GLD Is Crushing Gold Stocks

Over the last 6 months, GLD is showing a gain of 3.15% while the HUI is down by 11.7%.

There is a strengthening of fundamentals in the gold miners, not a deterioration.

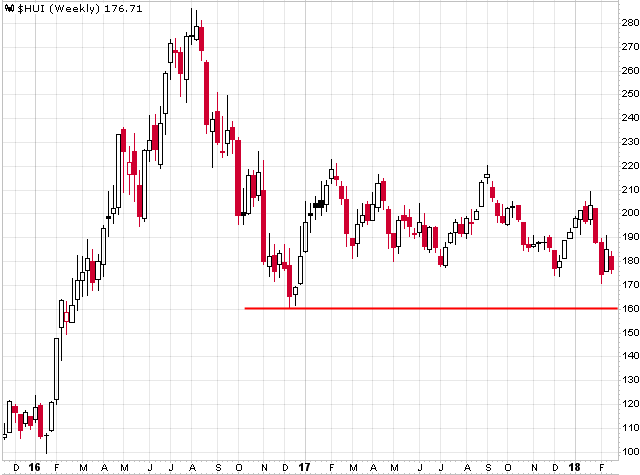

It certainly appears as though the HUI wants to hit a double bottom at 160.

The risk/reward heavily favors the miners.

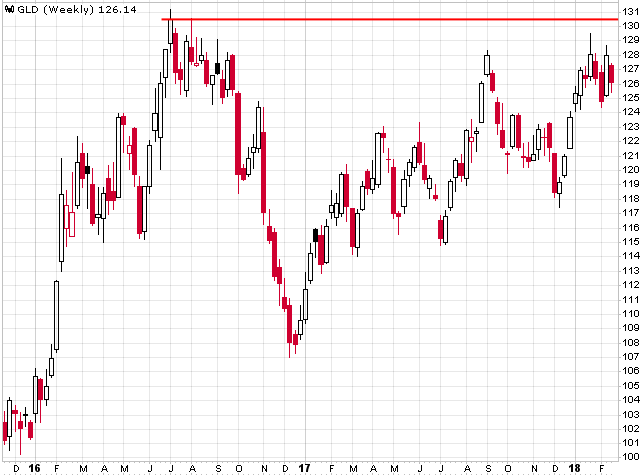

The story in the gold sector continues to be the severe underperformance in the miners compared to the SPDR Gold Trust ETF (GLD). And incredibly, this gap keeps widening. Over the last 6 months, GLD is showing a gain of 3.15% while the HUI is down by 11.7%. Mining stocks always have leverage to GLD, and worst case they should be at least 2x the performance. To have the HUI be this far in negative territory shows how extreme the divergence is right now.

GLD data by YCharts

GLD data by YChartsGLD remains only 4% away from breaking out to new multi-year highs.

We aren't seeing that same strength being exhibited in the gold miners, as they continue to struggle to gain any sort of upward momentum and remain far below their 2016 peak. Now we have the HUI quickly approaching December 2016 lows.

We aren't seeing that same strength being exhibited in the gold miners, as they continue to struggle to gain any sort of upward momentum and remain far below their 2016 peak. Now we have the HUI quickly approaching December 2016 lows.

During times like this in the gold mining stocks, it's hard for most investors to focus on anything fundamental related as sentiment for precious metal shares has soured quickly over the last few weeks and months. This is currently the short-term driving force.

It's difficult to keep attention on the solid foundation that is ultimately going to result in a major shift in attitude of outside investors towards the mining stocks. Or maybe I should also say shift in attitude for the gold bulls - given how much they have been shaken recently by the decline in the miners. But it's important to still discuss these long-term prospects, as at the end of the day, fundamentals rule and they will eventually correct any mispricing in the market.

I continue to see prospects for significant returns in the sector (in particular the mining stocks). Additional returns I might add given the exceptional profits racked up in 2016, and 2017 to a lesser degree.

We have seen two years of back to back gains in the HUI, we are down so far this year but it's only February. The year isn't over yet and there is still a long way to go.

The last time the HUI lagged gold to this degree was in 2010-2011, as the miners were seeing huge cost overruns for projects, swiftly rising AISC, flat to shrinking margins (even though gold was moving higher) and disintegrating balance sheets. Those trends continued for many more years - up to about 2014. It was just an overall poor investing environment as these companies were destroying shareholder value. There were valid reasons for the underperformance of gold mining stocks at that time.

Today we aren't seeing anything like that environment. These companies have strengthening fundamentals - and not just because of the rising price of gold either.

The miners have regrouped over the last few years and started focusing on the basics again: generating profits, increasing cash flow, paying dividends, shoring up balance sheets and not growing production at "whatever costs."

Most projects are coming in either on budget or under budget. AISC are far lower than they were several years ago and appear stable. Cost structures were already much improved by the end of 2015, now they are even better.

Even if gold should give back all of the gains that it has accumulated over the last few years, these mining companies should still bottom out at higher prices given they are in better financial shape and operationally stronger. In other words, I don't believe we are going to see the HUI at 100 again.

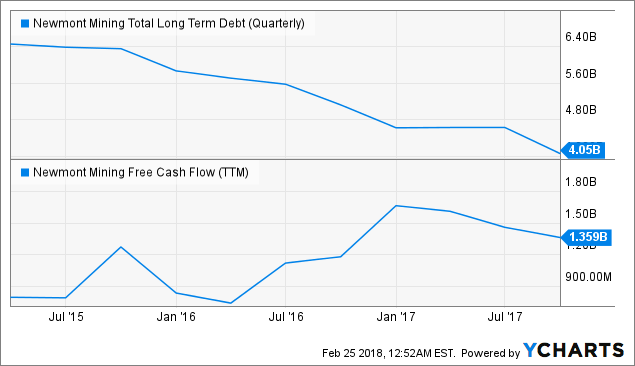

Just look at the two largest gold miners in the world:

Newmont's (NEM) long-term debt has significantly declined since 2015 while free cash flow has surged.

