Gold's 30-Day Window Is Closing

Immediate-term buy signal intact, but gold needs to rally this week.

Failing to make a new monthly high will violate cardinal trading rule.

Dollar strength is also an immediate-term concern for gold.

Gold suffered a setback on Friday as the U.S. dollar experienced its biggest rally of the month to date. With the gold price struggling to stay above its benchmark 15-day trend line, we'll examine gold's chances of breaking out from its 3-month trading range in the week ahead. As I'll argue here, a failure to do so would likely have negative consequences for gold's near-term outlook.

The price of gold was lower for the second straight day, finishing the week lower by nearly 1 percent in response to an easing of global political tensions. Spot gold lost 0.6 percent at Friday to close the week at $1,336, while June gold futures settled down $10.50, or 0.8 percent, to finish at $1,338.30.

The decline in gold prices came despite a drop in U.S. equity prices as investors remained jittery in the face of rising Treasury bond yields. There is also apprehension about an upcoming slew of earnings reports from several major companies as the latest earnings season enters its busiest week.

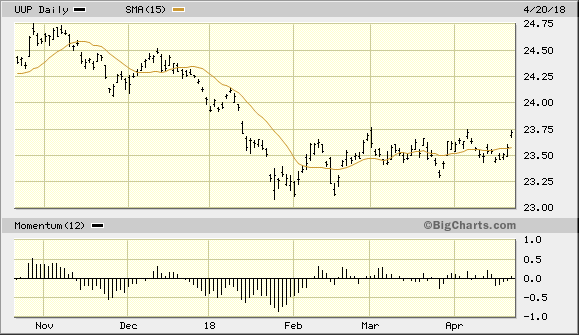

With gold prices failing to respond to stock market weakness, what is hindering the metal from rallying? The answer is obviously gold's currency component, the U.S. dollar. The dollar index rallied on Thursday and Friday, taking the wind out of gold's sails and snapping a 4-day winning streak for the metal. The extent of the dollar's latest rally is visible in the graph of the PowerShares DB US Dollar Index Bullish Fund (UUP), my preferred proxy for the U.S. dollar index.

Source: BigCharts

As can be seen in the above chart, the dollar ETF once again tested a benchmark level - the upper band of its 3-month trading range. This latest threat of the dollar ETF at breaking out of its range to a higher level represents a serious threat to the gold price, which is priced in dollars. A UUP breakout above the $23.75 level would be an open invitation to gold bears to raid the yellow metal and push its price below its own 3-month trading range. A lot is at stake here in the coming week as the latest test of UUP's trading range ceiling will make or break gold's immediate-term (1-4 week) trend.

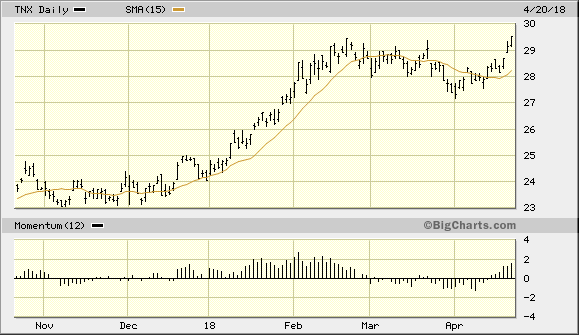

The dollar's latest show of strength was likely a result of investors raising cash after selling Treasury bonds and bond funds last week. The selling pressure on bond prices can be seen in the conspicuous spike in Treasury yields visible in the 10 Year Treasury Note Yield Index (TNX) below. TNX moves inversely to bond prices, thus a decline in bond prices leads to higher yields.

Source: BigCharts

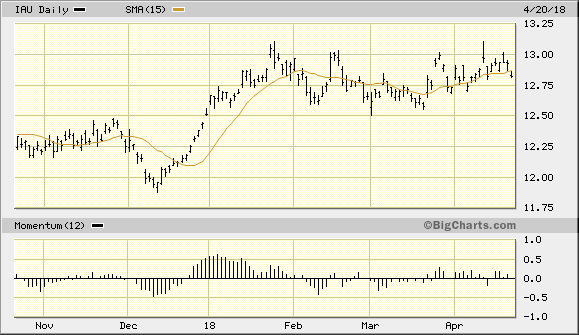

For gold's part, it remains well above its 3-month trading range floor and hasn't yet lost all its gains since the end of March. It's imperative, however, for gold to quickly rebound this week before its immediate-term forward momentum is completely reversed. Shown below is the iShares Gold Trust (IAU), my favorite gold trading vehicle. As a reminder, I'm using a stop-loss at the 12.55 level on my trading position in this ETF.

Source: BigCharts

Aside from price considerations there is also a time component to consider when evaluating gold's immediate-term trend. Amos Hostetter, the legendary trader and co-founder of Commodity Corporation (now owned by Goldman Sachs), many years ago developed a series of trading rules which he expected his traders to follow when managing the firm's capital. One of them was called the 30-day Rule. As the name implies, if a commodity failed to make a higher high within 30 days of initiating a trade, the trading position would be exited. This was a safeguard against the potential for a trend reversal, which often happens when a commodity fails to make forward progress within a month. Hostetter's rule can apply equally to gold, and as such I've incorporated it as part of my technical trading discipline.

With gold having failed to make a higher high in the last few weeks since confirming its last immediate-term buy signal in late March, we're getting very close to having the 30-day window close. If the iShares Gold Trust (IAU) fails to push decisively above its trading range ceiling at the $13.00 level this week, I plan to close the position even if my stop-loss isn't violated. Again, this safeguard is often necessary to protect against unnecessary whipsaws and trend reversals in what has been a very uncertain period for the precious metal.

On a strategic note, IAU confirmed an immediate-term buy signal per the rules of the 15-day MA trading method on Mar. 23. This signal is predicated on a 2-day higher close above the rising 15-day moving average. I've purchased a conservative trading position in the iShares Gold Trust after it confirmed the immediate-term (1-4) breakout signal on Mar 23. I'm using the $12.55 level as the initial stop loss on an intraday basis for this trade. Meanwhile longer-term investment positions in gold should be maintained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts