Gold - A Golden Escape / Commodities / Gold and Silver 2018

Theoil price is rising due to the upcoming restrictions on the sale of Iranian oil- the second of a two-part set of sanctions imposed on the Middle Eastern powerfollowing the Trump Administration’s decision in May to withdraw from the Irannuclear agreement, known formally as the Joint Comprehensive Plan of Action (JCPA).Sanctions lifted under the Obama Administration were re-imposed.

Theoil price is rising due to the upcoming restrictions on the sale of Iranian oil- the second of a two-part set of sanctions imposed on the Middle Eastern powerfollowing the Trump Administration’s decision in May to withdraw from the Irannuclear agreement, known formally as the Joint Comprehensive Plan of Action (JCPA).Sanctions lifted under the Obama Administration were re-imposed.

Trumpsaid the deal was disastrous for the United States and a security threat. Healso said Iran wasn’t following through on a number of changes it agreed tomake, such as more diligent inspections, including Iran’s ballistic missileprogram in the agreement, removing Iran's presence in Lebanon, and stoppingfunding terrorist groups like Hezbollah.

Some say the real reason forre-imposing sanctions is to change the clerical Iranian regime - a view sharedby US Middle Eastern allies, Saudi Arabia and Israel.

Atany rate, in August restrictions were imposed on Iran’s purchase of UScurrency, trade in gold and other precious metals, and the sale of auto partsand commercial aircraft.

November4 is when sanctions on the sale of oil and petrochemical products, take effect.This is the date everyone is watching, since the restriction of Iranian oil islikely to bump up oil prices, particularly the Brent crude standard. This,however, is anything but certain. While oil companies have until the 4th ofNovember to reduce their purchases of Iranian oil, China, India andseveral European countries have said they won’t cut their imports, preferringto honor the JCPA.

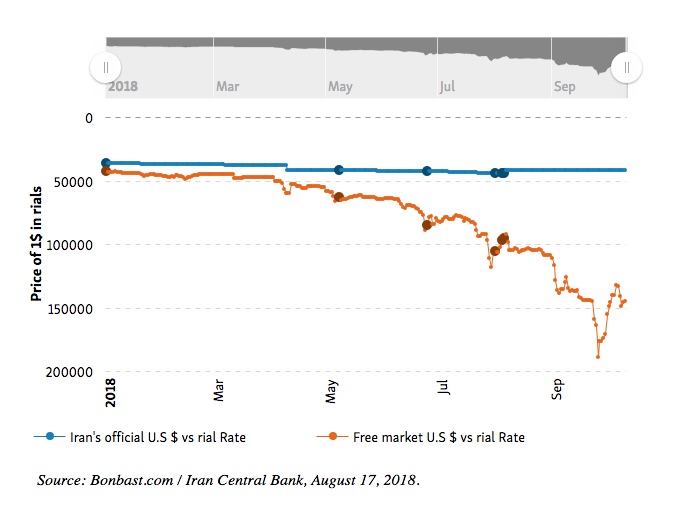

Thesanctions have affected the Iranian economy, but not dramatically. Yet. That’sbecause high oil prices between 2008 and 2014 allowed the country to build up awhopping $132.6 billion in foreign exchange reserves. However, the economy is80% dependent on oil sales, so the oil restrictions are bound to bite.Inflation currently sits at around 10% but the prices of certain other goods have gone up considerablymore as the black-market US dollar to rial exchange rate plummets. Iran has bothan official USD to rial exchange rate and a “free market” rate.

Porkfor example has risen 14%, eggs have gone up 54%, dairy products by 18% andfresh fruit by 64%.

Meanwhilein Turkey, on which the United States has also levied sanctions due to a riftcaused by the detention of an American pastor, inflation is worse.

InAugust the inflation rate in Turkey nosed up to 17.9% - the highest in 15years. But the big hit has been against the US dollar. The Turkish lira has dropped 42% this year against thegreenback as investors sell the currency, having lost confidence in PresidentErdogan’s ability to control the economy. That makes imports of neededcommodities and goods priced in US dollars more expensive.

Pricesare rising even higher in Argentina, where inflation hovers around 30% due toan economic crisis that has also caused a run on the peso, but the realinflation basket-case is Venezuela. There, consumer prices have risen 488,865%in the 12 months ending in September, Reuters reports, with daily inflationrunning at 4%. President Nicolas Maduro in August cut five zeros off thebolivar, mimicking what Zimbabwe did in 2008 - eliminate 10 zeros off theZimbabwe dollar while inflation was running at an annual 2.2 million percent.

Whatare all these inflation-prone countries to do, with their economic fortunes,and the plight of their populations, at the mercy of fiat exchange rates thatare being slaughtered by flights of capital and a strong US dollar? The answermay be simple: just establish a currency board.

Currency boards vs central banks

Acurrency board is like a central bank, but it only issues bills and coins,which are convertible into a reserve currency, be it gold, the US dollar, theeuro, etc. The reserve currency should be stable and easily convertible.Typically, the reserve currency board would hold low-risk securities that earninterest.

Where a currency board differs from a central bank is that thecurrency board by law is required tohave a fixed exchange rate between the country’s currency and the reservecurrency, and hold reserves equal to its monetary base. For example, if acountry has 100 billion units of its currency, which are worth 70 billion USdollars, the currency board can’t inflate or deflate the value of its currency,say to increase exports. The local currency is anchored to the reservecurrency.

Thismeans the only way a currency board can raise funds is through taxation orborrowing. It is not allowed to print money.

