Gold Above $1,600 As Iran Retaliates / Commodities / Gold & Silver 2020

We didn’t haveto wait long for Iran’s response. After the missile attack on U.S. bases inIraq, gold briefly soared above $1,600. What should we expect next?

Iran Retaliates, Gold Rallies

On Tuesday, I wrote that “given thatSoleimani was widely seen as the second most powerful figure in Iran, we shouldexpect a response.” And, indeed, it arrived before too long. On Wednesday, justhours after the funeral of the Iranian general, Iran launched a missile attackon two military bases in Iraq housing U.S. troops.

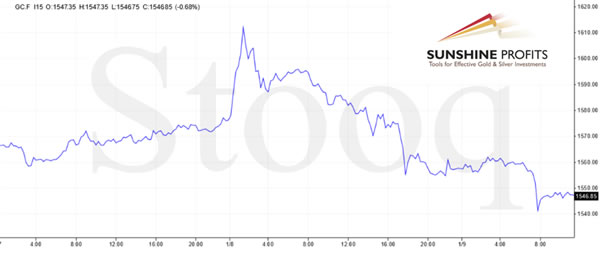

In the last edition of the Fundamental Gold Report, Ialso wrote “the elevated geopolitical risks may supportthe gold prices, at least in the short-term.” Indeed, gold got support – andwhat a strong one! Please take a look at the chart below. As one can see, the price of gold spiked to above $1,610,the highest level since February 2013.

Chart 1: Gold prices from January 7 to January 9,2020.

However, the rally was not sustainable. When the dustsettled, it turned out that there were no casualties, and gold returned below$1,600. Moreover, both countries sent signals that they did not go to war.Iran’s foreign minister said that Iran had taken “proportional measures inself-defense” and didn’t seek further escalation of the conflict. Some analystsspeculate that the said Iranian officials even warned the U.S. the strikes werecoming, as they did not want to kill Americans, but rather to appease Iraniancitizens calling for revenge. Meanwhile, President Trump tweeted that “all iswell” in the immediate aftermath of the attack. Later, he suggested that theU.S. is not planning to retaliate:

No Americanswere harmed in last night’s attack by the Iranian regime. We suffered nocasualties. All of our soldiers are safe, and only minimal damage was sustainedat our military bases (…) Iran appears to be standing down, which is a goodthing for all parties concerned and a very good thing for the world (…) Thefact that we have this great military and equipment, however, does not mean wehave to use it. We do not want to use it. American strength, both military andeconomic, is the best deterrent.

The whole statement indicated an important de-escalation in the conflict, which createddownward pressure for gold prices. The price of the yellow metal has alreadydecreased below $1,550.

Implicationsfor Gold

What does it all imply for the U.S.-Iran conflict andthe future of gold? Well, although the tensions have been put on the backburner somewhat, it would be naïve to think that Iran is done retaliating. Therecent attacks were just a first strike, or a symbolic response necessary tosave face after Soleimani’s death. But confrontation will almost certainlyexplode again at some point this year. So,gold could receive support then.

However, while not minimizing the importance of geopolitical risks forinvesting in precious metals, I am of the optinion that macroeconomic factors are far moreimpactful when investing long-term. The recent developments in Iraq do notchange the fundamental outlook for gold. And it has deteriorated somewhat, atleast when compared to 2019. Thus, while not being a bear, I expect that aftera solid beginning of the year, gold may struggle somewhat.

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.