Gold's Currency Component Finally Strengthens

A weakening dollar index has strengthened gold's currency component.

Expect gold to respond favorable to the softer dollar in the weeks ahead.

A more accommodative Fed policy will also boost gold's attractiveness.

Precious metals traders had almost despaired of ever seeing a currency-driven rally in the gold price this year. Yet, for the first time since June, gold finally has the support of its currency component. A weakening U.S. dollar index has paved the way for gold bulls to once again assert control over the metal's short-term trend. In this report, we'll review the evidence in support of gold soon breaking free from its 10-week holding pattern.

Most of the gains made by the gold price this year were made despite a strengthening U.S. dollar. This was counter to conventional wisdom, which states that gold needs a falling dollar to advance. Beginning last October, however, a gradual increase in the dollar's value wasn't enough to deter investors from buying the yellow metal. Most of the demand for gold among investors since last year has been motivated by a desire to preserve capital in the face of a shaky global economic outlook.

Indeed, an argument can be made that gold's safety bid has eclipsed the desire for capital gains since its bull market began a year ago. There has been a definite correlation between gold's rallies since last October and the periodic recurrence of panic over the U.S.-China trade war and other geopolitical factors. But when it was recently announced that representatives from both sides are seeking a trade truce, many gold bulls feared the worst for the metal's near-term outlook. That gold has lost some of its safety bid since August is undeniable. Yet what gold lacks from the diminishing "fear factor" is being replaced by a strengthening currency component.

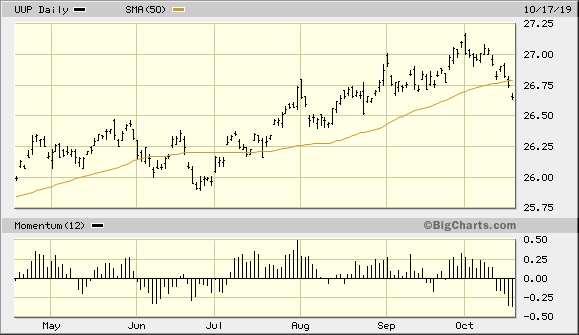

Specifically, the U.S. dollar index has seen a conspicuous decline since the start of this month. This marks the first instance of dollar weakness in four months. It's also the first time since June that the dollar index has fallen decisively under its widely watched 50-day moving average. Below is the graph showing the recent performance of the Invesco DB U.S. Dollar Index Bullish Fund (UUP), my favorite dollar-tracking ETF. Given that the extent of the drop so far this month has been comparable to the UUP drop in early June, a corresponding gold rally is the most likely outcome.

Source: BigCharts

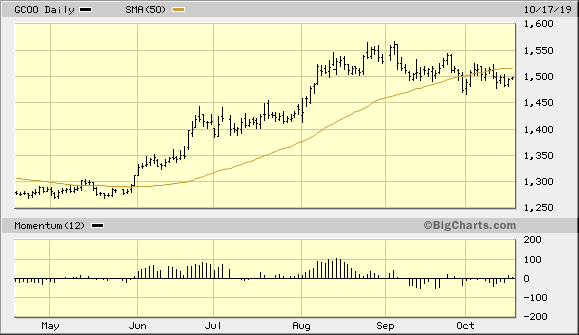

Source: BigCharts

The last time the dollar ETF fell sharply under its 50-day moving average, the gold price rose by just over 10% in a 1-month period. The magnitude of gold's currency-inspired rallies can't be predicted with a reliable degree of certainty, however, so traders should avoid reading too much into this. However, the depth of the dollar's latest plunge strongly suggests that we should see gold break out of its lethargic holding pattern at some point in the coming days.

Gold's historical tendency to move inversely to the dollar index is also instructive. It makes sense from this perspective that since the dollar index is under its 50-day MA, the gold price should rise above its 50-day trend line in (belated) response to the dollar's weakness. Gold is still priced in dollars, so it would be foolish to conclude that its inverse relationship with the greenback has somehow diminished.

Source: BigCharts

Source: BigCharts

Another factor which argues in favor of a stronger gold price trend in the coming weeks is the U.S. Federal Reserve's recent commitment to a looser monetary policy. The Fed will soon commence another sheet expansion by purchasing $250 billion to $330 billion in short-term T-bills. The central bank has also been incrementally lowering its benchmark interest rate, which means that gold will have less competition from yielding assets. In past years, a looser Fed policy has benefited gold as increasing liquidity sooner or later finds a way into the precious metals market.

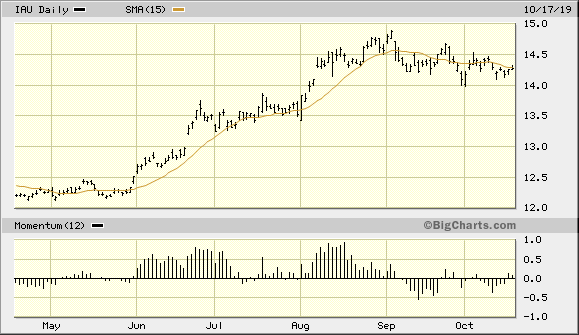

Turning our attention to the iShares Gold Trust (IAU), my favorite gold-tracking fund, a close above the technically significant $14.50 level would be enough to confirm an immediate-term (1-4 week) breakout based upon the rules of my trading discipline. This would also put IAU decisively above its key 15-day moving average and would be enough to suggest that 1.) short covering is underway in the gold market; and 2.) traders finally recognize that gold's currency component has strengthened enough to justify a renewed rally phase in the market.

Source: BigCharts

Source: BigCharts

Between a weakened U.S. dollar index and a much looser monetary policy on the part of the Fed, gold's outlook this fall is much improved since August. Gold's pullback and price consolidation since the August peak has also cooled off gold's substantially "overheated" market condition from earlier this summer. This in turn should make it easier for the sparks generated by short covering in the coming days and weeks to set fire to the market and catalyze another rally.

On a strategic note, I'm waiting for both the gold price and the gold mining stocks to confirm a breakout by closing the required two days higher above the 15-day moving average before initiating a new trading position in the VanEck Vectors Gold Miners ETF (GDX). GDX is my preferred trading vehicle for the gold mining stocks and the ETF I refer to most frequently in this report. I'm currently in a cash position in my short-term trading portfolio.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GDX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts