Gold's Window Of Opportunity For October

Gold has shown a tendency to rally in the last several Octobers.

Geopolitical uncertainties support the metal's intermediate-term trend.

Silver and gold stocks could use some improvement, however.

It has been a shaky month for gold investors, and some worry that the metal's extraordinary bull run might be ending. While there are some technical challenges that gold faces heading into the fall season, fundamental and sentiment-based factors argue in favor of gold's intermediate-term (3-6 month) upward path remaining intact. Here we'll review this evidence as we also examine the challenges for gold that lie ahead in October.

Volatility has been a constant theme in the past month; and not just for stocks and commodities such as oil. The gold price, which for most of this year has been bastion of stability in an otherwise turbulent global economy, saw a fair share of choppiness in September. After a promising 3-day rally in September's final week, the gold price fell 2% on Sept. 25 in the wake of the U.S. presidential impeachment inquiry.

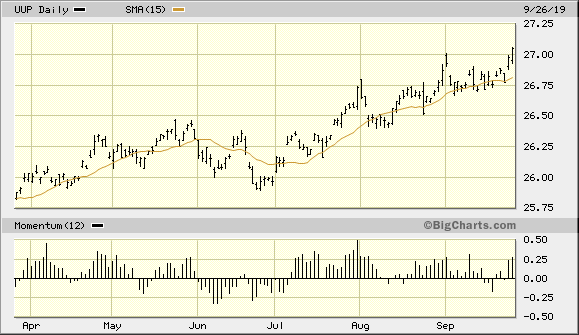

Oddly enough, investors preferred the U.S. dollar as a safe haven over the yellow metal in the wake of the latest political turmoil. The dollar index shot to a new high, as reflected in the Invesco DB U.S. Dollar Bullish Fund (UUP) shown here. The dollar is now being given preferential treatment by investors looking for protection against news-related equity market volatility.

Source: BigCharts

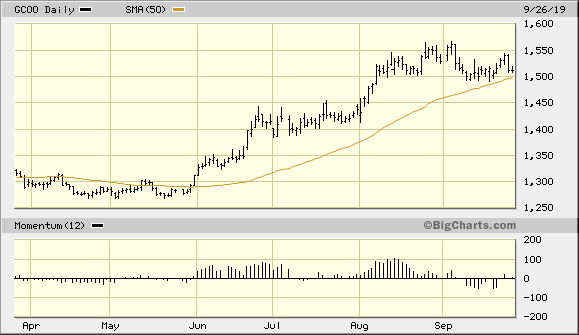

Source: BigCharts

The preference among international investors for the greenback doesn't mean that gold's thunder has been completely stolen, however. Although the metal's currency component is obviously weaker when the dollar is rising, gold's fear component is also an important consideration. With geopolitical and economic uncertainties abounding right now, gold isn't likely to be liquidated anytime soon. Gold's September price dip was likely the result of profit taking among individuals and investment funds in recognition of gold's "overbought" condition. Indeed, the precious metals market was in danger of becoming overheated in the last few weeks after this summer's powerful rallies in gold, silver, platinum and palladium. A pullback for the gold price wasn't unusual given the technical backdrop of the metals market.

Now that gold has had a few weeks to consolidate, however, the time has come for it to prove its worth. An important test of the 50-day moving average is about to be made. This widely watched trend line is important if only for its psychological significance. Given the widespread utilization of the 50-day MA as a trading tool, how the gold price reacts when it comes into contact with it will provide an important clue as to the metal's next directional move. The following graph shows the continuous contract gold price only about $10 above where the 50-day MA is presently located. An immediately rally once the gold price touches the benchmark $1,500 level would suggest a short-covering move higher as we begin the month of October.

Source: BigCharts

Source: BigCharts

Gold also has an historical tendency to see a notable short-covering rally in October. In recent years, this has happened even when gold has been in a downward trend. The last six Octobers witnessed short covering rallies of varying degrees, and last year's October saw the commencement of gold's latest bull market. Thus, there's an established seasonal pattern for expecting the bulls to make another charge at some point in the next couple of weeks.

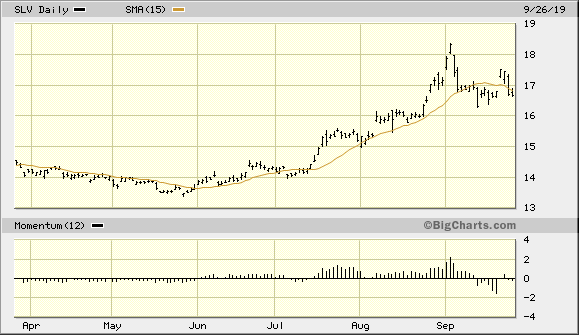

Before gold is ready to commence the next extended rally of its intermediate-term bull market, however, a couple of supporting factors need to be in place. For one, the silver price has shown relative weakness lately. Silver should ideally confirm gold price strength. The fact that the iShares Silver Trust (SLV) price is under its 15-day moving average suggests weakness on an immediate-term (1-4 week) basis.

Source: BigCharts

Source: BigCharts

Gold's impressive upward leg this summer was supported by a rising silver price; thus, SLV should reverse its recent decline to let us know that gold has the support of its sister metal. Whenever silver fails to confirm a gold rally, it suggests that the basis behind a gold rally is strictly speculative and therefore ephemeral. When both metals rally in tandem, however, the inference is that there is broad-based investment demand for the metals which increases the odds that the rally won't fail.

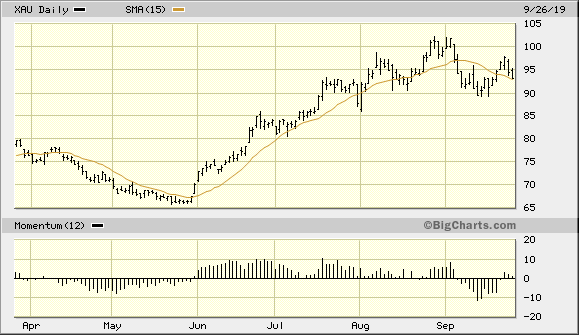

It's also imperative that the actively traded U.S.-listed gold mining stocks soon reverse the weakness they've recently shown. The late September pullback in the PHLX Gold/Silver Index (XAU) should ideally stop short of decisively violating the 90.00 level in the coming days. Otherwise, a failure of the XAU to strengthen would decrease gold's chances for a meaningful upside move in the first half of October.

Source: BigCharts

Source: BigCharts

While gold's technical backdrop is still shaky from a short-term perspective, its "fear factor" is still sufficiently strong to support its intermediate-term bull market. Trade tensions between the world's two largest economies are still high, and the month ahead will be pivotal for the tariff outlook. China and the U.S. are expected to engage in trade talks in October, and while both sides are optimistic that "positive progress" will be made, there are still many obstacles standing in the way of an amicable resolution to the trade war. As long as uncertainty remains, gold will continue to have a safety bid.

In summary, October promises to be an eventful month for gold. The seasonal tendency is for the metal to have a meaningful and tradable rally at some point during October, but more commonly in the first half of the month. Support from silver and the gold mining stocks would increase gold's bullish prospects in the coming weeks. However, with political and trade-related tensions still high, gold can and should feed of these residual fears and thereby keep its intermediate-term rising trend intact. Investors are therefore justified in maintaining longer-term investment positions in the yellow metal.

On a strategic note, the VanEck Vectors Gold Miners ETF (GDX), I'm currently long GDX after its recent above the 28.69 level on Sept. 24. I recommend using the 27.80 level as the initial stop-loss on an intraday basis for this trading position.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts