Gold's Long-Term Relative Strength Advantage

Gold is still outperforming several major assets on a long-term basis.

This is an argument in favor of its long-term bull market continuing.

Demographic trends also provide support for gold's fear component.

We often discuss the importance of short-term relative price strength when evaluating the gold price in this report. What's not often looked at, though, is gold's longer-term relative strength advantage over many leading asset categories including bonds, currencies, and other commodities. In today's report, we'll examine gold's longer-term bullish potential within the context of this strong outperformance.

Before we do, however, let's briefly look at gold's latest performance. A dollar rally took some of the wind out of gold's sails on Tuesday. After British Prime Minister Theresa May's Brexit deal was rejected, the U.S. dollar index rose and other currencies fell in response. Also weighing on the gold price was the news that China plans to stabilize its economy with tax cuts and tariff reductions.

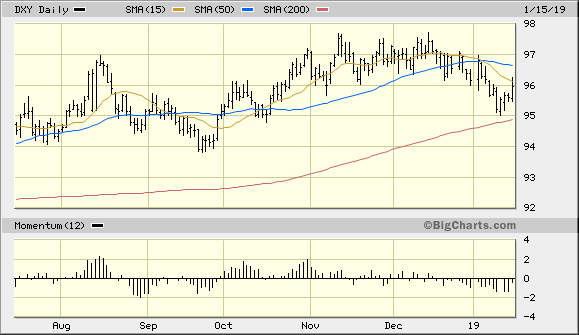

Shown here is the U.S. dollar index (DXY) in relation to three important trend lines. Included in this trend line series is the 15-day moving average, which I use to evaluate the immediate-term (1-4 week) trend. Also included is the popular 50-day moving average (blue line) and the even more widely watched 200-day MA (red line). The significance of the latter moving average can be clearly seen as the DXY price line stopped short of violating this psychologically important trend line during last week's decline. As long as DXY is above the rising 200-day MA, the dollar will enjoy a measure of longer-term technical support. This in turn will likely serve as an incentive to keep the gold price under its April 2018 high.

Source: BigCharts

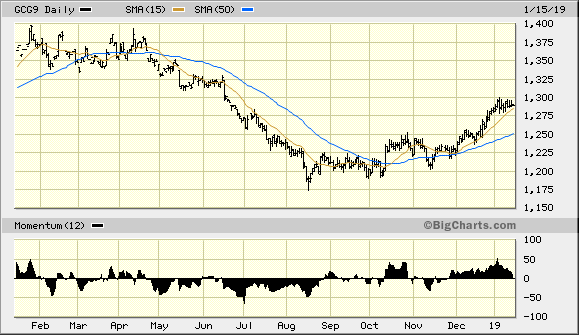

However, the dollar index remains under the 15-day and 50-day moving averages as of Jan. 15, which gives the gold bulls a continued advantage in the near term. Moreover, as long as the dollar remains under both these short-term trend lines, the bulls will have an opportunity to push the gold futures price (basis February) above its nearest round number resistance at the $1,300 level as shown in the following graph.

Source: BigCharts

Let's now turn our attention to gold's longer-term trend. As discussed in previous reports, gold has benefited - and should continue to benefit - from lingering fears over the health of the global economy. Gold's fear component is in fact one of its strongest calling cards anytime there is the slightest concern among investors over the state of the financial markets or the economy.

Along this line, it might surprise most investors to learn that gold outperformed equities in 2018 on a relative basis despite gold's sharp plunge in the April-August period. While the benchmark S&P 500 Index (SPX) lost 4.4%, gold shed only 1.6% of its value. Commenting on gold's 2018 performance, John Hathaway of Tocqueville Asset Management wrote the following in his Fourth Quarter 2018 Investor Letter:

The S&P index masked the full extent of the decline in equity markets due to the high concentration of the index in a handful of stocks that outperformed run-of-the-mill stocks. Gold outperformed all currencies last year except for the Swiss franc and the Japanese yen. It also held its own against bonds, roughly matching the 0.9% increase in the US ten-year bond."

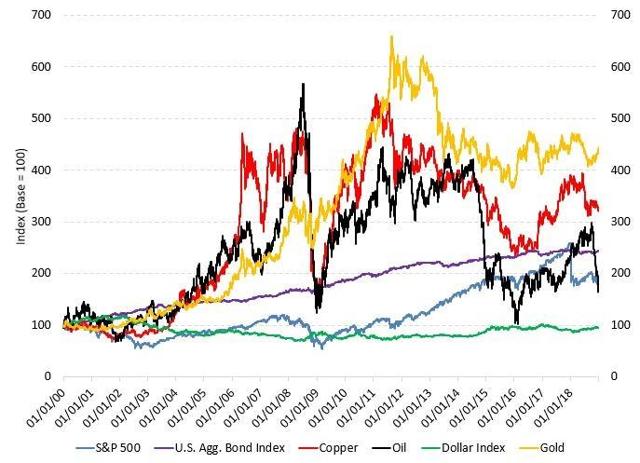

Hathaway further pointed out that gold has outperformed some key industrial commodities since at least 2011, including oil and copper, as shown in the following graph.

Source: Tocqueville Asset Management

Source: Tocqueville Asset Management

The relative strength advantage over other major assets mentioned by Hathaway is a major reason for continuing to lean bullish on gold's longer-term trend. Investors' concerns over slower growth in the global economy aren't going to dissipate anytime soon, especially in light of the long-term demographic trends discussed by economist Ed Yardeni in a recent blog. The presence of uncertainty as it concerns the global economy is a strong support for gold's important fear component. Gold for the long term is therefore still a smart bet and a reason why investors should own some gold in their investment portfolios.

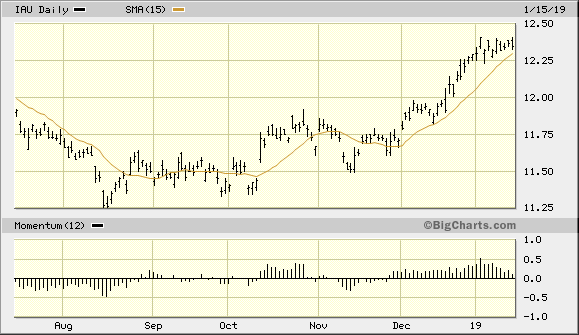

Turning our attention to the gold ETF outlook, while there's an increased possibility for a temporary dip in the iShares Gold Trust (IAU) price, the ETF should continue to benefit in the coming weeks from the high levels of fear still present among investors. IAU remains in a rising trend as of Jan. 15 as measured by the rising 15-day moving average. Even if IAU temporarily pulls back from here, however, the pullback should be short-lived as long as the dollar index (DXY) remains under its 50-day moving average as mentioned above.

Source: BigCharts

In closing, investors with a long-view time frame still have a major incentive for being bullish on gold. Specifically, its relative outperformance versus several leading currencies, commodities, and government bonds is a reason for continuing to use the metal as a hedge against the uncertainty surrounding the long-term global economic outlook. Meanwhile, short-term participants can continue to lean bullish on gold as long as the U.S. dollar index remains under its 15-day and 50-day moving averages.

On a strategic note, traders should remain long the iShares Gold Trust after recently taking some profit. I also recommend raising the stop loss for the remainder of this trading position to slightly under the $12.25 level on an intraday basis. A violation of $12.25 in the IAU would mean that price has fallen under the technically significant 15-day moving average, in turn signaling a shift in the immediate-term trend.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts