Global Trade Wars And Western Populism And The Case For Gold

Global risk escalates once again as geopolitical concerns reemerge.

The threat of a global trade war could derail the positive global growth outlook for 2018.

The outcome of the Italian elections will create renewed policy tension between Rome and Brussels.

Gold and gold equities continue to play a vital part of any portfolio, serving as a form of portfolio insurance.

Downside risks to gold from rising US interest rates and a rebound in the US Dollar can be offset by shorting or moving to an underweight position in Emerging Market assets or currencies.

Two key events that have taken place over the past week could fundamentally reshape the appetite for global risk going forward, the first being the renewed risk of a global trade war, and the second, the outcome of the recently held Italian elections. We will mainly address the first risk in this article, focusing on possible consequences and finally portfolio strategies that may help mitigate some of the risk factors associated with a global trade war. In a follow-up article, we may focus more specifically on the outcome of the Italian elections and what, if anything, this means for global risk going forward.

Global risk appetite and sentiment has broadly and markedly over the past year buoyed by robust global growth and the implementation of a large corporate tax cut in the United States. Despite the fact that some of the same populist political fault-lines that financial markets grappled with in 2016 remain a key risk today, most market participants have chosen to now ignore these risks, and instead see the glass as half-full instead of half-empty.

However, the proposed imposition of trade tariffs by the Trump administration and apparent willingness to instigate a global trade war, as well as the outcome of the recent Italian elections, is a stark reminder of the lingering political risks that will remain a key and ever present threat to the current global upturn. In light of this, we will detail some of our thinking on how investors should perhaps think about repositioning their portfolios in order to provide for some risk mitigation if these populist dynamics start to gain further traction in the coming months.

The (proposed) imposition of a tariff by the U.S. on steel and aluminium imports by itself is of minor consequence (to the U.S. itself), and apart from a localised or industry-specific impact, will have little consequence on the broader global economy. However, it is the threat of retaliation by the U.S's main global trading partners and the risk of a spiraling "tit-for-tat" that poses the most serious risk to the global economy. There is little doubt that the imposition of trade tariffs and barriers on a broad scale would impact negatively on world trade and global growth.

Surplus or export-orientated economies would fare badly in that they would see reduced export volumes and ultimately a moderation in growth. Deficit or import-orientated economies (such as the U.S.) would also be impacted negatively given that consumers would face higher prices (in essence tariffs are a tax on their consumption) and erosion in their disposable incomes. This too would eventually lead to a slowdown in growth in these economies.

So as a starting point, we would expect global bond yields and interest rates to stabilise or eventually decline somewhat as growth expectations are ratcheted down. Initially, the prospect of higher tariffs will have an inflationary impact and there may be reflex to sell out of fixed income products. However, the imposition of a tariff would only lead to a 'once-off' adjustment to the aggregate price level, and not in itself lead to sustained inflation. Of course, in an economy at full employment, higher tariffs on imported goods, which encourages some import substitution, could lead to an increase in employment and higher wages, at least initially, and before the negative effects of a reduction in real disposable income are felt.

The reflex in financial markets to the announcement of proposed trade tariffs by the Trump administration has also been to sell the U.S. Dollar. However, it remains open to debate whether the currencies of surplus or deficit countries should fare worse. Although both surplus and deficit economies are likely to be negatively impacted in terms of growth expectations, higher tariffs would arguably reduce the trade deficit of deficit countries (the reason for the imposition of the tariff in the first place), and one can therefore make a sound argument that the currencies of deficit economies should fare better comparatively in a global trade war relative to the currencies of surplus economies.

Trends in the US Dollar, which remains the world's main trading currency or reserve currency, also tends to be inversely correlated with trends in global trade growth. Over the last few decades, growth in global trade has often been accompanied by a weaker US Dollar and vice-versa. There are various reasons for this that have been cited, but our favoured reason is two-fold. Firstly expanding world trade is often accompanied by stronger US import volumes and therefore a widening in the US trade deficit. Secondly, expanding world trade often requires or is accompanied by an expansion in offshore US Dollar credit and financing, which expands the global stock of offshore Dollars. Whatever, the reason, if this correlation holds, then a decline in global trade volumes would tend to be US Dollar positive.

Although the above theories are open to debate, what can be conclusively said is that small, open emerging economies, highly dependent on positive world trade growth will be most adversely impacted. So, although in a global trade war there may ultimately be little relative movement between the currencies of the large deficit and surplus economies or say the U.S. Dollar relative to the Euro or Japanese Yen, a global trade war would be particularly devastating for countries such as Mexico, South Africa and even commodity producers such as Australia.

