GLD - Gold And Comey Testimony Scenario Analysis

Allegations made against Trump Administration representatives and the firing of Jim Comey have raised risk to the U.S. dollar and securities.

Thus, the SPDR Gold Trust should continue to enjoy strong support this week at least into the key testimony of Comey.

What happens immediately after the testimony depends greatly on the testimony itself, and a sell-the-news event is very possible for the GLD later this week.

Still, I expect burgeoning wage inflation and our more engaging foreign policy stature to continue to support gold over the medium term this year.

This short-term scenario analysis assumes no other factor comes into play this week, like for example a surprise economic stimulus announcement or a geopolitical event.

The testimony of Jim Comey should provide an upward bias for the SPDR Gold Trust (NYSE: GLD) at least into Thursday's event, because it could escalate concern about the Trump Administration and weigh against the U.S. dollar. As a result of these concerns and other factors discussed herein, the SPDR Gold Trust, your liquid trading proxy for the price of gold, has done well recently as the U.S. dollar has softened. What happens after the testimony depends greatly on the testimony itself, and a sell-the-news event is possible in the short-term thereafter for the GLD. Over the medium term this year, I expect burgeoning inflation and our more engaging foreign policy stature to support the GLD. This scenario analysis assumes no other factor comes into play this week, like for example a surprise economic stimulus announcement or a geopolitical event.

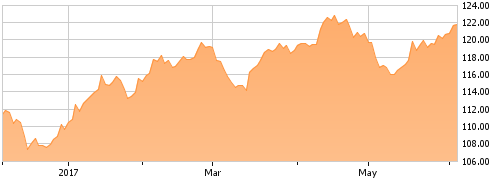

The GLD security is indicating a 0.7% higher open again this Tuesday morning, after gaining by 0.1% on Monday and displaying an upward trend this year.

The SPDR Gold Trust has been gaining ground, I believe, since the Trump Administration initiated a more engaging foreign policy strategy; namely since striking Syria with missiles and engaging North Korea with aircraft carriers. As a result, the GLD security has gained against the dollar's decline due to investor perception of a greater war risk profile.

Furthermore, more recently, scandalous allegations around the Oval Office, namely those tied to the investigation of General Michael Flynn; the Russian meddling in our elections; and the President's firing of FBI Director Jim Comey have driven further gains in precious metals against the U.S. dollar's decline.

One accredited expert and Harvard Law Professor says if the allegations relative to the firing of Comey are true, then the president may have obstructed the justice process. The professor claims this is an impeachable offense, and some in Congress agree. Investors in risky assets would prefer our president be focused on leading the nation, and so risky assets might be traded in for safe haven investment alternatives like precious metals and relative securities like the GLD.

The full faith and confidence in the borrowing power and stability of the United States is what keeps our borrowing costs so low. It also serves to support U.S. dollar strength relative to other global currencies. In rare instances when the full faith and confidence in our great nation come into question, usually for very brief periods of time, gold tends to benefit.

Gold and its proxy, the SPDR Gold Trust, have really taken off as more shoes have dropped in regard to these Oval Office concerns. Make no mistake about it, gold has gained as the U.S. dollar has declined. I believe that is at least partly due to the questions being posed about the executive branch of government. We cannot say it is completely due to it, because many factors weigh for the dollar and also for the currencies (read euro & British pound) the dollar's relative value is weighed against.

Jim Comey's testimony before Senate panel this Thursday threatens to escalate investor concerns, and so it provides an upside bias to the GLD into Thursday's event. What happens thereafter depends on the testimony itself, and I believe it could be less explosive than most expect. Over the next two days of trading heading into it, though, expect the GLD to have strong support. On Thursday, gold and the GLD could very possibly be sold-on-the-news.

Over the medium-term, I fully expect strength in the United States to prevail and for the full faith and confidence in the United States to stand. Still, I look for gold to benefit also this year from burgeoning inflation and our more engaging foreign policy stature.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.