Gold's Rational Price

The dollar rate by itself does not determine the gold price.

However, the dynamics of the dollar is generally inversely related to the dynamics of gold price.

Fundamentally, the current price of gold is quite justified now.

Only if the US real rate enters the zone of negative values, there will be a further rise in the price of gold.

By and large, the price of gold is influenced by three main factors: the U.S. level of inflation, monetary policy in the United States, and the dollar. But at the same time, the role of the dollar should not be exaggerated. Let's consider it in more detail.

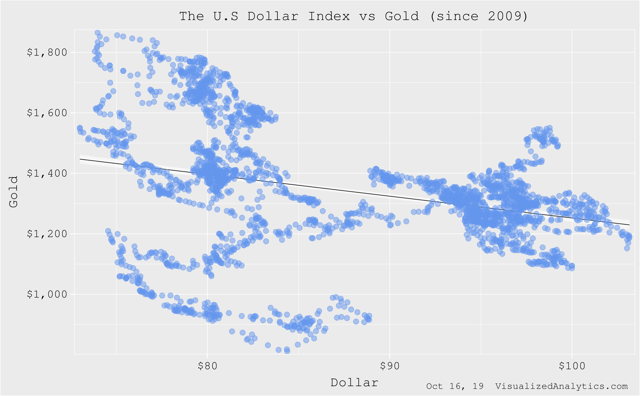

Let's take a look at the scatter plot of the daily values of the Dollar Index and gold prices over the last 10 years:

As you can see, there is no functional dependency.

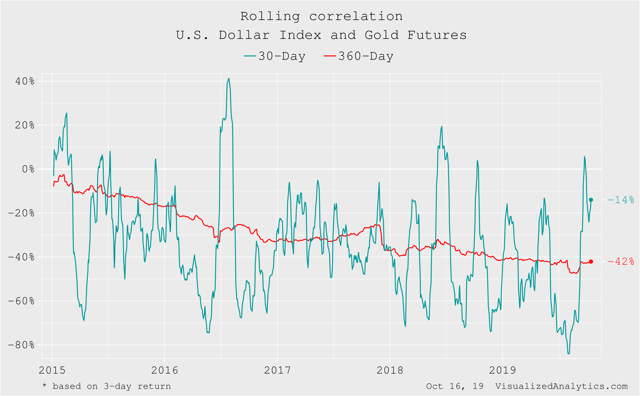

On the other hand, over the past years, gold price has shown a negative correlation with the Dollar Index. And by the way, in August 2019, this correlation reached its five-year maximum:

What does it mean in our case? It means that the Dollar Index by itself does not affect the gold price in the long run. When the Dollar Index equals 80, the gold price may be $1,000, $1,400, or, for example, $1,800. However, there is an inverse interdependence between dynamics of the dollar and the dynamics of the gold price: when the dollar goes up, it has a negative impact on gold price and vice versa.

What does it mean in our case? It means that the Dollar Index by itself does not affect the gold price in the long run. When the Dollar Index equals 80, the gold price may be $1,000, $1,400, or, for example, $1,800. However, there is an inverse interdependence between dynamics of the dollar and the dynamics of the gold price: when the dollar goes up, it has a negative impact on gold price and vice versa.

So, the dollar does not play a significant role in determining the fundamentally balanced price of gold. Therefore, let us return to the U.S. level of inflation and monetary policy in the United States.

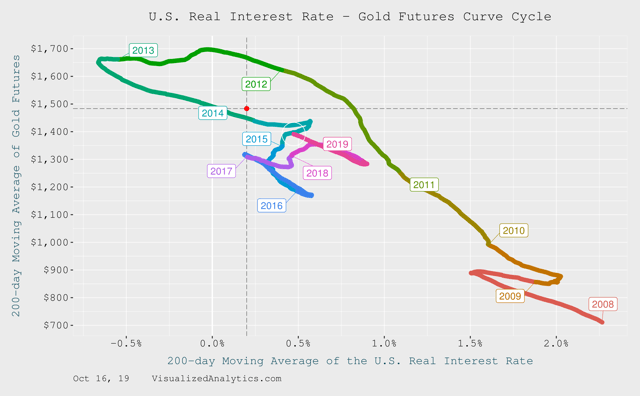

There is one main indicator that strongly affects the price of gold - this is the U.S. real interest rate. It should be noted that this indicator incorporates two indicators: the 10-year Treasury yield (the U.S. monetary policy mirror) and the rate of inflation in the United States:

