Gold and commodities set to soar in 2019

Summary:

An update to the Periodic Table of Commodity Returns.Goldman Sachs issues an overweight recommendation for gold and commodities.Paradigm Capital says royalty companies are the "best bet" in metals and mining.Our ever-popular Periodic Table of Commodity Returns has been updated for 2018 and is now available on the U.S. Global Investors website! I invite you to get lost using the interactive feature, which easily allows you to highlight a certain commodity, the top performer, the most volatile and more.

Explore the new periodic table of commodity returns 2018

Palladium was the best performing commodity for the second year in a row, returning 18.59 percent in 2018 after ending the previous year up a phenomenal 56.25 percent. As we've noted before in the Investor Alert and elsewhere, palladium and gold prices are now near parity, with a razor-thin spread of only around $2 separating the two at the moment. Late last year, the white metal actually overtook the yellow metal for the first time since 2001 on increased demand from automobile manufacturers. More than 80 percent of world supply is used in the production of catalytic converters.

Not to be outdone, gold ended 2018 on a high note, beating global equities and commodities for the fourth quarter. And as I mentioned last week, it was the sixth most liquid asset class, with daily trading volumes nearly identical to that of S&P 500 companies.

Goldman bullish on gold, forecasts $1,425

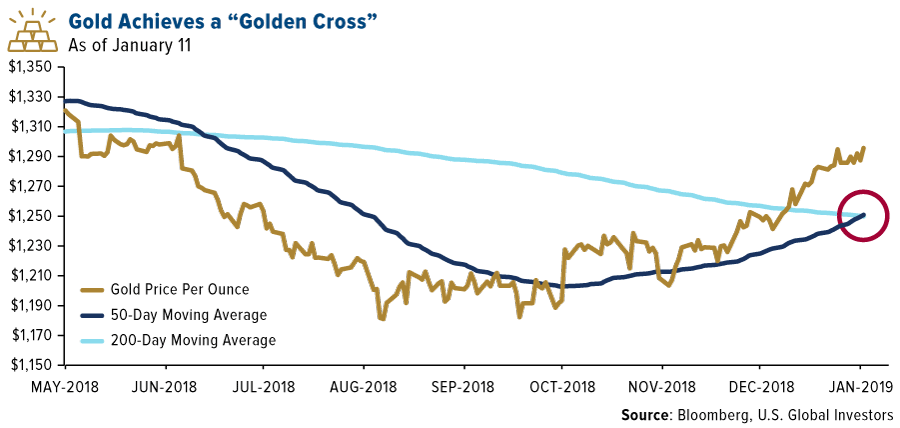

With a majority of investors now betting that the current rate hike cycle has peaked, the U.S. dollar looks to be in retreat, having lost about 1.7 percent over the past month. Mike McGlone, commodity strategist at Bloomberg Intelligence, writes that he believes the "2019 dollar downtrend has legs." This is constructive for metals and commodities in general, gold specifically. Today, in fact, the yellow metal achieved a "golden cross," whereby the 50-day moving average crosses above the 200-day moving average-a very bullish sign.

Among those that are most bullish on the precious metal is Goldman Sachs. In a report this week, the investment bank maintained its overweight recommendation and raised its 12-month price forecast up from $1,350 an ounce to $1,425, a level last seen in August 2013. Goldman analysts contend that the gold price "will be supported primarily by growing demand for defensive assets, with a slower pace of Fed rate hikes in 2019 boosting demand only marginally."

The World Gold Council (WGC) made a similar case in its 2019 outlook this week, predicting that global investors will "continue to favor gold as an effective diversifier and hedge against systemic risk." The rise in protectionist policies around the world is chief among the risks since they tend to lead to higher inflation and slower economic growth over the long term, according to the WGC.

I believe the current government shutdown, over funding for a wall along the southern border, is evidence of the risks protectionist policies pose. Soon to be the longest in U.S. history, the shutdown could start to take a toll on the economy the longer it lasts, according to Federal Reserve Chair Jerome Powell, and perhaps even cost the U.S. its triple-A credit rating.

Commodities could also be a buy right now

Goldman Sachs isn't just bullish on gold. Commodities also look like a strong buy, the bank's analysts say, after prices were slashed late last year. Before the fourth quarter, commodities were following the "late-cycle playbook." Up 16 percent, they were the best performing asset class of 2018. But with the Fed now "on hold" and there being "low risk" of a recession, Goldman says it can now argue "with confidence" that the sell-off last year was a "mid-cycle pause."