So, based on the above analysis and reasoning, how should an investor position himself or herself to best mitigate some of the downside risks that could emanate from a protracted global trade war? Although we would expect global growth to be impacted negatively, we would still avoid fixed income as an asset class. Global bond yields, and in particular, corporate bond yields remain close to record low levels, and with many of the world's developed economies now at or close to full employment, the upside risk from an unexpected acceleration in global inflation remains far too great.

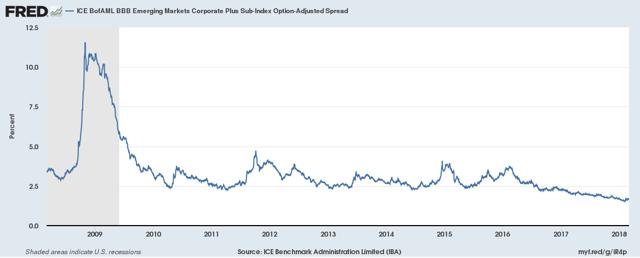

The better hedge would be to allocate some capital to gold (NYSEARCA:GLD), gold equities (NYSEARCA:GDX) or precious metals more broadly. Gold would benefit from an easing in interest rate expectations in the event that global growth slows due to the imposition of higher trade tariffs globally. More specifically, gold tends to perform very well during periods of rising risk aversion, particularly when the increase in risk aversion is reflected in a widening in credit spreads. As the chart below of the spread between BBB corporate credit and U.S. treasuries shows, credit spreads remain near record lows.

Source: ICE Benchmark Administration Limited (IBA)

These levels in the context of a sudden growth shock, coupled with the rise in corporate leverage over the past seven years, surely does not reflect a fair level commensurate with the evolving landscape. Similarly, the spread on a basket of emerging market BBB corporate remains at or close to the lowest levels seen since the global financial crisis in 2008.

Source: ICE Benchmark Administration Limited (IBA)

Although gold should perform relatively well should global growth expectations moderate and/or credit spreads widen out, there is a risk that a sharp appreciation in the US Dollar could depress the gold price. As we have noted, there is an argument to be made that a global trade war would benefit the currencies of deficit countries relative to those of surplus countries. This would be particularly relevant if the immediate impact on consumption is less visible than let's say the impact on export volumes from the surplus countries and the central bank of the deficit country (i.e. U.S.) reacts to the potential first-round inflationary effects of a trade tariff rather than focusing on the longer-term secondary effects.

Given this risk, investors allocating capital to gold and gold mining companies as a hedge or form of portfolio insurance should also perhaps look to "short" or minimize their exposure to the more vulnerable smaller emerging market economies or commodity producers that mainly export industrial metals. This "barbell" approach should cover both scenarios, with gold performing well if the U.S. Dollar succumbs to further weakness and gains from this part of a portfolio potentially offsetting any losses from a "short" or underweight position in emerging market assets or currencies.

From a technical perspective, the gold market, as well as gold equities, are approaching a potential inflection point. After a sharp rally during H1 2016, the Gold Bugs Index (composite index of various gold mining companies) has essentially traded sideways, and has more recently showed signs of breaking down. Gold and gold equities have come under some pressure recently due to stronger inflation data from the U.S. and a hawkish turn in the global monetary cycle.

Source: Gold Bugs Index- NYSE Arca INDX, March 2018

Without a meaningful growth shock, it is very likely we will see a further acceleration in wage and consumer inflation in the U.S, which will likely lead to a further rise in interest rates this year. The market is slowly starting to price in four rate hikes from the Federal Reserve this year, which would take U.S. short-term rates above 2% for the first time in a decade. In this environment, we could well see gold and gold equities remain under pressure for most of the year, possibly even retracing much of the rally from H1 2016 and testing the levels seen in late 2015 and early 2016.

If such a scenario unfolds and is accompanied by a broader sell-off in commodities, it is difficult to envisage a weaker US Dollar unfolding at the same time, and one would expect the currencies of emerging market economies and commodity producers to perform badly or at least relative to developed market currencies. The risk of this scenario supports our "barbell" strategy of maintaining both a long position in gold and gold equities, and short or underweight position relative to emerging market currencies and the currencies of commodity producing countries.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GDX over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.