And now we will do the following. Based on the history of the last 12 years, let's build a statistical model that will predict the price of gold based on the level of the real interest rate in the United States.

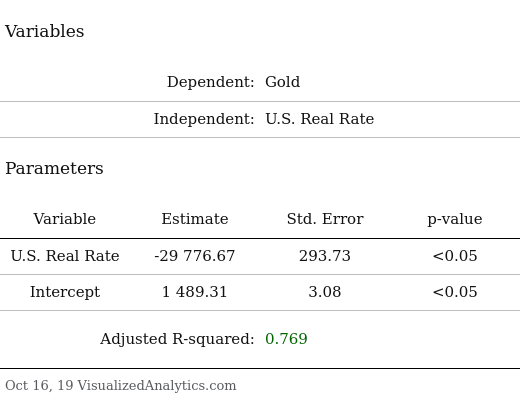

Here are the parameters of the model:

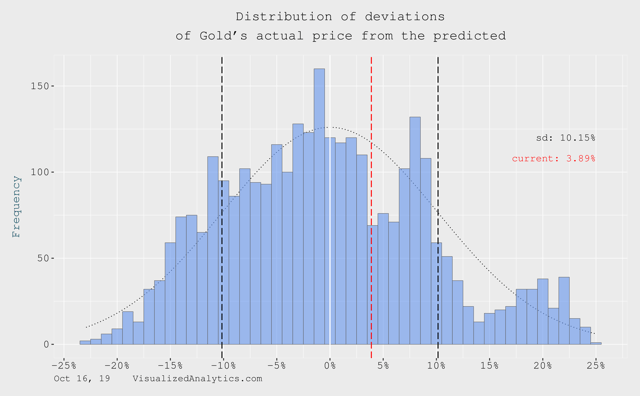

I want to note that the quality of such a model is really high: the adjusted R-squared is equal to 0.77 and the nature of the distribution of deviations between the predicted and the actual price of gold is very close to normal:

I want to note that the quality of such a model is really high: the adjusted R-squared is equal to 0.77 and the nature of the distribution of deviations between the predicted and the actual price of gold is very close to normal:

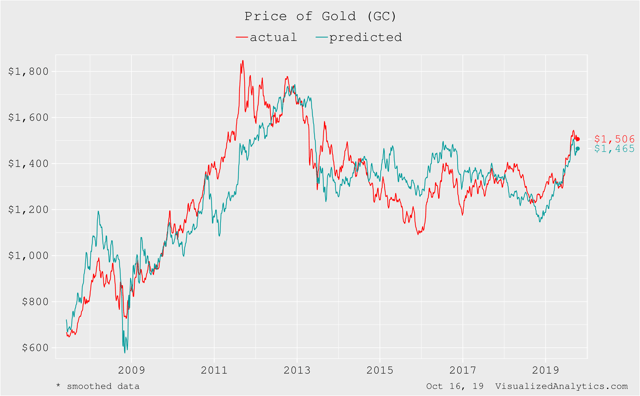

And, here is the model itself:

And, here is the model itself:

So, as you can see, now the rational price of gold is very close to the actual price or, in other words, it is balanced now.

So, as you can see, now the rational price of gold is very close to the actual price or, in other words, it is balanced now.

Putting it all together...

Speaking about the fundamental price of gold, it is not worth to take into account the dollar. The dollar affects the dynamics, but not the price of gold. Fundamentally, the current price of gold is balanced. To see gold more expensive, we must wait for a further decrease in the US real rate.Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Oleh Kombaiev and get email alerts