Gold's Biggest Trend Test Since November

One of gold's most followed moving averages is about to be tested.

Bullion demand and neutral dollar favor gold's intermediate-term trend.

Bitcoin is also drawing some attention away from gold, which is good.

Gold is on the verge of testing the strength of one of its most widely watched trend lines. Once the gold price comes into contact with this trend line, the 50-day moving average, it will mark the first such test since November. More importantly, it will tell us just how much strength remains in gold's intermediate-term recovery effort. In today's report, we'll discuss the signs which favor a resumption of gold's rally once the latest pullback has ended.

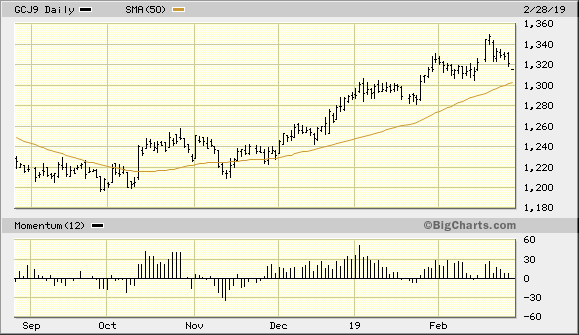

The price of gold is only a few dollars above where its 50-day moving average can be seen in the daily chart. This is an important consideration given the huge amount of attention paid to this trend line, which increases its psychological significance. As can be seen in the graph below, the April gold futures price is approximately $10 above the 50-day MA as of Feb. 28. It's likely that before the latest pullback in the gold price has ended the 50-day MA will be tested.

Source: BigCharts

Assuming the gold price doesn't decisively close below the 50-day moving average on a weekly basis, gold's intermediate-term upward trend can still be considered intact. The gold price became conspicuously over-extended from its underlying 50-day trend line during its rally a couple of weeks ago. Indeed, this is one reason for the latest pullback in the metal's price, and now that gold is closer in line with the 50-day MA, the market is decidedly less overheated. It's also in a far better technical condition to resume its upward march once the trend line has been tested.

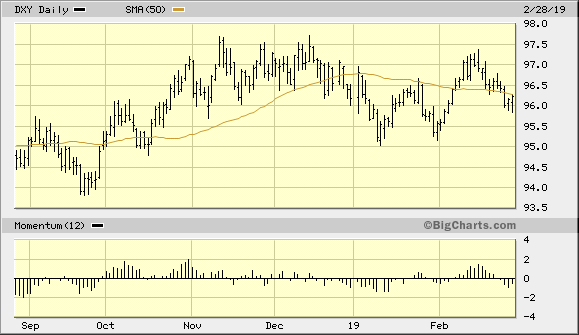

Fundamentally, gold remains in good shape as its currency component is still strong. The U.S. dollar index (DXY) is below its highs of the last few months and is also still under its 50-day moving average on a weekly closing basis. The most important observation is that the dollar index has established a lateral trend since peaking in November. As I've argued in recent reports, this bodes well for gold's interim outlook since it isn't being stressed by a rising greenback. If DXY was trending above a rising 50-day moving average, this would be an adequate reason to question gold's intermediate-term bullish outlook. However, with DXY's 50-day trend line (below) tilted downward, the dollar's interim trend is not yet a concern.

Source: BigCharts

While gold has recently lost some of its luster in the eyes of short-term traders, its attraction as a safe haven hasn't entirely diminished. As the battle over Britain's exit from the European Union continues to rage, the worry this has engendered is keeping gold's fear component alive. Gold and silver bullion demand has been quite high in recent months as investors around the world hedge what can only be described as an uncertain global economic outlook.

Picking up the recent slack created by gold's pullback has been alternative investments like Bitcoin. After being largely ignored by the financial media in the last several months, Bitcoin has made headlines on almost a daily basis since gold's latest peak. Despite the paltry nature of Bitcoin's latest rally, the financial press seems fixated on the prospects of the beleaguered cryptocurrency.

Source: Bitcoincharts

Source: Bitcoincharts

One good thing that has come from this profusion of crypto coverage, however, is that it has taken attention away from gold. From a contrarian's perspective, this makes it less likely that gold's impressive gains since the August 2018 low will attract a huge following from easily excitable retail traders. As we all know from experience, whenever the retail trading crowd jumps aboard gold - or any other asset for that matter - it tends to greatly increase market volatility. It also means that it's only a matter of time before the market's upside potential has been exhausted.

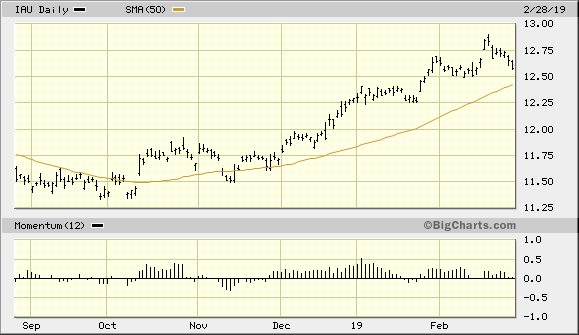

On the ETF front, the iShares Gold Trust (IAU) has closed decisively under its 15-day moving average for the first time since January. If IAU finishes the latest week below the 15-day MA, it will mean that its immediate-term (1-4 week) rising trend has been formally broken. A more important consideration, however, is the commonly followed 50-day moving average. As the following graph illustrates, IAU is on the cusp of testing this important trend line. As long as it remains above the 50-day MA on a weekly closing basis, the gold ETF's intermediate-term upward trend will remain intact. That said, I continue to recommend using a stop-loss for this trading position at slightly under the $12.50 level on an intraday basis. As long as IAU remains above this stop, short-term traders are justified in maintaining a long position in the gold ETF.

Source: BigCharts

While the gold price has pulled back in recent days and has even violated its immediate-term uptrend line, this period of weakness is likely to be short-lived. The bullish factors discussed here - ranging from the neutral trend in the U.S. dollar index to the continued strength of gold's fear component - favor gold's 3-9 month rising trend remaining intact. Based on the current weight of technical and fundamental evidence, longer-term investors are still justified in maintaining some exposure to gold regardless of the metal's performance in the coming days.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts