Gold's Thesis To Soar Remains Intact

Fed rate cuts and Trump's push for a lower dollar should increase the value of gold.

Low and negative-yielding bonds will entice investors to look for an alternative investment.

Equity markets push higher even though trade war tensions are increasing, making gold and other commodities increasingly attractive.

Using JNUG to capitalize on an upswing from gold.

Intro

As major indices are reaching all-time highs, commodities such as gold have been making strong moves to the upside. In the case of gold, I believe that investors have continued concerns over trade war tensions, the business cycle approaching the end, and skepticism towards the equity and debt markets.

These are some of the push factors away from the traditional debt and equity markets and have partially fueled gold's surge, but it also has pull factors such as lower interest rates and Trump demanding a weaker dollar.

For these reasons, I believe that gold can still push higher

Using JNUG to Optimize a Trade

JNUG is a 3x leveraged gold fund, but if used correctly, can dramatically increase your ROI. During my last trade idea highlighting JNUG, it is up over 95% in a little under two months. That was an exceptional move by gold and although it is unlikely to repeat that in the short term, I still see an upside.

Since JNUG is a 3x leveraged fund, it does come with risks and should be used as a trading tool rather than an investment. The Direxion Daily Junior Gold Miners Index Bull 3X Shares uses derivatives to deliver a 3x move in the gold index. As per the ETF's fact sheet, JNUG will not translate to a 3x move in the long run which is because of the decaying nature of a leveraged ETF.

This makes JNUG a much riskier trade, but can greatly reward investors. To get some kind of idea how volatile JNUG is, look at how it traded between July 31st and August 1st. JNUG started July 31st trading at $82.70, dropped all the way to $66.50, and is currently trading at $81.05.

With this said, timing is everything and this trade should be closely monitored. I'll dive deeper into this in the technical analysis section.

Saturated Debt Markets

Now that we've established how JNUG could be used as an attractive trading tool, let's take a closer look into some push factors that could potentially attract new investors.

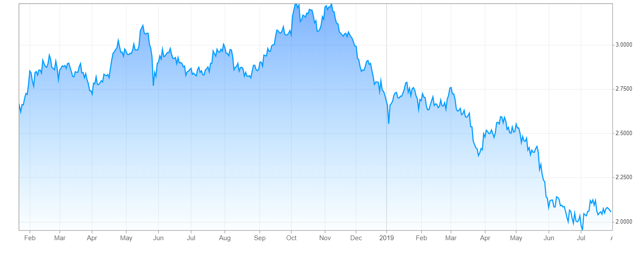

As the subheader says, I believe that the global debt markets are overly saturated as investors are piling in to safely put their money to work. Just looking at the US Treasury 10-year is trading at barely over 2%, a rate not seen since November of 2016.

In terms of global bonds, this is actually a fairly attractive interest rate as many European countries offer a negative-yielding rate. Most notably, the German 10-year Bund is yielding negative .397%. That means for every dollar loaned to the German government, you would actually be losing money. It seems ridiculous to think people would invest in this, but it has been increasing in popularity as Switzerland, France, Italy, and many others offer a negative yield. Although this negative-yielding bond is typically bought by institutions such as pension funds managing large amounts of public money, it should incentivize other investors to deploy their money elsewhere.

Equity Markets at All-Time High

A byproduct of the saturated debt market is equities recording new highs in the face of uncertainty. Although they seem to be riding a wave of pre rate cut euphoria, there is still concern over the trade war with China. After a meeting in Shanghai, US trade representatives talked with the Chinese Vice Premier to smooth over a potential deal.

An article by the WSJ states that they met to "establish goodwill", but a tweeting frenzy from Donald Trump may have thwarted any of that progress. Trump stated that if he were to be re-elected, "the deal will be much tougher than it is now".

With the continued threat of the trade war, the market seems to hardly mind, but only as long as it gets an interest rate cut.

Lower Rates Means Lower Dollar

The equity market has been pricing in a rate cut for the past few months, and it is because the Fed wants to increase inflation to their target rate of 2%. This cut is priced into the market but gives lower room for quantitative easing if the economy were to take a turn for the worse.

The cutting of rates will also lower bond yields and should create more demand for a safe investment that has room to grow. Since gold is traded in USD, raising the supply of dollars into the market through QE will subsequently increase the value of gold as it takes more dollars to buy the same amount of gold.

While on the subject of a lower dollar, Trump has offered his opinion on what the US should do with their currency. To incentivize exports to other countries, Trump would like to see a lower dollar and has made this clear on multiple occasions.

A lower dollar won't send gold soaring by itself, but it can help fuel a breakout.

Technical Analysis

As for the global case for gold, I believe there is still a strong fundamental argument for gold to tick higher. Just like any trade, the most important part in maximizing return is a strategic entrance, especially for a leveraged fund such a JNUG.

Source: Think or Swim, Author

I chose to look at the 4-hour chart of JNUG because I presume that the best action for this ETF is a swing trade. As stated earlier, the decay effect of leveraged ETF's can severely hinder gains so I believe the best action would be to sell within a month.

Yesterday was a wildly volatile day for JNUG as its price swung over 20% in a matter of 24 hours. JNUG's move to the downside caught support at the $60.45 level which happened to be the top line of resistance for its previous leg up. After bouncing from that support, it found its way back into its former trading territory.

JNUG's current range seems to be forming a bull flag which could signal a move much higher. What also intrigues me about this chart is the stratospheric move higher after breaking the top line of resistance. Over its last two legs higher, breaking the top line of resistance has resulted in parabolic growth and I'm looking for that same movement if JNUG breaks through.

For this trade, I am waiting for either a breakout through the top resistance line or a bounce off that top line of resistance and begin trading back in a channel. If JNUG does decide to break to the downside, I believe the 200-day moving average would act as a firm line of support. Either way, I will be looking for conformation in the move but could easily see a fairly substantial increase in price.

Stay focused when trading JNUG and if it makes a sizable move to the upside, I will draft another article detailing an exit point.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in JNUG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Ryan Waldoch and get email alerts