Global gold demand fell 1% in 2019 despite record investment inflows

High gold prices and a softer economic environment were the main culprits of the recent decline in consumer demand. (File image)

High gold prices and a softer economic environment were the main culprits of the recent decline in consumer demand. (File image)

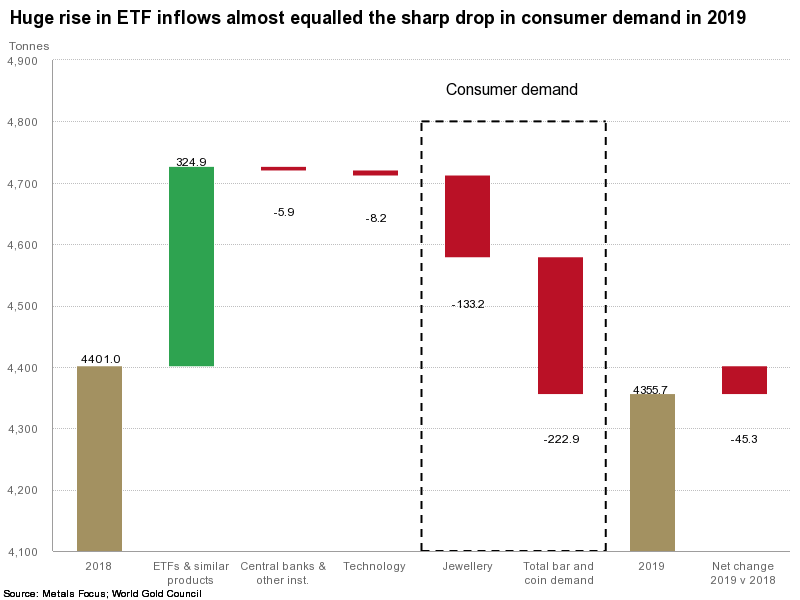

Gold demand fell 1% in 2019 to 4,355.7 tonnes as a huge rise in investment flows into ETFs and similar products was matched by a price-driven slump in consumer demand, the World Gold Council (WGC) says.

According to the WGC's latest report, 2019 was a broad year of two distinct halves: resilience/growth across most sectors in the first half contrasted with widespread year-on-year declines in the second.

Global demand in H2 2019 was down 10% over the same period in 2018 owing to declines in jewellery demand and retail bar and coin investment. The decline in the fourth quarter was the most significant, with demand falling sharply by 19% y-o-y to 1,045.2 tonnes.

China and India held sway over global consumer demand, accounting for 80% of the decline in Q4. The WGC attributes this decline to higher gold prices and a softer economic environment.

Central bank demand also slowed in the second half - down 38% in contrast with the 65% increase in H1 2019. But, the WGC pointed out that the slowdown in central bank purchases was partly due to the sheer scale of buying in the preceding few quarters. For the tenth consecutive year, central banks were still net buyers of gold with total purchases of 650.3 tonnes - the second highest level for 50 years.

Inflows into global gold-backed ETFs and similar products bucked the general trend. Investments held up strongly throughout the first nine months of the year, reaching a crescendo of 256.3 tonnes in Q3. Momentum then subsided in Q4, with inflows decreasing to 26.8 tonnes - a 76% decline y-o-y. Nevertheless, investment holdings pushed to a record total of 2885.5 tonnes at year-end.

On the other side of the equation, the total supply of gold increased 2% to 4,776.1 tonnes last year. This growth came purely from an 11% jump in recycling. Annual mine production slipped marginally, by 1% to 3,436.7 tonnes.