NEM Total Long Term Debt (Quarterly) data by YCharts

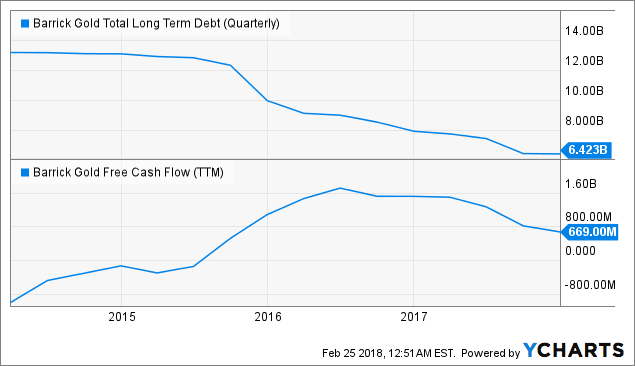

NEM Total Long Term Debt (Quarterly) data by YChartsIt's the same for ABX, but its balance sheet repair has been even more impressive as debt has been cut in half.

ABX Total Long Term Debt (Quarterly) data by YCharts

ABX Total Long Term Debt (Quarterly) data by YChartsThe gold and silver miners haven't forgotten what took place back in 2010-2014. In fact, one could argue that their current low stock prices continue to reflect that environment, which is also helping to keep these companies in check.

The problem several years ago was this sector was focusing too heavily on growth at whatever cost, now we have seen a significant reduction in spending and companies are running a very tight ship. They are generating healthy operating and free cash flow.

Companies sell their gold at "the gold price," not at the "sentiment" price of their stock. With the way these stocks are acting, you would think that investors haven't figured that out yet.

A $20, $30, even $40 decline in the precious metal does not drastically alter the big picture for these gold stocks. Miners don't deserve a 10% haircut if there is a 2% drop in the metal.

These companies are selling gold at some of the highest prices in years, and they are seeing a widening of margins, greater cash flow and stronger balance sheets.

There is a strengthening of fundamentals, not a deterioration. If these stocks continue to decline while gold keeps moving higher, then more astute investors should be looking at this as a gift, rather than a exercise in futility.

When things don't make sense in the market (whatever market), it's usually the best time to buy or sell. There is always a reversion back to the mean. For gold stocks, that mean reversion is much higher than current levels.

If we had rocketing AISC across the industry, major capex blowouts and out of control spending in general, then one could make the argument that gold miners don't deserve higher multiples. But that's just not the environment we are in right now. Just the opposite in fact.

Shorts can continue to try and drive fear into the gold stocks, but they will ultimately fail to stop the bull market. I will give them credit though, as even with the HUI up about 75% since the bear market lows, the slightest dip brings about a huge wave of concern and uncertainty in the bull camp. I can understand why, as the decline from 2011-2015 was an extreme event and even small pullbacks bring back some haunting memories. But it's only a matter of time before those memories completely fade and bulls become more confident in this run.

Double Bottom In The HUI And Then The Next Phase Begins?

Just like major topping patterns that signal the end to bull markets and bubbles, you have bottoming patterns that are similar to each other and signal the end of bear markets. It might seem like a tough environment for gold stocks, but I look at the chart of the HUI and I see similarities with other sectors and indices and how their bull markets played out in the earlier stages.

Back in November, I wrote this comment and posted this chart of the HUI for my subscribers:

If the HUI follows a similar path as STX in 2011, then the index could still have one more decline before it surges back to the August 2016 high (and eventually surpasses that mark). In no way would this be abnormal. Also, this is just a crude forecast, it's not meant to be an exact depiction of how this scenario will play out as time and price objectives can vary. What investors just need to understand is that this isn't really about the technicals, rather it's about absolute valuations, basic human psychology, and patterns. It's a combination of many aspects, not just one. The basic principle of this scenario is that the lows are never revisited but the sentiment still feels negative enough to make it seem like it's not a bull market.

Scenario 1:

Again: "The basic principle of this scenario is that the lows are never revisited but the sentiment still feels negative enough to make it seem like it's not a bull market." Sounds like the environment we are in today.

This is the chart of STX I was referring to. Like the HUI now, I'm sure many didn't feel that STX was in a bull market when it retested the $7-$8 lows. It took 19 months of consolidation before that double bottom was hit. Of course then it tripled over the next several months and kept on running. It certainly appears as though the HUI wants to hit a double bottom at 160. Guess what will likely happen after that event?

I can't emphasize this enough, this isn't really about technical analysis, this is about changes in behaviors and perceptions at major peaks and troughs.

The Risk/Reward Heavily Favors The Miners Over GLD

To recap, gold companies are seeing a stable AISC, drastic improvements in balance sheets, growing cash flow and expanding margins. Yet the HUI is nearing double bottom territory and almost 40% below its 2016 peak, while GLD is less than 5% away from hitting new multi-year highs.

At this point, the risk/reward is far more attractive in the gold stocks compared to GLD. GLD just isn't appealing right now.

I don't think it's "load up the truck time" in the miners, as I have been cautious on the HUI since it failed to maintain key support at around 205. But we are possibly nearing a major buying opportunity if 160 is hit in the next few weeks.

The Gold Edge - Rated 4.9 Out Of 5.0 Stars According To 31 Reviews

In-depth coverage of the gold sector, a constant stream of articles and commentary, and many happy subscribers.

You can subscribe here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.