Gold's Explosive Potential: The Shot Reverse Shot Chart and the Road to $8,000

John Newell of John Newell & Associates explains why he thinks an $8,000 per ounce gold price is not just possible; it'sincreasingly probable.

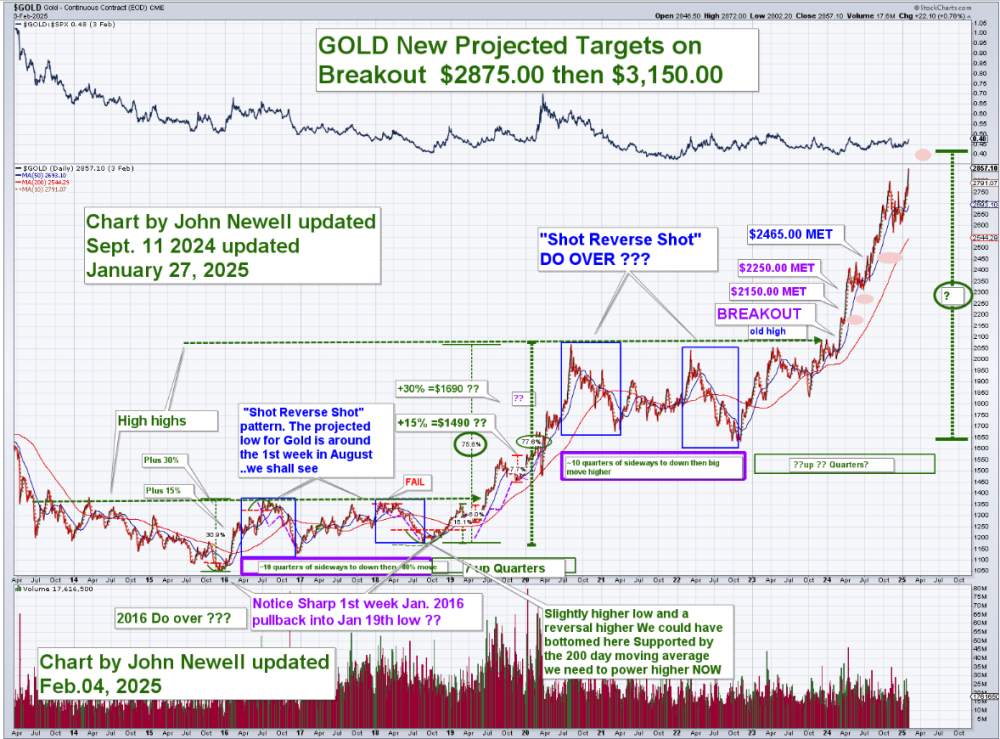

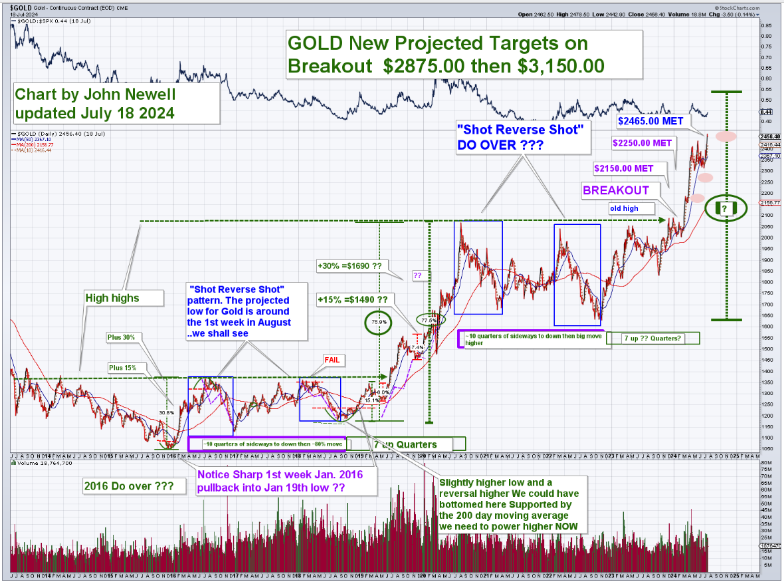

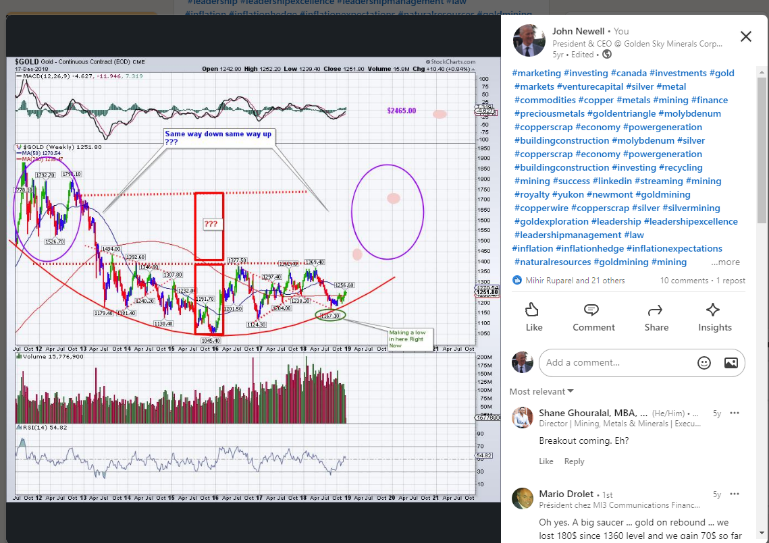

Gold has been following a consistent technical pattern over the past several years, and the updated "Shot Reverse Shot" chart suggests that another major breakout is on the horizon. Historically, gold had demonstrated its ability to make exponential moves, with one of the most notable runs occurring in the late 1970s when gold surged from $100 in 1977 to $850 by 1980, a nearly 750% increase.

Given this precedent, a similar trajectory today could see gold rising from its recent lows near $1,050 to as high as $8,000 per ounce. This isn't mere speculation; it's a pattern that has played out before and appears to be setting up once again.

The updated targets on the latest "Shot Reverse Shot" chart project potential breakout levels at $2,875 and $3,150, with further upside potential should gold enter a parabolic move.

Historical Trends and Technical Analysis

Gold's movement over the past several years has been well-documented, with key breakout moments aligning with major global economic shifts and monetary policy changes. After the 2019 breakout, gold saw a significant rally but also underwent necessary corrections before resuming its upward trend. We are now witnessing another setup where gold has moved sharply higher, but, like before, it may experience temporary corrections before launching into a sustained rally.

Some key factors supporting this bullish outlook include:

High Inflation and Currency Devaluation Central banks worldwide have engaged in aggressive monetary expansion, weakening fiat currencies and driving demand for hard assets like gold.Geopolitical Instability Global conflicts, economic slowdowns, and shifts in financial power structures make gold an attractive safe haven.Institutional and Central Bank Buying Hedge funds and sovereign nations continue to accumulate gold as a reserve asset, indicating strong long-term demand.Why Gold Remains the Ultimate Store of Value

Gold's ability to hold and increase its value over time sets it apart from fiat currencies and other asset classes. Its unique properties make it an essential part of any investment portfolio, especially in today's volatile economic climate.

