Gold's Next Move Depends On The Euro

Gold has broken through five-year resistance in USD terms, but is already at new highs in AUD and SEK and near all-time highs in CAD and JPY.

Gold's next move in dollar terms depends on the Euro this summer.

The UK staying in the EU would send the euro higher along with gold.

A no-deal Brexit could send the euro flying in either direction.

If the euro gets a bid after Brexit, gold will continue to rise in dollar terms, but if it collapses, dollar gold could fall.

A new global rate-cutting cycle has been announced, and gold has broken out to the upside, getting all the gold bugs excited. Gold traders are speculating whether or not gold is on its way back up to old highs. What they forget though is that in many currencies, gold has already reached new highs; in some cases, quite some time ago. Gold is at all-time highs in Australian dollars, Swedish krona, and Indian rupee among others. Gold is significantly above all-time highs in most emerging market currencies and has been since gold bottomed out in dollar terms in late 2015. Gold is even within 3% of all-time highs in British pound sterling and Canadian dollars. It is within 5% of all-time highs in Japanese yen. The dollar is one of the last major currency holdouts against a new record gold advance.

What this tells me is that it's not gold that's going up, but fiat currencies that are slowly dying around the world.

Obviously, the dollar is a bit different from other currencies and in a world of its own, as it represents the faith in the institution of fiat currencies; in other words, the faith in the competency of central banks. But, as can be seen by gold's price action in many other currencies, the question isn't necessarily whether gold's bull market is resuming, but is the dollar's long-term bear market about to worsen? That depends largely on how the euro gets through the summer.

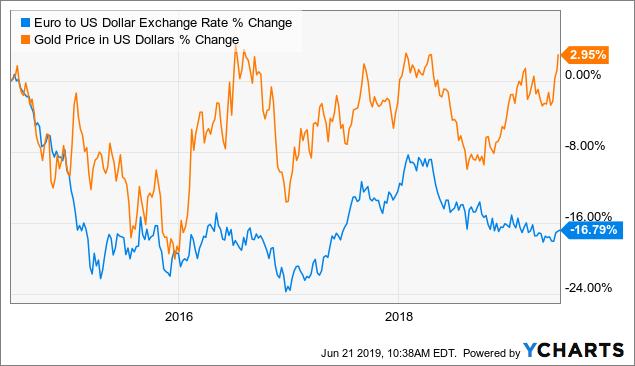

Data by YCharts

Data by YCharts

Since 2015, the dollar gold price has been moving generally in line with the Euro/Dollar exchange rate. That seems to have changed recently though, slightly, and in gold's favor. Starting last September, gold began resisting a weaker euro and has moved strongly higher on any minor euro move down. This could translate into very strong moves upward if the euro has a bad summer, which is very possible.

The Next European Crisis

The next European crisis looks like it is on the verge of unfolding, with the pinnacle event being Britain's exit from the European Union in October. The factors favoring this happening without a deal are first, Boris Johnson looks like a sure thing for the next British prime minister. He has said the UK is leaving with or without a deal. He also knows that if he doesn't take the UK out, the Tories could be doomed as a political force and be supplanted by the new Brexit party. The House of Commons has already voted against ruling out a no-deal, so it could actually happen.

If it doesn't leave, then the euro almost certainly strengthens, bringing down the US dollar, and gold continues on higher in dollar terms. If it does leave without a deal, here's where it gets interesting. At that point, a whole bunch of new tariff barriers come up automatically (as reported in The Guardian), and the European economy almost certainly tips into recession. European Central Bank President Mario Draghi has already hinted at this by expressing willingness to loosen monetary policy in the Eurozone despite negative yields in Germany.

The euro could go either way in this scenario. It could cause a systemic European banking crisis, which could either bring the euro way up or way down. The mechanics of how a systemic banking crisis would unfold are straightforward. Deutsche Bank (DB) for example is one of the most systemically important financial institutions in Europe. Deutsche is still teetering on the edge of insolvency at all time lows, and the STOXX Euro 600 Bank Stock Index generally is testing long-term support for a fourth time since 2012. Nobody expects sustained improvement in these banks. We're on our way to a banking crisis of some kind in Europe. It's just a question of when.

Deutsche has ?,?49 billion (page 114) in total exposure to the highly indebted PIIGS countries, and most of that is concentrated in Italy and Spain. A no-deal Brexit damages Italy's GDP as the UK is Italy's fourth largest export market, and recession forces Italy to spend even more, spiraling its debt to GDP ratio out of control, the doom loop, and threatening a breakup of the Eurozone entirely.

How the euro reacts to this will depend on whether European traders turn to the euro in a bet that it will survive and cash is king, or if currency traders think that this will be the end of the euro entirely and turn somewhere else. I don't know which scenario will be the case, but it will probably be extreme in whichever direction the euro decides to go.

So on the face of it, the UK staying in the EU past October would be the safe bullish outcome for gold in dollar terms, because it would push the euro higher. A no-deal Brexit would be riskier and could go either way for gold. If it ends up strengthening the euro as traders pile into cash, then gold in dollar terms would rise. If the UK leaves and it ends up causing panic selling in the euro, then gold in dollar terms could fall, unless investors escaping the euro choose gold over the dollar as their safe haven. That's impossible to know.

Gold traders should pay special attention to how gold performs if and when the euro weakens in a no-deal scenario. If gold does not fall in dollar terms in such a case, that would signal serious fundamental strength in the precious metals, and loss of faith in paper currencies generally.

Bonus Factors

On top of this Brexit binary, we have two potential superchargers to the dollar gold price. One is a potential war with Iran, which would bring the oil price much higher, seriously hurting the dollar. We are told this almost happened yesterday June 20 with a planned attack being called off at the last minute by President Trump when planes were already in the air.

The second is a change in price inflation expectations. This hasn't happened in 10 years, but considering the worsening trade war, bound to lower the supply of goods relative to money than otherwise, plus a new rate-cutting cycle about to begin in both the US and Europe, which will bring up the money supply more than otherwise, it could happen any time. Even without high price inflation as measured by government indexes though, gold can still break out to new US dollar highs. Price inflation in Australia for example has been moderate since 2008, bouncing between 1% and 3.5% annual. Still, gold is at all-time highs in Aussie dollars. In Sweden, the inflation rate is just now touching 2% after being negative most of the time between 2013 and 2016. Still, the gold price is at all-time highs in Swedish krona.

Conclusion

So as the new global rate cutting cycle likely puts a floor under the dollar gold price, the main risk at this point for gold as I see it is that the euro weakens significantly or even implodes under a no-deal Brexit. The flight into the dollar as a safe haven would likely hurt gold at that point. Important though is that if a seriously weakened euro doesn't hurt the dollar gold price that much, then it would signal long-term strength in the precious metals and the possible encroaching end game for fiat currencies generally.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Austrolib and get email alerts