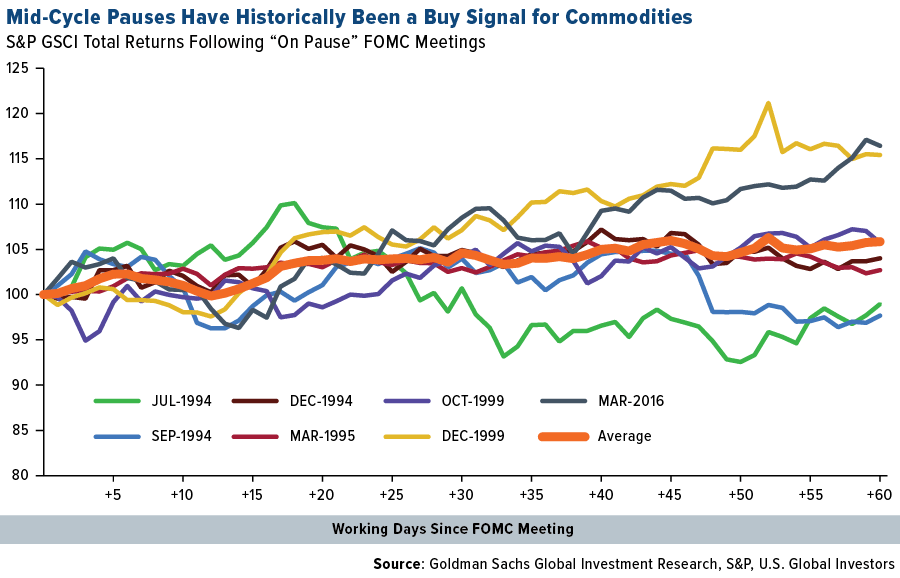

This is actually good news for commodities, as mid-cycle pauses have historically been a buying opportunity. Look at the chart below. It shows that, with few exceptions, commodity prices rallied in the days and weeks following a "pause" signal from the Federal Open Market Committee (FOMC). And as you might already know, Powell recently commented that the Fed "can afford to be patient" and "flexible" when it comes to additional rate hikes.

Goldman maintains an overweight recommendation for commodities, with a 12-month forecast of 9.5 percent.

Gold royalty companies are the "best bet," says Paradigm Capital

It's no secret that I'm a fan of royalty and streaming companies. (You can read my posts featuring Franco-Nevada and Wheaton Precious Metals.) I've long admired these companies for generating profits and creating value, even when the metals market is flat or weak.

This week, Paradigm Capital reaffirmed my conviction in the royalty model. The Canadian investment dealer shared its research into the long-term performance of the various tiers in gold mining, from juniors to seniors, from explorers to developers. The royalty companies-which include not just Franco and Wheaton but also Royal Gold, Sandstorm and Osisko Royalties-are the "best bet" when seeking to "make money in gold equities," according to Paradigm's senior analyst, Don MacLean. He adds: "Royalty companies have the best business model in the sector, by far."

Below, you can see that royalty companies have outperformed all other tiers, including gold itself. They collectively delivered 16 percent in compound annual growth from 2004 to 2018. Put another way, they returned a massive 884 percent in cumulative change, compared to gold at 300 percent.

Many junior and senior producers have struggled over the same time period, but Paradigm writes that gold equities are like "coiled springs" and should outperform the precious metal if a "meaningful" gold rally of 10 percent or more occurs. Right now large-cap seniors are leading the rally, having increased 24 percent over the past three months, followed by intermediates (up 18 percent) and royalty companies (up 15 percent). This is in line with past gold equity rallies, Paradigm says, as the largest producers have historically performed best at the start.

My focus lately has been on how the idea of "peak gold" might drive the need for mergers and acquisitions (M&As) within the metals and mining industry. It's been almost a decade since the last round of deals, and because there's a sore lack of big discoveries right now to replenish reserves, I feel as if we're due for more M&A activity this year. The Barrick Gold-Randgold merger, announced last September, might have been just the start of a new wave of consolidation.

Click here for a link to the original article.

By Frank HolmesCEO and Chief Investment OfficerU.S. Global Investors