Privacy and ConfidentialityUnlike stocks, bonds, or digital currencies, gold investments can be held privately, offering financial discretion unmatched by other assets.

Tangible AssetGold is one of the few assets you can physically hold, providing security in times when trust in digital and paper-based investments wanes.

Intrinsic and Finite ValueUnlike fiat money, which governments can print at will, gold's supply remains limited, making it a hedge against inflationary pressures.

Demand from Central Banks and InvestorsCentral banks and high-net-worth individuals continue to increase their gold holdings, reinforcing its status as a reliable store of value.

Safe Haven in Economic TurbulenceGold consistently outperforms fiat currencies during inflationary periods, acting as a wealth preserver in times of economic crisis.

Gold vs. Other Investment Classes

While equities like the S&P 500 have performed well over the past 15 years, history shows that markets move in cycles. The 1970s saw an exodus from equities into gold, a pattern that could repeat if inflation and monetary debasement continue.

Similarly, when compared to real estate and silver, gold's liquidity, portability, and universal recognition make it a superior asset for wealth preservation.

The Path Forward: What Investors Should Watch For

With gold breaking above key technical levels, investors should monitor:

Breakout confirmation at $2,875 and $3,150Potential consolidation periods before another leg higherMacroeconomic shifts, particularly monetary policy changesIncreasing institutional and central bank demandFinal Thoughts

Gold is entering a new phase of its long-term bull market. The "Shot Reverse Shot" chart continues to provide a roadmap for investors, just as it has successfully done in the past. With history as our guide and current market conditions aligning with past gold bull runs, an explosive move toward $8,000 per ounce is not just possible; it's increasingly probable.

For those looking to hedge against inflation, preserve wealth, and capitalize on a potential historic price surge, gold remains one of the most compelling investment opportunities of our time.

The charts below are reference only. . .

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.