Gold Advances On The Risk Of Trade Wars

Strengths

? The best performing metal this week was gold, up 0.62 percent. Gold posted its third quarterly gain last quarter, for the longest run since 2011, according to Bloomberg. The weekly Bloomberg survey of trader sentiment showed that most gold traders were neutral this week, while last week they were bearish on the yellow metal. The Perth Mint released sales figures showing gold coin and bar sales were up in March at 29,883 ounces, versus 26,473 ounces in February. Exchange-traded funds backed by gold saw $58.1 million in inflows this week bringing total assets to $97.5 billion.

? The potential trade war and tensions escalating this week proved to be positive for gold as a safe haven asset. Kirill Chuyko, head of research at BCS Global Markets in Moscow, said this week that, "Gold is advancing on the risk of trade wars, in particular between the U.S. and China, which increases the metal's appeal as a safe haven." George Gero, a managing director at RBC Wealth Management, indicated that gold is on the rise to hit $1,400 an ounce and that investors are "buying back hedges" due to fear of trade wars. The gold price rose earlier today to $1330.78 per ounce after President Donald Trump proposed $100 billion in additional tariffs on China.

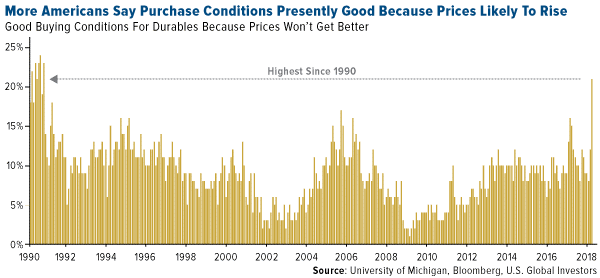

? In a survey of consumer sentiment, 21 percent of American consumers are convinced that now is the time to make large purchases, rather than later, because discounts and deals won't be around for much longer, reports Bloomberg. This is the highest percent of consumers positive in 27 years and indicates that fear of inflation is on the rise.

Weaknesses

? The worst performing metal this week was palladium, down 5.1 percent. Metals producers fell on Wednesday on fears of a trade war, but then rebounded later in the week. The BullionVault Gold Investor Index fell overall in March to 53.7, compared to 54.1 in February.

? Randgold Resources Ltd., known for its ability to operate successfully in Africa, is now one of the worst performing gold miners in the industry with its stock falling 20 percent this year, according to Bloomberg. Other gold producers fell in the first quarter with 10 of the top 14 gold producers down so far in 2018. Even as gold gained, the BlackRock Gold and General Fund, one of the largest gold funds, lost 15 percent last quarter due to the underperformance of royalty companies.

? Reuters reports that sales in March of U.S. Mint American Eagle gold fell and sales of silver coins fell to their lowest levels in 11 years. Sales of gold coins amounted to 3,500 ounces, down 36.3 percent from the prior month.

Opportunities

? Chakana Copper Corp. announced positive drill results from its copper-gold-silver Soledad project in Peru this week. The report indicates four new drill holes with one hole showing a high-grade margin zone with 19.4m of 2.7 percent copper, 14.36 g/t of gold and 26 g/t of silver. Positive news came this week for South African mining companies after they won a ruling that producers won't need to top up black-shareholding levels if they previously met the minimum 26 percent requirement, reports Bloomberg. The judgement should boost certainty and confidence for investors in one of the top mineral-producing nations.

? Bloomberg Intelligence analyst Mike McGlone writes that an industrial metals and gold rally is increasingly favorable. McGlone says that the stock bull market is slowly retiring and, in combination with the Fed's March interest rate hike, gold should see the next stage of its recovery. Commodities overall may be on the rise due to diminishing dollar returns and the increased pace of rate hikes weakening the dollar.

? According to Sprott's CEO Rick Rule, gold is on its way to $1,400 an ounce due to trade war risk. Bloomberg writes that the trade war could hinder demand for U.S. assets and the dollar could be vulnerable if international buyers turn away from American debt. Other signs that gold could move much higher is the oil to gold ratio. One ounce of gold now buys 21 barrels of oil compared with the 25.4 barrel two-year average, according to Bloomberg. Crude oil is around $64 currently and if the gold-to-crude ratio reverts back the mean, bullion would trade in the $1,600 an ounce range.

Threats

? Manhattan home sales continue to fall for the second quarter in a row with sales of all condos and co-ops falling 25 percent last quarter. Homeownership expenses are rising due to increased borrowing costs and federal limits on tax deductions for mortgage interest, writes Bloomberg News. Around 52 percent of all sales last quarter were for less than the asking price.

? Overall the first quarter of this year was negative for U.S. markets as debt continues to rises significantly compared to gross domestic product (GDP) growth. According to Jim Paulsen, chief investment strategist at Leuthold Weeden Capital Management, investors should proceed with caution in all asset classes as signs of stress have emerged. Since investors are positioning themselves defensively into safe haven assets, gold has started to outperform copper, driven by fear in the reports, writes Bloomberg.

? Zimbabwe, with the world's second largest platinum reserves, released a Mines and Mineral Bill on Thursday citing that no mining right or title will be granted to a public company unless at least 85 percent of the company's shares are listed on the local exchange. The nation's effort to hold mining companies more accountable is meant to spur economic growth and exports. Jee-A van de Linde, an analyst at NKC African Economics said "to compel firms to list a majority of their shares on the Zimbabwe's stock market may not necessarily yield the desire results, and may end up creating more uncertainty - especially for foreign investors."