Aquantitative easing program - like happened in the United States, the EuropeanUnion and Japan - would not be possible under a currency board. Monetary policyunder a currency board is determined by supply and demand for the localcurrency, not by targeting an inflation rate or interest rate - which is whatcentral banks do. In this way, a currency board is an excellent way to controlinflation.

Neitheris a currency board the “lender of last resort” like the Federal Reserve, whichloans money to other banks. It simply issues bills and coins, and converts thelocal currency to the reserve currency at the set exchange rate.

No failures

Mostpeople have never heard of a currency board, but they have existed in 70countries, with several still operating today. The first one was installed inMauritius in 1849, when it was a British colony. As Steve Hanke, a contributing writer to Forbes, wroterecently, “No currency board has failed.” Hanke gives another example, theNational Emission Caisse, established in 1918 in Russia during its civil war,which issued “British ruble” notes backed by pounds sterling. The father of theBritish ruble was none other than John Maynard Keynes, who then worked for theBritish Treasury.

A gold-backed currency board

Goldis the ideal reserve currency, which is why a gold-backed currency board makesa lot of sense.

Gold: a brief history

The ancient Chinese, Lydians (in Turkey), Greeks and the Romansall used gold as money, with the Romans acknowledged as the first civilizationto employ gold as a currency across their vast empire. Historical records showEmperor Julius Caesar brought back so much gold from a victorious campaign inGaul to give 200 coins to each of his soldiers and pay all of Rome’s debts.

Over time, as countries moved to paper money, they realized theycould fix one unit of currency to a weight in gold, a system that became knownas the gold standard. Britain was the first to adopt the gold standard andother countries soon followed suit. In the 19th century, all countries exceptChina used it. Domestic currencies were freely convertible into gold at thefixed price and there was no restriction on the import or export of gold.

In 1944 at Bretton Woods, New Hampshire, delegates from 44 nationsmet and agreed to peg their currencies to the US dollar, the only currencystrong enough, just after the war, to meet the rising demands for internationalcurrency transactions, as shattered economies got back on their feet.

In 1971 US President Nixon ended the convertibility of the dollarinto gold for central banks, effectively demolishing the gold standard. TheBretton Woods system collapsed and gold was allowed to trade freely without aUS dollar peg.

Investors love gold because it tends to hold its value throughtime. They see gold as a way to preserve their wealth, unlike paper or “fiat”currencies which are subject to inflationary pressures and over time, losetheir value.

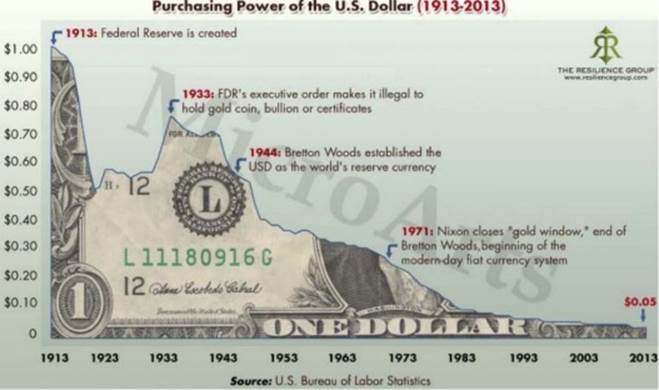

Since the Federal Reserve was created in 1913, the dollar has lost95% of its value. (see graph below). Over a hundred years ago a buck was wortha buck; in 2013 it was valued at 5 cents – it’s worth eroded by inflation.

Formore on the history of gold, read our Imaginations of the Misguided, and for ahistory of the dollar and why it is losing is privileged status as reservecurrency read The beginning of the end of the dollar

In1997, Canadian economist and Nobel Memorial Prize winner Robert Mundellpredicted that “Gold will be part of the structure of the internationalmonetary system in the twenty-first century.”

Thetruth of Mundell’s prediction is shown by the performance of gold-backedcurrency boards. In another Forbes article, Hanke writes that“Countries with such monetary institutions have experienced more fiscaldiscipline, superior price stability, and higher growth rates than comparablecountries with central banks.”

Inthat article, the author notes that since 1979, Iran’s rial has lost close to100% of its value. He argues that the most elegant solution to Iran’s weakcurrency and high inflation (around 20% in 2017) is to switch to a gold-backedcurrency board. Doing this would allow Iran to use a “currency” (gold) notcontrolled by another sovereign nation, while still retaining the rial.Everybody wins. Of course they didn’t do that, and as noted above, Iran’seconomic problems are just beginning, and are bound to get worse, as sanctionsbegin in November on its oil sales.

Hanke’ssuggestion also applies to Venezuela, Argentina, Turkey, Russia, or any othercountry whose currency is weak, but does not want to depend on a foreign powerfor fixing its local money to a reserve currency. Gold is apolitical.

Gold gets a kick

Thevalue of gold as a safe haven continues to ring true. Earlier this week we sawa steep selloff in global stock markets, causing gold to rally - along withweaker-than-expected US inflation numbers, indicating that the Federal Reservemay not be as aggressive in raising interest rates going forward.

OnThursday gold powered to the strongest daily gains in two years, with spot goldclosing the trading day at $1,224.60. (see chart below)

Conclusion

Willcountries suffering from high inflation take our advice and move from a centralbank system to a currency board, ideally backed by gold? Probably not. But withgold continuing to hold its value ($1,200+), despite major headwinds, includinga high US dollar, continued demand for Treasury bills, US interest rate hikesand falling demand (For more on gold’s woes, read our Gold and the great stage of fools), they wouldbe wise to. Along with all the other reasons to own gold (store of value,inflation hedge, safe haven) switching to a gold-backed currency board is asure-fire way to control inflation andput them on a road to recovery.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2018 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.