANF | OceanaGold Corporation | 60.87 |

FNV | Franco Nevada Corp. | 60.71 |

AGI | Alamos Gold Inc. | 59.62 |

HMY | Harmony Gold Mining Company Ltd. | 58.33 |

BTG | B2Gold Corp. | 57.63 |

GFI | Gold Fields Limited | 54.17 |

NGD | New Gold Inc. | 51.54 |

USAU | US Gold Corp. | 50.00 |

GORO | Gold Resource Corp. | 50.00 |

AKG | Asanko Gold Inc. | 50.00 |

AEM | Agnico Eagle Mines Ltd. | 50.00 |

ALO | Alio Gold Inc. | 50.00 |

VGZ | Vista Gold Corp. | 50.00 |

WDOFF | Wesdome Gold Mines | 45.00 |

WPM | Wheaton Precious Metals Corp. | 42.65 |

CDE | Coeur Mining Inc. | 40.27 |

NG | NovaGold Resources Inc. | 25.00 |

GG | Goldcorp Inc. | NA |

PGLC | Pershing Gold Corp. | NA |

Finally, we like growth at a reasonable price. Our growth Strong Buy rating on Harmony Gold Mining is also due in part to our PEG scores. We calculate in-house our PEG scores using both consensus forward P/Es and our estimated growth rate for company earnings and revenue. With a 98.97 PEG score, Harmony ranks number 10 of the 295 Materials companies we track.

Ticker (U.S.) | Gold Miner | PEG |

SBGL | Sibanye Gold Ltd. | 100.00 |

NGD | New Gold Inc. | 99.35 |

HMY | Harmony Gold Mining Company Ltd. | 98.97 |

AKG | Asanko Gold Inc. | 95.91 |

CDE | Coeur Mining Inc. | 93.66 |

GORO | Gold Resource Corp. | 91.87 |

CAGDF | Centerra Gold Inc. | 89.92 |

AU | AngloGold Ashanti Limited | 84.92 |

BTG | B2Gold Corp. | 70.03 |

IAG | IAMGOLD Corp | 62.99 |

NCMGY | Newcrest Mining Limited | 62.89 |

AGI | Alamos Gold Inc. | 56.30 |

NEM | Newmont Mining Corp. | 54.63 |

DRGDF | Detour Gold Corporation | 51.87 |

ALO | Alio Gold Inc. | 49.69 |

WDOFF | Wesdome Gold Mines | 48.61 |

AEM | Agnico Eagle Mines Ltd. | 48.16 |

KGC | Kinross Gold Corporation | 47.80 |

GFI | Gold Fields Limited | 47.65 |

KL | Kirkland Lake Gold Ltd. | 44.97 |

OCANF | OceanaGold Corporation | 42.45 |

WPM | Wheaton Precious Metals Corp. | 30.79 |

GOLD | Barrick Gold Corp. | 30.77 |

FNV | Franco Nevada Corp. | 21.85 |

AUY | Yamana Gold Inc. | 0.00 |

GG | Goldcorp Inc. | NA |

PGLC | Pershing Gold Corp. | NA |

USAU | US Gold Corp. | NA |

VGZ | Vista Gold Corp. | NA |

NG | NovaGold Resources Inc. | NA |

In terms of our Buy rating on Harmony for valuation, we see that this miner has exceptionally attractive Enterprise Value / EBITDA and Enterprise Value / Sales relative to peers. Our valuation score for Harmony at 88.25 places the miner in 18th place among the 295 Materials sector peers.

Ticker (U.S.) | Gold Miner | Valuation |

HMY | Harmony Gold Mining Company Ltd. | 88.25 |

AKG | Asanko Gold Inc. | 86.82 |

ALO | Alio Gold Inc. | 82.94 |

SBGL | Sibanye Gold Ltd. | 80.79 |

IAG | IAMGOLD Corp. | 75.09 |

CAGDF | Centerra Gold Inc. | 66.79 |

NGD | New Gold Inc. | 63.00 |

GFI | Gold Fields Limited | 62.04 |

BTG | B2Gold Corp. | 61.13 |

KGC | Kinross Gold Corporation | 60.31 |

AU | AngloGold Ashanti Limited | 57.98 |

GORO | Gold Resource Corp. | 56.27 |

OCANF | OceanaGold Corporation | 54.61 |

AUY | Yamana Gold Inc. | 54.37 |

KL | Kirkland Lake Gold Ltd. | 51.63 |

DRGDF | Detour Gold Corporation | 48.76 |

CDE | Coeur Mining Inc. | 46.46 |

NEM | Newmont Mining Corp. | 45.17 |

AGI | Alamos Gold Inc. | 43.96 |

GOLD | Barrick Gold Corp. | 41.84 |

NCMGY | Newcrest Mining Limited | 38.03 |

WDOFF | Wesdome Gold Mines | 34.37 |

AEM | Agnico Eagle Mines Ltd. | 30.44 |

WPM | Wheaton Precious Metals Corp. | 3.47 |

FNV | Franco Nevada Corp. | 0.00 |

GG | Goldcorp Inc. | NA |

PGLC | Pershing Gold Corp. | NA |

USAU | US Gold Corp. | NA |

VGZ | Vista Gold Corp. | NA |

NG | NovaGold Resources Inc. | NA |

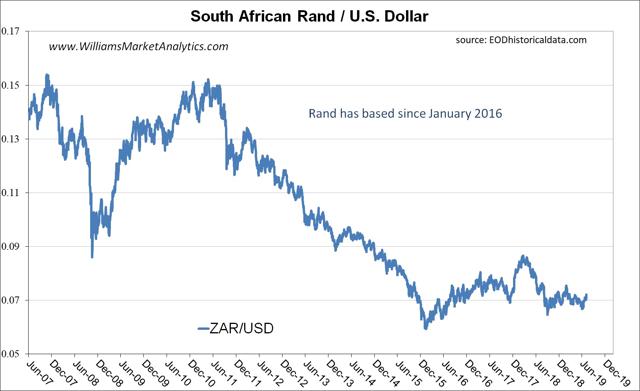

ZAR / USD

Another important consideration is the cross South African rand (ZAR) vs. U.S. dollar. If the Fed is going back to more accommodative monetary policy, this should soften the dollar. At the same time, commodity currencies like the rand will benefit from high metals prices. Technically, the long-term chart of the rand looks constructive. The big fall in ZAR/USD stopped in January 2016. The currency cross has built a multi-year base and has plenty of upside potential to recovery some of the 2010-2015 losses. Buying HMY gives investors exposure to rand versus the dollar.

Technicals

Like our fundamental Buy recommendation on Harmony Gold for both growth and value investors, Harmony's chart can also be interpreted as attractive by both value and momentum investors. Price is clearly in an up-cycle, up +50% from the May lows around $1.60. At the same time, the stock remains cheap, as shown above, and the chart still shows a beaten-down stock price when you pull back to 10 years of price history. We'll see how Harmony looks when the price gets above $4.50 to contemplate retracing some of the 2011-2015 losses above the 2016 bounce peak, just south of $5.00/share. From the current price, $4.50 represents a +87% appreciation of the share price. Near term, price has run up quickly in a short period, so some pullback should not be a surprise.

Conclusion

Harmony Gold Mining looks to be one of the most solid companies in the Materials sector on a comparative fundamental analysis. A continuation on the rally in the stock is predicated on gold remaining above $1350-1380. Harmony should be a profitable leveraged bet on the gold price. After the run-up since May, we are only mildly bullish as buyers today, but will look to establish a small position this week, leaving cash aside to add to Harmony on an inevitable pullback in the coming weeks.

Disclosure: I am/we are long HMY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow WMA, LLC and get email alerts